PeopleImages

Performance

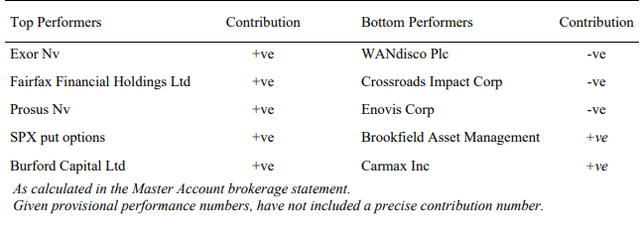

The Master Account, in which I am personally invested alongside SMA clients, provisionally returned 7.5% net in Q1 2023 vs 7.5% for the S&P 500. Unfortunately, one of our positions (discussed in more detail in this letter) has had trading in its shares suspended, so I could not provide a market price. Following discussions with our fund administrator and compliance advisor, I marked the position down by 50% for billing and reporting purposes. I will update full performance figures once trading resumes in the shares, and I can get a market price.

Position sizing and portfolio management

Except for WANdisco (OTCPK:WANSF), which I will discuss shortly, we had a very good quarter, with only three positions declining. In my subsequent analysis of the five top and five bottom performers, you will note that two “bottom” performers contributed profitably to the portfolio.

However, WANdisco’s shares have been suspended due to an accounting scandal and misrepresentation of revenues, warranting a more in-depth examination.

My strategy has always been, and remains, to invest the majority of our capital in “great public companies that have the power to endure, with long runways to grow through reinvesting cash flows at high rates of return, run by talented and aligned operators,” as I mentioned in my Q3 2019 letter. In my Q4 2019 letter, I elaborated on the deliberate barbell strategy I employ, which minimizes the chance of permanent capital impairment while still offering substantial appreciation potential over time. We can enhance returns while mitigating risk by including a few high-potential ideas in the portfolio, as long as these positions are sized appropriately.

WANdisco undoubtedly belonged to the more speculative category and initially constituted a low single-digit percentage of the portfolio.

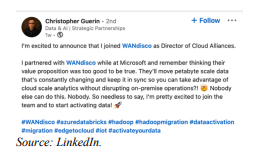

Over the past few years, I have frequently written about WANdisco. The company’s unique IP enables it to move vast amounts of on-premises data to the cloud. Large datasets are challenging to transfer, while enterprises have high expectations regarding data availability, consistency, security, and auditability.

Various groups, including senior software engineers at Microsoft and significant customers like GoDaddy, have validated the company’s technology. In addition, as part of my due diligence, I held numerous discussions with the company, investors, and others, some of whom had conducted their investigations and hired industry professionals to assess WANdisco’s product independently. The unanimous feedback was that WANdisco’s Paxos-based algorithm was uniquely effective at large-scale data migration.[1]

Despite having an excellent product, WANdisco’s suffered from a lack of “product-market fit,” as only a few companies genuinely required the benefits of WANdisco’s solution. Consequently, with limited success, the company spent years attempting to generate sales in data migration from old Hadoop clusters to the cloud.

WANdisco’s potential economics are very attractive, and it enjoys the backing of large shareholders who demonstrated a willingness to fund the company until it successfully ramped up revenues. It has near 100% gross margins and has fixed costs of approximately $45m per year, mainly in R&D. With the company’s strategy of “elephant hunting” going after fewer large accounts, it does not need to build out a large salesforce. All this meant that, once revenues ramped, the company would have minimal incremental costs and substantial cashflows. I had modeled that at $100m in revenue, the company would generate approx. $40m in net income, while $300m in revenue would render $170m, presenting a significant upside on a $250m market capitalization company.

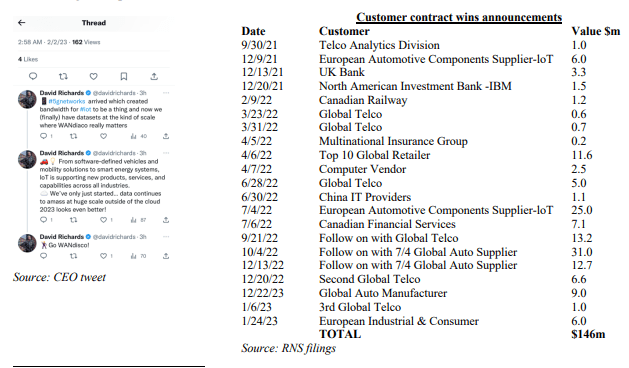

Last year, the situation appeared to change when WANdisco shifted its sales focus to the Internet of Things (IoT). According to CEO David Richards, there was an untapped use case from telecom companies transitioning to IoT backbone providers, offering comprehensive sensor-edge-cloud solutions. Automotive data, particularly from electric cars, is a significant and timely example. Manufacturers collect reliability and performance data from components, while insurance companies analyze driving data to determine premiums. Soon after, WANdisco began announcing an impressive series of contract wins.

While Paxos works on computers in a LAN (local area network), DConE works over Wide Area Networks (WAN), where servers can be thousands of miles apart, as found in practice on the cloud or over distributed enterprise servers. It achieves this scale and efficiency by reducing the number of peers required to form a quorum to achieve consensus, amongst other enhancements.

It seemed the company finally found a “killer app” in the form of IOT data synchronization. Unsurprisingly, the stock rallied strongly, going from approx. £2-4 per share to £13 per share.

To add to the excitement, on March 6th, WANdisco issued a regulatory news release that it was proactively exploring a listing in New York, and the CEO stated in an interview that the company could get to $1 billion in revenues with just 20 sales reps.

Against this backdrop, the sudden revelation of accounting issues just a few days later, on March 9th, came as quite a shock. A senior salesperson has allegedly lied about revenues from the company’s IOT clients and engaged in a sophisticated fraud. Consequently, 2022 revenues were only $9.7 million instead of the previously claimed $24 million, while bookings are expected to be around $15 million, not the $127 million initially indicated. We are still awaiting all the details, and it is unsettling that a month into the suspension, we do not have any firm answers as to what has happened or when the shares will resume trading.

Although I conducted extensive due diligence on the company over the past few years, in hindsight, I made two mistakes. Firstly, I placed excessive trust in a management team with a history of over-promotion. It is easy to understand how investors, including myself, were swept up in this seemingly fantastic news. I should have exercised more skepticism. As the stock price surged, my second mistake was to allow a speculative position to become too large a part of the portfolio (albeit one that had grown to that position through share appreciation).

While recognizing the severity of the situation, we have some grounds for measured optimism.

I believe I got two things right. Firstly, as I have written on several occasions, WANdisco benefits from the backing of large, sophisticated, and aligned investors who have repeatedly invested more money into the business. This gave me comfort that they would be incentivized to take a proactive role should the company ever experience difficulties. Indeed, at the behest of investors and activists, the board has reacted quickly to events. WANdisco’s CEO and CFO have resigned, and Ken Lever, former Chairman of Biffa, the prominent UK public company, was appointed Executive Chairman. Mr. Lever has successfully led several successful turnarounds at companies with similar problems to the ones WANdisco faces, including Xchanging Plc, iSoft, and BluePrism. In addition, he brought Ijoma Maluza, with whom he worked at BluePrism, on board as WANdisco’s Interim Chief Financial Officer. The company has also hired a forensic accounting firm and enlisted the help of Alvarez & Marshall, a professional services firm specializing in turnaround management, to assist in restructuring and ensuring the company remains viable.

Second, my thesis is likely correct in asserting that WANdisco possesses a significant technological advantage in large-scale cloud migration. The recent appointment of a new executive chairman and other personnel changes suggest a belief in the potential value of the underlying business. Moreover, interim management recently issued a press release announcing contract renewals with prominent companies like BMW and Maxim Integrated (a subsidiary of Analog Devices). Though the amounts involved are modest, the company specifically highlighted these well-known firms as customers to counter previous allegations of fraudulent sales to unnamed clients. Scuttlebutt suggests genuine contracts with large customers exist, but details have yet to be confirmed. While a $127 million pipeline is clearly out of the question, a dedicated turnaround effort could potentially result in a more modest yet respectable pipeline for 2023. Lastly, the company’s robust technology IP could make it an attractive acquisition target, although any potential IP sale would likely be at a fraction of the last reported trading price.

This is still an evolving situation, and I will update you on what transpires.

In a relatively concentrated portfolio like ours, it is reasonable to anticipate occasional missteps. Our overall strategy remains unchanged. We will selectively seek opportunities with the potential for significant appreciation. For instance, in this letter, I highlight Burford Capital, which has long been targeted by short seller but recently secured a substantial judgment in its favor worth several billion dollars. Additionally, I discuss Crossroads, a company with which we have previously enjoyed a 10x return.

To enhance my processes and mitigate the impact of inevitable mistakes on the portfolio, I have considered implementing improved “guardrails.” These include: 1) clearly distinguishing between high-quality and speculative positions, as well as setting strict limits on the size of the few speculative names we hold; and 2) conducting more frequent trimming and rebalancing of disproportionately large positions, reallocating proceeds to other high conviction ideas or bolstering our cash reserves.

Overall, I remain optimistic about the future of our portfolio, and the lessons learned from the WANdisco situation will only serve to strengthen the investment process moving forward. While I cannot guarantee that we will be immune to challenges in the future, the improved guardrails and disciplined approach to portfolio management will help us to navigate the unpredictable waters of the market better and deliver solid returns for our investors.

As I look ahead, I remain committed to our core strategy of investing in great public companies with attractive growth potential and talented, aligned management teams. I believe that this focus, combined with a willingness to occasionally consider more speculative opportunities that have the potential to deliver outsized returns, will continue to serve investors well.

Portfolio – top and bottom performers2

While there has been little news specifically about Exor, I appreciate the strategic direction the company is pursuing. Exor has been focusing on diversifying into healthcare through its significant investment in Institut Merrieux and developing an internal hedge fund and private investment vehicle. This strategy aligns well with my long-term investment thesis for the company – a Holdco run by an aligned and effective capital allocator with resources to capitalize on opportunities in the evolving markets in which it operates and to deliver value for its shareholders.

Exor’s existing businesses, including Ferrari, Stellantis, and CNH Industrial, have posted strong financial results in 2022 and have laid out robust plans to address the ongoing shift toward electric vehicles and mobility solutions. Ferrari achieved record results in 2022, with revenues of €5.1 billion and an adjusted EBITDA of €1.8 billion. The company plans to launch 15 new vehicles over the next three years, with 60% of its lineup being electric models. Stellantis also reported record revenues in 2022, totaling €179.6 billion with a 13% adjusted operating income margin. The company aims to double its revenues by 2030, partly driven by investments in electrification, autonomous driving, and mobility solutions. CNH Industrial saw its revenues grow by 21% in 2022, with an 11% operating margin. The company acquired precision agriculture leader Raven for $2.1 billion, enhancing its capabilities in autonomous farming systems.

I appreciate CEO John Elkann’s owner-operator approach, prioritizing growing the business’s intrinsic value over short-term market perceptions. With ample amounts of net cash on the balance sheet, I believe that Exor’s management will continue to make strategic decisions that will serve as catalysts for the company’s stock price.

Fairfax Financial Holdings Ltd. (OTCPK:FRFHF)

Fairfax continues to deliver strong performance, driven by an increased focus on its insurance operations.

In his 2022 letter to shareholders, CEO and founder Prem Watsa emphasized “rapid growth the last five years focused on underwriting profit and not reaching for yield.” By adopting the best practices of a diversified holding company, decentralized management (200 distinct profit centers) with a commitment to promoting senior leadership from within, and a firm adherence to core principles, Fairfax has grown premiums profitably, fivefold to nearly $28 billion per year. As a result, Fairfax now ranks in the world’s top 20 property and casualty insurance companies.

Fairfax currently generates $3 billion in operating profit from business segments less influenced by market fluctuations. These profits comprise $1 billion from insurance underwriting, $1.5 billion from interest and dividend income, and $0.5 billion from the earnings of non-insurance privately held companies. Importantly, these profits are separate from any gains made through its public equities portfolio, making them less susceptible to the whims of the public markets. Fairfax remains significantly undervalued, with a net profit of approximately $100 per share generated by these operations alone. Moreover, the company appears well-positioned for robust growth in the future, especially by growing insurance operations outside the US and Europe, where the market is relatively underpenetrated.[3]

Prosus remains committed to prudent capital allocation, which includes distributing the Meituan stake received from Tencent and continuing its open-ended share buyback program. The company has repurchased over $5.8 billion worth of shares. Additionally, Prosus has promised to simplify the Naspers-Prosus structure further to reduce the still-wide discount to Tencent.

Ultimately its goal is to balance its overweighting to Tencent by growing its other e-commerce businesses. Accordingly, Prosus’ capital allocation strategy has shifted towards investing in existing businesses to achieve profitable scale while rationalizing cash-intensive ventures and exiting those they cannot grow profitably. For example, in March, Prosus announced it was considering selling its OLX Autos classifieds business, as trading losses increased to $206 million despite generating $1 billion in revenues in H1 of the 2022/2023 fiscal year.

Prosus’ e-commerce portfolio has seen healthy growth, particularly in food delivery, classifieds, and payments sectors, demonstrating resilience in high-inflation markets like Turkey and India.

SPX put options

I recently had a profitable trade in SPX (the S&P 500 index) put options. After a robust Q4 in which we experienced a 20% gain, I spent about 1% of the portfolio to hedge against tail risks, as I felt the market was becoming complacent regarding the various risks. Put options were reasonably cheap, as measured by their relatively low implied volatility. Troubles at Silicon Valley Bank – an event we hadn’t explicitly predicted – provided the needed volatility spike to exit the put options at a profit and provide a little extra cash.

Burford Capital Ltd. (BUR)

Burford has effectively secured a victory in its landmark case against Argentina. On paper, Burford stands to receive between $1.9bn and $3.3bn before interest. The range is due to the technicalities of the formula used to calculate the damages owed. Argentina will additionally be responsible for paying an annual interest of 6-8% on the specified amount, beginning in 2012 when Argentina seized YPF and continuing until it makes payment. This case could add $13-$25 per share to Burford’s value. The timing of receipt of funds is uncertain. Burford could pocket roughly $500 million in the near future by selling a portion of its claim to institutional investors and is likely to negotiate a lower (yet still substantial) settlement or agree to payment terms over several years to ensure payment certainty.

This case holds significance for Burford for various reasons. Firstly, it should help validate Burford’s business model in the eyes of many skeptical investors who have been doubtful since Muddy Waters released its short report a few years ago. A fair value assessment of the Argentina case makes a significant part of Burford’s balance, and this win lends credibility to those numbers. Moreover, Burford can put the money to good use, whether it is distributing a large special dividend, buying back shares, or generating 15-20%+ returns on investment as it deploys its substantial windfall in future cases, as it has proven it can do.

I believe the shares remain considerably undervalued at $11/share. While there is uncertainty on the timing and final amount from the Argentina case, there is low risk regarding a large payout. The company is worth about $35/share (approximately $20/share for the core business, plus an estimated $15/share for Argentina).

WANdisco Plc

As discussed in the introduction to this letter.

Crossroads Impact Corp. (OTC:CRSS)

At the end of January, Crossroads issued a press release alerting investors that it would postpone the publication of its Q1 results due to an evaluation and review of its PPP loans, which has impacted the share price. As you may remember, the PPP loans resulted in a windfall profit to Crossroads, which prompted the company to distribute $260m ($40/share) in a special dividend to shareholders. Although, in recent days, the price has rebounded strongly, it is not clear if the market has sniffed out positive developments or if this is merely price volatility typical of microcaps. Either way, Crossroads is a small part of the portfolio, so the potential damage is limited, while upside to the stock presents us with asymmetric opportunity.

Over the past year, Crossroads has significantly expanded its loan portfolio from long-duration housing loans to three new verticals: climate change, transitional real estate, and small business lending, featuring shorter tenures of 12-48 months. The company leverages its relationship with controlling shareholder P10 Capital for financing and expertise. It raised $180 million at a $10.76 per share valuation with the option to raise an additional $350 million and signed an advisory agreement with P10 subsidiary Enhanced Capital Group for investment assistance.

In 2022, Crossroads issued over $200 million in impact-based loans. As a CDFI bank, the company benefits from a cost of capital advantage. For instance, in October, Crossroads received a $125 million bond through the US Treasury Department’s CDFI Bond Guarantee Program, providing long-term, fixed-rate capital for projects in low income urban, rural, and Native communities. With a competitive lending spread, Crossroads aims for a 20% return on its book value. Moreover, the current cadence of loans is approximately $100m per quarter, providing an opportunity for substantial upside over the next few years as profits from those loans accrue to the company.

Special thanks to Rimmy Malhotra of Nicoya Capital for sharing his invaluable insights on Crossroads.

Enovis Corp. (ENOV)

Enovis is an intriguing company with a team steeped in Danaher’s operating excellence with a potentially long growth runway through innovation and acquisitions. The company has two operating segments: the more mature Prevention & Recovery, which includes the market-leading DonJoy brand in injury recovery products such as knee braces, and the faster-growing Reconstruction segment focusing on surgical implants. Enovis aims to accelerate the latter’s growth within Ambulatory Service Centers (ASCs) using its established relationships through the DonJoy business.

Enovis, formerly Colfax, was established after spinning out ESAB, a welding systems manufacturer (we retained our shares following the spin). ESAB serves as an indicator of Enovis’ financial potential. By applying the renowned “Danaher business system” that permeates its culture and operations, ESAB now achieves organic revenue growth in the low teens and operating profit margins of approximately 15% (excluding amortization of acquisition intangibles). Enovis has 6% organic growth and margins of roughly 7.5%, presenting considerable upside if it can emulate ESAB’s success with a similar operational focus and scale.

Over the last three years, Enovis has completed 12 acquisitions. First, it has expanded its presence in the “extremities” subsegment (a sector growing 8% annually, double the overall orthopedics market rate) by adding foot and ankle to its robust reverse shoulder offerings. Second, Enovis has entered international markets by acquiring Mathys, a company with a solid European presence. Finally, to address a potential shortcoming in surgical robotics, Enovis acquired the ARVIS surgical navigation system, which boasts a compact design, making it ideally suited for the Ambulatory Surgical Centers (ASCs) that Enovis targets.

Enovis has ample opportunities to grow through acquisition, with approximately 30 mid-sized companies with revenues between $100m and $500m that could be potential targets and a further 1,000 early-stage companies. Enovis further emphasizes its “vitality” metric – the percentage of revenues from new products (developed within the last three years) divided by total revenues – which currently stands at 15% and provides insight into the potential for organic revenue growth.

Brookfield Asset Management (BAM)

On December 9th, Brookfield spun out its management company, now carrying the “Brookfield Asset Management” name and the BAM ticker. This spin-off aimed to offer investors direct access to an “asset-lite” alternatives manager with its robust, contracted, and growing cash flows generated through steady fees applied to significant assets under management. 83% of BAM’s $418 billion fee-paying AUM is long-term or perpetual. BAM expects to grow its $2.1 billion in fee-related earnings (FRE) by 15-20% per annum for the next five years as it continues to raise and deploy funds into attractive segments of the alternatives sector, including infrastructure (a vast multi-trillion-dollar market that complements Brookfield’s unique global operating strengths), renewables, and direct lending. Moreover, as an asset-lite business, BAM can distribute 90% of these earnings as dividends.

Through the spin, Brookfield aimed to emphasize the value of the asset management franchise as a standalone entity, acting as a catalyst for re-rating. While Brookfield initially guided towards an $80 billion valuation for BAM (with a $20 billion free float representing the 25% owned by shareholders), the market has thus far only assigned an approximate value of $52 billion to the manager (with a $13 billion free float). BAM trades at a relatively full multiple, around 25x Price-to-FRE (fee-related earnings, a P/E equivalent measure for asset managers) at the upper end of comparable company valuations.

CarMax Inc. (KMX)

Despite contributing positively to the portfolio, CarMax’s performance ranked among the bottom five positions during a period when most of our holdings experienced gains.

CarMax suffers from difficult macro conditions coinciding with increased investment as car retail is increasingly moving online.

High prices (stemming from COVID-induced supply constraints on new cars and increased demand due to stimulus money filtered down to the used car market) have impacted used car affordability. Meanwhile, recent interest rate hikes have worsened the situation. CarMax has surrendered some market share to maintain gross margins in this more challenging market, while CarMax Auto Finance (CAF), which generates profits from the spread between auto loan rates charged to consumers and rates paid in securitization markets, has faced squeezed margins.

Against this backdrop, management has increased investment into expanding its omnichannel offerings, recognizing the company’s strength in leveraging its extensive physical presence to provide a hybrid online-offline service to customers. For example, CarMax launched Finance Based Shopping nationwide, enabling consumers to receive pre-approval from multiple lenders and introducing MaxOffer, a digital appraisal product for wholesale dealers. These tools improve customer and dealer experiences and have increased CarMax’s self-sufficiency (36% to over 70%) while reducing vehicle sourcing costs. CarMax now generates at least 30% of revenues online; however, this has come at the expense of short-term profitability.

CarMax operates a strong business, with better profitability than competitors, within a cyclical industry. It leverages its data-driven pricing and inventory management systems to optimally pay for inventory to maintain gross margins while also optimally pricing a vehicle for sale to minimize depreciation from cars idling on the lot. With improved online capabilities, it will further outperform the industry as pricing normalizes.

CarMax shares have declined significantly from their November 2021 peak and may face additional short-term pressure. Given that much of the negative news is already priced in, further weakness could offer an opportunity to increase our position.

Portfolio – other changes

I sold covered calls on Wayfair (W), based on the assumption that the company was unlikely to experience significant price fluctuations before the next earnings report. High implied volatility should enable me to generate attractive income from the options premiums.

Samer Hakoura

Alphyn Capital Management, LLC

April 2023

Disclaimer

Alphyn Capital Management, LLC is a state registered investment adviser.

The description herein of the approach of Alphyn Capital Management, LLC and the targeted characteristics of its strategies and investments is based on current expectations and should not be considered definitive or a guarantee that the approaches, strategies, and investment portfolio will, in fact, possess these characteristics. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. Alphyn Capital Management, LLC has presented information in a fair and balanced manner. Alphyn Capital Management, LLC is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed.

Reference or comparison to an index does not imply that the portfolio will be constructed in the same way as the index or achieve returns, volatility, or other results similar to the index. Unlike indices, the model portfolio will be actively managed and may include substantially fewer and different securities than those comprising each index. Results for the model portfolio as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”) for informational purposes only. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance. The investment program does not mirror this index and the volatility may be materially different from the volatility of the S&P 500.

Performance results of the master portfolio are presented for information purposes only and reflect the impact that material economic and market factors had on the manager’s decision-making process. No representation is being made that any investor or portfolio will or is likely to achieve profits or losses similar to those shown.

Results are net of all standard fees calculated at the highest rate charged, expenses and estimated incentive allocation. Model portfolio returns are inclusive of the reinvestment of dividends and other earnings, including income from new issues. The return is based on annual returns since inception and does not give effect to high water marks, if any. Returns may vary for investors who are restricted from participating in new issues.

Hypothetical performance results are unaudited and do not reflect actual results of any accounts managed by Alphyn Capital Management, LLC. Hypothetical performance results are for illustrative purposes only and are not necessarily indicative of performance that would have been actually achieved if an investment utilized the strategy during the relevant periods, nor are these simulations necessarily indicative of future performance of the strategy. Inherent limitations of hypothetical performance may include: 1) hypothetical results are generally prepared with the benefit of hindsight; 2) hypothetical results do not represent the impact that material economic and market factors might have on an investment adviser’s decision-making process if the adviser were actually managing client money; 3) there are numerous factors related to the markets in general, many of which cannot be fully accounted for in the preparation of hypothetical performance results and all of which may adversely affect actual investment results.

There is no assurance that any of the securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

This report is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Our research for this report is based on current public information that we consider reliable, but we do not represent that the research or the report is accurate or complete, and it should not be relied on as such. Our views and opinions expressed in this report are current as of the date of this report and are subject to change. Any reproduction or other distribution of this material in whole or in part without the prior written consent of Alphyn Capital Management, LLC is prohibited.

Footnotes

[1] The Paxos algorithm, a mathematical model, is designed to maintain synchronization among a network of computers, accounting for occasional computer failures and unreliable connections resulting in message delays or loss. Unlike other solutions that typically feature a master-slave configuration and present a potential single point of failure (data is lost if the master server goes down), Paxos treats all computers on a distributed network as peers. It achieves “consensus” by requiring that any data change at a single computer on the network be agreed upon by a majority of its peer computers before being accepted by the system and then synchronized among all computers.

[2] There is no assurance that any of the securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable. See “Disclaimers” at the end for more details.

[3] For example in April 2023 Fairfax acquired an additional 46% interest in Gulf Insurance Group in Kuwait for $860m.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment