Robert Way/iStock Editorial via Getty Images

Price Action Thesis

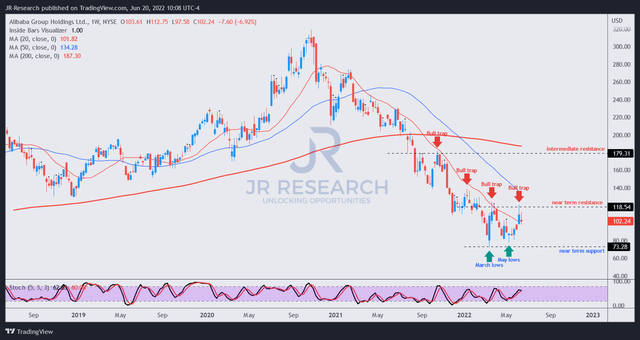

We follow up our post-FQ4 earnings update with a detailed price action analysis on Alibaba (NYSE:BABA) stock. As expected, BABA hit our near-term price target (PT) of $120 in early June but formed a bull trap. Therefore, we revisited our price action thesis and update readers on some significant developments.

Accordingly, it’s increasingly clear that BABA stock has faced stiff selling pressure at the $120 level. Notwithstanding, its March capitulation levels have held firmly, which bodes well for longer-term recovery in momentum.

However, we must emphasize that we have not observed a significant bear trap price action that could indicate a sustained reversal in its bearish bias. Therefore, the market has been very astute in using positive news in Alibaba over the past three months, drawing in dip buyers rapidly toward the $120 resistance before creating those bull traps.

Our price action analysis indicates a possible re-test of May lows before the next leg higher. But, we don’t expect a breakdown of March lows for now.

We also revisited our valuation analysis and tried to model the market’s perception of BABA valuation. Our reverse cash flow model indicates that the market could be asking for a higher hurdle rate and a higher free cash flow (FCF) yield, given its risks. Therefore, BABA stock could continue to underperform, as seen by the bull traps at its near-term resistance.

Therefore, we revise our rating from Strong Buy to Hold as we await a re-test of its May lows. We will reassess our rating if we observe a double bottom bear trap or constructive price action signals close to its near-term support.

Another Bull Trap impeded BABA’s Recovery in June

BABA price chart (weekly) (TradingView)

On our weekly chart, we can corral the two significant bull traps that formed at the $120 near-term resistance level in March and June. Therefore, we hope investors have used our previous short-term PT to take profit and loosen their exposure. We have also cut 50% of our exposure at our near-term PT (using automated sell-limit orders).

However, we didn’t expect a bull trap to form again so soon at its near-term resistance. As a result, we believe that BABA could continue trading at a range below the $120 level. Therefore, we think it’s apt to rescind our medium-term PT of $160 given the price action developments.

Given the bull trap, we expect the price to retrace further to re-test its May lows. However, it’s still too early to observe whether the May lows could hold. Notably, we expect to see a bear trap price action trigger at its May lows to inform us of a potential reversal in its bearish bias. Therefore, we urge investors to pay attention to the upcoming re-test.

BABA Stock Valuation Could Face Challenges

| Stock | BABA |

| Current market cap | CNY2,148B |

| Hurdle rate (CAGR) | 15% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 4.75% |

| Assumed TTM FCF margin in CQ2’26 | 12.1% |

| Implied TTM revenue by CQ2’26 | CNY1,474.81B |

BABA stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

The market’s bull trap in June highlighted its lack of confidence in BABA stock. Therefore, we revisited our models and checked on the updated consensus estimates.

We noticed that its FCF estimates had been marked down significantly as the Street factored in macro headwinds and weaker consumer spending. Consequently, it affects Alibaba’s FCF profitability and our previous valuation analysis.

Therefore, we updated our model with a reverse cash flow valuation analysis. We used a hurdle rate slightly above the Invesco QQQ ETF’s (QQQ) 5Y CAGR of 14.7%. We believe it’s the minimum we require to take risks investing in Alibaba. We also used a slightly higher than average FCF yield of 4.75% (but below its current NTM FCF yield of 6.02%).

Finally, using a blended FCF margin of 12.1%, we require Alibaba to post a TTM revenue of CNY1,474.91B by CQ2’26. The revised consensus estimates indicate that Alibaba could deliver revenue of CNY1,167B in FY25 (ending March 2025).

Accordingly, it requires Alibaba to post a revenue CAGR of 20.6% from FY25-CQ2’26, an unlikely scenario. Therefore, we think it could explain why the market remains tentative in re-rating BABA stock above its near-term resistance.

Is BABA Stock A Buy, Sell, Or Hold?

We revise our rating on BABA stock from Strong Buy to Hold for now. We have already taken profit and cut 50% of our exposure at our near-term PT of $120. Given its series of bull traps at its near-term resistance, we rescind our medium-term PT of $160.

Our valuation analysis also indicates that the market doesn’t expect to re-rate BABA higher anytime soon. Therefore, investors should avoid adding anywhere near its near-term resistance.

Notwithstanding, we urge investors to be patient and let the bull trap price action play out before adding exposure. We are awaiting a re-test of its May lows but will continue to monitor its price action closely.

Be the first to comment