pressureUA/iStock Editorial via Getty Images

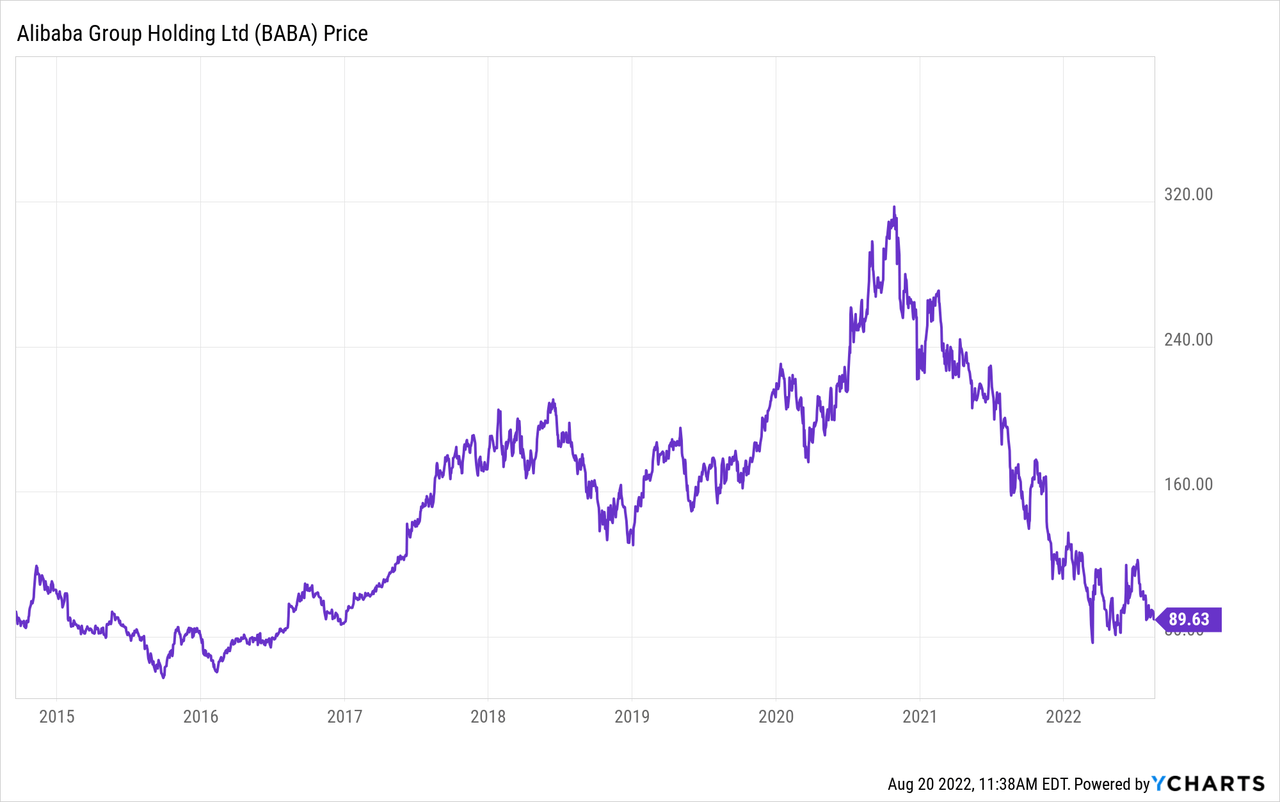

Alibaba (NYSE:BABA), once a must-have investment of China, has been in the penalty box for quite some time now. The risk of regulatory action from either the Chinese or United States government has sent the stock plunging from undervalued levels down to deeply distressed levels. This is a growth stock benefitting from various secular tailwinds. Yet even before accounting for the $50.8 billion of net cash and $66.6 billion of equity investments (recently this stock traded for a $237 billion market cap), the stock is trading at only 12x forward earnings. While the high risk should not be ignored, the stock is worth buying in small quantities.

BABA Stock Price

After peaking at above $300 per share in late 2020, BABA has seen its stock drop 70%. The stock is now trading at the same price it did when it came public in 2014.

I last covered BABA in March, where I discussed why the stock was falling and why I believed that the bottom was in. The stock has fallen another 11% since then, but with the company continuing with share repurchases, the bears may have gone overboard on this one.

What Were Alibaba’s Expected Earnings?

Given China’s more restrictive COVID lockdowns as well as the ongoing macro headwinds, BABA has been reporting slowing growth rates and analysts expected no different this latest quarter.

Did Alibaba Beat Earnings?

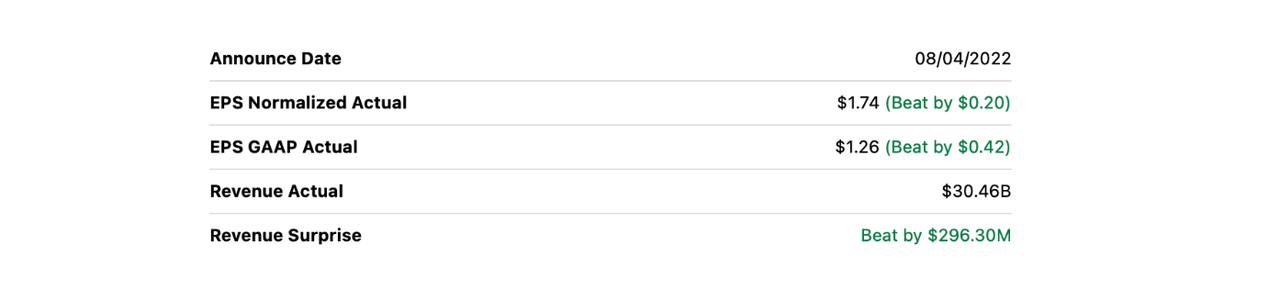

BABA ended up slightly beating on both the top and bottom lines.

Seeking Alpha

BABA Stock Key Metrics

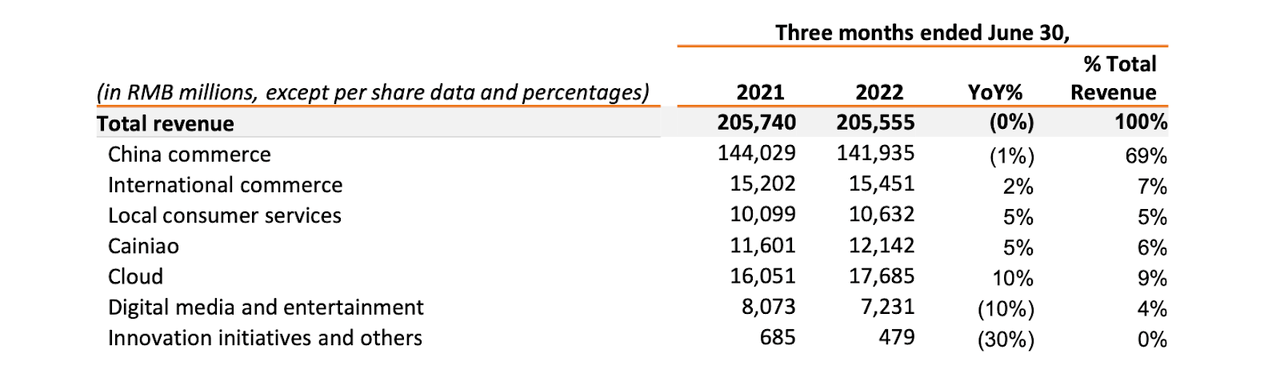

Still, though, growth has not returned for the company. We can see below that while cloud revenues led the way at 10% growth, the rest of the company saw stagnating if not negative growth rates. I note that the 10% growth rate in cloud is not necessarily satisfactory considering that cloud computing peers like Amazon Web Services (AMZN) or DigitalOcean (DOCN) are still seeing around 30% growth.

June Quarter 2022 Presentation

Couple the stagnant growth with increased operating expenses and that led to a 29% decline in non-GAAP earnings per share.

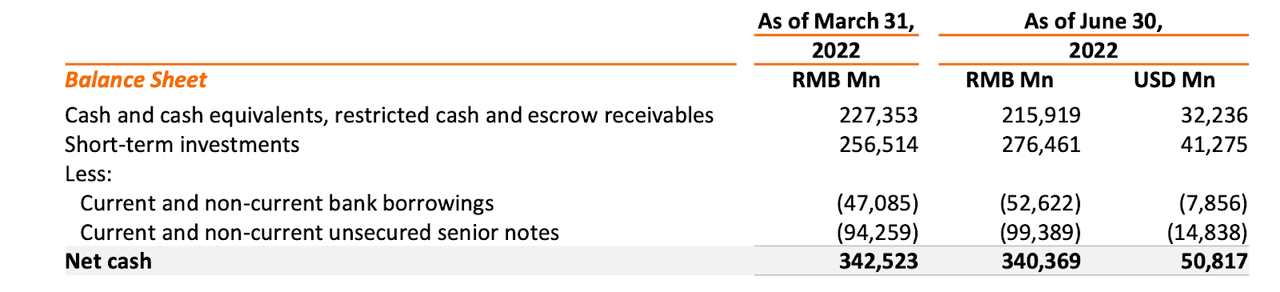

BABA ended the quarter with $73.5 billion of cash versus $22.7 billion of debt. BABA also had $66.6 billion of equity investments as well.

June Quarter 2022 Presentation

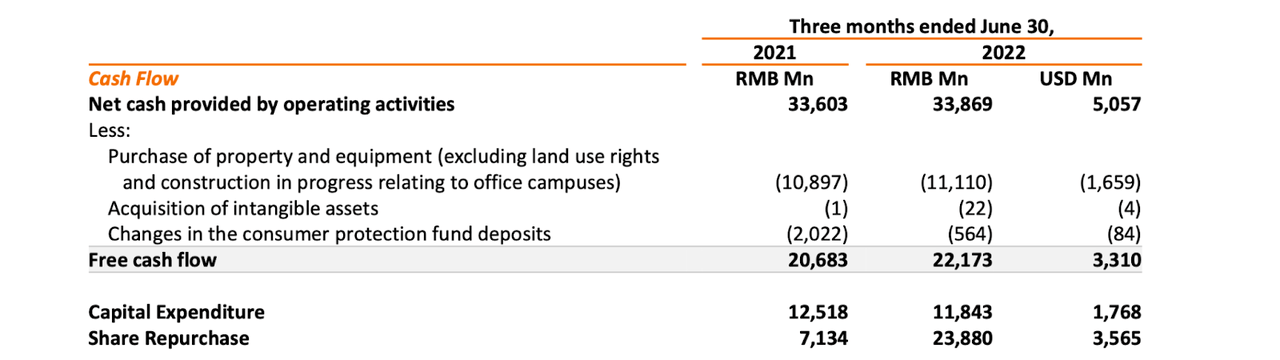

In my view, the most critical metric to follow is that of share repurchases. This is because a long-standing bearish take on the stock has been mistrust of the accounting and management’s alignment with shareholders. I personally have expressed such reservations before. But my reservations have subsided substantially as the company repurchased shares – a surprising development considering the weak fundamentals of the Chinese economy. BABA repurchased $3.6 billion of stock in the quarter, exceeding the $3.3 billion in free cash flow.

2022 June Quarter Presentation

This comes after the company spent $9.7 billion on share repurchases last year. While the company could arguably lean in even more aggressively considering its net cash balance sheet, this is already an impressive amount of share repurchases. I expect investors to gradually increase their trust in the company and stock as management continues to execute the share repurchase program.

What To Expect After Earnings

On the conference call, management reported signs of a recovery “as logistics and the supply chain situation gradually improved after COVID, restrictions eased.” Yet I wouldn’t count on growth returning in earnest until next year.

Some key investors have been reducing or exiting their stakes in the company, including Ray Dalio and SoftBank. There may be less selling pressure once such investors cease their selling, but these events may also negatively impact investor sentiment towards the stock.

BABA has reported being approved for a primary stock listing in Hong Kong. While it remains unclear if BABA will eventually have to delist its shares from US exchanges, the Hong Kong listing approval potentially removes one overhang from the stock’s outlook.

Is BABA A Good Investment Long-Term?

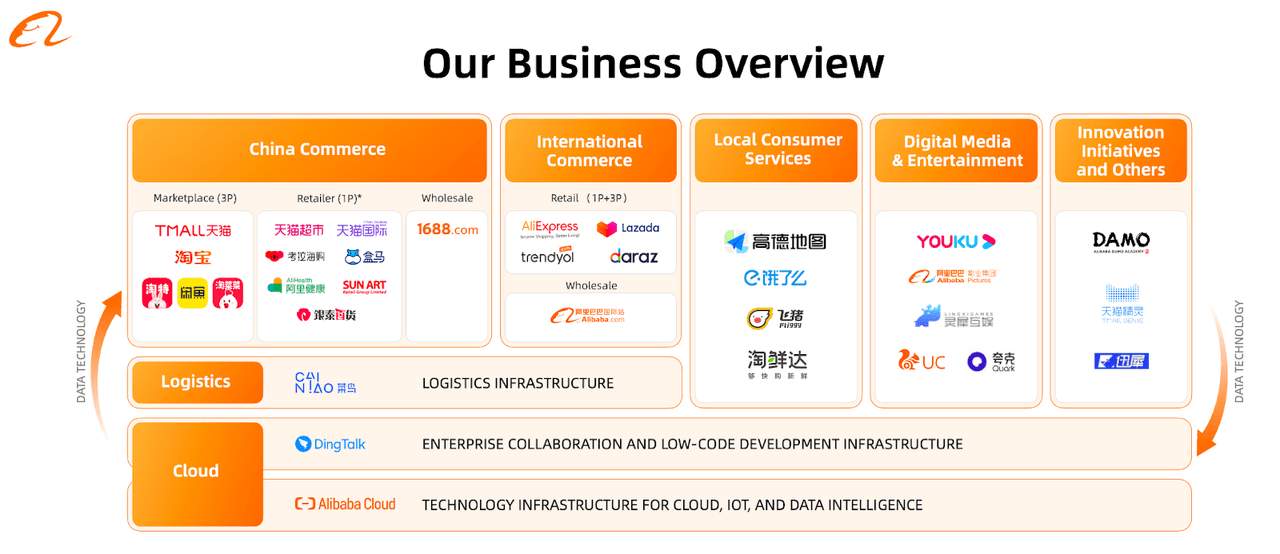

BABA remains a compelling long-term investment due to being a conglomerate of many secular growth businesses. These include the e-commerce powerhouses Taobao and Tmall, its cloud computing division, its video streaming division Youku, and much more.

2021 Investor Day

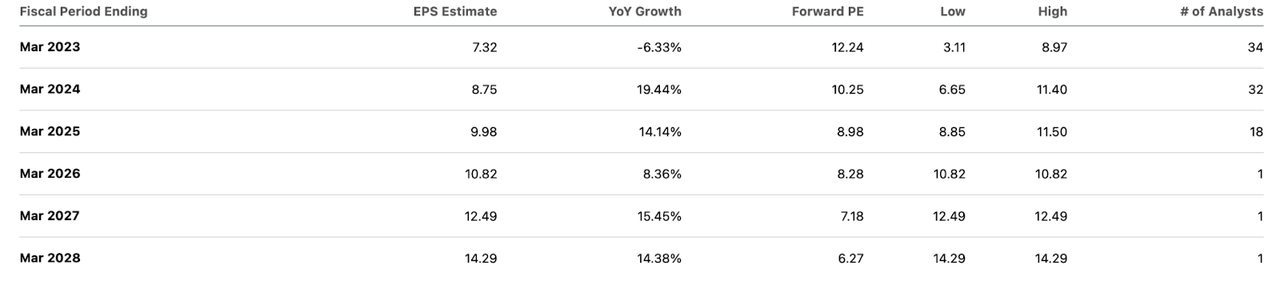

BABA is expected to see earnings growth rebound beginning in 2023.

Seeking Alpha

Is BABA Stock A Buy, Sell, Or Hold?

Even before the recent crash, BABA was already trading at buyable valuations. The problem was never really valuation, though the stock is certainly cheaper now that the multiple has compressed to 12x forward earnings. After adjusting for $50.8 billion of net cash, the stock trades at around 9.7x earnings. If we only give 50% credit to the $66.6 billion in equity investments, then the valuation further declines to 8x earnings. Compared against a 15% long-term earnings growth rate, that represents around a 0.8x PEG ratio (or 0.5x PEG ratio net of cash and investments). I would expect tech stocks in the US to trade at 1.5x to 2x PEG ratios, highlighting the undervaluation in BABA stock. The current valuation is implying more than a 50% relative discount – the stock can deliver double-digit returns even assuming no multiple expansion from here. If management continues to repurchase shares using free cash flow, then I would not be surprised to see that relative discount gradually decline.

The risks here are numerous. BABA has been in the crosshairs of Chinese regulatory authorities. I have previously written about the large $15 billion “common prosperity investment” and difficulty bringing Ant Financial public. US regulatory authorities have also expressed interest in delisting Chinese stocks which do not satisfy audit requirements. These lead to the potential for great downside irrespective of the fundamentals.

While BABA is quite cheap, there is no guarantee that the company continues to return cash to shareholders through share repurchases nor that the company will continue to sustain the current profit margins. While this view may have political bias, it would not be inconsistent if the company began prioritizing job creation and employee wages over shareholder earnings.

For these reasons, any bullish view on the stock should be confined to small quantities. I rate the stock a buy on account of valuation but emphasize the risks.

Be the first to comment