Avalon_Studio

Economic realities await us in 2023

The year 2022 will be remembered as the year with the sharpest decline in bond markets in many decades, caused by unprecedented hyperinflation and exceptionally tight monetary policy by central banks. After the abrupt regime change in 2022, what will 2023 hold for investors? We face the (unpleasant) economic realities, which means a move towards “normalcy” challenged at the same time with a prolonged period of higher structural inflation and interest rates as well as rising unemployment rates. Companies will face earning declines and profit margin pressure. Thus, in 2023 global growth will slow in most developed countries, with a still uncertain end-result: weaker economy, stagflation or recession?

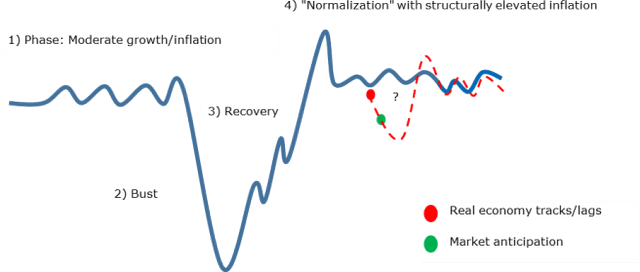

Chart 1: Normalization with structurally higher inflation

Chart 1: Normalization with structurally higher inflation (Source: Bloomberg Finance L.P., Alpinum Investment Management)

With inflation reaching levels not seen in decades, previously strong consumer spending and consumer sentiment will be affected by the cost-of-living crisis. Central banks, which were forced to respond aggressively to price increases in 2022, will maintain a restrictive stance at least through the second quarter of 2023 to further reduce inflationary pressures by cooling demand and preventing unintended loosening of financial conditions. By the end of 2023, however, inflation should have fallen to a level low enough to encourage policymakers to consider interest rate cuts. Nevertheless, history teaches us that such journeys can also lead over bumpy roads.

United States

In the final quarter of the year, macro data continued to point to a resilient economy in the US. Despite concerns about rising interest rates and recessionary tendencies, key indicators for consumer spending and labor markets continued to show signs of strength. In November, the US economy created more jobs than expected and the unemployment rate remained unchanged at 3.7%, despite the Fed’s aggressive measures to slow down the economy and lower inflation. More positive news came from the consumer price index, which fell from 7.7% year-on-year to 7.1% in November, below the expected 7.3% yearon-year, reinforcing the belief that the peak of inflation is behind us. After the Fed raised rates by 0.75% at four FOMC meetings this year, Jerome Powell raised rates by 0.50% in December, confirming that smaller rate hikes are likely in the future. Nevertheless, monetary policy is probably to remain restrictive for some time until real progress on inflation is seen, as rate hikes and the Fed’s reduction of bond holdings usually take time to settle into the system.

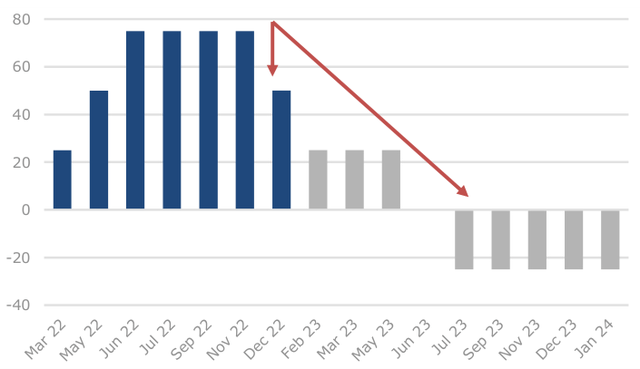

Chart 2: Expected US interest rate hikes/cuts in basis points

Chart 2: Expected US interest rate hikes/cuts in basis points (Source: Bloomberg Finance L.P., Alpinum Investment Management)

On the back of this promising economic data and the expectation of a less aggressive Fed, the S&P 500 rallied 7% from its September low and crossed the 4,000 mark in November. On the other hand, bond markets indicated an increased risk of an (mild) economic recession with the yield curve inversion at its highest level in decades (-0.84). The strength of the US dollar so far this year also reversed, returning to levels seen in June. Finally, one trend to watch is the development in US home sales, which fell for the eighth straight month, the longest stretch since 2007, while the average 30-year fixed-rate interest rate topped 7% in November (double the year-ago level and the highest since 2002).

Europe

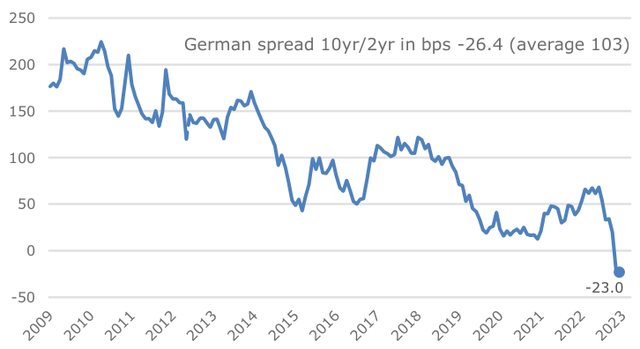

Eurozone GDP surprised on the upside in the third quarter and lifted growth for 2022. Although economic indicators continued the positive trend in the first part of the fourth quarter, the eurozone economy is expected to fall into recession in the fourth quarter of 2022. The inverted yield curve in German bond markets also suggests that Europe’s leading economy is heading for recession. The yield on the two-year Schatz hit its highest level in a decade.

Chart 3: Inverted German yield curve anticipates recession

Chart 3: Inverted German yield curve anticipates recession (Source: Bloomberg Finance L.P., Alpinum Investment Management)

During the quarter, eurozone inflation fell slightly, from 10.6% year-on-year to 10.1% year-on-year, with energy and food continuing to contribute to the high inflation numbers, albeit with a significant decline in energy. Although energy prices have fallen 60% since peaking in August, Europe has announced plans that include an initial version of a price cap and a common procurement system. In addition, Europe will support households and businesses with a new EUR 40 billion stimulus program to address the energy crisis. To fight inflation ECB began 2022 with a 50 bps hike in July and two 75 bps rate hikes in September and November. In December the ECB raised the interest rates by another 50 bps bringing the deposit rate to 2.0%. The ECB will likely slow down its interest rate hike pace with an expected terminal deposit rate of 3%. During the quarter, Europe witnessed a change in political leadership in two countries. In the UK, Rishi Sunak was appointed as the new prime minister, reversing many of the previous chancellor’s tax cuts and promising to present a much more austere budget. In Italy, Giorgia Meloni, known as a Eurosceptic, won the elections with her right-wing “Brothers of Italy” party and was named the country’s first female prime minister.

China and emerging markets (EM)

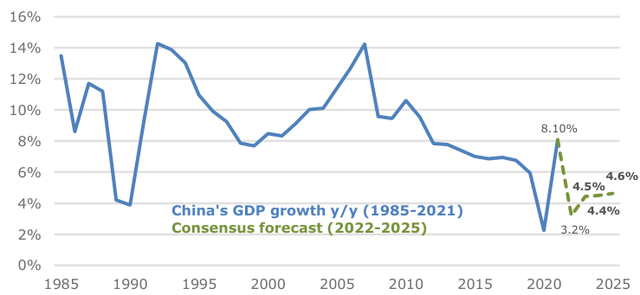

This year, for the first time, Beijing will fall well short of its GDP growth target, which is 5.5% for 2022. The IMF estimates that Chinese GDP growth will decline to 3.2% in 2022. This would be the weakest pace since the 1970s, had the pandemic not broken out in 2020. During the quarter, both import and export growth continued to face strong global as well as domestic headwinds. Chinese import data slumped in November, while export growth continued to contract month-on-month. The shift in consumption from goods to services is impacting not only global output but also demand for Chinese goods. Although the country is in the midst of a third major Covid-19 wave, Beijing started a more growth-friendly course after months of economic turmoil triggered by Covid record outbreaks and a property market crisis.

Chart 4: China’s GDP growth since the 1985s

Chart 4: China’s GDP growth since the 1985s (Source: Bloomberg Finance L.P., Alpinum Investment Management)

The pressure also came from unprecedented protests by the Chinese people expressing their deep disappointment and frustration with the country’s three-year zero Covid policy. As a result, Chinese authorities had no choice but to announce various measures to ease Covid restrictions to appease citizens’ displeasure. Another positive signal came from the revival of the real estate market, which has been in a downturn since mid-2021, supported by a significant swing in real estate policy with the announcement of a “16-point plan” by the Chinese authorities. To illustrate the importance of this policy measure, it is worth noting that the real estate market has historically accounted for one-third of China’s GDP. Consequently, investor sentiment toward China increased, and the MSCI China Index and CSI 300 Index rose 34% and 9% respectively from their late October lows.

Investment conclusions

The economic cycle has turned negative, driven by increased inflationary forces and geopolitical issues. The US economy could experience a period of stagflation, the eurozone most likely a mild recession, and China still faces headwinds with its Covid-policy and regulatory measures. We are living in the transition phase from a “pandemic world” to a “normal” economic cycle with inflation pressures, while at the same time being challenged by the escalation of the conflict between Ukraine and Russia. In 2022, stock prices fell, credit spreads widened, and interest rates rose steeply. We are in a late-stage economy with (peaking) inflationary pressures on the brink of recession. This combined with an interest rate normalization phase and geopolitics urge caution.

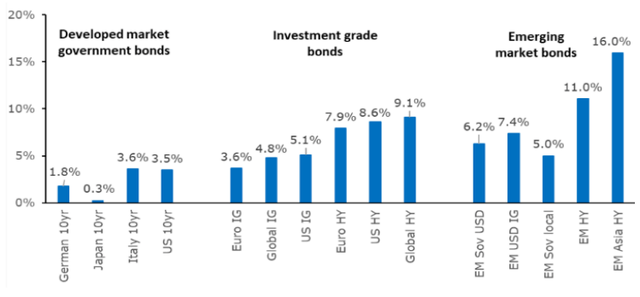

Chart 5: Yield-to-worst of global bond segments

Chart 5: Yield-to-worst of global bond segments (Source: Bloomberg Finance L.P., Alpinum Investment Management)

Bonds: Monetary policy is in tightening mode worldwide, led by the pace of the US Fed. Currently, markets are assuming a policy rate close to 5%. After the recent sell-off in credit, selective credit is attractively valued. We expect short and long rates to converge somewhat over the next 6-9 months (bear flattening). Therefore, long duration investment grade and sovereign bond assets should be avoided. We continue to favour higher rated European loans, non-cyclical US and Scandinavian short-term HY bonds, as well as senior exposure in structured credit.

Equities: Equity multiples remain challenged by rising interest rates and vulnerable/shrinking profit margins. We have increased our conviction on emerging market equities, maintaining a mixed approach with a slight tilt towards value.

At this point along the way, we are preparing for further volatility and focusing accordingly on preserving capital. Having said that, investors shall remain cautious by adopting an active and controlled downside-risk management within an absolute return approach.

Scenario Overview 6 Months

|

Base case 65% |

Investment conclusions |

|

|

| Bull case 20% | Investment conclusions |

|

|

| Bear Case 15% | Investment conclusions |

|

|

| Tail risks | ||

|

|

|

Equities |

Comment |

|

|

| Credit/Fixed Income | Comment |

|

|

| Alternatives | Comment |

|

|

| Real Assets | Comment |

|

|

Be the first to comment