loveguli/iStock Unreleased via Getty Images

Thesis

In January among all the bullish frenzy surrounding Alibaba (NYSE:BABA) we wrote an article detailing why we thought we were going to see $100/share first in the stock price before witnessing a rebound. The respective price action has now occurred and it was deeper and more violent than expected on the back of de-listing fears for the ADRs as a consequence of a potential action by China to help Russia in its conflict with Ukraine. The violent downward price action across Chinese equities forced the China Securities Regulatory Commission to verbally intervene and stabilize markets and provide a level of comfort for investors around future U.S. based capital raises and the status of existing ADRs. Concurrently, Alibaba also announced an upsize of its share repurchase program to take advantage of a historical low price in its stock and P/E multiple, and better utilize its substantial cash balance. We now feel the worst is behind us in terms of price weakness for the BABA shares, and while we do not know the velocity of the recapture of a correct fair value for the shares, we propose an options based strategy that provides for a 28% annualized yield and takes advantage of the bottom we have seen in the stock price as well as the high implied volatility that the latest moves have caused in the BABA option chain.

Alibaba – Performance & Political Landscape

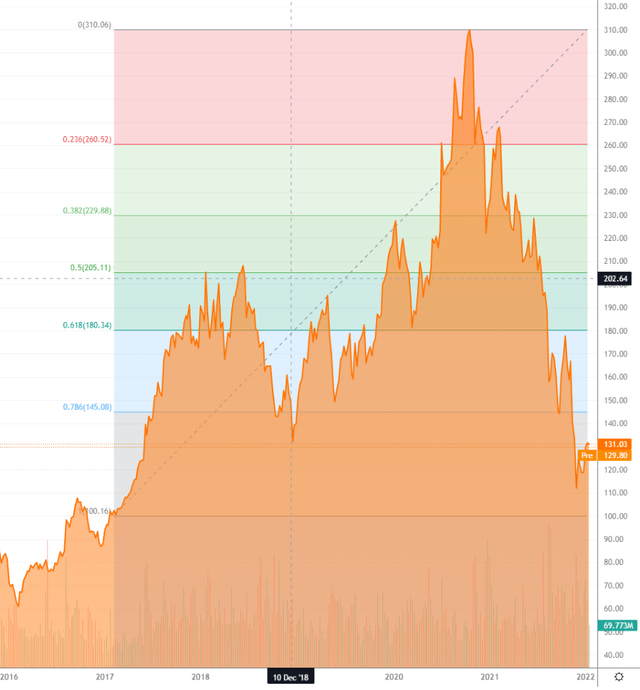

In our prior article we presented a technical picture of the price action in the BABA shares and outlined why we thought the price would move to $100/share, which would represent a full retracement of the upswing in the shares during the past years:

Technical Picture Jan 2022 (Seeking Alpha)

As predicted the shares dipped to the $100/share level:

BABA Share Price (Seeking Alpha)

The reason for the violent move below $100/share is represented by the conflict in Ukraine and the market speculation that a move by China to help Russia would trigger a U.S. regulatory maelstrom that would ultimately result in a de-listing of Chinese ADRs. As we have seen with Russian equities, political risk is a very difficult factor to price and it usually results in binary price actions for the impacted securities. How many market participants would have expected the vertical down move in Russian equities at the beginning of 2022?

We now feel that the European and U.S. sanction capabilities have been robustly showcased and that for any political actor the picture is clear around the velocity and robustness of a trade response to aiding Russia. We feel that given their own economic slowdown and internal issues China will be hesitant to step into a conflict which would not bring it any benefits and thus we feel the de-listing probability is low, with a bottom having been established in the BABA shares on the back of the capitulation trade we saw recently.

Xi Jinping is facing re-election this year and with the Chinese economy in the worst slowdown since the Covid pandemic the country’s priorities lie with appeasing an ever more sophisticated and globally connected population. In our opinion China might take advantage of the Russia/Ukraine conflict via rock-bottom purchases of Russian energy companies or the engagement in well priced long-term supply contracts (basically arbitraging the Russian bind but not running afoul of U.S. sanctions) but it will not overtly help the Russians with their “special operation” in Ukraine.

Furthermore, despite the furor over certain U.S. based listings that were not cleared with the internal regulators, China has now recognized its need to keep the U.S. capital markets open to further listings, understanding that capital and the flow of investments are a key to economic development and ultimately growth and well-being. Throughout its history China has demonstrated thoughtfulness and the ability to be patient which has paid handsome dividends. We expect the jurisdiction to do more of the same and eventually overtake the U.S. as the main world economy. This objective will not be achieved by engaging in Vladimir Putin’s war in Ukraine.

BABA Stock – What is the trade

The substantial recent moves in the BABA stock price have resulted in an increase in the implied volatility exposed by the Alibaba option chain. A high implied volatility is a rich ingredient for a high option premium.

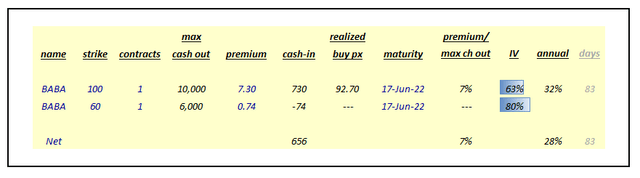

The proposed trade is the selling of a $100 strike put with a 3-month tenor and the purchase of a $60 strike put with the same maturity:

The net cash provided by engaging in the trade for 1 contract (i.e. $10,000 maximum cash exposure) is $656 for a 3-month trade. When annualizing this payoff the obtained yield is 28%.

Potential payoff scenarios for the trade:

A) On June 17, 2022 the BABA stock price is above $100. The options expire without being triggered, hence an investor realizes the described 28% annualized yield

B) On June 17, 2022 the BABA stock is below $100, but above a doomsday scenario price of $60/share. The $100 strike put option will be triggered and the investor will buy the stock at a price of $92.70 share for a lot size of 100 shares

C) A doomsday scenario occurs and on June 17, 2022 the BABA stock price is below $60/share. In this case the investor realizes a net loss of $3,344 but avoiding a max loss of $10,000 if the stock were to go to zero.

Conclusion

The Alibaba shares have been on a wild ride in 2022. Between a substantial slowdown in the Chinese economy, a political driven crackdown on tech shares in the jurisdiction and fears of ADR de-listing, the BABA shares have been at the high end of the volatility spectrum this year. While we cannot speculate how fast the stock will move towards its fair value which is higher than what we are seeing today, we do believe that the bottom is in for the stock and we have seen the capitulation trade that is very often associated with bottom formations. In our opinion, we also believe that the Chinese political leadership will not run any sanctions risks by engaging in Vladimir Putin’s war and they will maintain a neutral stance in the conflict and ensure the viability of capital raises in foreign jurisdictions remains a healthy source of capital for their developing economy. We feel the best way to take advantage of the current situation and the wild price swings witnessed in the BABA stock price is represented by the put spread trade outlined above where ultimately an investor realizes a 28% annualized yield by believing that in 3 months’ time the BABA stock price will still be above $100/share.

Be the first to comment