Morris MacMatzen/Getty Images News

Investment Thesis

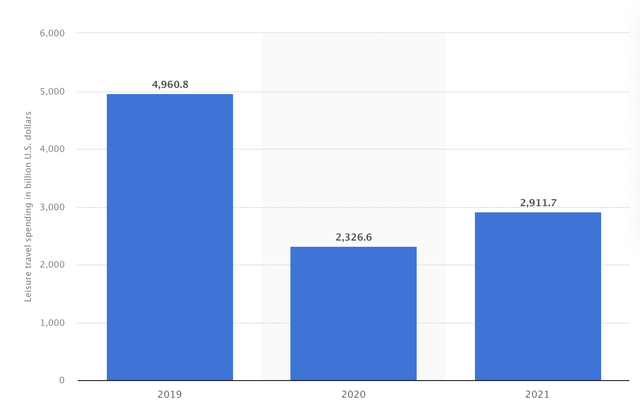

The travel industry had a very tough time during the Covid-19 pandemic and the airlines most of all. Covid lockdowns all around the world made it impossible for people to get out of their houses, let alone travel to other countries. This had some serious impact on airlines, booking sites, and all industries involved. Total travel spending fell from $5 trillion in 2019 back to just $2.3 trillion in 2020. During 2021, we saw a small recovery, but still, total spending stayed low at $2.9 trillion. This means that for two straight years all the companies in the travel industry saw their revenues half, with some hit harder than others of course. The airlines had a difficult time because of their already thin margins.

Total spending on travel (Statista)

Now, in 2022, with Covid pretty much gone (so I hope), the travel industry bounced back again, and the first airlines reported green numbers during the latest quarters. But the good news did not last for very long. At the start of 2022, Russia invaded Ukraine.

Now in this article, I am going to get into Airbus (OTCPK:EADSF), which is a builder of aircraft, but also a defense/space company. This puts it in a very interesting position with the travel rebound, the search for more sustainable airplanes, and the extra defense spend incoming from NAVO in response to the Russia-Ukraine war.

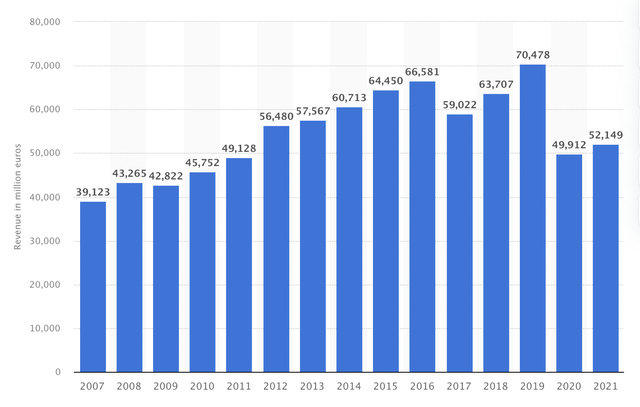

Airbus, just like most airlines, took a hit during Covid. This was mainly because its commercial aircraft business, which is the biggest revenue driver, took a hit on less use of planes. Revenues decreased from a record high of €70 billion in 2019 to just €50 billion in 2020. This is an almost 30% drop in revenue. Airlines had to cancel orders and because a lot of planes were stranded on the ground, service revenue dropped significantly. In 2021, Airbus was still far away from 2019 levels and reported €52 billion in revenues. In the period 2007-2016 Airbus grew its revenues very strong from €39 billion in 2007 to €66.5 billion in 2016. Remarkably to see here is that Airbus even managed to grow in the period 2007-2010, through the financial crisis, where it only saw a slight drop during 2009.

Airbus is in my personal investment portfolio as I believe Airbus shares are undervalued and still under pressure from covid impact. Airbus’ business is still recovering but will recover strongly over the next couple of years, supported by global growth trends. Airbus is a huge player in the production of commercial aircraft but also has strong defense and space businesses.

I will discuss my reasoning in this initial coverage of Airbus. I rate the company a buy on strong tailwinds and recession resistance.

Airbus

Airbus is a French multinational aerospace company. Airbus is a manufacturer of commercial and military aircraft, helicopters, and has a space and defense division. Airbus is the largest aeronautics and space company located in Europe. The company is based in Blagnac, a suburb of Toulouse, southern France. Airbus has roughly 180 locations and 12,000 suppliers globally.

Now let’s take a more specific look at their separate divisions:

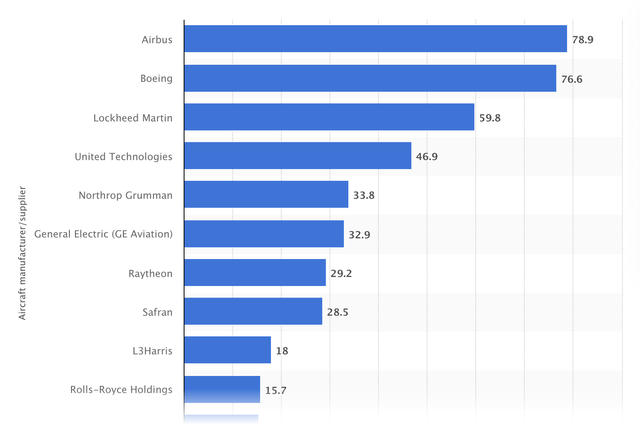

- Commercial Aircraft: Airbus has a diverse product line that includes everything from passenger aircraft to freighters and private jets. This is the company’s biggest segment accounting for a little over 30% of revenue in 2021. Airbus is the largest manufacturer worldwide of commercial aircraft, just outperforming its close, and more known rival, Boeing (BA).

Commercial aircraft revenue (Statista)

The global commercial aircraft market was valued at close to $100 billion in 2021 and the industry is expected to grow at a 5% CAGR until 2027. According to Airbus the global aircraft services market will double by 2041 and expects the market to recover to pre-covid levels in 2023. The market will reach a total value of $230 billion in 2041, according to Airbus. This will be a strong tailwind for Airbus as the largest player in commercial aircraft service, just in front of its main competitor Boeing. With Airbus still way behind its 2019 revenue levels, there is still significant upside until 2023, and growth to remain solid until 2041 driven by global trends. It is of course important for Airbus to take its business in the right direction and keep innovating.

- Airbus Helicopters: Airbus offers the full spectrum of rotary-wing aircraft solutions for government, civil, and military purposes. Airbus wants to provide the best helicopter solutions for all customers who serve, protect, and save lives. Airbus Helicopters service across more than 150 countries worldwide. Airbus helicopters are very regularly used by hospitals as medical helicopters. Customers can personalize helicopters in any way they want. This segment accounted for 12.5% of revenue in 2021.

- Airbus Defense: Airbus delivers high-tech solutions for all areas of defense: land, air, sea, space, and cyber. Airbus produces fighters, drones, and satellites. It manufactures military aircraft, UAS (unmanned aerial systems), and satellite connectivity for secure and resilient communications. Airbus Defense reports together with Airbus space because the segments share a lot of business parts. These segments accounted for 19.5% of total revenue.

There is a boost in defense spending following the invasion of Russia into Ukraine. With military spending reaching $2 trillion as Europe spends more on defense just this year, we are seeing a clear signal that military spending is only going to increase. A few months after the invasion of Russia into Ukraine, Germany already stated it would secure a €100 billion defense fund to reach its 2% of GDP goal. Now Airbus is in a bit of a strange space in defense, as it mostly provides satellite communication and helicopters to the military. It is not active in the weapons or rocket industry like Lockheed Martin (LMT) or L3Harris (LHX) for example.

But these are just two examples of the increasing defense spending as a result of the war in Ukraine. The expectation is that the longer the war keeps going, the more countries will feel the need to spend on defense. This spending is an additional tailwind for Airbus as they are a major player in the defense space.

- Airbus Space: Airbus supplies earth observation appliances for world imagery; Airbus states it can supply the perfect earth observation solution for every customer. Airbus is also a global player in the design and manufacturing of high-performance telecommunications satellites. Navigation is another space where Airbus is a global leader. Airbus is not a builder of spaceships of rockets. It is mainly active in the satellite space. It specializes in:

Satellite navigation, possessing all the necessary skills & capabilities to support the successful implementation of satellite navigation systems, used to provide Position, Navigation and Timing (PNT) solutions to all users.

Financial performance

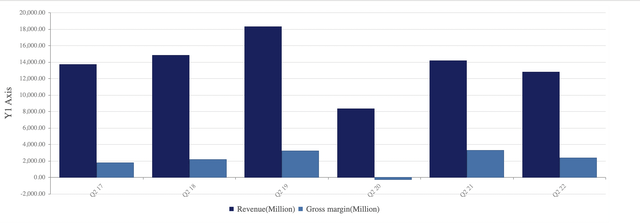

As mentioned in the previous few chapters, the company is still recovering from the covid-19 hit in 2020. 30th of July 2022 Airbus reported 2Q22 results. Airbus managed to report €12.8 billion in revenue and a gross profit of €2.4 billion. Revenue was a substantial improvement compared to 2Q20 when Airbus only managed to bring in revenue of €8.3 billion. Yet, it was lower than revenue in 2Q21 which was €14.2 billion. Revenue is still only at about 70% of the 2019 level.

Airbus Q2 revenue and EBIT (Airbus)

Since Airbus works on a project basis and builds and delivers what is being ordered, comparing QoQ results does not paint a fair picture. For now, we will take a further look at their 1H22 results, since this will paint a better picture.

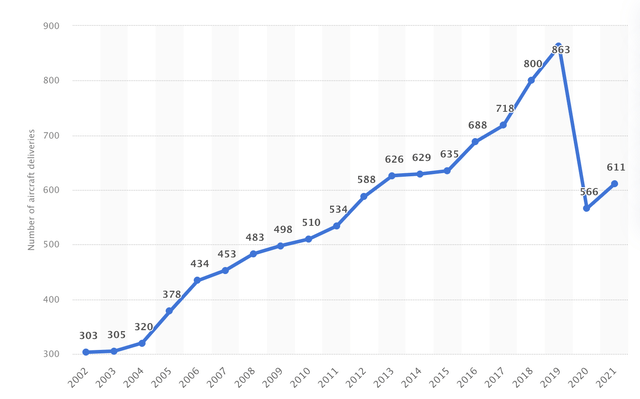

During the first half of 2022, Airbus managed to deliver 297 commercial aircraft. During 2021 this was the exact same 297 commercial aircraft deliveries. The bigger difference is to be found in the total orders made during the first half of both years. During the first half of 2021, Airbus reported total net orders of just 38 aircraft. During the first half of 2022, this got a boost to a total of 259 aircraft orders. This shows us that airlines are investing in their fleet again and thus forming a strong backlog for Airbus and the potential to grow revenue. Until 2019 Airbus was growing its yearly deliveries at a solid pace as shown below. I expect total delivery numbers to come in just a bit higher by the end of the year compared to 2021 and to then get a boost into 2023/24 when supply chain problems also start to fade away.

Total deliveries Airbus (Statista)

So, with total deliveries equaling 1H21, how did revenue do so far this year? Airbus reported revenues of €24.8 billion and adj. EBITDA of €2.6 billion. Both were flat on a YoY comparison coming in at +1% and -2%, respectively. Of course, this was no real surprise looking at delivery numbers. Net income did take a hit thanks to higher resource costs and came in at €1.9 billion, dropping 5% YoY. Free cash flow and EPS took a similar hit coming in at €2 billion and €2.42, respectively.

Looking at these metrics so far, we can see Airbus was not able to show the same YoY improvement it did during 2021. And despite earnings coming in lower, Airbus did expand its total employee base to a total of 128,873 employees, growing 2% YoY. Airbus is not slowing down hiring yet as it has to boost total output following the big order intake.

By looking at the different segments, we can see some clear differences. The top performer during H1 was Airbus Defense and Space, which grew revenue 11% YoY to over €5 billion. We also saw strong growth at Airbus Helicopters, growing 6% YoY to €2.7 billion. The big disappointment on drag and revenues were Airbus’ commercial aircraft, which saw a 2% decrease in revenues YoY. Remarkably, this segment did report a stronger EBIT margin YoY by growing their EBIT to €2.5 billion, growing 2%. Airbus Helicopters saw an even stronger increase in EBIT with 17% growth YoY and the big problem here was Airbus Defense and Space which saw a negative EBIT of €113 million compared to a profit of €157 million one year ago. These numbers show us that Airbus did not have an easy first half of 2022 profit-wise and performed mostly flat YoY.

Airbus did see a big improvement in its order book which is a strong sign for future quarters and revenue growth. Airbus’ commercial aircraft net order intake (in units) skyrocketed compared to last year with a 582% higher intake. This brought the total order book to 7,046 aircraft. Airbus helicopter saw a net order increase (in units) YoY of 33% and the total order book grow to 787 helicopters (+17%). Finally, Airbus’ defense and space saw its net order intake grow by 86% YoY (in euros) to €6.5 billion. So, where revenue and EBIT were disappointing, order intake was great for Airbus and shows a strong improvement. Of course, these are not products built over a few days and it will take Airbus some years to be able to get back to its 2019 output. Yet, a strong backlog does show us growth is incoming.

Airbus also gave off a strong outlook for the rest of the year. They expect total deliveries for the year to come in at 700 now, which is an improvement to their previous guidance and stronger than FY21. The company maintained guidance for revenue, EBIT, and free cash flow for the rest of the year. This is what CEO Guillaume Faury had to add to the numbers:

Airbus delivered a solid H1 2022 financial performance in a complex operating environment, with the geopolitical and economic situation creating further uncertainties for the industry. The supply chain challenges are leading us to adjust the A320 Family ramp-up steps in 2022 and 2023, and we now target a monthly rate of 65 in early 2024. Our aircraft delivery target for 2022 has been updated accordingly. The earnings and free cash flow guidance are maintained, underpinned by the H1 financials. The Airbus teams are engaged with suppliers and partners to ramp up towards an A320 Family monthly production rate of 75 in 2025, backed by strong customer demand.

Balance sheet and valuation

The company had strong free cash flow during 1H22. The company paid its dividends during the first half which were a total of €1.2 billion, well covered by free cash flow. At the end of June, the company had a gross cash position of €21.6 billion and a net cash position of €7.2 billion. Total cash and cash equivalents were €14 billion and Airbus had €11.5 billion in total debt. Airbus has a very strong cash position and plenty of cash. I am very impressed with this and if we compare it to its main rival Boeing, we can see it does way better. Boeing has just $11.45 billion in cash and has a huge debt load of $57.2 billion. Airbus has a very clean sheet, which is impressive if we look at the difficult time during Covid. This shows Airbus has very strong management and can control and adapt its business if necessary.

The company, as mentioned before, pays a nice dividend yield. The forward dividend yield currently stands at 1.5%. Better than main rival Boeing, who was forced to cut its dividend to zero. Airbus pays its dividend at a very safe payout ratio of 30%. As mentioned before, the company can easily pay its dividend by using its free cash flow.

Airbus is not the cheapest stock at all. It is currently valued at a forward P/E of 16.64. The company has a market cap of $79.82 billion. It is worth mentioning that Boeing is still valued at over 30 P/E. I should also mention Boeing has a stronger and larger defense segment, which makes it more resilient to downturns and therefore earns a higher valuation. Yet, all things considered, I see Airbus as the stronger business. I believe Airbus should have a P/E of at least 20. Airbus has multiple tailwinds behind it with the strong recovery of the travel sector shown by massive order intake growth and the increase in defense spending. The company pays a solid dividend and has a very clean balance sheet. Airbus’ valuation shows a significant upside.

Risks

The biggest risk for Airbus is the threat of a new covid-19 wave which might have an impact on the travel industry and slow the recovery again. Mainly in China this is a serious risk. Although I do not see Covid having the same impact again as it had during 2020 and 2021, it is still something to keep in mind. Airbus’ backlog also has a lot of exposure to China after a lot of orders from most Chinese airlines and these account for a huge chunk of the backlog right now.

A risk with aircraft builders is technical problems. We have seen this in recent years with Boeing having multiple problems and even crashes with its planes and this has been a massive drag on Boeing over recent years. It is an important risk to be aware of when investing in Airbus.

The biggest risk for Airbus seems to be its supply chain problems. Airbus has already stated that it expects supply chain problems to remain at least until 2023. For a company having many different suppliers and a huge number of parts, the supply chain is a crucial part of the business. Airbus thinks supply chain problems will fade but for the aerospace industry, this might take till late into 2023.

Conclusion

Airbus is a diversified company working in different industries. It has shown in the past it is fairly recession-resistant and inflation proof. The company is still having a hard time with its supply chain and therefore delivery numbers. The order book does show the future growth by exploding so far this year. I expect Airbus to recover strongly over the next few years, no matter where the economy is headed. Yes, growth may go slower during a recession, because of airlines being careful, but defense spending will remain strong and even increase. I see Airbus trading at least at a P/E of 20-25 as growth increases due to the recovery and the company being a safe haven during uncertain times. So far this year the stock is down by 30%, underperforming the S&P 500. With increasing business fundamentals and a drop in share price, this does offer a good buying opportunity over the long term. I recommend buying Airbus on this weakness. This stock will be a winner over the next 5-10 years, by using its industry dominance and operations in growing markets.

I rate Airbus a solid Buy.

Be the first to comment