Yaroslav Astakhov

Allegiant (NASDAQ:ALGT) is a leisure travel company that focuses on providing travel and leisure services to residents of underserved cities in the US. Having a diversified revenue stream among various travel services and product offerings distinguishes Allegiant from other travel companies.

The company operates low-cost passenger airlines, primarily for leisure travelers in underserved cities through about 593 routes between 98 origination cities and 33 leisure destinations. Along with that, in the last year, the company recommenced the construction of Sunseeker Resort, which is funded through debt of $350 million and expected to open in early 2023.

Due to the various setbacks that the airline industry has been facing, the stock has dropped significantly despite a robust business model and a strong financial position, and from such an undervalued price, the stock offers significant upside potential.

Historical performance

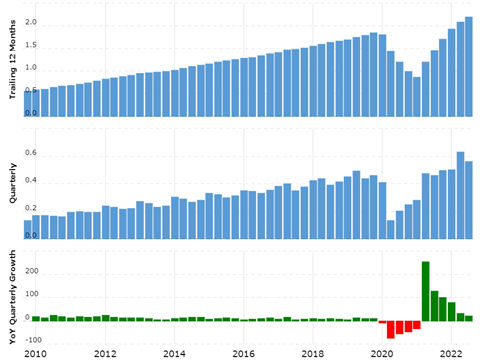

Revenue (Macrotrends)

Over the last ten-year period, the company’s revenue has grown consistently, with no considerable drop except during 2020. Such a significant improvement shows that the company could grow its business consistently and has a substantially strong business model.

Along with the revenue growth, over the same period, profitability has also increased consistently and reached its all-time high level of $232 million in 2019, but during 2020, the company had to incur loss due to covid-19-related shutdown of its operations.

Note that significant losses in the airline industry in the last two years have been mitigated through a government payroll program, where the government has supported many airline companies by granting significant money to cover the airline operating expenses. Therefore, the company could post a profit in the last year. But in the last few quarters, the grant amount has stopped, leading to a significant rise in expenses.

Over the period, management has played the game safe by keeping debt levels at moderate levels, but recently due to higher CAPEX and reconstruction of the resort, debt levels have increased and reached $1840 million; also note that the company has over $1.1 billion of current assets, which provides the business with significant financial stability.

Also, with time, management’s thinking has evolved and management started focusing on ancillary revenue, which is the reason why, from 2004 to 2021, ancillary item revenue increased significantly from $5.87 per passenger to $64.73 per passenger.

Recently, the company has started a new initiative called Allegiant 2.0, which focuses on expanding the domestic network, strengthening the business model, and providing affordable air travel. This initiative is going to bring substantial growth to the company.

Strength in the business model

Allegiant operates a unique business model, where it focuses specifically on leisure customers, resulting in significant cost savings as compared to those who serve a wide variety of customers.

Whereas most airlines focus on a wide variety of customers, high base fare, and low ancillary revenue, Allegiant does the opposite as it mainly focused on the leisure market, low base fare, and high ancillary revenue model. The company seeks a majority of its profitability by offering various air-related products, which helps the company to increase its profitability while keeping the airfares low.

Also, having low base fares helps attract low-budget customers and provides a significant competitive advantage in underserved cities where customers mainly focus on the price of the air ticket.

The company actively manages seat capacity as per the demand patterns, and over the period, its ability to quickly manage capacity has helped the company retain its profitability even in dynamic travel conditions, as the demand rises, the company increases the utilization in such a way the company could mitigate the effect of increased fuel cost by reducing overall capacity if the demand is not high enough to turn operations profitable. Having such a unique operating strategy helps the business to make most of the flight profitable, whereas other airline players have to incur huge losses if the demand falls.

Over the period, the company’s ability to focus on ancillary revenue and its ability to manage its capacity has turned out to be extremely profitable in an industry which has a history of significant losses and consolidation.

Risk factors

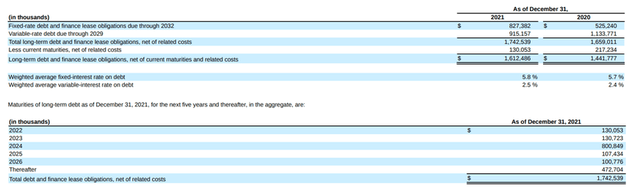

debt maturity (annual report)

Currently, the airline industry has been facing significant drawbacks due to lower fares, higher fuel costs, and pilot scarcity. As a result, a large number of airline companies have been facing significant trouble in obtaining debt refinancing.

Also, investors have become cautious about airline companies, and in such conditions, obtaining refinancing has become very difficult. In the case of Allegiant, significant debt is going to mature in the next two to three years, which puts the company at significant risk. But the business model is substantially strong and has produced huge cash for the business.

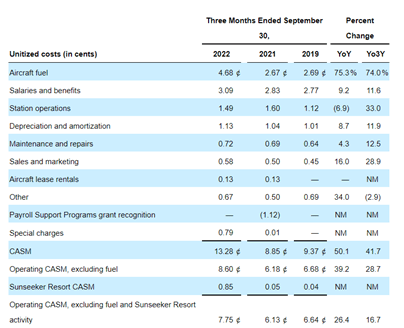

expense structure (quarterly report)

The next major risk is Pilot Scarcity – due to the pandemic, a large number of pilots have taken early retirement, resulting in a significant shortage of pilots. But in the case of Allegiant, it seems that management has been significantly managing the pilot scarcity as the salary cost has not seen a significant rise as compared to its peers.

Although the company has a business model which manages capacity and mitigates the effect of fuel cost rise, recently, the company has been incurring huge losses due to significantly hiked fuel prices. If the prices remain high for longer, the company will have to incur huge losses and, in such a condition, it will become very difficult to obtain debt refinancing, which might result in a sharp fall in the share price.

Why am I bullish on the stock?

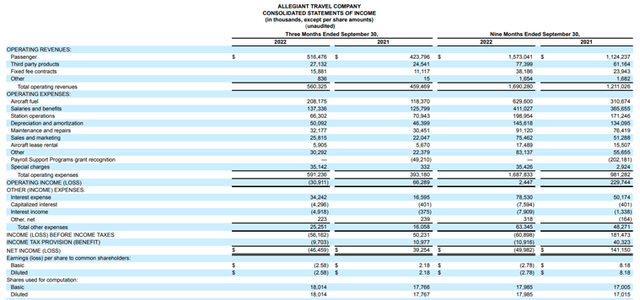

quarterly result (quarterly report)

Due to a substantial rise in fuel costs, the company has been incurring losses, but the overall business model is significantly strong and has produced huge cash flows. Although there are various risk factors, the company has a strong financial position and a robust business model through which it can manage the risk.

Also, due to the adverse economic conditions and the negative sentiment about the airline industry, the stock has fallen more than 68% from its all-time high, despite a strong history of profitability. The company is currently trading for about $1.4 billion, whereas it has produced a profit of about $232 million in the pre-covid period. It seems that the company has been trading for just 6 times its pre-covid earnings.

The stock has become significantly undervalued and provides huge upside potential. I believe Allegiant is a buy.

Be the first to comment