t_kimura

We are becoming less optimistic about the potential of office REITs with the work-from-home trend remaining strong. For instance, we recently saw evidence that fundamentals are eroding for Boston Properties (BXP). That is why we went through Alexandria’s (NYSE:ARE) third quarter results in great detail to see if there are signs its fundamentals are weakening too, but so far what we see is that the company remains resilient. Its focus on laboratory buildings and biotech tenants seems to have insulated the company to a certain degree from the work-from-home trend and low office occupancy affecting most office REITs. It also helps that its buildings are very well located in research clusters, and that they are difficult-to-replace assets.

Results for the quarter included FFO per share of $2.13 and $6.28 in the first nine months, increasing by 9.2% and 8.3% over the corresponding periods in 2021. This is solid growth at a time when other office REITs are posting declining FFO numbers. Importantly, occupancy is up 30 basis points since the beginning of the year and is expected to continue to increase by year-end.

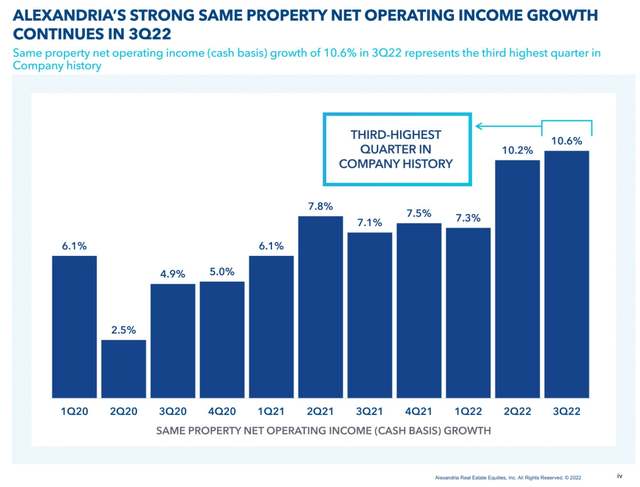

With its North American asset base of 74.5 million square feet, 431 properties in operation, development, or redevelopment, and over 1,000 tenants, Alexandria has become one of the strongest REITs in the market. It is also one of the fastest-growing, with same property net operating income growth of 10.6% in Q3. This shows the pricing power the company has, and the continue desire by tenants to remain in its properties.

Alexandria Investor Presentation

Alexandria Real Estate’s Project Pipeline

The company started delivering some of its value creation pipeline. This pipeline is expected to add approximately $645 million in incremental annual rental revenue from 4Q 2022 through the third quarter of 2025. During the third quarter the company leased and delivered approximately 330,000 square feet from this pipeline, at a weighted average yield of 7.1%, which will add approximately $30 million in annualized net operating income.

Leasing

Despite current macroeconomic conditions, demand for Alexandria’s facilities continues to be strong. In the third quarter leasing volume was 1.7 million rentable square feet which is above the company’s 10-year quarterly average of 1.3 million square feet. Year-to-date leasing volume of 6.4 million square feet is above its five-year average of 6 million square feet, and it still has the fourth quarter to add to these totals.

Importantly, rental rate growth on lease renewals and re-leasing was 27.1% and 22.6% on a cash basis. Most of the leases are from existing tenants, with 87% coming from the tenant base this quarter.

Rent Growth

The company commented that supply growth remains at a reasonable level, with construction at a fairly normal rate. The company therefore believes it will continue to be in a good competitive position to continue increasing rents, as long as other players remain rational and don’t over expand. Alexandria expects to continue seeing good rent growth, maybe not year 2021 rent growth, but to at least exceed inflation over time.

CEO Joel Marcus has this to say regarding rent growth during the company’s earnings call:

I think, we’re still seeing rent growth in almost not necessarily all of our markets, but in almost all of our markets. It certainly won’t keep pace with the hockey puck growth that you’ve seen over the last year or two, the kind of COVID years. But I think it remains, I mean, just look at the numbers we posted this quarter and last quarter was an indication of kind of where things are and how they look like they’re kind of settling out on a normal run rate.

Balance Sheet

Alexandria improved the strength of its balance sheet in the third quarter with a significant increase in liquidity. It completed an amendment to its line of credit, increasing aggregate commitments to $4 billion, up $1 billion over the prior credit facility. Total liquidity as of the end of the quarter is now very significant at $6.4 billion.

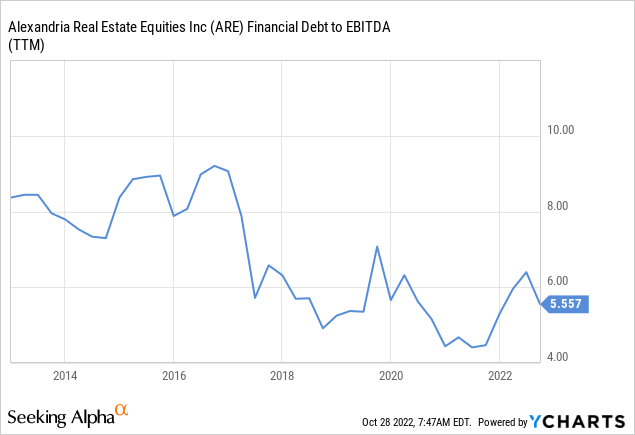

The company has no debt maturities until 2025 and 96% of its outstanding debt represents long-term fixed rate debt. Net debt to adjusted EBITDA is on track to hit its 5.1x target by year-end. Total outstanding debt has a weighted average rate of 3.52% and a weighted average maturity of 13.2 years.

Valuation

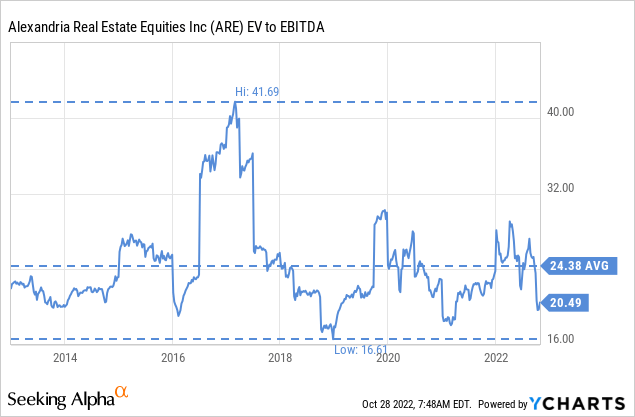

While Alexandria does not look particularly cheap, it has proven that its assets are very valuable, with dispositions at very low cap rates. It has raised $2.2 billion in capital to-date, including $1.26 billion in the third quarter, through this type of asset dispositions at excellent valuations. Shares are trading a ~16.8x guided FFO for the year, which at the mid-point is $8.41. Based on EV/EBITDA, shares are trading with some discount to their ten year average, but we would not call ~20x a bargain valuation.

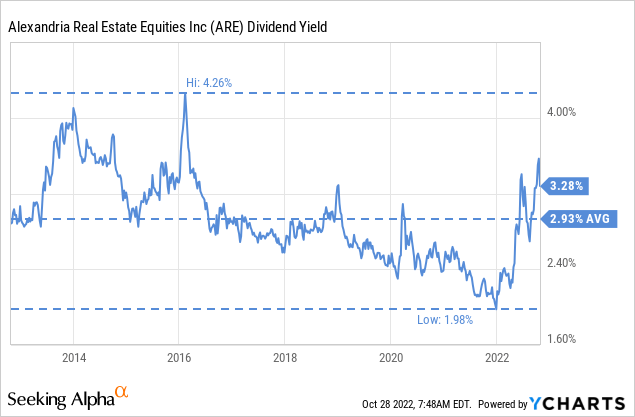

Based on the dividend yield, shares are a little cheaper than usual, yielding ~3.2%, compared to a ten year average of 2.9%. We believe the valuation at the present time to be quite fair, given the quality of the company and its assets.

Risks

While we have yet to find signs that work-from-home is affecting Alexandria, it is clear that some of its peers are already experiencing deteriorating fundamentals, with physical office occupancy in the US below 50%. Even if Alexandria is expected to be more resilient given its focus on the biotechnology industry, with its need for laboratory space, and closeness to research centers, it remains to be seen if it can completely avoid this headwind.

Conclusion

Alexandria delivered another strong quarter, showing resilience to the tough macro-economic conditions, and the work-from-home that is causing so much trouble to other office REITs. The company is well positioned to continue growing thanks to its significant project pipeline, as well as expected continued rent growth. At current prices we find shares fairly valued, and still offering an attractive return potential.

Be the first to comment