Solskin

Many office REITs a few years on from stay-at-home orders during the pandemic years have yet to see occupancy rates or rental revenue recover to their pre-pandemic averages. Whilst this was to be the expected outcome from the heavy disruption to the old way of working, it is still somewhat too early to say whether this trend will persist. In the meantime, investors could gain exposure to a resilient part of the American real estate market through Pasadena-based office REIT Alexandria Real Estate (NYSE:ARE). The company primarily rents out to life science and technology companies and focuses on developing clusters.

These are essentially critical masses in one place of linked industries and institutions where the economics of agglomeration and the marriage of location, innovation, talent, and capital combine to create competitive advantages. As these clusters tend to enjoy competitive success on a global scale, Alexandria is better able to drive strong financial performance. The company counts Bristol-Myers Squibb (BMY), Illumina (ILMN), and Eli Lilly and Company (LLY) as some of its many tenants.

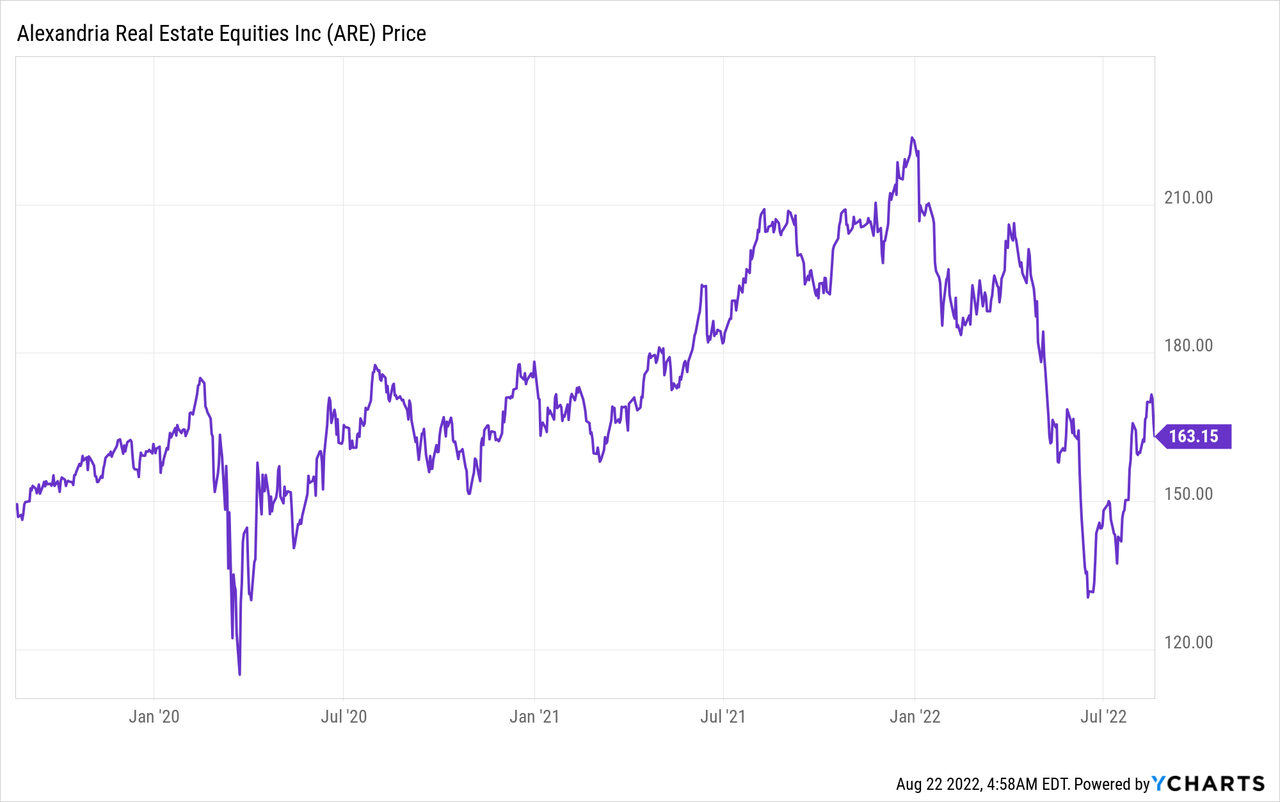

The high degree of stable blue chip companies and its unique cluster model to create healthy and thriving scientific ecosystems has meant Alexandria historically trading at a premium to its peers. However, the company’s common shares have pulled back somewhat markedly from all-time highs and currently trade at just $163.15 per share.

With the company now trading lower than its pre-pandemic peak, an opportunity to acquire shares has opened up. Alexandria has been on my watchlist for months. Other prospective investors would be advised to show some caution. The company’s venture capital arm, which primarily invests in life sciences companies, has been taken some losses as a result of the broad market crash, which has had an impact on private company valuations.

Total Revenue And Net Operating Income Grows With premium Valuation Still On Focus

Alexandria last reported earnings for its fiscal 2022 second quarter which saw total revenue come in at $643.8 million. This was a 26.3% increase from the year-ago quarter and was a beat of $10.6 million on consensus estimates. Growth was driven by a 33.9% cash basis rental rate increase, the highest quarterly increase in the company’s history. This boom came against an occupancy rate of 94.6%, a small sequential decline from 94.7% in the preceding quarter.

Annualized net operating income on a cash basis of $1.6 billion was up 24.3% compared to the annualized figure for the year-ago period. This meant a second quarter adjusted FFO of $2.10, an increase from $1.93 in the year-ago period. The company has also revised its fiscal 2022 adjusted FFO guidance to be between $8.38 to $8.44, up from the prior guidance range of $8.33 to $8.43.

Using the low end of guidance would place its price to forward FFO at 19.4x. This would be a 24.8% difference from the 15.5x sector average. Whilst a steep premium that might be hard to justify with the current uncertainty being wrought on the global economy by rapidly ramping energy prices, Alexandria will never trade in line with its peers because of its unique rental portfolio and cluster model. To put it simply, its market niche is likely to be more resilient in the face of the pressure of post-pandemic changes to the ways of working.

Building The Future Of Life Science

Academics from NYU Stern School of Business and Columbia University have come out to say that the work-from-home trend could result in $500 billion of lost value in office real estate as it would cause significant disruption to rental revenues, occupancy rates, lease renewal rates, and lease durations.

Life sciences is a sector more impervious to this due to the need for specialist scientific equipment and in-person collaborative working. The company’s tenants are working to cure disease, improve nutrition and fundamentally enhance the future of human health.

Alexandria’s top tenants are broadly high quality and financially stable firms. Indeed, 50% of total annual rental revenue was derived from investment grade and publicly traded large-cap tenants. However, their venture capital investment portfolio exposes the company to the gyrations of startup funding rounds and is of course more speculative. During the good times, this provides an avenue for alpha but injects more pain during times of market pain and uncertainty.

Whilst the valuation has declined, Alexandria still records on-balance sheet unrealized gains of around $460 million with a $1.1 billion adjusted cost basis. The company has also been noted to be the most active corporate investor in biopharma for the past five consecutive years. Critically, this supports the scientific ecosystem and drives downstream value for Alexandria.

I remain bullish on the company’s long-term prospects. It is largely resilient to the work-from-home trend, operates in a future-proof sector, and continues to realize strong financial performance. Shares could decline in the near term with downward volatility back, but the long-term trend is clear.

Be the first to comment