huettenhoelscher/iStock Editorial via Getty Images

Investment Thesis: A resurgence in appetite for aircraft orders as well as a low P/E ratio relative to earnings could mean significant upside for this stock going forward.

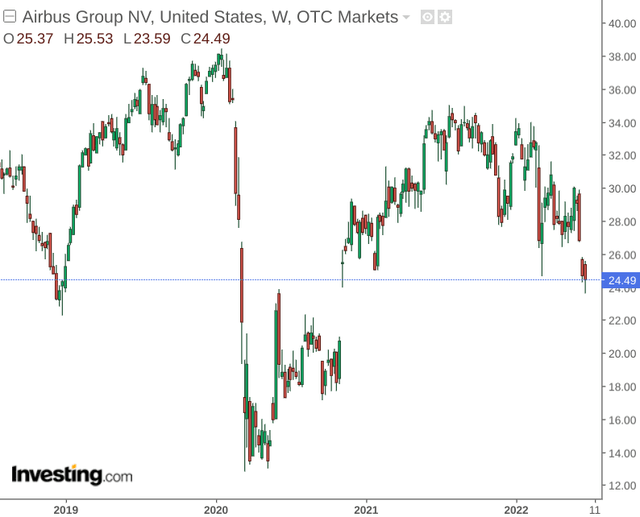

At the end of 2019, I made the argument that Airbus SE (OTCPK:EADSY) could see limited upside going forward.

My reasons for making this argument included a potential overvaluation on an EV/EBITDA basis, along with the ceasing of A380 production at the time and potential delays in bringing newer models such as the A320neo to market.

Against a backdrop of severe pressures being placed on the aviation industry in the past couple of years due to COVID-19, Airbus has seen an overall decline since 2019 in spite of a recovery in the interim:

More recently, with fuel prices getting more expensive and factors such as shortage of staff and airspace closures between Russia and the West increasing the cost of operations for commercial airliners – this has also led to the stock trailing lower recently.

With that being said, I make the argument that Airbus SE could in fact be trading at discounted levels and growth prospects could make the stock a potential buy at this point.

Inventory and Quick Ratio Analysis

The business model of Airbus is quite simple – the more aircraft it can sell to potential customers – the higher the company’s sales and, ultimately, earnings.

Of course, it stands to reason that during periods of uncertainty for the airline industry – airlines are more reluctant to commit to orders for new fleet as lower than expected demand may not justify the outlay.

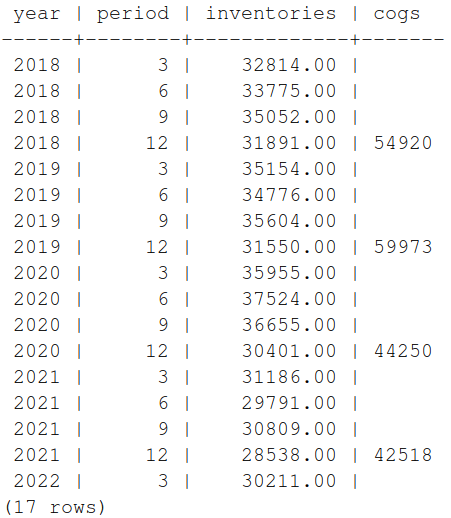

To get a better picture of inventory turnover for Airbus over the past few years, I decided to collate quarterly data on inventories and cost of goods sold from the company’s previous financial statements.

Here is the collated data (where cogs = cost of goods sold):

Figures sourced from historical financial statements of Airbus SE. SQL table created by author.

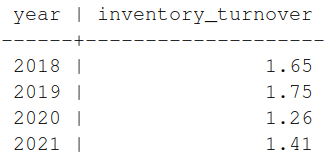

By taking the total cost of goods sold for each particular year and dividing it by the average inventory across each period in the year, the following inventory ratios were calculated:

Inventory turnover ratio calculated by author using SQL.

From this, we can see that while turnover is up from 2020 – it still has yet to reach levels seen in 2018 and 2019.

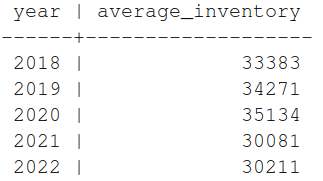

When looking at average inventory, we can see that the increase in the ratio in the previous year has been down to a lower average inventory held by Airbus as opposed to an increase in sales:

Average inventory calculated by author using SQL.

In spite of the drop in inventory turnover, Airbus has still managed to maintain a healthy cash position – with the company’s quick ratio higher than that seen in 2018 and 2019:

| Year | Current Assets | Inventory | Current Liabilities | Quick Ratio |

| 2018 | 58300 | 31891 | 60354 | 0.44 |

| 2019 | 56723 | 31550 | 62374 | 0.40 |

| 2020 | 58400 | 30401 | 49771 | 0.56 |

| 2021 | 55800 | 28538 | 47807 | 0.57 |

Source: Figures sourced from previous historical financial statements. Quick ratio calculated by author.

Looking Forward

With the airline industry still unstable in spite of the recovery in air passenger traffic coupled with macroeconomic concerns pertaining to inflation – it is probable that it could still take several years before we see inventory turnover reach pre-2020 levels once again.

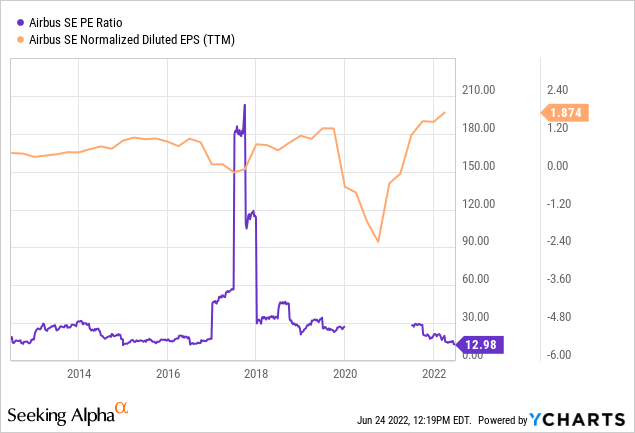

With that being said, a visual analysis of earnings per share shows that EPS has rebounded to a 10-year high, while the P/E ratio is trading at levels seen between 2014 and 2016.

YCharts

In this regard, there is a possibility that the stock has been taking an excessive decline due to a broader bearish market sentiment.

Additionally, while inventory turnover has been lower – I would not see this as an overly big concern if Airbus has been showing prudent cash management in the meantime – which appears to have been the case.

Moreover, with higher costs of operating likely to be a concern for commercial airliners over the next couple of years – it is quite possible that the narrow-body market could see more demand than wide-body – as air passengers could choose to prioritize short-haul over long-haul travel for cost savings.

For instance, easyJet (OTCPK:EJTTF) has recently agreed to buy 56 Airbus A320neo jets for a list price of $6.5 billion, while Air India is set to order 200 new airplanes in what would mark the company’s biggest order since 2006. With 70% of these orders set to be narrow-body jets – such an order could provide a sizable boost to sales growth for Airbus, which would also be likely to increase overall inventory turnover.

While the airline industry is still on shaky ground, major airliners are clearly gearing up to upgrade their existing fleets, and demand for narrow-body aircraft will play a major part in this endeavor.

Should we see order demand continue to rise going forward, then I see it plausible that Airbus could see prior highs of €40 once again if current earnings growth maintains pace.

In terms of potential risks to the stock, the travel industry as a whole is still operating in an uncertain environment. Should risk factors such as new variants of COVID or a lower-than-expected rebound in demand affect order appetite on the part of potential customers – then Airbus might struggle to rebound to prior levels.

In addition, with Boeing proving more popular overall in the supply of widebody aircraft (typically used for long-haul flights) – a continued recovery in the travel industry might also mean that long-haul travel rebounds to pre-COVID levels once again as risk appetite on the part of potential travelers increases. Should we see this scenario play out over the next decade, then Boeing could stand to capture a greater chunk of this market relative to Airbus.

Conclusion

To conclude, I take the view that despite a difficult few years, Airbus could see significant growth in the years ahead as air travel continues to recover and major airliners seek to upgrade existing fleets. Moreover, with the company’s P/E ratio trading near 10-year lows – this could mark a buying opportunity for investors with greater risk appetite.

Be the first to comment