Asia-Pacific Images Studio/E+ via Getty Images

Investment Thesis

Align Technology, Inc. (NASDAQ:ALGN) has established a dominant position in the global clear aligner market. Despite competition rising since its patents began to expire in 2017, the Company continues to execute on all fronts.

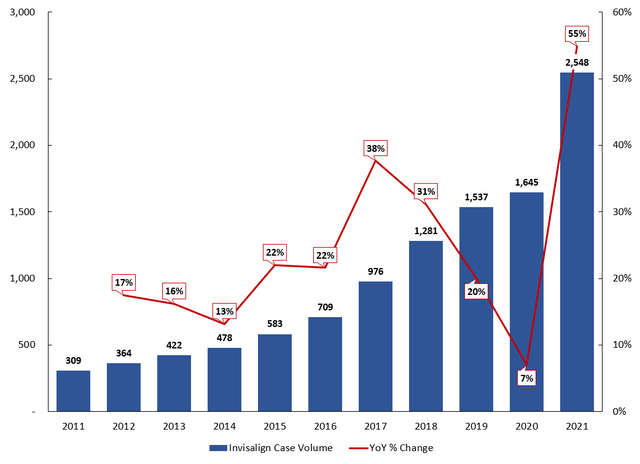

Revenues have compounded at 23% annually since 2011. Conventional braces, however, still hold the lion’s share of global orthodontic cases, leaving plenty of room for expansion.

In North America, clear aligners are used in less than 20% of orthodontic cases. International penetration is even lower, at less than 10%. As Invisalign continues to expand its share of orthodontic cases, the business should extend its impressive growth.

Align is a profit machine, averaging 70%+ gross margins and 20%+ operating margins since 2011. Significant free cash flow, coupled with zero debt and over $1 billion of cash on the balance sheet adds optionality and defensibility to the business.

Trading at prices 40% below highs and near 52-week lows, Align is a high-quality business at a reasonable price. Interested long-term investors should consider beginning to buy shares with a view to holding for the next decade.

Company Overview & Market Opportunity

Align is a global medical device firm that designs, manufactures and markets Invisalign clear aligners and iTero intraoral scanners / associated services.

Founded in 1997, Align revolutionized orthodontic treatments by using computer-aided design (“CAD”) software and custom 3D printing to move teeth. Invisalign has treated over 12 million patients since inception.

Invisalign is a proprietary system for treating malocclusion (misaligned teeth), which affects approximately 60-75% of the global population. Each year, around 21 million people visit orthodontists for treatment. Of these, Align estimates over 90% of cases are treatable using Invisalign. In 2021, Invisalign held only 10-15% share, leaving considerable room for growth.

Similarly, the iTero scanner has significant room to run. With an estimated 2 million dental professionals worldwide, at an average of 2 scanners per office, Align considers its total addressable market for iTero scanners to be 4 million.

Of course, not every dental professional in the world will buy an iTero scanner (large up-front cost with cheaper options, likely no need in less developed markets, lack of new tech adoption). However, haircutting that by 75% leaves a more reasonable target of 1 million.

Align has sold only ~68k iTero scanners, implying it has room to increase scanner sales by 4x and still only hold ~25% share.

Around 50% of existing Invisalign doctors do not submit their digital scans through an iTero scanner, providing a high-probability opportunity to double the installed base in the near-term.

As a whole, the global clear aligner market is estimated to grow from $3 billion today to $10 billion in 2028, producing a 20% CAGR over the period.

Market Dynamics

Within the clear aligner market, there are direct-to-consumer (“DTC”) companies, such as SmileDirectClub (SDC), and operators such as Invisalign who distribute through orthodontists. The primary competitors include Straumann’s ClearCorrect (OTCPK:SAUHF, OTCPK:SAUHY) and Envista’s Spark (NVST).

I believe the key to winning this market long-term will be executing on the most important distribution channel: orthodontists and general practitioners (“GPs”). The DTC channel will continue to be restricted to milder cases because of the lack of on-site dental supervision. SmileDirectClub’s struggles, even after what should have been a tailwind in Covid, indicate the fundamental weakness of the DTC channel.

Broadly speaking, what parent wants to buy their child’s (or their own) dental treatment from anywhere but a dentist or orthodontist? Most people want a medical professional to evaluate progress and assure them the treatment is progressing smoothly. As such, Invisalign, ClearCorrect, and Envista’s distribution strategy seems to be the most promising in the long run.

Invisalign, however, dominates the market with a 90%+ market share, similar to Google’s (GOOG, GOOGL) share of the search market.

Competitive Advantages

An analogy can be made between Invisalign’s ubiquitous use in reference to clear aligners and Google’s use as a verb (though I make no claim that Align’s moat is comparable to that of Google).

Establishing such a dominant position in the global orthodontic market has not been easy, however. Align has proved the defensibility of its intellectual property (“IP”) several times.

Its willingness to litigate has made it difficult for competitors to build scale early, thereby allowing Invisalign to gain a strong foothold in the market.

Nearly five years after the major patent expirations, many firms have entered the clear aligner space. Yet Align continues its dominance due to several competitive advantages that have allowed the Company to sustain profitable growth in the face of increasing competition.

Trained Doctors and Installed Base

For every doctor that trains on Invisalign, Align becomes more entrenched in the market. Further, doctors’ reluctance to re-train on a different system encourages natural growth within practices as each year after training, the proportion of cases treated with Invisalign typically increases.

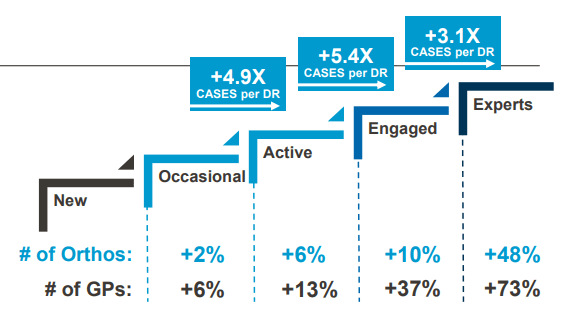

Align Technology September 2021 Investor Presentation

Over 122k active doctors are trained on Invisalign, providing a stable platform for organic growth in existing practices. Internationally, trained doctors grew 21% YoY, providing further impetus for growth in the global market.

For every iTero scanner that is sold, Align also becomes more entrenched in the doctor’s practice because of the significant investment required upfront: the time to learn the system and the money to buy the scanner, which is a meaningful ($50k+) expense for a practice.

Scale

Align benefits from economies of scale in the marketing, production and distribution of clear aligners. Invisalign is available in more than 100 countries, while ClearCorrect is available in 46 and Spark in even fewer. This allows Invisalign to establish leadership in the dental ecosystem early and capture the growth of newer markets.

On the production front, Align continues to expand its capabilities in conjunction with demand. It recently announced the construction of its third manufacturing plant in Wroclaw, Poland – to go with existing facilities in Juarez, Mexico, and and Ziyang, China.

This moves production substantially closer to European customers, providing a platform to drive Invisalign unit sales growth in the future. Historically, case shipments have driven revenue growth, exhibiting a 27% CAGR from 2017 to 2021 (after patent expirations) compared to 21% from 2011 to 2017.

Value Proposition to Orthodontists / Dentists

In a typical orthodontic practice, the cost structure is heavily weighted towards labor. (Think of how cheap small wire brace materials are compared to the staff, office maintenance and other labor needed to run a practice.)

Invisalign changes this by charging practitioners a higher cost of goods (cases of Invisalign) but enabling a more profitable and efficient practice. Doctors can serve more patients with less staff, less overhead and less office hours as the digital Align platform requires less frequent in-office visits and less labor to attach and service the braces.

At the same time, consumers benefit from a more comfortable product, less stringent eating guidelines, fewer office visits and minimal aesthetic worries.

Consumer Awareness

Invisalign is the household name and dominates consumer mindshare of clear aligners. When most people visit an orthodontist, they are asking for Invisalign.

Consumers have historically demonstrated their willingness to pay a once-in-a-lifetime premium price (generally around $5k+ for moderate to severe cases) for what is seen as the leading method to straighten teeth. No competitor can speak to over 12 million patients with a 96% satisfaction rate.

Consumer engagement has increased meaningfully recently, indicating momentum moving forward. Align’s NPS score is around all-time highs, and unique website visitors increased 127% YoY to 21.7 million in 2021.

Patent Protection

Although the core Invisalign patents began to expire in 2017, the Company still holds a portfolio of 600+ U.S. patents, 700+ foreign patents and 700+ more pending applications, which it has proven it will be willing to defend.

As the first mover in the dental technology space, Align has had decades to iterate on its patented technologies and develop supplementary capabilities. It then patents the add-ons to provide a buffer against competitor offerings.

Growth Avenues

Opportunity abounds for Align. The Company remains in the early stages of transforming malocclusion treatment and building the leading digital dentistry platform.

North America

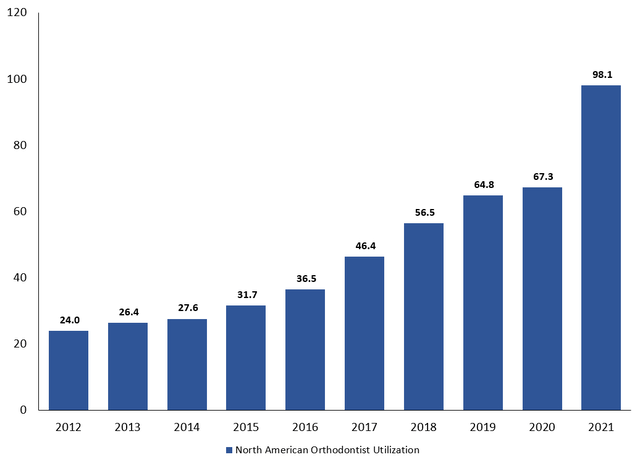

North American orthodontists are using Invisalign 4x more today than 10 years ago. Considering the market remains less than 20% penetrated, there remains significant growth potential in both existing and new practices.

The steadily rising utilization (calculated as number of Invisalign cases shipped divided by number of doctors shipped to) proves the value of Invisalign’s strategy to train doctors before building up to treat the majority (if not 100%) of the practice’s total malocclusion cases.

Align Technology September 2021 Investor Presentation

It also proves the value Invisalign brings to each practice. As more doctors become trained on the system, Invisalign will naturally own a larger portion of total cases as the practitioner looks to leverage lower labor costs across more cases.

International

International utilization stands at less than 1/5 of North America, demonstrating the scale of the international opportunity without even accounting for new doctors trained in the future. As international economies mature, Invisalign should be able to bring this metric much closer to parity.

While international utilization has grown at a slower rate than North America, this represents the relative maturity of the orthodontic markets. Orthodontic and dental procedures are not nearly as prevalent internationally – even in wealthy nations such as Germany and the U.K. – as in the U.S., but I expect this to change meaningfully moving forward.

International utilization has increased from 13.2 in 2017 to 17.5 in 2021. However, 2021 could be the start of increasing momentum as utilization increased 21% YoY, significantly higher than its previous record annual growth of 5%.

Market Growth

Perhaps most importantly, Align benefits from a sustained tailwind in clear aligners stealing market share from conventional braces. Conventional dental braces are expected to grow at less than 5% annually though 2028 compared to 20% for clear aligners. As the undisputed category leader, Align will almost undoubtedly drive much of this projected growth.

Financial Performance

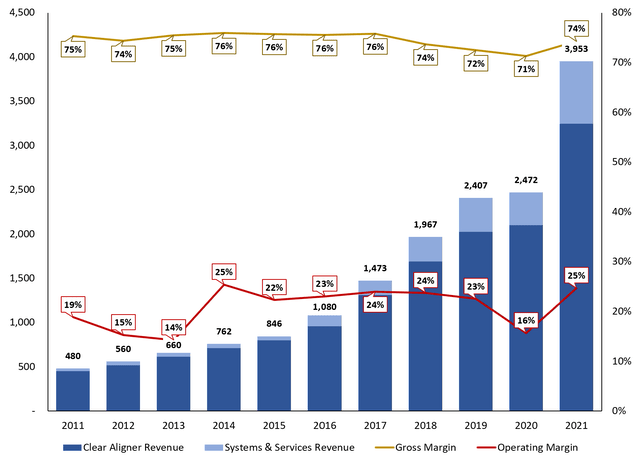

Sales growth has been healthy over the last decade, exhibiting a 23% CAGR since 2011. Clear Aligner revenue has grown at 22% while Systems & Services (iTero scanner and related services) revenue has expanded at 38% annually.

Gross margin has averaged 75% over the same period, which indicates the premium value proposition Align offers practitioners. Doctors are willing to pay the premium price because Invisalign enables meaningful operating efficiency at the practice level compared to conventional braces. The consumer, in turn, is willing to pay the premium price because of the one-time nature of the purchase and tangible value received in return.

Operating margin has averaged 21% since 2011 and reached 25% in 2021 thanks to some modest operating leverage on 60% YoY sales growth. I expect Invisalign to sustain this profit level in the long run as it has built out a global sales force and demonstrated a repeatable recipe to slowly penetrate the worldwide dental market.

Free cash flow margin has averaged 21% from 2011 to 2021, demonstrating the strength of the underlying cash flows. Despite CapEx surging 160% in 2021, free cash flow grew 52% YoY because of a growing deferred revenue balance (~$1.2 billion).

Deferred revenue has long indicated Align’s top-line momentum and has exhibited a 36% CAGR from 2011 to 2021. Importantly, there has been no slowdown in momentum recently as evidenced by deferred revenue growing at 44% annually from 2017 to 2021 compared to 31% between 2011 and 2017. I view this as an indication of Align’s ability to protect its position despite the entry of numerous competitors.

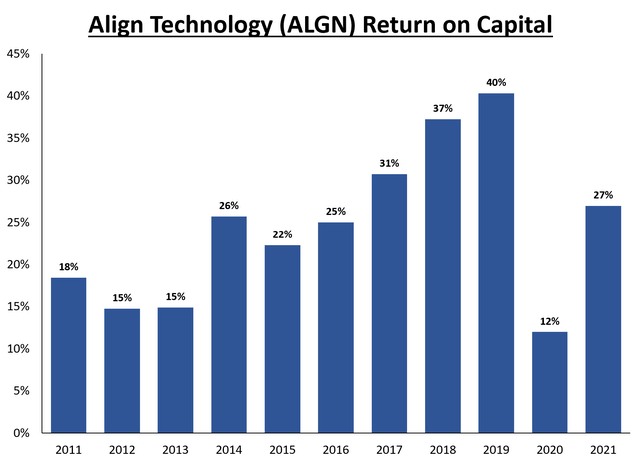

Align continues to reinvest each year and has generated solid returns on capital, averaging 24% from 2011 to 2021. Again, it’s notable that the Company has generated increasing returns since 2017. Returns on capital averaged 29% from 2017 to 2021 (including a one-time compression due to Covid in 2020) compared to 22% from 2011 to 2017. Excluding 2020, the Company has averaged a 34% return on capital since 2017.

Consistent with increasing returns to scale, this suggests Align’s scale in the industry has created a durable advantage that allows the Company to drive growth by reinvesting in the business.

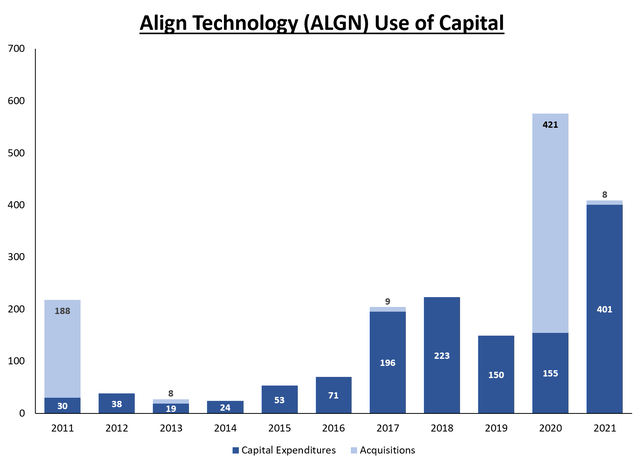

Align primarily invests in expanding its manufacturing capabilities, including the Poland facility, which is the first step in a long-term plan to move production closer to customers. The facility is expected to open this year.

Looking at acquisitions, the Company has been selectively active and highly successful. The Cadent acquisition for $188 million in 2011 gave Align what is now a $700 million revenue business that grew at 46% annually over the last decade, with gross margins north of 65%.

In 2020, the Company acquired exocad, a dental CAD / computer-aided manufacturing (“CAM”) software company as part of its effort to create a fully integrated digital dental platform.

Since the acquisition, exocad has grown the number of software licenses installed from 40k to 47k, an early indication of moderate success cross selling the software into existing practices. With 122k doctors actively using Invisalign, there seems to be plenty of run room for exocad to continue to grow just within Align’s ecosystem.

Risks

Competitive Environment

The principal risk associated with an investment in Align is the evolving competitive situation. Many new players have entered the market and will continue to do so, experimenting with different products and business models as they do. Some will stick and gain traction, but I expect most to only gather an insignificant portion of the market.

Align, however, continues to dominate the large and growing clear aligner market, five years after its patents expired. It has built a protected business by gaining a strong foothold in the primary distribution channel. In the long run, Align should exhibit strong growth in its core products while continuing to innovate and expand its addressable market.

Commoditized Product

Because the initial patents have expired, many people now consider the clear aligner market to be largely commoditized. I do not think this is entirely true as clear aligners are a medical product, delivered primarily through medical professionals, with varying levels of efficacy.

However, even in the case it is now or becomes a commoditized market, Align remains the advantaged player. It has the highest consumer preference, the largest production capability, the largest sales force and control of the largest distribution channel. Align has protected its position masterfully over the years, and I do not expect it to stop now.

Supply Chain and Inflation

As with most companies, particularly product-based firms, Align faces threats from supply chain struggles and rising inflation. In the near term, Align may continue to experience difficulties related to supply shortages and shipping disruptions. And, as a premium purchase, Invisalign could certainly experience some headwinds if inflation continues to rocket higher.

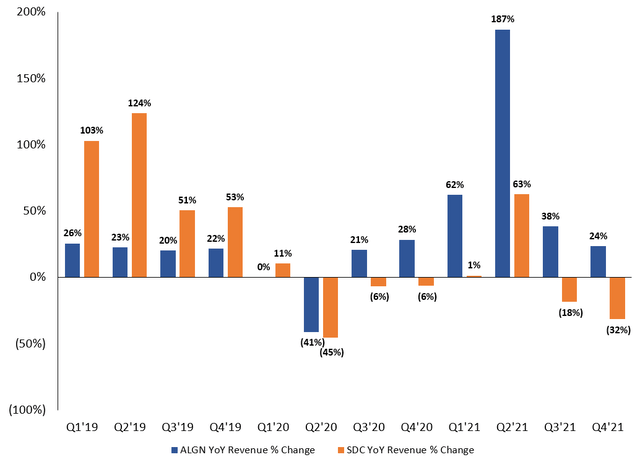

The key, however, is that its competitors are almost certainly dealing with the same issues. Looking at SmileDirectClub, for example, its recent results do not provide much hope in its future. Its momentum has evaporated since COVID, with no observable rebound (see graph above). At the same time, its selling, general and administrative expense has averaged 104% of revenue for the last two years, compared with 46% for Align over the same period.

Spark Clear Aligners

Envista’s Spark appears to be the most dangerous competitor. Some practitioners claim its TrueGen material is more durable, comfortable, and transparent than Invisalign’s SmartTrack.

I haven’t used either, so I can’t comment on the specifics. But, at face value, the improvements must be relatively minor given the satisfaction of Invisalign users. Spark costs around the same as Invisalign, yet Invisalign has a track record of 12 million satisfied patients. Spark, on the other hand, has yet to treat even close to that many. Align has built staying power through a leading consumer dental brand and an unmatched track record of satisfied patients.

Valuation

Align is an expensive proposition at nearly 45x free cash flow. However, I believe it warrants such a premium valuation because of its consistent growth over the last decade and strong prospects in the next decade. Free cash flow has increased more than 7x from 2011 to 2021, and I believe it is possible to more than 5x in the next ten years if it maintains a 20% CAGR compared to the 23% CAGR in the prior decade.

The clear aligner market remains largely untapped, with Invisalign being the leading and most widely distributed brand by a wide margin. At the same time, iTero / software sales are heating up, demonstrating a 44% CAGR from 2017 to 2021 compared to 34% from 2011 to 2017.

Sitting at levels 40% below highs, I believe Align is at a point where long-term investors can begin accumulating shares over time.

Conclusion

Align’s historical execution gives me confidence in its ability to successfully capture the market opportunity in the next decade. With the leading dental brand and unmatched scale in production, marketing and distribution, I anticipate Align to stay a winner.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment