Philiphotographer

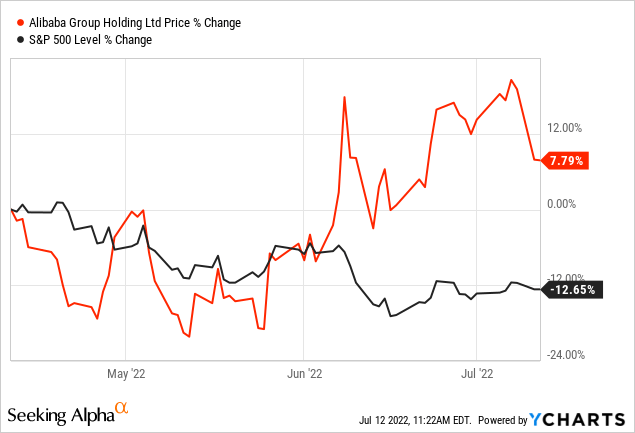

Since Alibaba Group Holding Limited (NYSE:BABA) (OTCPK:BABAF) probably bottomed in March 2022, the stock has gained about 50%. In the last few months, Alibaba clearly outperformed the U.S. stock market. While the S&P 500 (SPY) is down about 20% year-to-date, Alibaba declined only 7% in the same timeframe. And when looking at the last three months, the S&P 500 declined 13% while Alibaba could increase 8%.

While we can be cautiously optimistic that Alibaba found its bottom, we certainly must not be afraid that we are too late for an investment in Alibaba. Risks for an investment in Alibaba certainly exist, but the stock remains deeply undervalued in my opinion and is one of the great long-term investments.

Risks: Fines, COVID-19, Recession

We can start by addressing these risks, and while there are several worth talking about, three are especially standing out – Alibaba being fined by state authorities, the ongoing lockdowns due to COVID-19, and the looming recession.

Last weekend, Alibaba – together with several other Chinese technology companies – was once again hit by fines. Alibaba had to pay about $373,000 as the business was failing to file report on five deals (Tencent (OTCPK:TCEHY) (TCTZY) was involved in 12 transactions). And while it might seem absurd for Alibaba to lose $30 billion in market capitalization due to a $373k fine (the stock declined 9% following the news), we should not look at the fine in isolation, but rather see it as a message the Chinese state authorities are sending. A message that the Chinese state authorities are not done tightening the screws on Alibaba (and other technology companies) and this could lead to further problems and lower profitability in the years to come.

When wondering why Alibaba lost 9% on a single trading day, there might be another explanation. In the preceding few days, COVID-19 cases were rising in China and fears of further lockdowns were present again. And while China is still committed to its Zero-COVID strategy, which seems to be a difficult strategy to achieve and might come at the cost of several lockdowns and economic troubles, we still should see COVID-19 as a short-to-medium-term issue that should not have lasting effects on Alibaba.

A final risk we should mention is the looming recession. This might not just threaten companies in China, but all over the world. And while I see the recession especially hitting the United States and Europe, we should not ignore that in a complex, dynamic, and interconnected world, countries, and companies all over the world might be affected similarly. And as consumer demand will decline during a recession, Alibaba will certainly be hit.

Annual Results

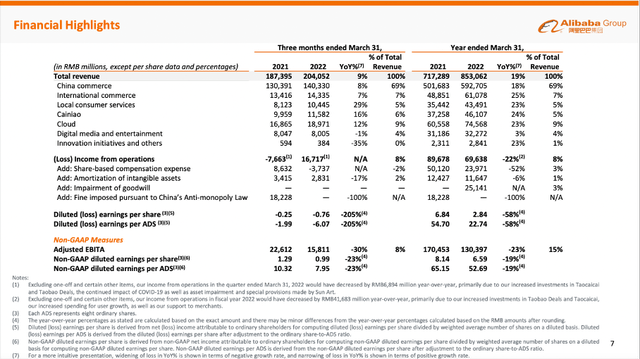

When talking about risks, we can also look at the annual results for fiscal 2022, as several of the risks are already visible in the numbers. Fiscal 2022 results are a mix between declining profitability and still high top line growth. Alibaba generated RMB 853.1 billion in revenue in fiscal 2022, and compared to RMB 717.3 billion in fiscal 2021 this resulted in 18.9% YoY growth. And while revenue was still increasing, adjusted EBITDA declined 19.6% year-over-year from RMB 196.8 billion to RMB 158.2 billion. Diluted earnings per share declined from RMB 6.84 in fiscal 2021 to RMB 2.84 in fiscal 2022 – a decline of 58.5%. And free cash flow – in my opinion one of the most important metrics – declined 42.7% YoY from RMB 172.7 billion in fiscal 2021 to RMB 98.9 billion in fiscal 2022.

When looking at the different segments – and Alibaba is now reporting in seven different segments – all contributed to growth. While China Commerce is still the most important segment (it generated RMB 592.7 billion in revenue), International commerce (growing 25% year-over-year to RMB 61.1 billion) and Cloud revenue (increasing 23% YoY to RMB 74.6 billion) are becoming more and more important.

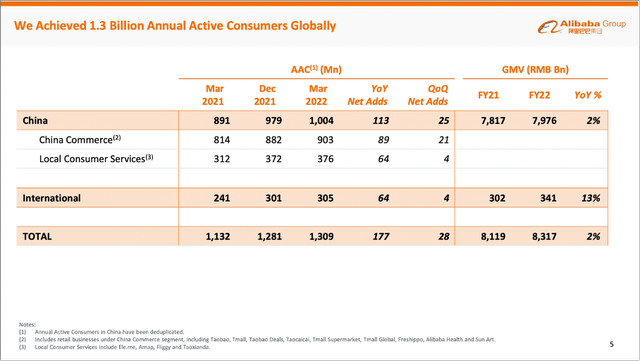

Alibaba could also increase its active consumers globally, from 1,132 million in March 2021 to 1,309 million in March 2022 (15.6% YoY growth). And while the number of active consumers increased with a rather high pace, the gross merchandise volume increased only slightly: 2.4% YoY from RMB 8,119 billion in fiscal 2021 to RMB 8,317 billion in fiscal 2022.

National Growth

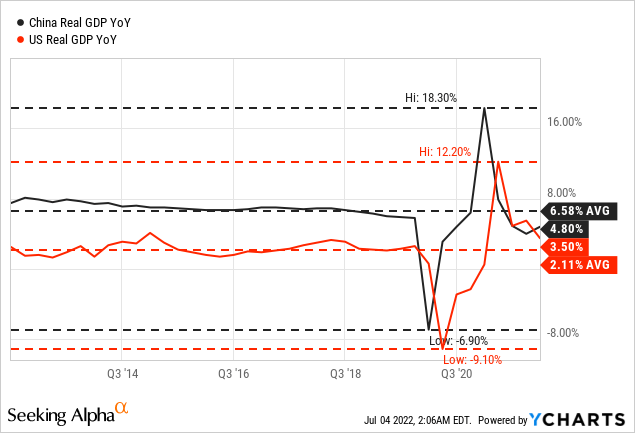

We can expect the Chinese economy to grow with a much higher pace than the U.S. economy or the European economy in the years to come. When looking at GPD growth in the last ten years, China was always growing with a higher pace than the United States. While the average GDP growth in the United States was around 2% in the last ten years, the average growth in China was about 6.5%.

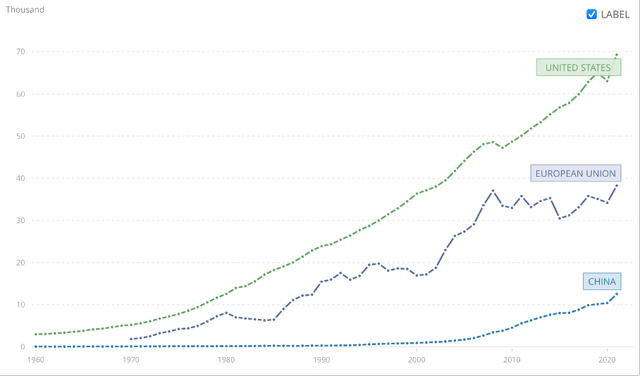

And we clearly see growth slowing down in the last ten years – and we must assume even lower growth rates in the years to come. However, the underlying market for Alibaba will grow much faster than the underlying market for most U.S. or European companies. When looking at the GPD per capita in the United States (close to $70,000) or Europe (about $40,000) and compare it to China (slightly above $10,000) we can see a lot of growth potential – at least in theory as China does not necessarily have to reach a similar GDP per capita as European countries or the United States.

GDP per capita for China, EU and US (World Bank Open Data)

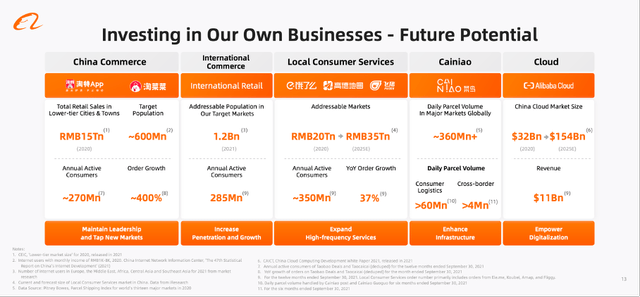

Alibaba is seeing future growth potential for several of its segments. And not only is the China Commerce market expected to grow with a rather high pace, but the Cloud business is also expected to increase fivefold in the next few years and Alibaba might be one of the businesses profiting.

International Growth

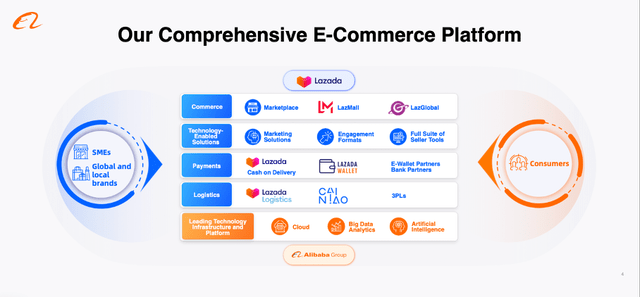

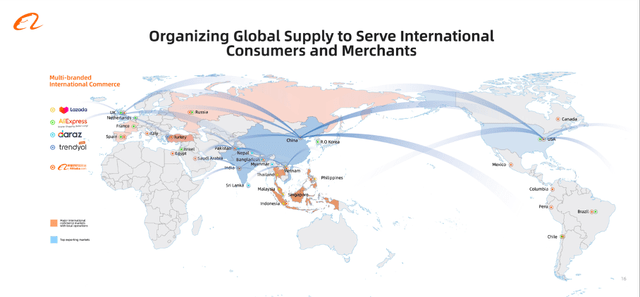

And Alibaba cannot just continue to grow with a high pace in China, but it is also trying to expand internationally. Especially Lazada – a comprehensive e-commerce platform including logistics services, payments services and technology-enabled solutions – is driving the growth in Southeast Asia. Lazada is already a significant global player – it is number seven in the world by MAUs and number 12 by GMV – but the vision for Lazada is to serve 300 million customers and achieve $100 billion in gross merchandise volume.

Alibaba is expecting the Southeast Asia e-commerce market size to grow from about $79 billion in 2020 to $260 billion in 2025, which is resulting in a CAGR of 27% and a gigantic growth opportunity for Alibaba.

Aside from expanding to Southeast Asia, Alibaba might also try to expand to Europe or the United States, but we can expect the Chinese company to have some difficulties to become a major player in the Western hemisphere as many people still seem to mistrust Chinese companies.

But that could change over the next decade or two – especially if the world order should change and China is becoming the leading power in the world and Chinese companies might be able to expand all over the world (like American companies in the decades after World War II). This is an aspect we should pay closer attention to.

Changing World Order

I compared China and the United States several times in this article and mentioned that China could become the leading power in the world and there is a reason. While we can be quite confident that China will be able to grow with a higher pace than the United States of America or most European countries for several years to come, we can even try to look further down the road. Of course, we should always be aware that these assumptions are highly uncertain and should only be seen as very vague predictions and certainly not something we base investment decisions on.

I know that Warren Buffett is frequently warning us not to bet against the United States of America. And not only are about 50% of the companies in my portfolio listed and mainly operating in the United States, but Buffett is also one of the billionaires I would listen to. However, another billionaire I would listen to is Ray Dalio, and in his last book “The Changing World Order” he makes the argument that major shifts are going on in the world – and China might be the country profiting the most.

Dalio argues (see short version here) that these shifts happen when the dominant power (right now, the United States of America) is not only confronted with an increasing external conflict (like the trade war between the United States and China) but also with increasing internal conflicts (like rising populism and polarization) as well as interest rates being zero and large amounts of money being “printed” by the central bank.

And it is definitely a plausible scenario right now that the United States might be struggling in the decades to come, while China might become the dominant economic power again. And if China should become the dominating power in the world, this would not just fuel growth in China, but would also make it easier for companies like Alibaba to grow internationally. Typically, the dominant power was able to expand abroad, and Chinese companies might become dominant in a similar way as American companies became dominant in the 20th century.

Valuation

When turning away from macroeconomic assumptions and looking at Alibaba once again, one strong argument for an investment remains – the still extremely cheap valuation of Alibaba. Although many might disagree, the stock is still one of the best long-term investments one can make and trading for unreasonably low valuation multiples.

As always, we are trying to determine an intrinsic value by using a discount cash flow calculation. As basis, we are taking the free cash flow from fiscal 2022, which was $15,597 million. To be fairly valued, Alibaba has to grow about 4.5% annually from now till perpetuity, and despite all the risks surrounding Alibaba, this seems more than achievable. And we must consider that the free cash flow in fiscal 2022 was already much lower than in the previous year. When taking the free cash flow of fiscal 2021 as basis for our calculation ($26,353 million in free cash flow), Alibaba must grow only about 1% annually to be fairly valued right now.

But in my opinion, neither 4.5% annual growth nor 1% annual growth are realistic assumptions for Alibaba. Instead, we assume the same free cash flow for fiscal 2023 as in fiscal 2022 ($15,597 million) and for fiscal 2024 we assume the same free cash flow as in fiscal 2021 again ($26,353 million). And for the following years, we assume growth rates to slow down from 15% in fiscal 2025 to only 6% growth in ten years from now. For perpetuity, we also assume 6% growth. When calculating with a 10% discount rate (as in all the other calculations), we get an intrinsic value of $322.40 for Alibaba and have a deeply undervalued stock.

Conclusion

I mentioned above that Alibaba most likely bottomed, although that is only a speculation as the stock is still in a downtrend, and we can’t know for sure. However, we can be pretty sure that Alibaba is deeply undervalued from a fundamental point of view. Even when including the risks mentioned above and assuming rather low growth rates, Alibaba is trading far below its intrinsic value and is one of the great bargains in this market.

Be the first to comment