Matteo Colombo

Investment Thesis:

As financial markets struggle, we continue our search for good investment which can navigate the times ahead and outperform when markets improve.

AllianceBernstein (NYSE:AB) are one of the most well-respected firms on the Street, with few able to match the quality of their Research division. That is what initially peaked our interest in the firm but what makes AB stand out is the expansion into Asia. We believe AB can exploit its brand image to grow AUM in this sector, which should have a positive impact on the bottom line through improved margins.

Till then, investors can enjoy good dividends, with the downside protection of the business being slightly undervalued when compared to peers.

This is far from a high conviction play, but we believe the dividend returns are attractive enough to assume the risk.

Company Description:

AllianceBernstein is a global asset management firm which offers predominantly actively managed funds across multiple asset classes, including equities, bonds and alternative investments.

Unlike many of the large cap asset managers, such as BlackRock (BLK), AB has developed a focus on private wealth management and services for UHNW individuals. Further, AB are well-renowned for their equity research department, which provides coverage across several geographic markets for mainly institutional investors.

AB’s current revenue breakdown as follows:

| Income Stream: | % Q2 22: |

| Base Fees | 71% |

| Distribution Revenue | 15% |

| Research | 11% |

| Performance fees | 2% |

| Other | 1% |

AB’s revenue is well diversified. Of course, fees make up the bulk of their revenue but research and distributions account for over 10% each. Importantly, they are not reliant on performance fees, earning only 2% of revenue from this in Q2 2022 and 5% in Q2 2021.

Macroeconomic Considerations:

It is clear that we are experiencing extremely negative market sentiment. The reason for this is partially rampant inflation, which Central Banks so far have been unable to reign in. The hesitancy to increase rates likely stems from the fear that growth may turn negative. In Europe, rate hikes would effectively cause defaults in many of the Euro-based countries. Further, we are seeing a serious deterioration in households’ ability to service their obligations, as a cost-of-living crisis begins. This has naturally spooked markets, with the S&P 500 down 13.89% year-to-date.

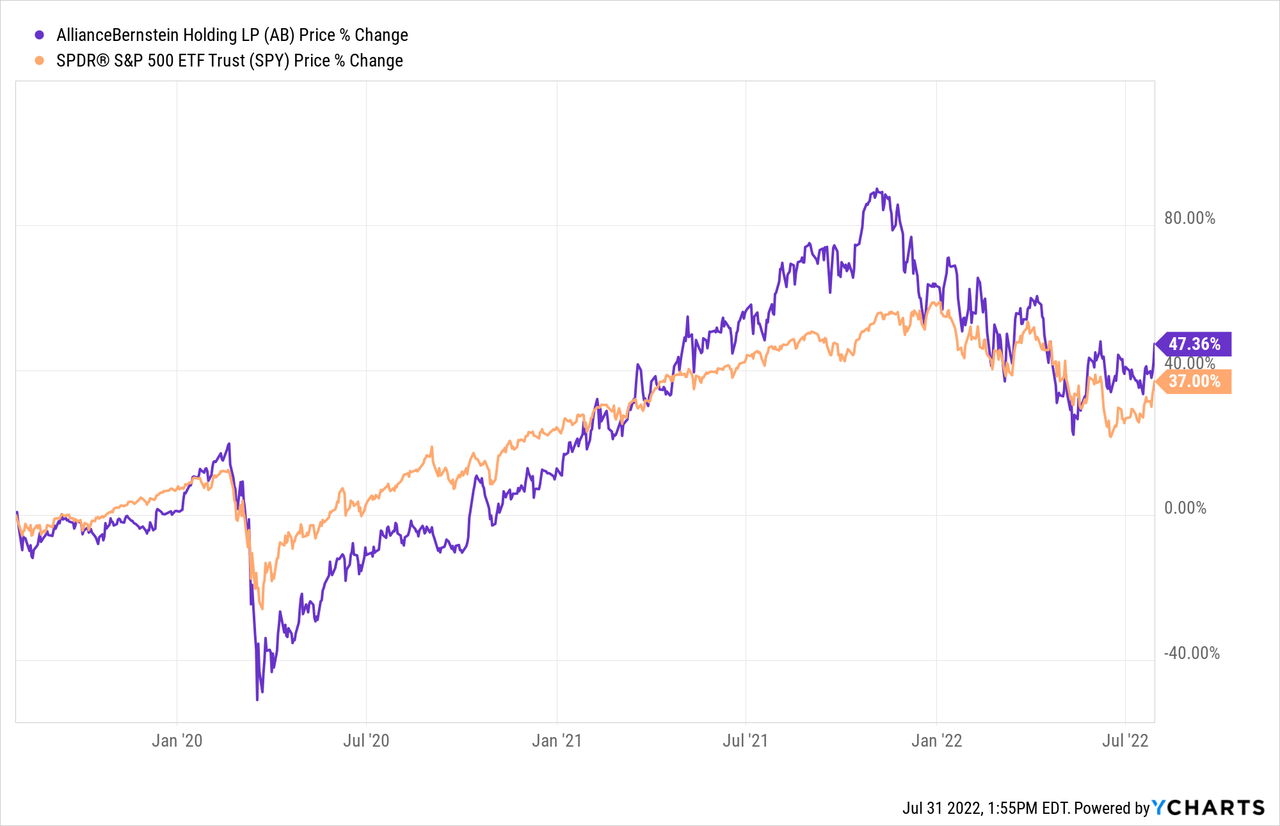

So how does this impact AB? Well firstly, it seems the sentiment has not fully reached the business, with the stock price down only 9.8% YTD v. 13.9% of the S&P. The reality, however, is that this will continue to have a knock-on effect on the business. A large portion of AB’s AUM is tied to equity markets and so its profit generating base, in theory, should move somewhat in-line with the market. With the assumption that AB can outperform the market, it will still likely fall.

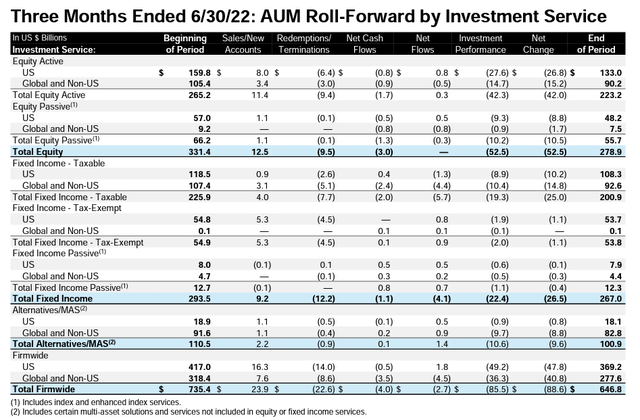

AB’s current AUM sits at 647BN, which is down 12% from the previous quarter. Of this drop, 97% is attributable to a fall in value, rather than redemptions. Therefore, if markets do continue to fall, it is likely that fees will fall also. What we like however, is that investors remain committed to AB. With a large UHNWI base, there is the risk that investors pull their money during down periods.

We do not have a crystal ball and so cannot tell you what markets will do, but we can try to decipher how macroeconomic conditions will change in the coming 12 months, and what impact this could have on AB.

With both the UK and US posting 9%+ inflation in the most recent recording, it is clear the slow rate hikes is not working. Credit to the British, they are leading the G7 in raising rates but it’s clearly not enough. The likely outcome is more rate hikes and a gradual slowing of the economy, as inflation related cost of living problems are replaced but monetary tightening. This will likely further bring markets down and greatly so. A nuance I have seen many yet to mention is that up until Q2 earnings, most companies were beating analyst estimates, some companies are still beating in Q2. Therefore, any potential economic slowdown is yet to hit the bottom line, even if it has already hit the share price.

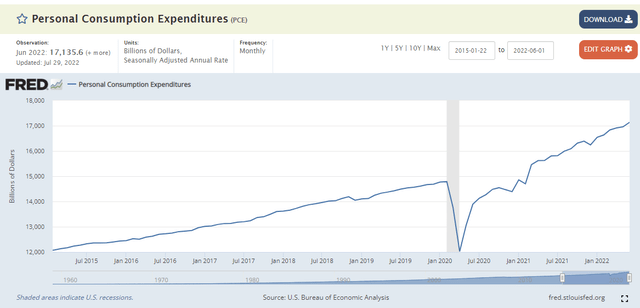

To counter this however, one must consider that beyond anything else, consumer spending remains strong. The UK returned to growth in the most recent month, with both manufacturing and services performing well. This is important to consider as we have yet to see an impact on personal consumption. If demand can stay robust, any potential recession will be short lived and shallow.

Although AB is exposed to alternative asset classes also, such as hedge funds, our base case assumption is that they cannot hedge against a fall in markets. Therefore, investors thinking short-term should avoid AB as evidence suggests in the next 12 months may see AUM fall further. If one can hold through a turbulent period however, we believe AB is an attractive proposition.

Asset Management:

The asset management industry can be very broadly broken up into two main segments, traditional equities and bonds, and alternative investments (such as private equity and direct lending). We are seeing now more than ever, investors looking for exposure to alternative asset classes as a means of generating alpha. The reason for this is clear, one can gain uncorrelated returns from the market and potentially greater returns (dependent on the manager). Contrast this with a traditional equity/bond or all listed equity portfolios, have shown an inability to outperform long-term without dabbling in the alternative space. Blackstone (BX) is a specialist alternative asset manager and grown its AUM in the high double digits in recent years, showing the market appetite for these services (See our paper on BX here).

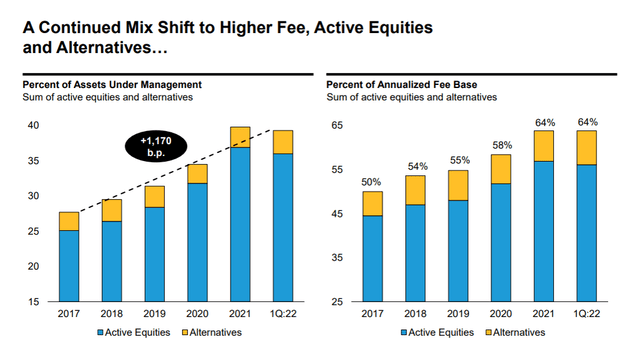

Management have stated their intention to shift focus towards these asset classes. As we have mentioned, the business does have some exposure here, but the desire is to continue to grow this. The benefit to AB is that they can command a much greater fee and faces less competition. With a traditional equity fund, fees are small, and competition is rife, especially with ETFs.

Given the wide variety of strategies and asset classes, the quality of management is a lot more important, and one of the leading factors of success. AB’s asset managers are highly regarded in the market, with countless award wins over the years. The firm has developed a strong track record which gives them expertise in this area. Not only this but the managers have access to the equity research side of the business, which is arguably the best research house on the Street. This gives AB an edge when attracting potential investors and producing outsized returns.

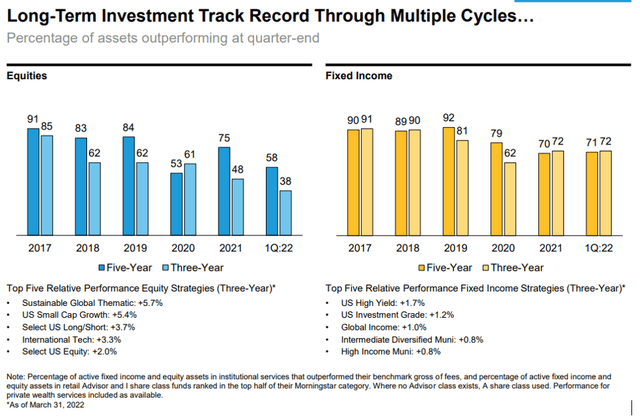

When we look at AB’s outperformance, we see just that. Active managers cannot survive without constant outperformance, this has not been an issue so far for AB.

AB’s long term performance (AB)

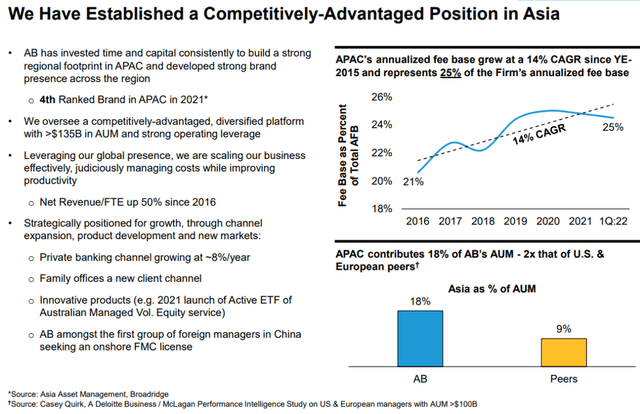

Another interesting development within the asset management industry is the growth in the Asian markets. Led by China, we are seeing outsized funds flowing into businesses across the region and the rapid development that follows suit. Not only this but we are seeing many lifted out of poverty and entering the middle class. This creates a great opportunity to exploit, there are many people who want to invest in the region and many people in the region who want to invest. This is clearly an opportunity that AB has spotted, as they have invested heavily in the region, being awarded the 4th best brand in APAC. They are also among the first to operate in China and are now looking for a license to onshore.

The potential here is for AB to exploit the greater growth in the region, when compared to the West. As incomes and wealth is generated faster (as a %), this can support out scaled returns when compared to traditional asset managers. This is supported by the greater fees that can be charged in the region, which AB have been good at offsetting with scale. The potential here is for AB to become the leading alternative manager (at least for UHNWI) in the region, which when we look long-term, could propel the business to new heights. It currently has double the AUM exposure of its peers, showing the relative investment, but hiding the scale difference (which is likely a lot).

Financials:

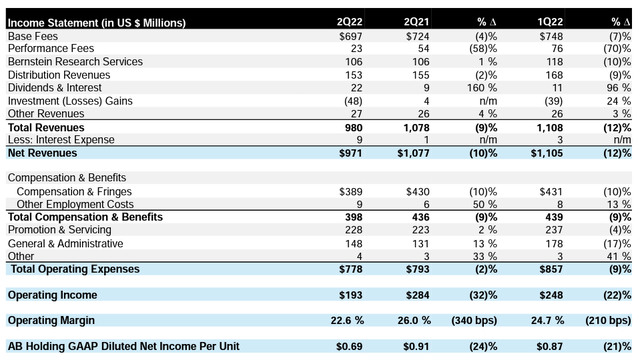

AB’s H1 2022 performance was ok all things considered. The business grew net revenue 10% when compared to Q1 2021 but fell 13% when compared to Q4 2021. Q2 followed with a 10% fall compared to Q1 and Q2 2022. Given that Q4 2021 is likely going to be the top of the market for a while, this is not a surprising fact. Blackstone (BX) for example saw marginal gains compared to Q1 2021 and a greater fall compared to Q4.

Given the ratio of income generated from fees + research, we are very bullish on the downside risk. AB’s profits are not reliant on the sensitive performance fees but is generated from the more reliable sectors. Now, of course, if markets fall, AUM will too, and thus fees. But with AB’s clientele being predominantly sophisticated investors, we are unconcerned by the risk of large redemptions. As the below shows, redemptions look fairly healthy (within the context) when compared to investment performance and new business.

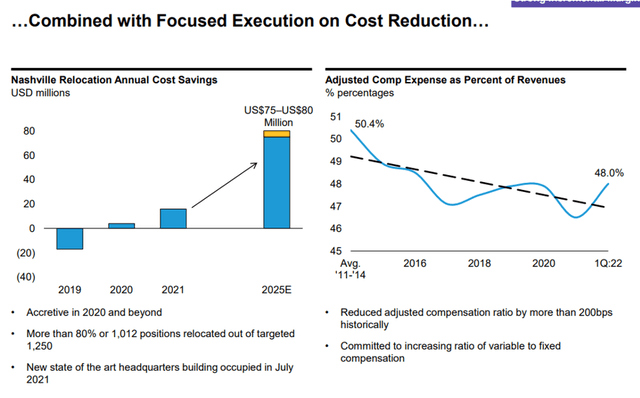

What is slightly concerning for us is the deterioration in margins over time and the compensation ratio. Although we certainly agree that AB’s employees need to be remunerated well and that they deserve their pay, the issue is that costs will not flex with income. As a result of this, as markets continue to fall, margins will compress aggressively.

Valuation:

AB is currently trading at a 11.85x multiple of LTM earnings, which compares to 18.83x by Blackstone, 11.91x by TROW and 17.62x by BlackRock (Source: Tikr Terminal).

This suggests a market discount applied to AB, as we note a discount to comps historically. The reason for this is AB does not have the scale (or the potential scale) due to much of their clientele being UHNWI and investors seeking active funds. Seeking Alpha’s valuation rating is an A-.

Seeking Alpha’s valuation rating (Seeking Alpha)

What is really attractive about AB is its dividend, the business’s current yield is 9%. Due to AB’s policy of a 100% pay-out ratio, this will likely continue to be elevated unless we see a serious deterioration in operations. This gives investors a great return on investment, during what is otherwise tough economic conditions. The downside however is that profits are falling, as a result the amount of dividend will also. However, when we look at revenue breakdown, we note performance related income is a small minority of their income. Most of their revenue is earned from Research plus base fees, which is a less volatile form of income. Stress testing income suggests revenues should keep dividends in excess of 6%.

Investment Risks:

AB’s two largest investors, EQH and AXA, make up c.20% of AB’s AUM. There is clearly a risk here that these investors pull their money, resulting in a large outflow and change in the fundamentals of the business. EQH are the parent company of AB and so we see this risk as unlikely.

Final Thoughts:

Investing into asset managers today does not seem like a good idea, they are subject to the (mostly negative) whims of the market. This said, some firms have a uniqueness about their operations that will allow them to perform fairly well over a longer period of time, which will reward investors. We have written articles on both Blackstone and KKR (KKR), giving both businesses a buy rating.

When it comes to AB, we feel the same. Our conviction is a lot less, but the downside risk is lower here. With AB, we see the selling point as the attractive dividend yield, partnered with the growth potential of AUM. Investors can earn a fairly strong yield in the short-term, before ideally seeing capital appreciation through AB’s growth strategy.

Be the first to comment