xavierarnau/E+ via Getty Images

Investment Thesis

Fortified by a wide economic moat, Airbnb, Inc. (NASDAQ:ABNB) is leveraging its strong growth to drive meaningful profitability. This focus on improving margins and cash flow helps protect the company against the risks it faces, both competitive and economic. Based on conservative free cash flow (“FCF”) projections and the current ABNB stock price, now down 50% YTD, I argue why ABNB looks to be a Buy for long-term investors.

Financial Highlights

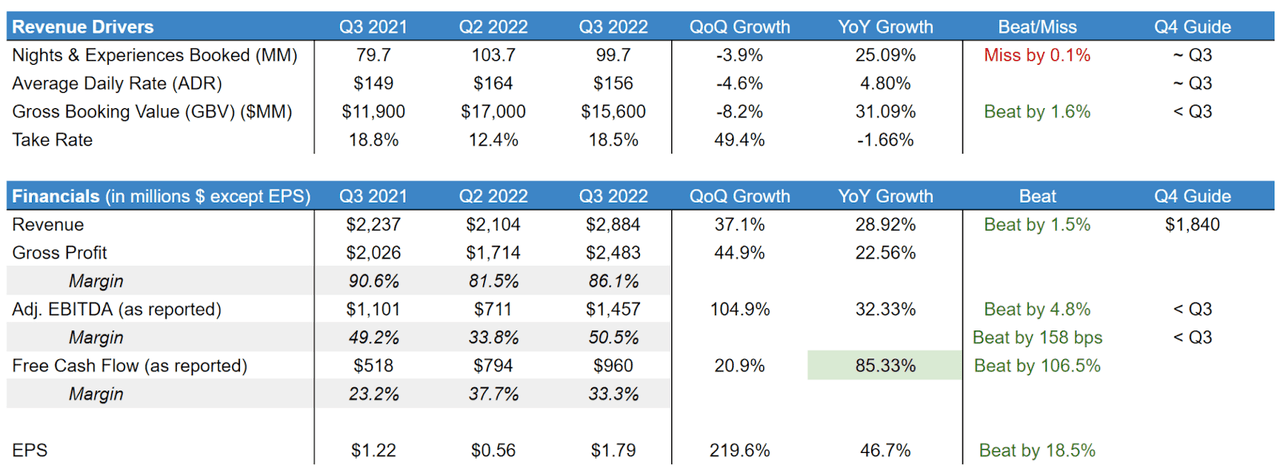

Airbnb posted stellar Q3 performance, breaking records all the way down its income statement. In addition to topline strength and widening margins, its key performance indicators continue to climb at growth rates in excess of 20% YoY. The company added to its now $7.5 billion pile of cash with $960 million net cash provided by operations in Q3. All while maintaining a healthy Debt-to-Capital ratio of 30%. Below is a snapshot of ABNB’s quarter 3 results.

ABNB Q3 Filing

Quarterly results should never act as the “be-all-end-all” for long-term focused investors, but they can give insight into the health of the business and its future. Airbnb is seeing several positive trends amidst a challenging macroeconomic and competitive environment.

Even with normalizing travel demand, Airbnb continues to see pent-up demand via longer lead times and a strong Q4 backlog. Urban and cross-border travel has recovered nicely since the pandemic, increasing 27% and 58% YoY, respectively. During 2021 and part of 2022, Airbnb’s fastest-growing stay-length category was long-term stays. A changing work-life structure drove guests, and employees, to live and work in Airbnb’s across the world. This trend has slowed in growth, but long-term stays held steady at 20% of ABNB’s gross nights booked. Lastly, active listings grew 15% YoY excluding mainland China.

Competitive Advantages and Strategy

This continued growth in supply highlights one of Airbnb’s advantages: unique resources. Airbnb’s leadership recognizes the importance of hosts in maintaining a strong competitive position. As a result, the Company has invested in its host community by rolling out features such as AirCover, Ask a Superhost, and the new Host onboarding flow. Happy hosts result in a higher quantity of hosts via network effects, which results in a higher quality of supply via competition. Higher quantity and quality of supply are ways Airbnb differentiates itself from other Alternative Accommodation platforms. Compared to its closest competitor, Vrbo, Airbnb has millions more listings across the globe with a focus on value and uniqueness.

Airbnb’s strategy the past decade has been to disrupt and take over the Travel industry. Financially, this meant heavily reinvesting cash flows back into the business to drive growth, often at the expense of profitability. The strategy played out well, as Airbnb now holds a secure leadership position in Alternative Accommodations with regards to GBV. This market control lends itself to greater brand awareness, scale advantages, and network effects between supply and demand.

Brand awareness and scale advantages go hand-in-hand for Airbnb. The company is able to spend less on advertising and still grow. Airbnb.com averages between 80-100 million unique visits monthly, with 90% of traffic being direct or unpaid. In addition, the Airbnb app is the leading Travel and Accommodations app in the United States. Airbnb has built a massive network of hosts (supply) and guests (demand), largely through word of mouth. What’s more, the vast majority of hosts are previous guests, which creates a cycle of network effects.

With an established market position and competitive moat, management has shifted its focus to shareholder value creation. The past few quarters highlight this shift, with ABNB breaking records in profitability and free cash flow. CEO Chesky explains:

What our Q3 results demonstrate is that Airbnb continues to drive growth and profitability at scale. And even with the macroeconomic uncertainties, we believe that we’re well-positioned for the road ahead…

…when the pandemic hit, we lost 80% of our business, and we completely changed our cost structure. And out of that crisis, we made a decision. And the decision we made is we weren’t going to wait for another crisis, another weakened economy or a recession to change how we invest or run the company. So we were going to be lean regardless of the economy.

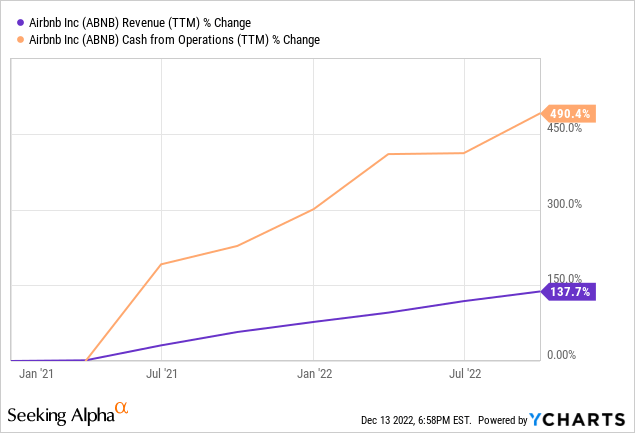

Even with normalizing travel demand and a tough macroeconomic landscape, Airbnb’s new structure is driving significant operating leverage: every basis point of revenue growth is creating 3x itself in cash flows.

YCharts

Risks

Airbnb’s most significant risk is the macroeconomy. Rising prices are pushing consumers to cut spending, thus potentially slowing travel demand. But as we saw above, Airbnb has restructured itself for adaptability and cost control. Additionally, as the economy weakens, hosts will rely more on supplemental income from their listings, creating another buffer for Airbnb. Management is also confident that demand will remain strong despite a slowing economy:

So one of the things that we’ve seen is despite a lot of consumers pulling back on spending, the one area that I haven’t seen them pull back on as much is travel. And in particular, like travel, where you can go and see your friends, see your family, more inspirational type of travel. In other words, meaningful travel, not just mass travel. And I think the reason why is just because many people are now working from home, the mall is now Amazon; the movie theater is now Netflix, people still want to get out of the house.

They still want to have memories. They still want to have meaningful experiences. And I think that’s why they continue to turn to Airbnb. And so just like people continue to travel this quarter, we expect really strong demand for Airbnb next year.

Guidance and Projections

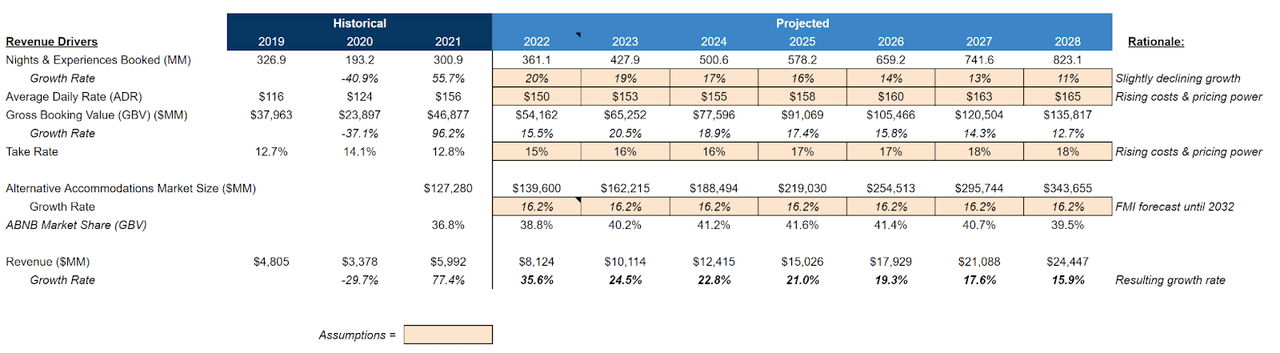

Looking forward, management expects GBV to decrease slightly in Q4 and guides for approximately $1,840 million in Q4 revenue. This results in a total fiscal year GBV and revenue of at least $60 billion and $8 billion. With this in mind, I forecasted revenue growth 7 years forward based on growth in the Alternative Accommodations market, GBV, and Airbnb’s take rate.

Author

Valuation

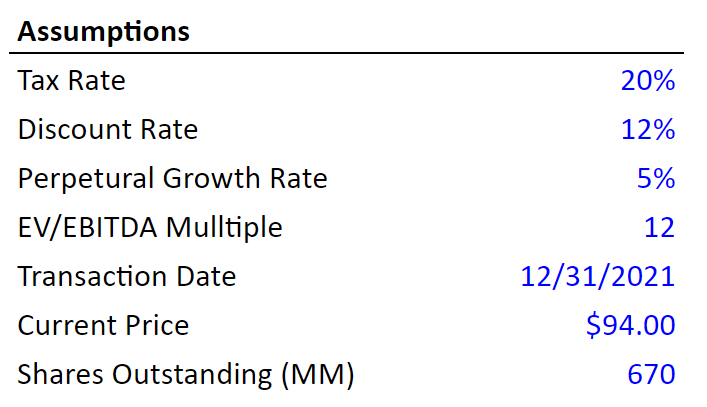

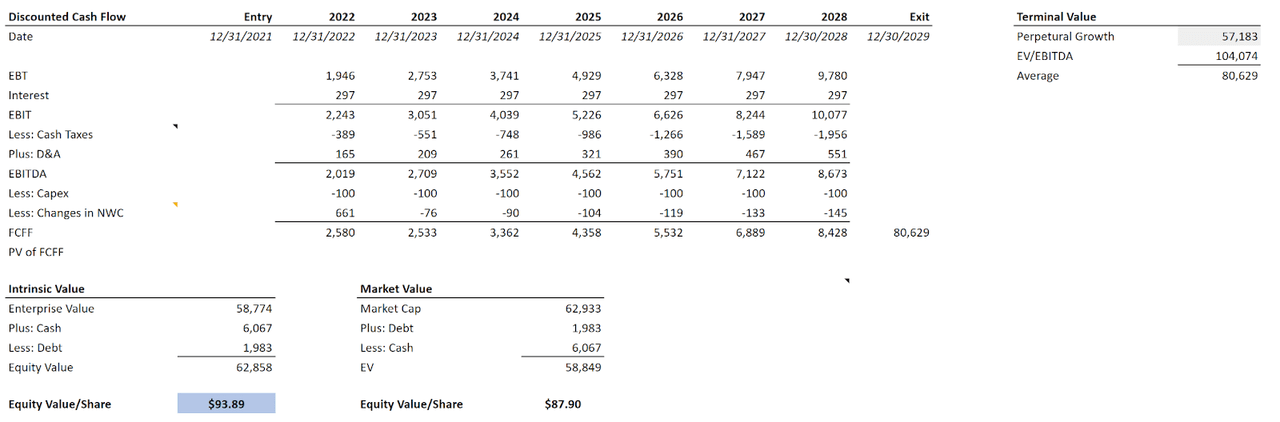

Moving to valuation, I forecasted Airbnb’s financial statements for 7 years and used these projections to calculate the Company’s intrinsic value based on a traditional DCF model. In addition to revenue growth, my major forecast assumptions are for Airbnb to maintain gross margins of 82%, EBITDA margins to remain in the mid-20s, and other Income Statement/Balance Sheet items to be relatively unchanged. The assumptions and results for the DCF model are as follows:

Author Author

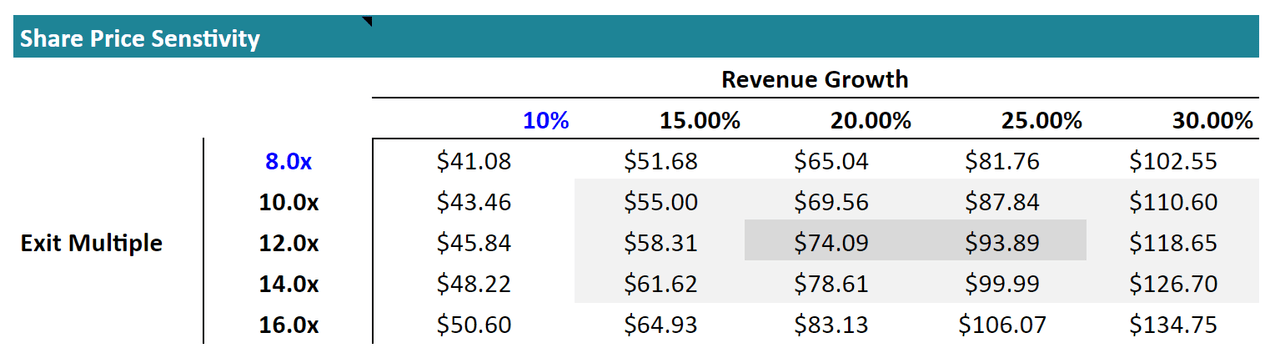

Based on my assumptions and the resulting unlevered free cash flow (“FCFF”), the intrinsic value of ABNB is close to $94 per share. I also included a sensitivity analysis of the two main drivers of the model: revenue growth and the exit multiple.

Author

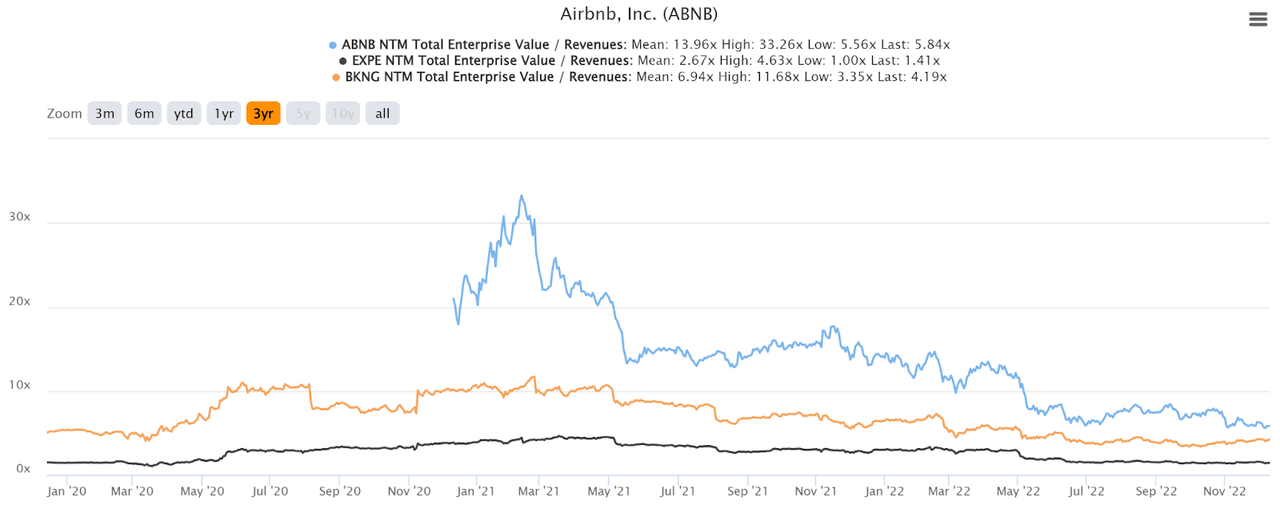

DCF models are highly sensitive to their inputs and should not be fully relied upon for valuation. When we compare the EV/Revenue of ABNB and its competitors, we see the stock historically trades at a premium but has seen record lows in recent months.

TIKR.com

Conclusion

Being a long-only investor with a long-term investment horizon, my decision to invest is based on three factors: quality, growth, and value. I am more willing to compromise valuation than the first two as some of the best investments were deemed “overvalued” as their stock price climbed year after year. Airbnb easily surpasses my bar for quality and growth. They hold a strong competitive moat in my view and look poised to continue showing “growth and profitability at scale.”

I love the story of Airbnb, Inc. and feel confident that their Founder Chesky will continue to shape the company for long-term success. With shares trading at record lows and near intrinsic value, Airbnb, Inc. is a Buy, in my view.

Be the first to comment