ContentWorks

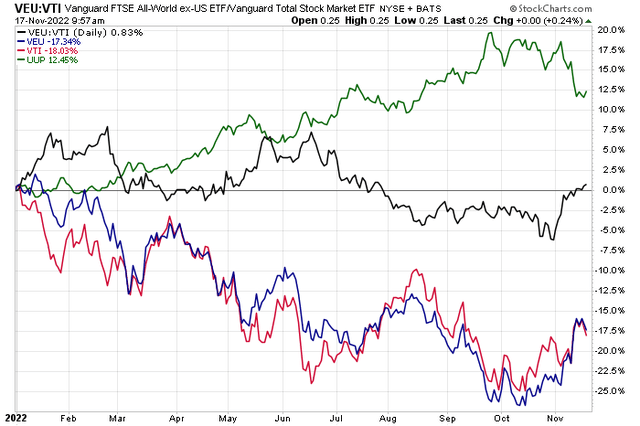

Did the U.S. dollar peak? That is a major question as we head into year end. If the greenback indeed turns south in 2023, that could be a major tailwind for foreign stocks. Consider that even in 2022 with an extraordinarily strong dollar, ex-U.S. equities are actually fractionally beating the broad domestic stock market. That tells me there could be more relative strength brewing. Finding decent growth names overseas could be the play for your portfolio.

Foreign stocks are now beating U.S. stocks YTD. And this with the USD +12.5% in 2022.

According to Bank of America Global Research, Alcon (NYSE:ALC) is a medical device manufacturing company that develops and manufactures innovative medicines and devices to serve the full life cycle of eye care needs. It specializes in the fields of ophthalmology pharmaceuticals and medical devices, eye care, and eye health.

The company was founded in 1945 and is headquartered in Geneva, Switzerland. It is a $33.4 billion market cap Health Care Equipment & Supplies industry company within the Health Care sector and features a high 56.1 trailing 12-month GAAP price-to-earnings ratio. Paying just a 0.3% dividend yield, the company reported better-than-expected bottom-line numbers on November 15 but missed on revenues.

Alcon features strong earnings margins through its devices and international sales. It’s a key metric to watch in quarterly earnings numbers. What’s also important is Alcon’s ability to grow organic sales while leveraging strong assets on its balance sheet. It did, though, announce its plans to acquire Aerie Pharmaceuticals back in August on a bet on glaucoma treatment demand. Recently, however, Societe Generale downgraded the stock on weaker margin guidance in its Q3 report.

Upside potential for ALC comes via faster adoption of its premium services as well as demand for its reusable contact lenses. Downside risks stem from weaker reimbursement policies which could cap market penetration efforts. There’s also intense competition around the world in the contact lens market.

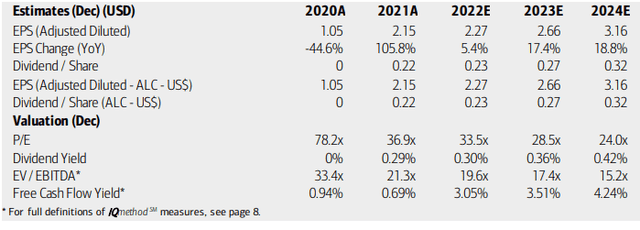

On valuation, analysts at BofA believe a high earnings multiple is warranted on ALC given its high growth. Per-share profits are seen as growing modestly this year, but then accelerating in 2023 and 2024. Dividends should grow about commensurate with earnings, but the yield should remain small. While trading at a P/E north of 30, that could retreat should earnings verify strongly. Moreover, the company is free cash flow positive. Overall, a forward PEG ratio of 2.0 is not overly expensive in my eyes.

Alcon: Earnings, Valuation, Free Cash Flow Forecasts

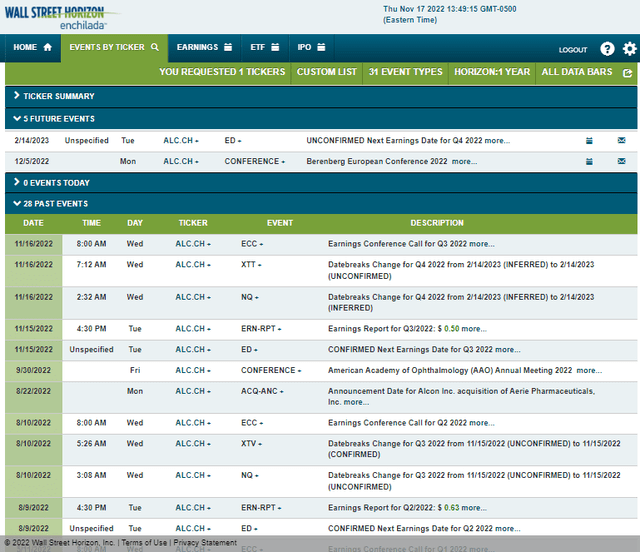

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2022 earnings date of Tuesday, February 14. Before that, though, Alcon’s management team is expected to speak at the Berenberg European Conference 2022 from December 5 through 8. Often at these events, particularly for pharma companies, share prices can move when industry or company-specific news breaks.

Corporate Event Calendar

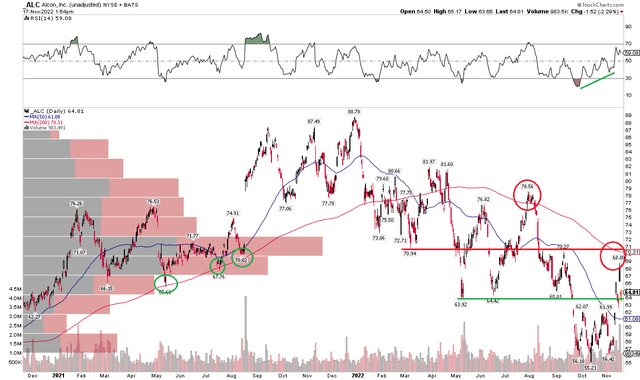

The Technical Take

ALC has been stuck in a downtrend for nearly one year. After peaking in December 2021, shares eventually dipped to a 38% drawdown, but the stock rebounded more than 20% to its November high. Post earnings, the stock has pulled back though. I see support in the $62 to $64 range – right below the current price. There could be solid resistance at the falling 200-day moving average. That line was support on a few tests in 2021 before becoming a point of selling this past summer.

I think the stock is a favorable risk/reward at the moment, but it would look better on a longer-term basis on a climb above about $71. Also take note of improving RSI, which further supports the bullish case.

ALC: Shares Above Support, Watching the 200dma

The Bottom Line

After a steep drawdown and with still-robust earnings growth on the horizon, I think Alcon is a buy here. Short-term traders can also play it using the price levels I outlined.

Be the first to comment