Kevin Frayer

China’s flags were once welcomed symbols, displayed proudly at the NYSE and other major U.S stock platforms. Oh my, how considerably things have changed in just a few short years. Several years ago, Chinese companies were among Wall Street’s biggest darlings, regarded as some of the safest and fastest-growing companies in the world. Many Chinese stocks, including Alibaba (NYSE:BABA), have recently lost billions in market cap value. As maximum pessimism sets in, it’s time to get greedy while so many are still fearful and there is so much blood in the streets.

What Has Happened to Alibaba, And China, In General?

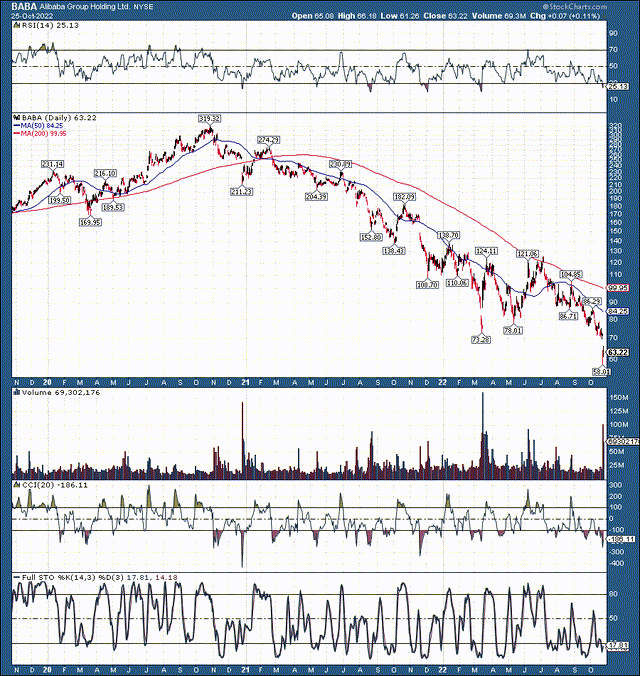

Around its high in late 2020, Alibaba commanded a market cap of approximately $850 billion, and its stock price topped at about $320 fewer than two years ago.

BABA (StockCharts.com)

Alibaba’s stock recently hit an all-time low of about $58, illustrating a mind-blowing 82% decline from the company’s all-time high in under two years. Of course, you will say this is a horrible performance, and you’d be right. However, you want to avoid buying a company at its top. It’s much better to buy a stock at a significant discount, like our current scenario with Alibaba. The company went through numerous complicated factors in the last two years, and pessimism may be reaching a maximum right now. Despite the stock’s drop of more than 80%, many of the company’s issues have been resolved.

Furthermore, unresolved concerns are likely transitory, making Alibaba’s shares undervalued. Alibaba remains a remarkably profitable company with well over a billion global customers. Alibaba’s revenue growth and profitability should improve, and its stock will probably go much higher in the coming years.

Alibaba: Much Bigger Company Now

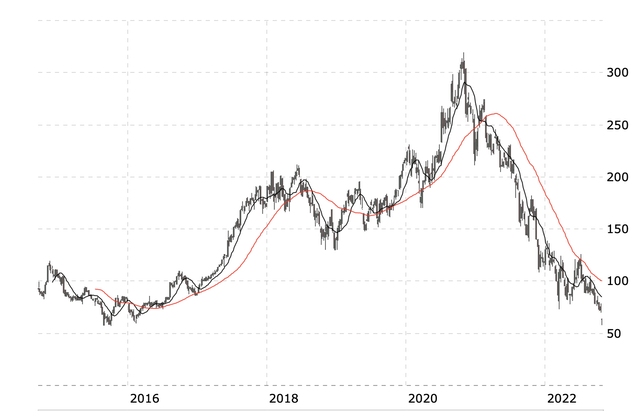

BABA (macrotrends.net)

Alibaba went public around eight years ago. We see that nearly a decade later, Alibaba’s stock price is roughly 10% below its initial IPO offering. So, has the company done anything constructive over the last eight years, or is Alibaba around the same as when it went public?

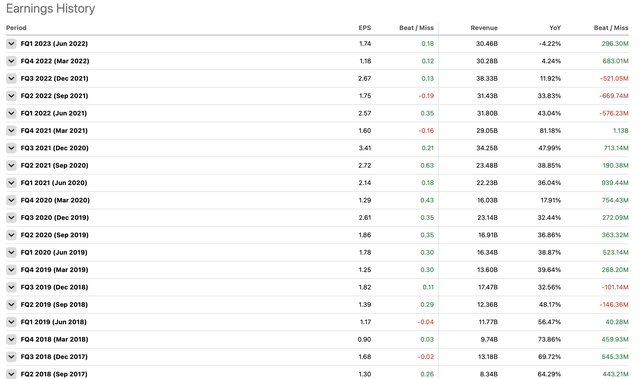

Earnings and Revenue History

Earnings and revenues (SeekingAlpha.com)

Xi Jinping consolidated power, further firming his grip on the CCP recently. However, this dynamic does not necessarily pose a significant threat to Alibaba and other top Chinese tech companies, especially if we’re discussing a long-term (3-5 year) investment horizon. Moreover, Xi’s unrivaled power should lead to stability and order in China, benefiting China’s best and brightest companies (like Alibaba) as we advance.

When I look at Alibaba’s financial performance over the last several years, I see a company that has matured and grown substantially but is going through a challenging transitory phase. Just look at Alibaba’s first four quarters (2017-2018) in the table above. The company reported $43 billion in revenues during those four quarters. If we look at Alibaba’s TTM results, we see that the e-commerce juggernaut delivered about $365 billion in revenues during its last four quarters.

Despite Surging Revenues (8X), The Stock Is Cheaper Now.

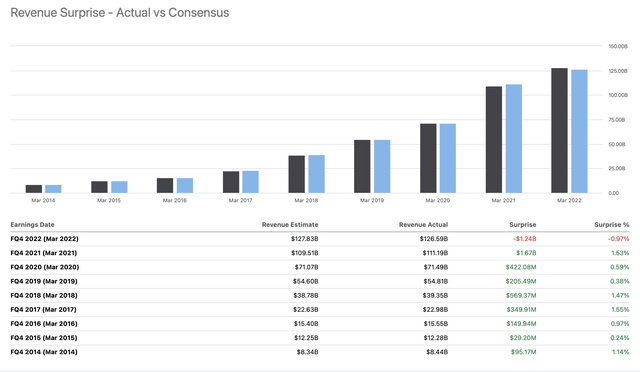

Revenues (SeekingAlpha.com)

Alibaba’s revenues have skyrocketed by roughly eightfold over the last five years. This growth rate has been phenomenal and unrealistic to sustain perpetually. Therefore, it’s perfectly normal for a company in Alibaba’s position to go through some regulatory hurdles, growth slowdowns, and other transitory difficulties. However, Alibaba gets no respect, and this temporary slowdown phase should lead to a new growth cycle. After the recent revenue and earnings decline phase concludes, Alibaba could return to 10%-20% YoY revenue growth.

Improving Revenue Growth Dynamic

Revenue growth (SeekingAlpha.com )

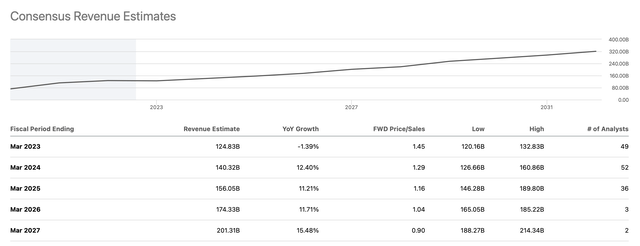

We have a consensus estimate for approximately $125 billion in revenues this year. While the company can report closer to $128 billion this year, the consensus estimate represents a 1.4% YoY decline. Also, temporary periods of revenue and earnings declines almost always lead to excellent buying opportunities.

Consensus revenue estimates for next year are $140 billion, but my projections suggest a number closer to $150 billion. Therefore, if we see a YoY increase from $128 billion (this year) to $150 billion in fiscal 2024 (next year), Alibaba’s revenue growth rate would be about 17.2% next year. Provided the unique dynamic surrounding Alibaba, my estimates are not overly bullish, and there are significantly loftier higher-end estimates from several analysts on Wall Street.

Let’s Talk Earnings

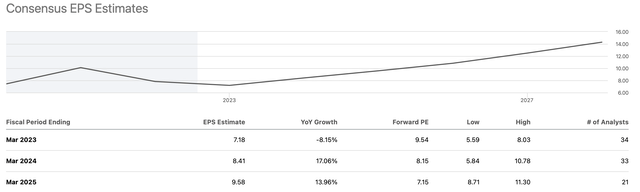

EPS estimates (SeekingAlpha.com )

Again, we see a modest period of earnings declines occurring here. Additionally, so much bad news has been baked into this stock, and analysts have become so cautious that EPS projections are probably being low-balled here. Next year (fiscal 2024), the consensus EPS estimate is about $8.40. My projection is for approximately $10 in EPS for next year. My fiscal 2023 EPS forecast for Alibaba is $7.80. However, if we can jump from $7.80 to about $10 next year, we’re looking at EPS growth of approximately 28% YoY. Moreover, once Alibaba enters a more stable environment, it can continue providing 20%-30% EPS growth for several years.

The Bottom Line – Several Factors Have To Align

The company must get its sales growth back up. The growth scare is one of the most detrimental factors hitting the stock in recent years. Presumably, the company can get back to 10%-20% annual revenue growth once its issues with Xi Jinping and the CCP are resolved. China has some of the best high-tech global companies that took decades to develop and deploy properly. Therefore, XI Jinping will not likely be the CCP leader responsible for China’s tech sector collapse and the wealth destruction that could lead to mass panic and political unrest. If it’s one thing the CCP hates is an unhappy populous.

Alibaba has been under a lot of pressure lately. The company has been dealing with fines, higher costs, increased competition, advertising costs, R&D, and other factors. Therefore, Alibaba’s profit margins have worsened in recent quarters. The major mistake here is that people feel Alibaba’s margins can’t or won’t improve. On the contrary, there’s a high probability that the company’s profitability metrics are around a low point and Alibaba will earn much more money in future years.

I also want to point out that I’m using a low P/E ratio, and if market conditions normalize, we may see Alibaba’s forward P/E valuation much higher than my projections suggest. While my predictions may seem quite bullish, they are realistic and attainable if several crucial factors go right.

Here’s where I see shares heading in the long run:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (Billions) | $128 | $150 | $182 | $205 | $230 | $255 | $280 | $305 |

| Revenue growth | 1.1% | 17% | 18% | 17% | 16% | 15% | 15% | 14% |

| EPS | $7.80 | $10 | $13 | $16.65 | $21.47 | $27.05 | $33.54 | $50 |

| Forward P/E | 6.6 | 10 | 12 | 15 | 18 | 20 | 19 |

18 |

| Stock price | $66 | $130 | $200 | $322 | $487 | $671 | $950 | $1000 |

Source: The Financial Prophet

What The Guys on Wall St. Think (This is only One Year)

Price targets (SeekingAlpha.com )

Alibaba currently has a consensus one-year price target of around $137, roughly 105% above current levels. Moreover, the bottom-end, an ultra-low price target, is approximately $70, still higher than Alibaba’s stock price today. Moreover, if we look at the higher-end estimate of around $216 gives the company’s stock a potential 222% upside from current levels.

Risks To Alibaba

While I’m bullish on Alibaba, various factors could occur that may derail my bullish thesis for the company. For instance, the CCP could resume its tough stance and clamp down further on Alibaba and other Chinese tech giants. Moreover, despite the optimistic tone from Chinese authorities, U.S. regulators could still decide to delist Alibaba. Increased competition could impact Alibaba’s growth and profits. The company’s growth could be worse than my current anticipation. Also, Alibaba’s profitability could continue to struggle for various reasons. This investment has numerous risks, and shares are very cheap right now. I believe Alibaba remains an elevated risk/high-reward investment, and investors should carefully examine the risks before opening a position in Alibaba stock.

Be the first to comment