Sundry Photography/iStock Editorial via Getty Images

Many investors are now turning to cash as the world economy suffers from the Russia and Ukraine war, which aggravates the probability of today’s recession. The semiconductor industry is among those affected, prompting today’s valuation reset. Alpha and Omega Semiconductor (NASDAQ:AOSL) dropped more than 50% from its peak in March. It is one of the leading semiconductor companies that has a focus on analog semiconductors and power semiconductors globally.

AOSL is well positioned to capitalize on the growing power MOSFET market, as people look for efficient ways to save money in today’s high inflationary environment. Demand for solar inverters and the continued shift towards electric vehicles should drive AOSL’s growth in its power semiconductor products.

Despite the fear of a semiconductor meltdown, industry experts believe that the semiconductor outlook remains stable. In fact, according to the Semiconductor Industry Association (SIA), global semiconductor sales remained positive on a 21.1% and 0.7% YoY and month over month basis in April, where US sales generated an increase of 40.9% YoY. I believe demand will remain stable or at least elevated than pre-pandemic as the world moves towards a new era of technological innovation. AOSL is a buy at today’s weakness.

Company Background

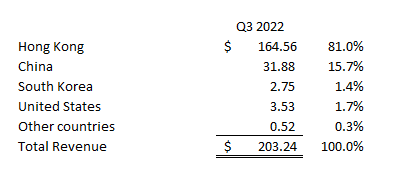

AOSL has an outstanding performance, doubling its total revenue, amounting to $760.9 million (LTM) compared to $342.3 million in FY2012. However, this growth seems challenged by temporary lockdowns in Shanghai, where analysts expect a negative impact on the company’s Q4 top line by around $20 to $50 million. AOSL operates globally and most of its revenue derived from the Hong Kong and China regions during its Q3 2022.

AOSL: Revenue by Geographical Location (Source: Q3 2022 Report. Prepared by InvestOhTrader. Amounts in Millions)

Concentration in China and Hong Kong operations still remains a risk for the company. Luckily, according to management, they have enough backlogs to work on.

…our total backlog is still a lot higher than our current capacity to meet it even after baking in macro softness.

While the Shanghai situation has been very unfortunate, it serves as a tangible reminder that our strategy to diversify our supply chain is the right one, and it further strengthens our commitment in that direction. Source: Q3 2022 Earnings Call Transcript

On top of the declining growth of the US’s GDP forecast, I believe its reduced equity stake and loss of control in its joint venture company in Chongqing China adds another layer of fear.

On the bright side, this transaction is expected by management to be immaterial in relation to its operational performance. The said transaction materialized a capital gain on deconsolidation amounting to $399.09 million, resulting in a temporary boost in the company’s bottom line recorded in Q2 2022. Additionally, management believes lock downs will be temporary and reassures its investors that they are on track to achieve $1 billion in annual revenue in FY2024 and beyond.

An Effective Management

In order to meet demand, the company is upgrading its Oregon fab’s R&D facility and looking to expand its capacity. AOSL is seeking more advanced technology and is improving its operating efficiency as quoted below.

In the March quarter, we accelerated our Oregon fab’s R&D facility upgrade and capacity expansion. We purchased more advanced lithography and related production equipment and continued the clean room construction. Source: Q3 2022 Earnings Call Transcript

Management identified some of its noticeable growth drivers with its business segments and employed an effective sales mix strategy.

Its computing business segment, which accounts for 44% of the company’s total revenue, grew 28% YoY and up 2% sequentially. AOSL gets positive results with its focus on the commercial market rather than the softening consumer market, as quoted below.

The main driver of this outperformance was continued strength in notebooks, particularly from OEM customers that have a higher concentration of their business serving commercial laptop applications.

We believe this was driven by return to office trends and company’s refreshing employee work laptops. We deliberately targeted a higher mix of commercial projects during the past years since our power ICs and power MOSFETs have higher performance specifications and higher prices that better suit commercial markets Source: Q3 2022 Earnings Call Transcript

Expansion Is The key

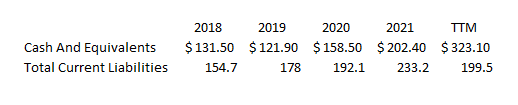

AOSL: Improving liquidity (Source: Data from Seeking Alpha. Prepared by InvestOhTrader. Amounts in Millions)

Its plan towards diversification and its recent deconsolidation of its JV company mentioned earlier, makes me believe that we can potentially see a meaningful expansion for the company, especially considering its growing cash and cash equivalent relative to its total current liabilities.

Management continues to provide a positive catalyst for AOSL, where they expect a continued capital expenditure investment bringing a potential record of CapEx for FY2022.

Our capital expenditures for the March quarter were $43.4 million. We expect a similar level of CapEx for the June quarter.

Our Oregon fab expansion project is on track. Clean room expansion was over 80% down at the end — at the quarter end and a small portion of the equipment has been moved in.

We expect the clean room construction can be completed and a majority of the equipment can be moved in during the June quarter. And we anticipate additional capacity to come online in the December quarter. Source: Q3 2022 Earnings Call Transcript

Relatively Cheap Compared to Its Historic Levels

After its huge drop from this year’s peak, AOSL is more attractive at today’s level, especially while looking at its trailing EV/EBITDA of 4.77x compared to its 12.74x 5 year average and its trailing price/cash flow of 4.14x compared to its 16.55x 5 year average. With its reassuring top line outlook for its Q4 2022 amounting to $190 million, it can still provide a $773.5 million in its FY2022, up 18% YoY compared to its $656.9 million recorded in FY2021. This estimated 18% growth is relatively stronger than its pre-pandemic level of 6.97% in FY 2019 and 9.97% in FY 2018.

The reassuring story continues with its GAAP margin to be around 31.9% in Q4 2022, and on an annualized basis, AOSL may potentially provide a record gross margin figure of 34.35%.

To sum it up, with its controlled operation outlook, I believe the average price of $57.33 set by Wall Street’s analysts is a conservative figure to set as the initial target price considering today’s operating environment.

Near Support Zone

AOSL: Weekly Chart (Source: TradingView.com)

AOSL is currently trading below its 20 and 50 day moving averages as shown in the chart above. This catalyst implies a short-term bearish momentum, but I believe it remains fundamentally sound and should trade near the street’s average target.

As AOSL enters a strong support zone as shown in the chart above, I believe today’s price and its near $30ish will be a good place to start accumulating this semiconductor stock. Looking at its MACD indicator, it remains below the zero line, and a potential crossover may signal a bullish reversal.

To Sum It Up

In my opinion, AOSL’s $1 billion annual revenue target in FY2024 and beyond seems reasonable and achievable, especially with the growing power semiconductor market. Although the company is already experiencing a softer PC market, its effective management provided a strong financial result despite today’s tough operating environment. Additionally, besides its computing business, AOSL’s communication and industrial businesses, which contribute a total of 33% of its total revenue, still have room for growth in light of the connected and electrifying of everything.

In fact, despite the broad market sell-off, companies in the semiconductor industry, such as KLA Corporation (NASDAQ:KLAC), remain optimistic about their long-term prospects and have initiated a strong buyback and dividend increase catalyst. Another one is the recent acquisition catalyst of Applied Materials, Inc. (NASDAQ:AMAT). These kinds of catalysts support the idea that the semiconductor industry will continue to expand as demand for macro technology trends continue to shape the world.

Moving forward to its balance sheet accounts, AOSL has an improving current ratio of 2.59x, better than its 1.85x 5 year average. On the other hand, its long-term solvency has improved, as evidenced by its trailing debt/EBITDA ratio of 0.63x, which is better than its 5-year average of 3.32x, and its debt/equity ratio of 11.65x, which is better than its 5-year average of 0.41x. This enormous improvement is due to the company’s substantial deleveraging, which has reduced its total debt to $96 million, better than the $201 million recorded in FY2021.

I believe the market is severely beating AOSL, especially with its unbroken growth in its margins and today’s boost from Biden’s Solar initiative, where AOSL’s US operation may benefit. Another value adding catalyst is that AOSL has recently been added to the S&P 600, which may provide more trading liquidity for the company.

AOSL has an outstanding ROE of 78.08% compared to its 10.04% 5-year average. It has an improving liquidity, an improving cash level despite material deleveraging, and most importantly, a positive outlook on its gross margin, making this stock a buy at today’s weakness.

Thank you for reading!

Be the first to comment