Andrew Burton

The likelihood that China will make significant changes to its zero-COVID policy provides Alibaba (NYSE:BABA) with a shift to positive sentiment. This optimism came from Zeng Guang, a former chief epidemiologist at the Chinese Center for Disease Control. Guang stated, “The situation is changing now and China’s ‘dynamic zero’ will also undergo major changes. Substantive changes will happen soon.” No official word has come from China’s government yet. However, the financial markets appear to be interpreting Guang’s statement that China is likely to relax restrictions in the near future.

Alibaba’s stock is currently undervalued with strong future growth expected for FY24. This should help drive the stock higher, especially if China stops the restrictions, which are not likely to go on forever.

Possible Change of COVID Restrictions in China

Alibaba’s stock rallied 11% since Zeng Guang made his statement that changes are coming soon for China’s zero-COVID policy. It makes sense that restrictions won’t last forever. China has to realize that strict restrictions are not a long-term sustainable option.

COVID hasn’t been declared an endemic yet, meaning that the virus is still around, but does not cause significant disruptions to our daily lives. However, it should be getting close to an endemic as vaccines can reduce the severity of the virus and antivirals such as Gilead’s (GILD) Veklury (remdesivir) and Pfizer’s (PFE) Paxlovid can treat those who have COVID. China also has its home-grown drug, Azvudine, cleared to treat COVID.

Frankly, COVID doesn’t have to be officially declared an endemic for China to ease or stop the restrictions. China’s government just needs to realize that its citizens can live with COVID without strict restrictions just the way the rest of the world has. Alibaba’s stock is likely to respond positively when the official announcement comes. Ending the restrictions is likely to spur economic growth, which is likely to increase Alibaba’s business since the company is one of China’s largest firms.

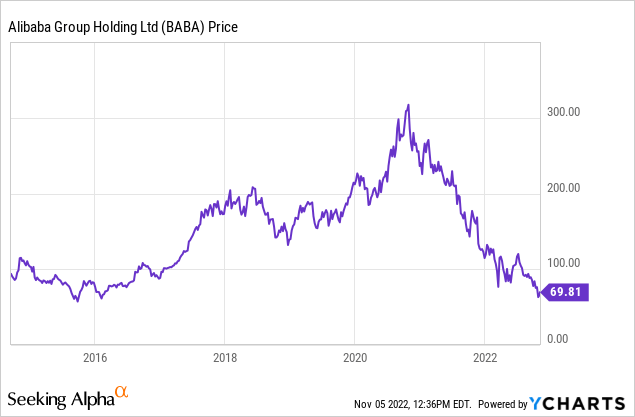

So, it makes sense to me to buy the rumor that the restrictions will be eased or ended. Investors are already responding positively to this expectation. Unless some other news comes out to cancel this possibility, the positive momentum is likely to continue. This marks a change in investor sentiment and a potential positive catalyst for Alibaba’s business which is likely to mark a reversal for the steep decline that occurred over the past two years.

Bargain Valuation

It is not too common to find profitable, growing companies with PEs below 10. Alibaba is one of them with a trailing PE of 9.5 and a forward PE of 9.7. This is lower than the S&P 500’s (SPY) trailing PE of 18.5 and forward PE of 16. Alibaba also has a low price/cash flow ratio of 8.7 as compared to the S&P 500’s 12.8. Alibaba’s undervaluation shows that the stock has plenty of room to move higher as the pace of growth ramps up.

It is important to note that earnings estimates are likely to be increased when the actual announcement of China easing COVID restrictions takes place. Positive earnings estimate revisions of 5% or more tend to have a positive effect on stock prices, leading to outperformance. So, it makes sense to pick up the stock when the valuation is low and the positive price momentum is just starting.

Technicals Shifting to Positive

The daily stock chart above shows the RSI indicator rising from an oversold condition, showing positive momentum. The green MACD line recently crossed above the red signal line, indicating a change in trend from negative to positive. The money flow [CMF] increased from a low negative level to the positive zone. This shows that money is flowing back into the stock on renewed optimism.

Some may point out that similar setups occurred earlier this year, but the stock dropped lower. I think the difference this time is that the optimism for China to change its COVID restrictions policy is likely to act as a sentiment trend shifter. Investors must see that the upward potential for the stock is higher than the downside risk over the long-term.

We can see from the long-term multiple year chart above that Alibaba’s stock has price support in the $60 – $70 price range going back to 2016. So, the current price is likely to find support here in my opinion.

Investors could also watch for a positive MACD crossover on the weekly chart, which would be a longer-term confirmation of the positive change in trend.

Balance Sheet/Cash Flow

Alibaba’s balance sheet is strong with $26.4 billion in total cash/equivalents and a negative net debt of ($41.7 billion). The negative net debt shows that Alibaba has more cash & equivalents than financial obligations. This gives the company strong financial stability. Moody’s has an A1 rating for Alibaba which was last confirmed on October 28, 2022.

BABA also has 1.6x more current assets than current liabilities and 2.7x more total assets than total liabilities with total equity of $162 million. This demonstrates that Alibaba is in great shape to handle short and long-term obligations.

The company’s cash flow is also strong as BABA generated $21.3 billion in operating cash flow over the past 12 months. The cash flow gives Alibaba the ability to accomplish multiple things such as capital expenditures, acquisitions, stock repurchases, paying down debt, and other investing activities. After all of this, the company was still left with about $7 billion in levered free cash flow.

Overall, the strong balance sheet and positive cash flow provides Alibaba with the flexibility to handle obligations on a regular basis while investing in growing the business.

The Risks

I would consider Alibaba as a high-risk investment with the potential for a high reward. It is possible that China takes longer than expected to change its zero-COVID policy. Restrictions could remain in place, suppressing economic activity. The current optimism that China will ease its zero-COVID policy is really speculation at this point. Until China makes an official change or announcement, this is just speculation based a statement from a former chief epidemiologist. With that said, China’s restrictions are not likely to last forever. It just makes sense that restrictions would ease over time. That sets up Alibaba for strong growth over the long-term.

Other government decisions could be made from China’s government that could have a negative impact on Alibaba’s business. China could increase taxes on the company or create other unfavorable conditions which could suppress growth.

The risk of a recession occurring in 2023 could put a pause on Alibaba’s growth expectations and my thesis. However, a recession would probably only be a temporary setback as the recovery following it would likely put the thesis back on track.

Alibaba’s Long-Term Outlook

My claim that Alibaba’s stock could double in 2023 is due to a perfect storm of the stock’s undervaluation, the recovery from an oversold condition, the change in investor sentiment from negative to positive from the likely easing of COVID restrictions in China, and Alibaba’s strong expected growth.

Alibaba is expected to grow revenue at 11.5% and earnings at 16% to 17% for FY24 which ends in March 2024 according to consensus estimates. This strong growth is likely to drive the stock for significant gains from the low valuation level.

If the stock price doubled in approximately one year, it would take the current price of about $70 to $140. The target price of $140 would take the PE to 16.6 which is still lower than the S&P 500’s current PE of 18.5. Analysts have a one-year price target of $139 for the stock. So, my price target is about in-line with the target of the covering analysts.

Be the first to comment