utah778

Investment Thesis

Allkem (OTCPK:OROCF) was an addition to our portfolio when we were looking for exposure in forward-facing commodities at reasonable valuations. Upon reviewing Allkem’s first set of post-merger full-year results we feel that the company has a strong performance outlook that is not evident from headline numbers. Combined with its enigmatic history, geographic presence and track record, in our opinion it makes for an undervalued stock.

The Company

Allkem is a resources company focused on the extraction and processing of Lithium chemical compounds. The company is the result of an August 2021 merger between Orocobre (based in Argentina) and Galaxy (based in Australia). Prior to merger, Orocobre had reported net losses in its previous two reporting periods.

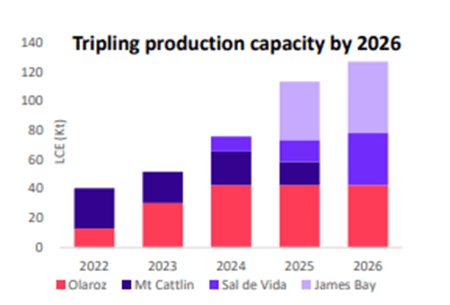

Allkem’s production output forecast for the next 4 years (excerpt from FY22 Financial Results)

Its current production of Lithium products come from 2 legacy locations – Olaroz and Mt Cattlin. Additionally, the company has been building out a conversion facility in Naraha (Japan) as well as making progress on 3 other lithium mining sites – Sal de Vida (Argentina), Cauchari (Argentina), and James Bay (Canada). In progressing on these plans, the company has stated expectation to triple its production output by 2026.

Its primary listing on the Australian Securities Exchange is likely due to legacy reasons, however the company clearly sees its future in other parts of the world.

We were attracted to Allkem for the above reasons: a Lithium pure-play, a diversified geographical presence, and its project pipeline. We also felt the lack of positive earnings history, and its footprint across borders obfuscated the profile and earnings potential of the company.

Valuations

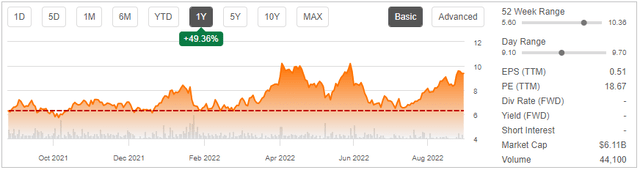

In its recently reported FY2022 results, Allkem reported revenues of US$770m and net profits of US$337m. This equates to an EPS of 51c, and a trailing P/E ratio of 18x. Because of its short post-merger history and the negative legacy earnings, these results gave a first glimpse of a meaningful P/E value.

We note that 18x P/E is at the high range of mining firms on our radar – for example BHP (NYSE:BHP) trades at 12x and Rio Tinto (NYSE:RIO) at 6x. We follow a rule-of-thumb that a 18x multiple is roughly equivalent to coverage of initial capital outlay within 18 years. On face value this investment horizon is too long duration for our consideration.

However, because these are backward-looking headline numbers, we felt it didn’t reflect three important factors: future production output increase, a lag effect in realised sales price, and stock price volatility.

Production Output Increase: All else being equal, if production increases three-fold, we can expect future earnings to eventually follow at a similar rate.

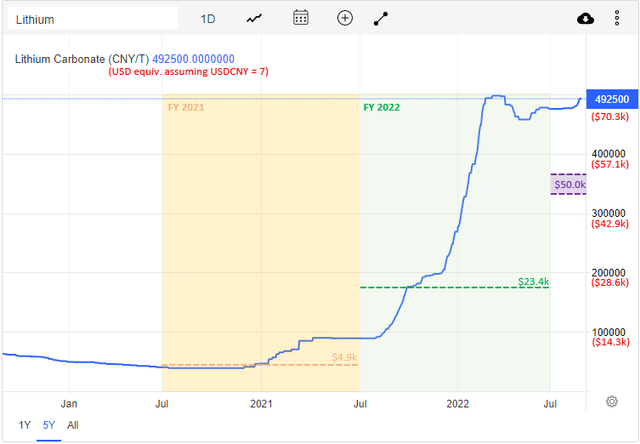

Realised Sales Price: Taking Lithium Carbonate as an example, the latest financials state that the average realised price was US$23,398/t in FY2022, and US$4,938/t in FY2021. When we map this out against the spot price of Lithium Carbonate, we see that realised price sits much lower than the average price for the year.

Realised sales price (dotted lines) from the prior reporting periods, vs spot price (blue line). We predict FY 2023 realised prices (purple) to be c. $50k (tradingeconomics.com)

We attribute this largely to much sales occurring based on contracts, and the lag effect in these contracts reflecting updated market price. For the coming year, we expect realised prices to better reflect spot price moves in the last 6-12 months, and predict average realised price to conservatively double to c. US$50,000/t.

Stock Price: The above graph showed that spot price has quadrupled in the last 12 months. However, the stock price movement for the same period has been much more subdued, with August 2021 levels of $6 retested as recently as last month, and at time of writing the stock price has only increased 50% YoY. We feel the stock price is currently not moving in sync with fundamentals, and instead is more influenced by the uncertain macroeconomic backdrop.

OROCF’s price movement has not reflected the price movement of Lithium in the last 12 months (Seeking Alpha)

That in itself is not sufficient evidence to suggest the stock is undervalued at $10. However, with continued headwinds in the global economy, and specific to Allkem, earnings downgrades post-release of results, we feel near-term volatility may persist resulting in downward price pressures on the stock.

In totality, we calculated that adjusting for production output increase warranted a 40% haircut to current P/E, and a 50% cut for realised sales price. This implied a forward P/E of 6x at current levels of $10. Stock price volatility resulting in a hypothetical drop of stock prices to $7 would pull implied forward P/E to almost 4x.

Risks, or Possibilities?

In listing out potential risks we wish to simplify it to four factors: supply, demand, price and cost. For each of these factors, we have also looked to implement measures to help us mitigate worst-case scenarios.

Supply: Aligning with our first valuation adjustment above, we note that the output target of 3x is more likely to surprise to the downside. The company has highlighted labour issues and lower ore quality at Mt Cattlin as ongoing concerns, and in an environment with continued uncertainty in supply chains and geopolitics it is appropriate to factor in further negative surprises.

To combat this we added an element of conservatism in deriving our 40% haircut adjustment. We also think we can assess ongoing production from regular management communication.

Demand: We feel that the extensive market coverage of the nascent EV industry gives great insight into the direction of travel of the Lithium market. We would be sensitive to perceived weakness in Lithium demand, or the impact of higher Lithium to manufacturers, and would be looking to understand trends influencing demand, and how it corroborates with price movement.

Price: Aligning to the second valuation adjustment, we see 2 key factors that influence price: execution failure and lower spot prices. To address the first point, again our 50% haircut was calculated using conservative inputs.

We have assumed future spot prices will average out close to current levels of $70k in the coming years. A higher spot price over time would be a positive to P/E and a lower price would be a negative drag.

Should lower spot prices eventuate, we expect realised sales price to continue to lag spot and therefore allow us time to reassess our investment case before the impact is fully reflected in company earnings.

Costs: We have assumed gross profit margins in line with current levels, even as output increases or sale prices improve. We will look to regular communication from management for further guidance.

Conclusion

At first glance, 18x P/E is a level uncomfortable with our value-based investment approach. However, underpinned by the anticipated long-term positive impact of production output tripling, and the near-term benefit of realised prices doubling, we’ve conservatively estimated an investment in Allkem can pay off fully within 6 years. At this level, we think that Allkem gains at least equal footing with other attractive names in the commodities, materials and energy sector.

For interested investors, we would advocate initiating exposure to Allkem at current prices, but keeping in mind an opportunity to buy into weakness may present itself in the coming months (a dollar cost averaging approach would also be appropriate). We would then look to sure up conviction in our investment over time by continuing to monitor Lithium spot prices, market trends, and regular communication from management.

Be the first to comment