Anton Vierietin/iStock via Getty Images

Investment Thesis

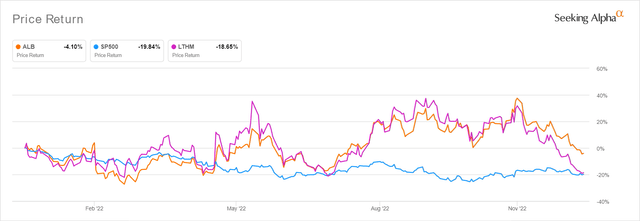

ALB YTD Stock Price

Seeking Alpha

Albemarle Corporation (NYSE:ALB) remains speculative, despite the drastic correction thus far. The stock was recently trading at $226.96, 14.13% above our moderate price target and 26.08% above our planned entry price of $180. While higher lithium prices may be here to stay, it remains to be seen how the company may perform in the short term, due to the narrowed FY2022 guidance. The company expects to deliver revenues of up to $7.4B against the previous guidance of $7.5B, for an adj EPS of $21.75 against $22.25 previously. These numbers indicate a YoY increase of 222.42% and 538.36%, respectively, significantly boosted by the 276.47% YoY expansion in lithium prices.

In contrast, the Feds plan to keep raising until a terminal rate of 5.1%, as opposed to the previous projection of 4.6%, suggesting prolonged commodity volatility through 2024. Powell’s shift to a more dovish stance may be supported by future hikes being moderated to 50 basis points, but China’s rapid reopening cadence has significantly destabilized the situation.

China’s economic activity is expected to fully normalize by mid-2023, with a projected GDP growth of 5% by the end of the year. This indicates an expeditious reopening cadence over the next few months. Though it remains to be seen if EV subsidies may be reinstated, the government has already extended the vehicle tax exemption through 2023, potentially triggering a flurry of consumer spending ahead. Xu Haidong, Deputy Chief Engineer at the China Association of Automobile Manufacturers expects a 3% YoY growth of domestic auto sales in 2023, with new-energy vehicles (the equivalent of EV) expanding tremendously by 35% YoY. The same cadence was previously observed in 2021, with a 169.1% YoY increase in new-energy vehicle sales.

Due to the contrarian government policies, the resulting global supply chain imbalance will likely influence the commodity and stock markets over the next few months. Investors must take note of this developing risk.

Lithium Demand Remains Safe, Despite The Newly Developed Sodium-Ion Batteries

According to the US Department of Energy, most EV automakers prefer to work with lithium-ion batteries due to their improved energy efficiency and high-temperature performance. While some companies may have successfully developed Sodium-Ion based batteries, we believe there is no material risk of lithium displacement in the intermediate term.

The Sodium-Ion batteries reportedly come with an energy density of 160Wh/kg (the second generation potentially reaching 200Wh/kg), which remains a far cry from lithium-ion batteries with a density of up to 350Wh/kg. This number is significant, since it also implies the mileage capacity of the eventual vehicle. Based on the current 2170 lithium-ion batteries in Tesla (TSLA), drivers have been able to go as far as 300 miles on a single charge, with the 4680 batteries potentially delivering up to 500 miles. Charging is extremely fast too, with the Supercharger adding up to 200 miles within 15 mins.

On the same note, Sodium-Ion batteries proved highly promising, with Huang Qisen from CATL guiding approximately 240 miles on a single charge. The system similarly boasts a fast charge of up to 80% capacity within 15 mins. As a result, we can understand why the newly developed battery’s halved cost is garnering remarkable market attention. While Sodium-Ion batteries may eventually improve closer to Lithium-Ion’s performance, we reckon that the market is big enough to accommodate multiple battery types.

In addition, CATL already hints at its pioneering AB battery system integration, combining Sodium-Ion and Lithium-Ion technology, to achieve an expanded 310 miles per charge instead. This may be the standard approach moving forward, bringing down the cost of the hybrid AB battery by up to -25% to $60 per kWh, instead of the current $80 per kWh offered by Lithium Iron Phosphate batteries.

CATL is already starting the industrialization process for Sodium-Ion batteries, with plans to form the relevant supply chain by 2023. BYD has similarly featured the batteries in its new sub-RMB 100,000 EV range (the equivalent of $14.3K) for future releases. Since the segment accounts for 36.8% of total pure EV sales in China, experts already predict its use by cost-conscious consumers and for energy storage purposes. CATL may also include the hybrid AB battery in its future factory expansions, due to the massively improved design mileage for mid-range passenger vehicles comprising 65% of the global consumer demand.

Meanwhile, CATL, as the world’s largest lithium-ion battery manufacturer, continues to command 34.8% of the global EV batteries produced in H1’22. Furthermore, the company plans to aggressively expand its total lithium-ion batteries output by 207.17% to 353 GWh by 2025. These may sustain the elevated lithium prices and, consequently, ALB’s stock prices ahead, since the global lithium-ion battery market is expected to grow tremendously from $58.61B in 2021 to $278.27B by 2030, at an accelerated CAGR of 18.9%. Sodium-Ion batteries may remain the alternative choice for some time, since the market demand is only projected to reach $4.3B in value by 2030. Lithium bulls may rest assured for now.

In the meantime, we encourage you to read our previous article on ALB, which would help you better understand its position and market opportunities.

- Albemarle: Growth-At-All-Cost Strategy Will Drive Its Stock Price Higher

So, Is ALB Stock A Buy, Sell, or Hold?

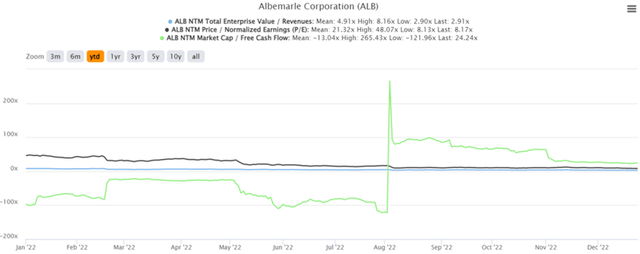

ALB YTD EV/Revenue and P/E Valuations

S&P Capital IQ

ALB is currently trading at an EV/NTM Revenue of 2.91x, NTM P/E of 8.17x, and NTM Market Cap/FCF of 24.24x, lower than its 3Y pre-pandemic mean of 3.56x, 18.60x, and 38.32x, respectively. The worsening macroeconomics have naturally further moderated its valuations against its YTD P/E mean of 21.32x as well. Based on its projected FY2025 EPS of $24.34 and current P/E valuations, we are looking at a price target of $198.85.

Market analysts are more optimistic about ALB’s prospects, with a consensus price target of $306.50, which represents 35% upside potential from current levels. In our opinion, these numbers are a little too bullish, due to the rapidly evolving commodity and stock markets in the short term. On the other hand, since its lithium and mining peers are trading at NTM P/E mean of 13.36x, as is Livent (LTHM) at 13.85x, we can understand the consensus’ confidence for now. These numbers may boost ALB’s price target nearer to consensus estimates indeed, assuming its outperformance through the next decade.

Due to the mixed signals ahead, we view ALB stock is suitable only for investors with higher risk tolerance and long-term trajectory. Consequently, those nibbling at current levels should also size their portfolios accordingly, in the event of capital loss. Meanwhile, we prefer to proceed cautiously and iterate a below $200s entry point. This will provide an improved margin of safety for the next decade’s portfolio growth and investing. There is no need to rush since economists are predicting a 70% chance of recession in 2023. With such a pessimistic outlook, bottom-fishing investors only need to practice patience and load up at a lower dollar cost average.

Be the first to comment