Pobytov

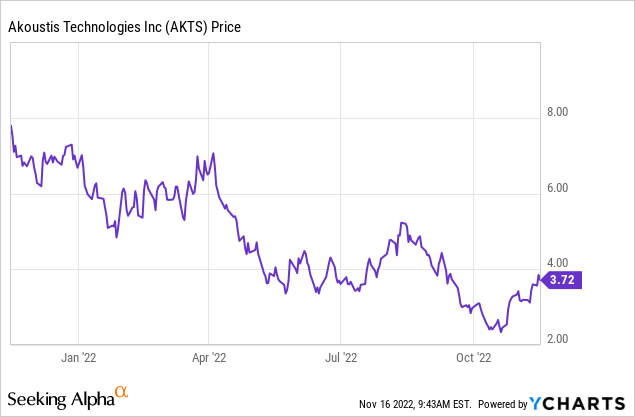

As I have been reporting, proprietary XBAW RF-filter manufacturer Akoustis Technology (NASDAQ:AKTS) is working to disrupt the global high-frequency, ultra-wideband, and high-power coexistence RF-filter market (think 5G and Wi-Fi6/6E) and grab market share away from entrenched suppliers that arguably have inferior solutions (see my previous Seeking Alpha articles here, here, and here). So far, the thesis has not panned out and I myself am underwater in the stock. Higher interest rates, the credit crunch, and the market’s pivot to value over growth have taken a toll on the stock over the past year (see below). However, I’m not selling because the speculative growth thesis is, in my opinion, still firmly intact. Let me explain why.

Investment Thesis

In my previous Seeking Alpha articles on AKTS referenced above, I explained the main challenges for a relative up-and-comer like Akoustis will have taking on the giant RF-filters suppliers – companies like Broadcom (AVGO), Qorvo (QRVO), and Murata (OTCPK:MRAAY) (OTCPK:MRAAF) – in the multi-billion dollar RF-filter market. The challenges are to convince new customers (especially tier-1 customers) that:

- It can deliver high-quality designs with competitive advantages, and

- It can do so in the volume necessary to meet demand in the high-volume smartphone and WiFi markets.

I would argue the company is making excellent progress on both these fronts (see below) while continuing to innovate and protect its proprietary designs. On the Q1 FY23 conference call this week, we learned that Akoustis, as of Oct. 28, has been awarded 73 issued patents and has 123 patents pending. That being the case, AKTS continues to build a wide IP-moat around its propriety RF-filter and related manufacturing technology.

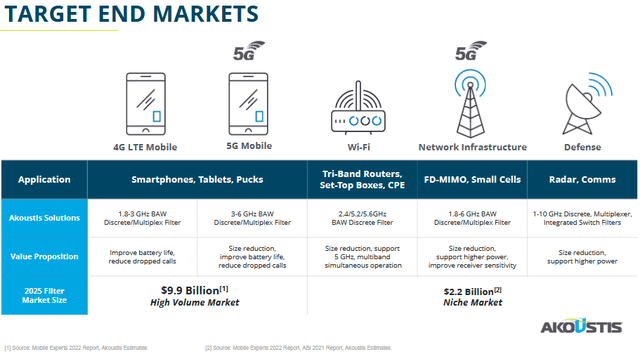

The following slide from AKTS’s October Presentation shows the TAM opportunity across multiple sub-markets is over $12 billion:

Akoustis

Earnings Update

I said the company is making progress on both challenges and the Q4 EPS report released this week proves it. Highlights included:

- Revenue of $5.57 million was up 195% yoy.

- Guidance for Q2 is for a continued ramp-up of XBAW filter revenue with overall revenue growth expected to be another record and in a range of +50-70% yoy.

- AKTS now has a total of 15 customers in production with finished products.

Akoustis is still seeing robust customer engagement. In Q1 AKTS announced, among other developments, the following:

- Three new Wi-Fi 6E design wins for MU-MIMO (multiple-in, multiple-out) architectures, bringing the total number of Wi-Fi design wins to 20.

- Received first purchase order from tier-1 RF module maker for 5G filter.

- New design win for a 3.5 GHz 5G network infrastructure filter, bringing the total number of 5G design wins to 5.

- Awarded significant new design win for RFMi product line from a leading integrated circuit supplier for a secure battery management system for use in EVs.

- Started multi-year, multi-million-dollar contract from the Deference Advanced Research Projects Agency (“DARPA”) to advance XBAW technology to 18 GHz.

- Started qualification of two timing control resonator products for first customer and received an order from a second timing control customer for resonator products.

As you can see, AKTS’s superior XBAW technology continues its impressive ability to win new customers across a wide range of applications.

Primary Catalyst: The CHIPS and Science Act

As most of you already know, the Biden Administration was able to get a strong CHIPS & Science Act passed by Congress in order to accelerate the re-shoring of critical semiconductor manufacturing and related supply chains (and the good high-paying manufacturing jobs that come with them) back to the U.S. homeland. The CHIPs Act allocates nearly $50 billion in additional investments in American semiconductor manufacturing.

New York Sen. Chuck Schumer has personally visited Akoustis’ upstate New York manufacturing facility and was a strong advocate of the CHIPS Act. Meantime, Akoustis CEO Jeff Shealy was asked during the previously reference Q1 conference call about the potential impact of the CHIPS Act on Akoustis. He responded by saying:

… regarding the U.S. CHIPS Act … we would be looking for would be an increase in capacity, another 10x to be able to really have Tier 1 type capacity for that end market.

In terms of the timing … we expect the program to be stood up in applications to be open sometime in Q1, perhaps middle of Q1 in the February time frame. These sorts of announcements will take typically three months in order to receive feedback from the government on the application and then the funding, the contracting vehicle could be an additional three months on that.

So you’re looking at somewhere in the middle of summer time frame for actual receipt – receive funding. We’ll have to look at the rules in terms of if there’s you know, how they roll the program out to whether you can actually get started sooner than that. But that’s the timing, and we’ll be more local going forward. I think it’s safe to say that the magnitude of proposal could be a multiple of what our current market cap is.

If we take the CEO’s words at face value, we’re looking at AKTS potentially being able to increase capacity by a factor 10x (note current capacity is ~0.5 million devices annually) and that the magnitude of the funding could be a “multiple” of AKTS’s current market-cap (at pixel-time, that’s $205 million).

That being the case, it’s obvious that the CHIPS Act is a major and positive catalyst for AKTS going forward because it will enable the company to greatly accelerate its manufacturing capacity and enable tier-1 customers to be confident the company can meet a high level of demand (~5 million devices annually). And, through CHIPS Act funding, it should be able to do so without issuing as many shares, or taking on as much debt, as it otherwise likely be forced to do prior to reaching “escape velocity” – which I define as achieving enough quarterly revenue to be FCF positive on a consistent basis.

Risks

AKTS is still losing money – in Q1, the company lost $0.33/share.

At the end of Q1, AKTS had $60.7 million in cash, which was down from $80.5 million at the end of the prior quarter. That is, AKTS had a ~$20 million cash burn for the quarter. At that rate, and all things being equal, the company likely has only a couple more quarters before it would need to raise cash (i.e. shareholder dilution and/or a rise in interest expense). The company already has $43.9 million in long-term debt.

Upside risks include a potential takeover bid. As reported in my previous articles on AKTS, the company was able to take advantage of the “free money” era to raise $35.6 million through a combination of at-the-market (823,439 shares at $17.16/share) and institutional direct stock offerings (1.5 million shares at $14.36/share). Now the share count has expanded since then, but the point is that institutional investors willing to buy shares at appreciably higher prices than the current stock price ($3.69) while the company has continued to ramp-up production, significantly increase revenue, and continues to ink new design wins. With a current market cap of only $205 million, it would be a drop in the bucket for entrenched and “old RF-filter tech” companies like Broadcom (AVGO), Murata, or Qorvo (QRVO) to make a bid considering their market-caps are $208 billion, $35 billion, and $9.6 billion, respectively. That being the case, a bid for AKTS in the ~$1 billion range would be a rational step to protect their RF-filter market business from being taken away from them by a small company with superior and patent protected technology.

However, I never invest on the basis takeover hopes. It’s my belief that AKTS is a compelling investment on its own merits. That said, I’m an electrical engineer myself and very familiar with this technology. While I try to be objective in my investment analysis, it could be that the nerd in me is over-riding my investment advice (a risk). However, as I have said, AKTS is clearly a “speculative growth” stock and not an opportunity suitable for all investors and certainly not a company to “bet the ranch” on. Meantime, the weakness in the stock could lead to additional end-of-year tax-loss selling (but not by me). Also, note Seeking Alpha reports a AKTS currently has an 8.6% short position. However, as you know, that could work in shareholders’ favor should something like a big grant from the CHIPS Act be announced.

Bottom line: I reiterate my BUY rating on AKTS because the investment thesis is still firmly intact for investors looking for a strong “speculative growth” opportunity.

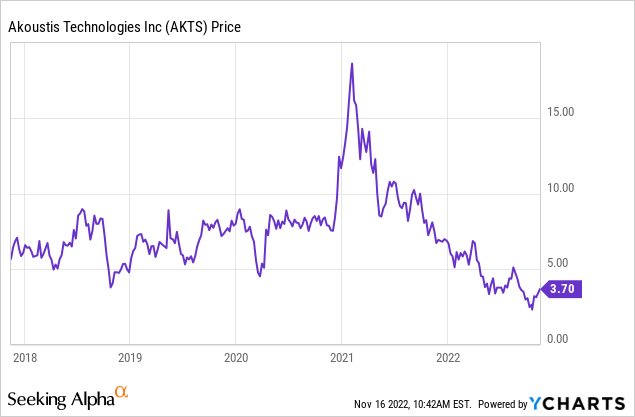

I’ll end with a five-year price chart of AKTS and repeat that the stock is trading much lower than it has in the past (even pre-pandemic) despite the fact that it continues to win market share away from the “big boys” with superior products, new design wins, and it continues to increase revenue at an impressive rate:

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment