David Becker

This year Alibaba (NYSE:BABA) has experienced a crazy downside correction and has shuffled around the $80-$120 range in recent months (currently trading at $92.5/share). All this was provoked by facing a number of headwinds, including the Chinese regulator which raises concerns about possible delisting and increase of military presence in Taiwanese waters. In addition to that, a COVID-19 resurgence in China led major cities to be locked down which obviously chopped high two-digit revenue numbers to flat, because 90.7% of Alibaba’s revenue in FY 2022 was coming from China and only 9.3% from overseas. Thus, Alibaba reported flat revenue for the June Q1 2022, a first-ever 1% drop YoY in e-commerce revenue, and a moderate increase in cloud computing of 9% YoY, whereas last year’s cloud business showed an upside of 29% YoY. All these uncertainties together, including the world economic slowdown, form the improbability of Alibaba’s stock appreciating in the nearest time (less than a year). Therefore, we don’t recommend it buying at the current price.

June Q1 2022 results

On August 4 Alibaba posted its first-quarter earnings report with flat revenue and at the same time, it managed to beat the Street expectations (205.55B RMB ($30.68B) actual vs 203.19B RMB estimates in revenue and 22.73B RMB vs 18.72B RMB in net income).

First of all, this is the first time ever revenue from Alibaba’s e-commerce segment, which is its main segment, has fallen by 1% YoY (From 144.03B RMB in Q2 2021 to 141.94B RMB in Q2 2022). According to company management, this 1% fall in the commerce segment is attributed primarily due to a “mid-single-digit year-over-year” decline in Taobao and Tmall businesses and “increased order cancellation due to the impacts from Covid-19 resurgence and restrictions that resulted in supply chain and logistics disruption in April and most of May”.

Alibaba’s cloud business has slowed down a lot to 10% in the June quarter (from 16.05B RMB in Q2 2021 to 17.69B RMB in Q2 2022) compared to 29% YoY growth in the last year for the same quarter and 12% increase YoY in March 2022. This was the most prominent segment of the company’s business. This slowdown is partly explained by the loss of their top Internet client, which stopped using their services. This kind of growth is not enough to make their cloud business dominate the industry and more importantly to diversify their revenues because currently, their computing is only 9% of total revenue.

It could have been worse regarding all the situation happening right now in China and the economic environment in total, but we view this situation differently. Even though the company elaborates clearly on why its revenue declined, this keeps many questions unanswered of whether it could deliver sustainable growth in the future, because it is facing a couple of challenges from different directions, such as from the macro level – the world economy is slowing down. Prices were going up worldwide and consumers experienced high inflation even in China, in July food prices in China were up 6.3%, PPI is 4.2% and CPI is up 2.7%. So, what the consumers shall they do? They obviously sooner or later cut back on expenditure on discretionary goods which they don’t really need. Secondly, China’s e-commerce segment was subdued after the pandemic-driven boom and increased competition. Thirdly, Chinese government regulation has been holding Alibaba and its investors back. And all these risks together comprise one giant uncertainty about Alibaba’s future growth perspective.

Another concern is about China conducting military exercises in Taiwanese waters including shooting missile tests and that is something we need to carefully monitor. GS thinks that short-term volatility surrounding those events is going to be an issue, but GS is trying to look at the longer time horizon for better returns. If China is not getting actively involved, Alibaba’s future is not going to be a huge concern, but still, it is a huge risk.

Valuation

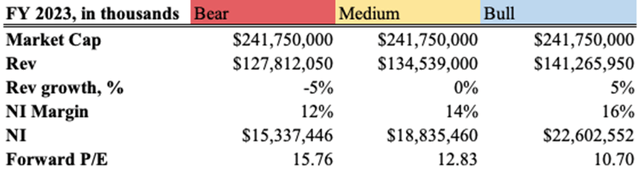

In the current turbulent environment, Alibaba decided to skip revenue guidance for FY 2023. Short-term (for FY 2023) we see BABA possibly reaching a forward P/E of 17.19 in the “Bear” and 13.82 in the “Medium” scenarios, conservatively assuming a 5% revenue decrease and 12% NI margin for the first and flat revenue and 14% NI margin for the second scenario. The average street analyst estimates forward P/E at approximately 12.7 and revenue growth at 6.2%. We believe in a neutral scenario more, but a pessimistic case could also happen if China continues governmental interventions and military power increases around Taiwan. Moreover, possible pandemic breakouts could also worsen the situation for Alibaba’s logistics and business segments.

Own Valuation (Own research)

Source: own research

Long-term view and main takeaway

While we don’t see a short-term (next 12 months) recovery for the company and buying entry at the moment, for the long-term horizon (over 2 years period) it may look fairly valued. It experienced flat revenue and slowdown mostly because of the pandemic, in late May and early June, we could see a recovery from the lockdown in China and accelerated growth in the future:

“Following a relatively slow April and May, we saw signs of recovery across our businesses in June,” said Daniel Zhang, CEO of Alibaba, in a press release.

GS still remains bullish on China and sees 24% in potential returns over the next 12 months for China market.

To sum it up, the numbers obviously don’t look horrible, but that is not what we want to see from the Chinese giant. Ideally, we would like to see BABA easily approaching a forward P/E of around 10, acceleration in growth, and more certainty about its future. And the certainty is crucial here because a smart investor could predict company risks, but political risks are out of his control and it is better to avoid such investments unless it is extremely undervalued and provides a great return for the risk. Alibaba bears too many risks including, but not limited to Chinese regulations, Taiwan situation, pandemic resurgence, e-commerce and cloud segments slowdown, etc. Thus, we do not recommend buying this stock.

Be the first to comment