Dow Jones & Nasdaq 100 Outlook:

- The Dow Jones and Nasdaq enjoyed modest gains despite uncertainty

- Even if a larger rebound materializes, the financial, airline and energy sectors may remain a concern

- Consequently, traders and investors will await a fiscal response from the Trump administration

Dow Jones & Nasdaq 100 Forecast: Airlines, Banks and Shale at Risk

After suffering their worst day in 12 years, stocks attempted to recover on Tuesday but gains appear tenuous for the time being. Unsurprisingly, it seems investors are hesitant to fully commit to equity exposure given the highly uncertain and volatile market climate. In turn, market participants may wait for clarification from the ECB and the Trump administration which is reportedly considering a range of fiscal measures.

Financials, Airlines and Shale Sectors Take a Hit

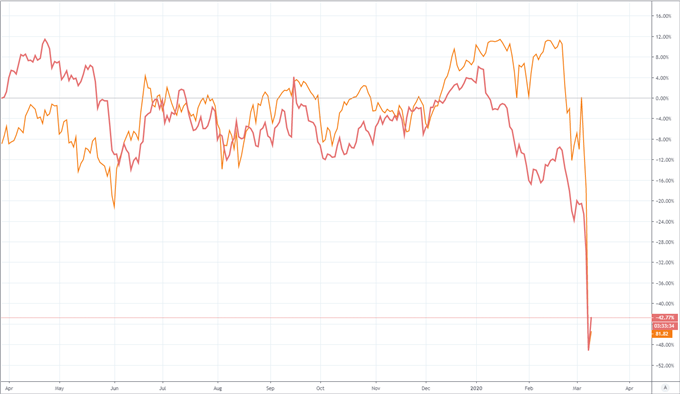

Chart created in TradingView. Financials in blue, airlines in orange, equally-weighted shale index in red

In the meantime, airliners, banks and the shale industry will likely be among some of the most vulnerable sectors. In the case of airlines, an acute drawdown in international travel has seen some of the country’s largest airlines reduce flights and connections in an effort to cut costs. Nevertheless, the XAL Airline ETF has been battered in the recent rout. In response, the Trump administration has announced plans to investigate aid measures for airliners.

Financials May Flounder

Similarly, lower interest rates and slow economic growth will look to weigh on the XLF Financials ETF. While banks can look to offset lower rates with higher volume, slower growth may weigh on demand and prove troublesome – a theme outlined by the performance of European financials which have had to grapple with low rates and tepid Eurozone growth for years.

Shale Slumps

The US shale industry has also fallen under threat. A massive decline in the price of crude oil amid a bubbling price warwill look to reduce the profitability and in some instances, viability, of the shale industry. Further still, should US shale producers fail to repay debt, there may be a knock-on effect for banks which have exposure to the industry.

WTI Crude Oil and High Yield Corporate Debt

Chart created in TradingView. Crude in red, HYG in orange

Since the shale industry has notoriously high levels of leverage, investors have been quick to express their concern for the sector which has been partially reflected in the HYG High Yield Corporate Debt ETF. As it stands, President Trump has not revealed detailed plans for assistance, but did suggest the companies at risk may receive some form of aid.

Recommended by Peter Hanks

Traits of Successful Traders

While these sectors look to stem the bleeding, market participants will eagerly await concrete plans from the Trump administration going forward. So far, President Trump has called for payroll taxes to be waived until the election is over, assistance for airlines and cruise lines and aid for shale companies but specifics remain opaque and many measures would require bipartisan support. Meanwhile, market volatility will likely persist as the drastic moves in various markets work to pressure weak points in the economy.

Recommended by Peter Hanks

Forex for Beginners

With that in mind, the performance of crude oil could play a crucial role in the coming months as shale producers look to keep their heads above water. Already the commodity has helped spark an array of moves in other markets like the Canadian Dollar which suffered a bearish breakdown versus its southern counterpart.

–Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Be the first to comment