The global coronavirus pandemic has significantly disrupted the lithium industry. Unsurprisingly, Albemarle (ALB) has seen its stock price drop precipitously over the past month. The combination of lukewarm quarterly results and an accelerating pandemic has put Albemarle in a precarious situation. Albemarle has witnessed its stock price drop from $92 a little over a month ago to $56.

Albemarle will likely continue to experience supply chain disruptions, especially considering the fact that the company operates numerous facilities in China. Unfortunately for Albemarle, demand will almost certainly weaken moving forward as lithium-dependent markets like electric vehicles witness a downturn. While Albemarle will undoubtedly face near-term challenges, the company’s long-term prospects are still solid.

The global pandemic has taken a huge toll on Albemarle over the past month.

Tepid Q4 Results

While overall demand for lithium is likely to follow an upward trajectory over the long term, demand will likely be weak in the near-term. Albemarle’s tepid Q4 results do not inspire much confidence for the next few quarters. Albemarle’s revenue of $992.6 million and non-GAAP EPS of $1.73 missed expectations by $17.4 million and $0.02, respectively.

The company already expected a slow year in 2020, with lower and flat results expected for lithium and bromine specialties respectively. With how the coronavirus has played out since the company released its Q4 results, these businesses will likely face further downward pressure. Albemarle faces a great deal of near-term uncertainty with both supply and demand likely to be negatively impacted.

Impact of Coronavirus

Albemarle’s exposure to China could have a negative impact on the company in the near-term. The company currently operates lithium hydroxide conversion facilities and offices across China. With quarantines in effect and a lowered workforce count, China is clearly still suffering from the effects of the coronavirus.

Albemarle’s operations have been directly impacted by the pandemic and will likely continue to operate at a lowered capacity in the near-term. With so much vagueness regarding the impact of the coronavirus coming out of China, it is hard to tell how badly Albemarle’s operations will be impacted. Albemarle’s presence in China clearly adds an element of uncertainty and risk for investors.

Albemarle will also likely see reduced lithium demand as a result of the pandemic. The economic downturn will almost certainly have a large impact on EV (electric vehicle) demand, especially considering the fact that EVs are generally more expensive. A huge percentage of lithium demand comes from the EV industry, which makes EV an incredibly important market for lithium companies

Albemarle’s lithium business accounted for $1.358 billion of the company’s 2019 net sales, which was higher than the net sales from its catalysts and bromine specialties businesses. This means that any major disruption to lithium demand will severely impact Albemarle. Tesla (TSLA), which is one of the single largest consumers of lithium, is already being severely impacted by the coronavirus.

Lithium companies will not be immune to the current economic downturn.

Long-Term Future Remains Bright

Albemarle already expects somewhat of a slower year in 2020. The coronavirus outbreak will only make 2020 an even more difficult year for the company. Despite the near-term headwinds facing Albemarle, the company’s long-term future is still incredibly promising.

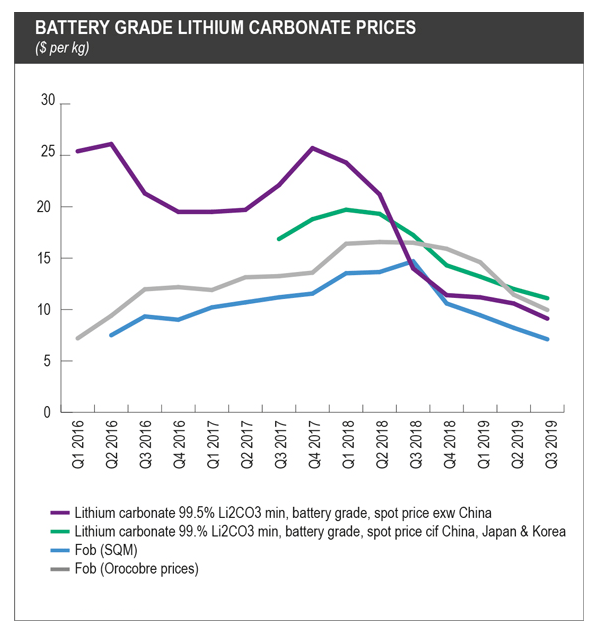

The transition towards EVs looks inevitable at this point, especially after Tesla’s huge surge prior to the coronavirus outbreak. Demand for lithium will likely continue to grow rapidly over the long term. While low lithium prices have plagued Albemarle in recent years, lithium prices will likely rise as the supply-demand situation normalizes.

Other major lithium producers like Livent (LTHM) are already scaling back capacity expansions in response to the lithium price situation. While the current market downturn adds another layer of complexity for lithium producers, Albemarle is robust enough to withstand near-term headwinds. The company has some of the best lithium resources in the industry and is well-positioned for growing lithium demand.

Low lithium prices will likely continue to plague the industry in 2020. Declining lithium prices have wreaked havoc on lithium companies over the past few years.

Source: fastmarkets

Source: fastmarkets

Conclusion

Albemarle will undoubtedly face large challenges in the coming quarters. The workforce disruption and economic downturn are set to negative impact Albemarle’s operations. However, the markets have more than priced in this new reality at the company’s relatively depressed market capitalization of $6 billion and forward P/E ratio of 12.

While a prolonged coronavirus pandemic adds a great deal of uncertainty to Albemarle, the company still appears to be an attractive investment at its current valuation. Albemarle is one of the best positioned companies to capitalize on long-term lithium demand growth. While catalysts and bromine specialties still account for a large percentage of Albemarle’s business, lithium will likely be the company’s true growth driver in the long term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment