PonyWang/iStock via Getty Images

The selloff in 2022 has been epic for just about any sector besides energy, but some have been hit harder than others. Growth-oriented sectors of the market – and in particular, ones that command high earnings multiples – have been destroyed. That includes the semiconductors, which are high-growth, high-multiple stocks that are also extremely sensitive to economic conditions. With a fear of recession permeating through Wall Street and Main Street, that’s not a particularly good combination.

However, I think the selling is overdone in the group, and some names have better setups than others. One that I think has a terrific setup is Alpha and Omega Semiconductor (NASDAQ:AOSL). Below, I’ll detail the favorable chart setup, as well as the tremendous value shareholders receive today, the combination of which I think sets AOSL up for a very strong second half of 2022, and into 2023.

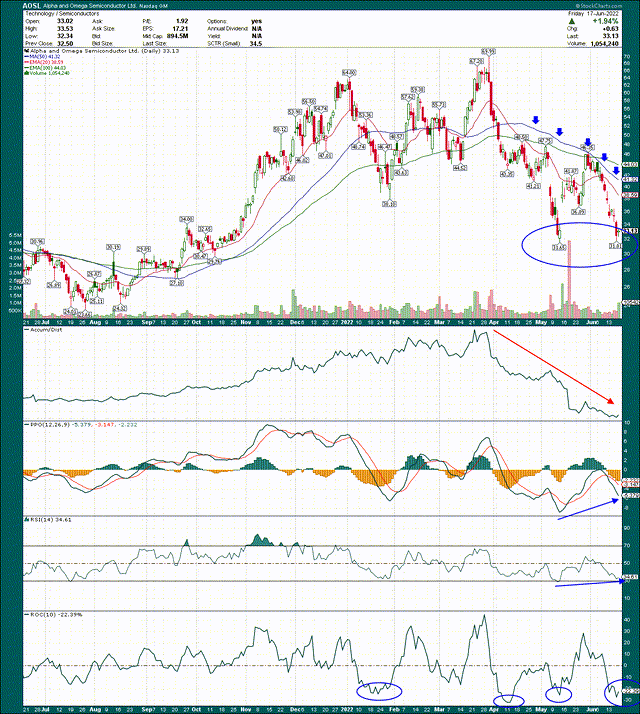

There’s a lot going on here, so let’s start with the price chart. The blue circle shows a double bottom that was confirmed on Friday with the up move we saw, and double or triple bottoms are very bullish price patterns. Essentially, a prior low was defended by the bulls and they managed to move the stock higher, so that’s a great sign. The 50-day simple moving average is rapidly declining, but is currently $41, which is ~$8 ahead of the share price, so there’s significant rally potential even just to that resistance line. Of course, the stock needs to crest that eventually for the rally to be confirmed longer-term, but for now, there’s a good short-term setup as well.

The accumulation/distribution line remains very weak, so that’s something I’d want to see turn around pretty quickly. However, the PPO and 14-day RSI are both showing signs of life as they put in positive divergences with the double bottom. We often see that at double/triple bottoms and while I’m not saying AOSL cannot revisit the $31 area where the double bottom was made, I do think the odds of a break down have declined significantly.

Finally, the 10-day rate of change in the bottom panel shows extreme oversold conditions where AOSL has bounced before. Does the combination of these factors guarantee us anything? Absolutely not. However, it does make it much more likely this is a sustainable bottom.

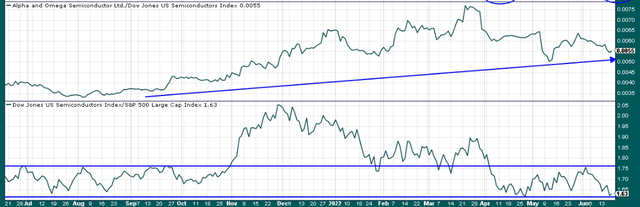

Now, let’s take a brief look at relative strength, or lack thereof. The first panel is the stock against the semiconductors, and the second is the semiconductors against the S&P 500.

AOSL’s strength against the group has been okay but dropped off significantly in the past few months. It was a leader during the bull run last year, which is what I’m counting on this next time around. The group itself, however, has been awful for the past half year, but the good news is that the relative weakness appears to be leveling out. Is that the start of the bottoming process? I think there’s a good chance it is, but if you buy a semiconductor stock today, just know you’re not buying into a position of strength by any means.

Now, let’s take a look at the fundamental case for AOSL, which I think is also pretty compelling.

Modest growth is good enough

I profiled AOSL a couple of months ago when the stock had a favorable, bullish setup. I said at the time AOSL was a buy, but the setup I identified never materialized, and the end result was rapid, nasty selling. Episodes like that are exactly why we keep stops in place. However, the stock is in a much better position technically today because of it, and the valuation has improved massively.

I profiled why I liked AOSL’s business in the linked article, which you can read in the section titled “Mega-trends support revenue and earnings growth for Alpha and Omega”, if you’re interested. None of that has changed so I’m not here to back off of what I saw as favorable long-term trends a couple of months ago. Essentially, AOSL has diverse revenue and earnings streams with a wide variety of applications, and in products that have stood the test of time and should continue to do so for the foreseeable future. Is there recession risk? Sure, anything consumer discretionary-related has recession risk. However, I also think that fear is overblown at the moment.

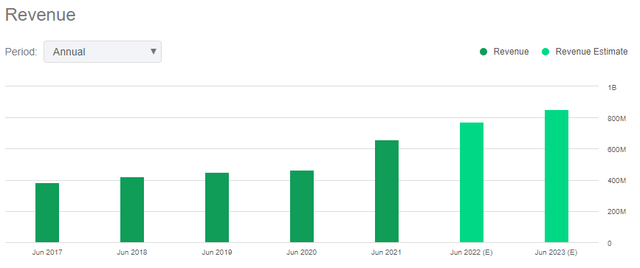

Now, below we can see the growth AOSL saw last year and is projected to see in the fiscal year that ends in a couple of weeks, as well as next year. In short, AOSL is posting very strong growth numbers, and its runway is significant given it’s still a very small company compared to most other semiconductor stocks.

AOSL has one quarter remaining in its current year, and it should get somewhere close to $800 million in revenue this year, but noted in its Q3 release there was downside risk to Q4 revenue from lockdowns in China. We’ve heard that story before so it’s understandable, but “understanding” is not a word I’d use to describe investors today. If, however, we focus on the long-term and not the next few weeks, I think the case for AOSL’s growth is compelling.

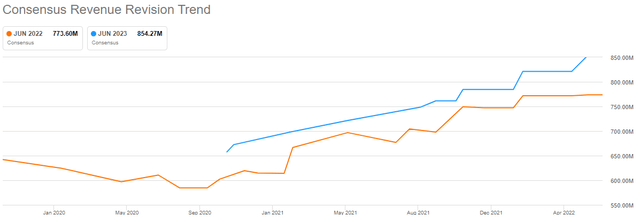

What is even more impressive than pure revenue growth year-over-year is the fact that revisions have been very strong, and critically, haven’t reversed in recent months like so many other companies have seen.

Estimates have been flat for most of 2022 for this year, but next year continues to rise, and I can’t imagine anything more bullish than constantly rising revenue (and earnings) estimates. When we look at this compared to the price chart, there’s a massive disconnect I cannot reconcile. However, that creates opportunities for those willing to take a risk on buying a stock that looks to be bottoming.

COVID panic valuations abound

We all know that when the COVID panic hit two years ago, stocks of just about any kind were destroyed. That’s why the S&P 500 or any other index you can think of made new lows, because investors didn’t know what to do, and uncertainty tends to create selling. I say this because if we look at AOSL’s valuation metrics, they’re almost identical to that COVID panic period, which simply doesn’t make any sense given how far we’ve come since then. We are nowhere near the level of sheer terror in the financial markets those days produced, but AOSL is being valued that way anyway.

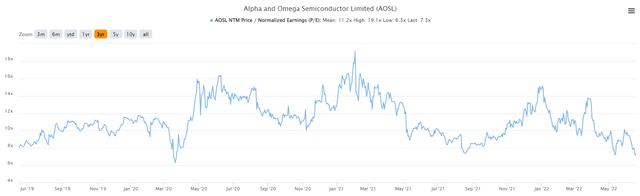

Let’s begin with the forward P/E ratio, which we can see for three years below.

AOSL’s average valuation over this period is just over 11X earnings, with the peak at 18X and the trough during the COVID panic briefly hitting 6.3X. We are at 7.3X forward earnings today, not in the midst of a global panic over a pandemic. Keep in mind that AOSL is growing revenue at double-digit rates year-over-year while sporting a forward P/E of ~7, and earnings – which we’ll get to in just a second – remain quite elevated. In other words, there’s no fundamental reason for this stock to be as cheap as it is.

EPS was $2.13 last year, and is slated to be in the area of $3.84 for this year, and ~$3.80 for next year. In other words, AOSL’s earnings aren’t exactly falling off a cliff here, but the stock is being priced like they are. Is there downside risk to earnings? Sure, anything is possible. But with the way the stock is priced today, that downside risk is priced in and then some, so the real risk here is being too bearish and the stock taking off higher to create a more reasonable valuation once the fear subsides.

Apart from what looks like a ludicrously low forward P/E ratio, AOSL is trading for just above tangible book value today, which sounds unbelievable for a stock in a group that is usually high-flying and nowhere near book value.

The stock goes for just 1.1X tangible book value at the moment, and actually, the way AOSL has been generating cash in recent quarters, we may find that when it reports Q4 earnings, it is actually at or below TBV right now. At any rate, the stock’s average valuation by this metric over three years is 1.7X, and the peak was over 4X. Just like the forward P/E, the price action today is impossible to reconcile for me.

Final thoughts

I’m of the opinion that the semiconductor stocks are likely to lead us out of this bear market once the bear market has run its course. I also happen to believe we’re either at the bottom now, or are very close, so I’ve been buying exposure to growth stocks accordingly. If I’m right, AOSL’s double bottom may prove to be the buying chance of a generation in this stock, because if the bear market is ending soon, stocks that have strong growth and are tremendously undervalued – both of which AOSL fits – should attract huge amounts of money from Wall Street. I’ll reiterate we haven’t received confirmation of this yet, so those more risk-averse may prefer waiting until the all-clear has been sounded. However, I think AOSL at $33 is too cheap to ignore.

We cannot ignore that semiconductors and other economically sensitive stocks are cheap because of the fear of a recession. However, if you look at how far these stocks have fallen, I have a hard time seeing significant additional downside that hasn’t already accrued. However, I see a ton of upside if the recession is more shallow than feared or doesn’t happen at all. That’s the balancing act one must take today on stocks like AOSL.

Based upon the forward P/E reaching even a normalized level of 11 to 12, we’re looking at potential upside of 50% to 65%. On the P/TBV ratio, reversion to 1.7X could produce 55% gains. While the percentage gains are fun to think about, the point is this; the stock is far too cheap, pricing in a recessionary scenario where earnings will fall off a cliff. That’s a possibility, but I don’t see it today as a probability. For that reason, I think AOSL is a strong buy here, particularly with that double bottom in place.

Be the first to comment