JulPo/E+ via Getty Images

Investment Thesis

Alpine Income Property Trust (NYSE:PINE) is a real estate investment trust focusing on net leasing properties to industry-leading tenants in Metropolitan Statistical Areas. The company has recently reported strong third-quarter results mainly driven by continued acquisitions and attractive supply and demand dynamics which can sustain for a longer period, further accelerating its growth by diversifying its portfolio in high-growth markets. The company also pays a high quarterly dividend, making it an attractive investment opportunity for risk-averse and retired investors.

About PINE

Alpine Income Property Trust mainly deals in owning and operating a portfolio that consists of commercial net lease properties across the United States. The company primarily leases its properties to industry-leading tenants operating mainly in industries resistant to the impact of e-commerce. The tenants are from various sectors, such as pharmacy, sports goods, grocery, home furnishings, general merchandising, consumer electronics, health and fitness, and entertainment. Its portfolio comprises 146 net leased properties in markets of 35 states. These properties are located in favorable economic and demographic growth markets and near major Metropolitan Statistical Areas (MSA). These attractive locations represent the company’s portfolio of 3.7 million gross rentable square feet. 63% of the annual base rent was derived from properties in MSAs for the year 2021. The net lease property market has experienced steady growth over the years, and investor demand for net leased properties has continued to gain significant momentum, which has significantly contributed to the company’s growth. It is a more flexible business, unlike gross leasing, as net leases do not include financial responsibility for expenses such as insurance, property taxes, maintenance, and capital expenditures. The company currently targets tenants with attractive credit characteristics, proper rent coverage levels, and healthy operating history.

Financials

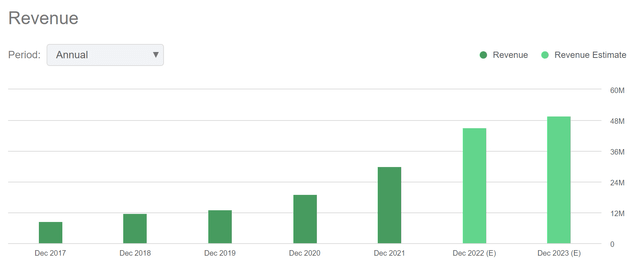

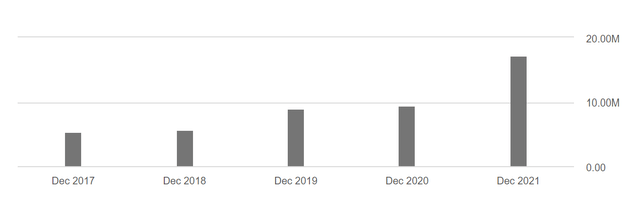

As we can see in the above chart, the company has managed to achieve solid growth in the last five years. The revenue has grown from $8.45 million in FY2017 to $30.13 million in FY2021 resulting in a substantial 5-year CAGR of 28.95%. Also, the company has experienced strong FFO growth in the past five years. The FFO has grown from $5.3 million in FY2017 to $17.2 million in FY2021 resulting in a 5-year CAGR of 26.55%

Recently, Alpine has reported strong Q3 FY2022 results. The company has reported revenue of $11.52 million, a 41% jump compared to Q3 2021 revenue of $8.17 million. The revenue growth was supported by lease income from the new acquisition of nine high-quality retail net lease properties, representing a total acquisition volume of $36.7 million and reflecting a weighted average going-in cash cap rate of 7.1%. These acquired properties were leased to tenants of four growing sectors, which include dollar stores, sporting goods, home improvements, and home furnishings. The company has surprised the market with outstanding net income growth of 957.8% YoY, which is 9.60% more than the market consensus. Net income of the third quarter is $11.17 million compared to $1.05 million in the previous year’s third quarter. The company reported AFFO per diluted share of $0.42, up 13.5% from $0.37 in Q3 2021. The results beat the market’s expectations of AFFO per diluted share and presented a positive outlook for Q4 2022. The company ended its third quarter with $2.24 million in cash & cash equivalents and net debt of $271.9 million. At a weighted average exit cash cap rate of 5.5%, six net lease properties were sold for $50.5 million, generating $11.6 million in gains. There was an increase to $350 million in the credit facility, which consists of a $250 million unsecured revolving credit facility and $100 million in existing unsecured term loans.

The strong results of the company are a reflection of attractive supply and demand dynamics and also its portfolio expansion in high-growth markets. I believe this growth of the company can be sustainable as the Southeast and Southwest portfolio can continue to benefit the company from population shifts. After analyzing all the growth factors, I think the company has an upside potential, and I am estimating a solid quarter in the coming years. Even the management is very optimistic about it. That’s why the company has raised its previous guidance. The company is estimating AFFO per diluted share to be in the range of $1.53-$1.63. I think the company’s expectations are conservative. Looking at the current growth factors, I think AFFO per share for FY2022 can be between $1.80-$1.95. I estimate the revenue for FY22 can be in the range of $44.9 million, up 49.1% from the previous year, which can be mainly fueled by the company’s continuously growing net leasing operations in the Metropolitan Statistical Areas. This increase in revenue can further help the company expand its profit margins and push the stock upside.

High Dividend Yield

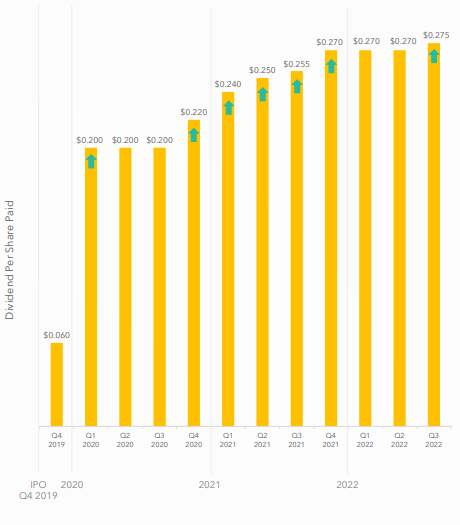

We can see significant growth in the company’s dividend payout over the years, which reflects its well-positioning in the competitive market. Since the beginning of 2020, we can see a healthy upside of 37.5% in the quarterly cash dividends. In the current year, the company has distributed a dividend of $0.2700 per quarter in the first two quarters and recently declared a dividend of $0.2750 for the third quarter. The company has recorded strong third-quarter results and is considering other growth factors, such as benefits from population shifts and the new acquisition of nine high-quality retail net lease properties, which I think can fuel the company’s performance. That is why I believe this dividend of $0.2750 can be constant for the last quarter, which makes a full-year dividend of $1.09. This dividend represents a dividend yield of 5.84%, which makes it an attractive investment opportunity for risk-averse and retired investors.

Dividend Payment Trend (Investor Presentations: Slide No: 16)

What is the Main Risk Faced by PINE?

Dependency on Demand of Retail Space

92% of the straight-line annual rent of the company’s initial portfolio was leased to tenants running retail establishments. PINE plans to buy more properties in the future that are now leased to a single tenant that runs a retail operation there. As a result, the company may be more negatively impacted by declines in the market for renting retail space than it would be if it had less of an investment in retail buildings. The leasing market for retail space has historically been negatively impacted by weak national, regional, and local economies, the poor financial health of some major retailers, retail industry consolidation, an excess of retail space in some locations, and growing e-commerce pressure. If unfavorable circumstances develop or persist, they are likely to have a negative impact on market rentals for retail space and could have a considerably negative impact on the business.

Valuation

The company has recorded strong third-quarter results. I believe it can maintain this growth in the coming years due to strong supply and demand dynamics, diversification in high-growth markets, and targeting industry-leading tenants. After considering all the above factors, I am estimating an FFO per share of $1.95 for FY2023, giving the forward P/FFO ratio of 9.56x. After comparing the forward P/FFO ratio of 9.56x with the sector median of 13.54x, I think the company is undervalued. After considering the strong demand for retail space, I think the company might trade at the sector median. Hence, I estimate the company might trade at a P/FFO ratio of 13.54x, giving the target price of $26.40, which is a 42% upside compared to the current share price of $18.65.

Conclusion

Alpine Income Property is a real estate investment trust which deals in the net leasing of properties, mainly focusing on Metropolitan Statistical Areas. The company has recently reported strong third-quarter results, which were driven by leasing incomes from vigorous acquisitions carried out by the company in the third quarter. I believe this growth can be sustainable as the company is focusing on high-growth markets, well-operating sectors, diversification in Metropolitan Statistical Areas, and emphasizing strong supply and demand dynamics. After comparing the forward P/FFO ratio of 9.56x with the sector median of 13.54x, I think the company is undervalued. After considering all the above factors, I assign a buy rating for PINE.

Be the first to comment