Thomas Barwick/DigitalVision via Getty Images

Airbnb (NASDAQ:ABNB) delivered excellent numbers for Q3, with revenue and earnings exceeding expectations. Profitability and cash flow generation are truly outstanding for such a young growth company, and the management team is doing a great job in terms of cost discipline.

In spite of these numbers, the stock was down by more than 10% on Wednesday morning. Guidance for Q4 is below Wall Street expectations, but that is mostly due to tough comparisons versus last year.

Besides, management is doing the right thing by being cautious with guidance in this economic environment.

At current prices, Airbnb stock is cheaply valued based on cash flow generation, and the long-term upside potential is quite compelling.

The Numbers For The Third Quarter

Airbnb delivered a 29% increase in revenue during the quarter, reaching $2.9 billion. Excluding currency fluctuations, the year-over-year increase in revenue is an even stronger 36%.

Nights and experiences booked grew 25% to 99.7 million, with the gross booking value reaching $15.6 billion. This number represents a 31% increase in US Dollars and a 40% increase in constant currency.

Airbnb registered its most profitable quarter in history, with the net income margin reaching 42% of revenue. Net income amounted to $1.2 billion during the quarter, growing 46% versus the same quarter last year.

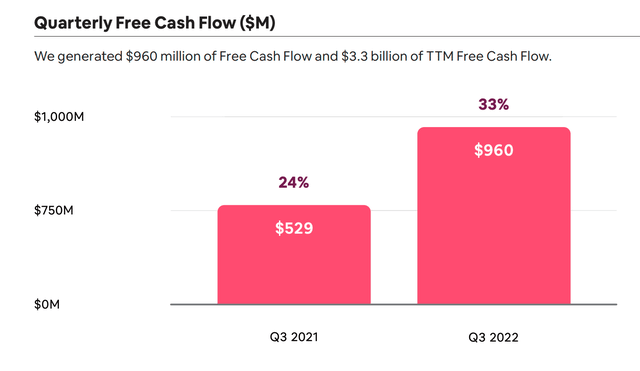

Airbnb produced $960 million in free cash flow during the quarter and $3.3 billion in free cash flow during the past 12 months. The free cash flow margin is in the neighborhood of 40% of revenue.

Going forward, the company is expecting between $1.80 billion and $1.88 billion in revenue for Q4. This is an increase of 17% to 23% versus 2021 and a 62% to 70% increase versus the same quarter in 2019. In constant currency, management is expecting revenue growth to be between 23% and 29%.

Wall Street analysts were on average expecting $1.86 billion in revenue for Q4. The guidance at the midpoint of $1.84 is 1% below analysts’ forecasts.

Management said that lead times for Q4 of 2022 are longer than for Q4 of 2021, but that is mostly because travelers were booking more rapidly between Delta and Omicron last year. As a reference, revenue growth in Q4 of 2021 was 78.3%, so comparisons are in fact quite challenging.

The company specifically said that demand looks strong and they are not seeing any material deceleration during the quarter.

From the conference call:

We’re just doing incredibly well despite the macroeconomic environment. We saw continued strength in Q3. The Q3 nights experiences grew 25% year-over-year, and our revenue grew 29% year-over-year. And as we stated, it’s actually 36% growth year-over-year, excluding the impact of foreign exchange. And what we’re seeing in Q4 is not seeing any overall changes in booking behaviors in our guests.

Four weeks in this quarter, we’re seeing really strong promising trends in cross-border, renewed interest in urban stays, stabilizing cancellations and just strong future bookings.

And that, we included in our guidance here. Our guidance for Q4, we’re anticipating revenue growth between 17% and 23%. And that’s 23% to 29%, excluding the impact of foreign exchange.

If you actually go back to 2019 historic rates, we’re actually seeing stable to increasing demand for bookings here from Q3 into Q4. The decel that we see from Q3 into Q4 is really a hard comp on Q4 last year where we had really strong demand after Delta and before Omicron.

A Lean Cash Machine

Airbnb was founded in 2008 and the company benefitted from the fact that homeowners were looking to make extra income and travelers were looking for cheap accommodations during the Great Recession.

The company then had to face a tremendous challenge during the lockdowns in 2020 and management learned the importance of being lean and efficient.

In the words of founder and CEO Brian Chesky:

Let me just recap how we think about expense management and investment. Before the pandemic, we were essentially a nearly breakeven business doing like a little under $250 million in loss from an EBITDA perspective. And of course, when the pandemic hit, we lost 80% of our business, and we completely changed our cost structure.

And out of that crisis, we made a decision. And the decision we made is we weren’t going to wait for another crisis, another weakened economy or a recession to change how we invest or run the company. So we were going to be lean regardless of the economy. In other words, we were going to go from the Navy to the Navy Seal, a small, lean, elite group.

Running a lean business provides more resiliency during tough times and abundant cash flow generation during good periods. The company has done an excellent job at sailing through storms in the past, although a global recession would clearly hurt discretionary spending and Airbnb cannot be expected to remain immune in such an environment.

Growth Initiatives

Airbnb is focusing on Experiences and Categories as new growth venues going forward. Travelers can basically book experiences such as cooking lessons, city guides, and photo shoots via Airbnb. This is still a young segment for Airbnb, but it could offer attractive opportunities because supply creates its own demand and Experiences can be a great way to unleash and benefit from human creativity.

Categories offer the possibility to start your search by looking for specific houses as opposed to specific locations. For example, you can look for houses on the beach or in the mountains. Instead of deciding where you want to go and then looking for accommodation in that area, you look for inspiration from different alternatives offered by Airbnb.

Management is also actively focused on Aircover for both hosts and guests. Promoting confidence with guarantees on both sides of a transaction makes a lot of sense because this is a major concern for travelers and hosts alike when considering Airbnb.

Pricing is an important pain point for many guests, as they often find too many hidden fees. The company is planning to move more into all-in pricing, where the guest can see the full price as opposed to seeing a nightly rate and then the different fees on the side.

Airbnb is also optimizing the search ranking in order to prioritize properties offering the best value for the fully loaded price. More pricing transparency and more price competition among hosts are much-needed improvements to the platform, and it is good to know that management is paying attention.

Valuation Is Quite Attractive

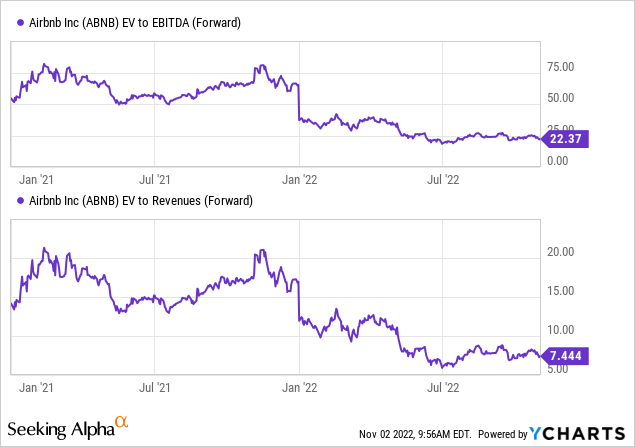

The company made $3 billion in free cash flow over the past 12 months, and Wall Street analysts are on average expecting 3.2 billion for 2023. This looks like a conservative estimate, even when factoring in a considerable deceleration in growth for next year.

The price-to-free cash flow ratio is in the neighborhood of 20, which is quite compelling for a company that can sustain free cash flow growth in the mid to high double digits over the years ahead.

Ycharts

Risk And Reward Going Forward

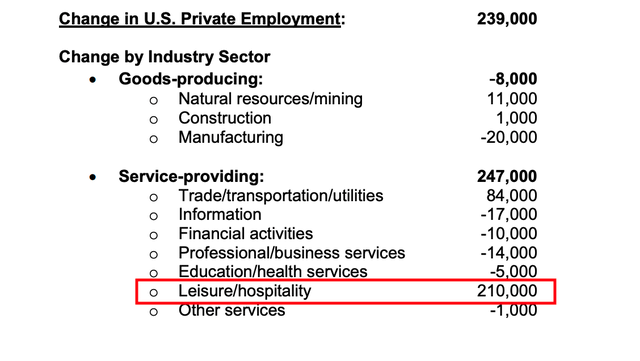

Looking at the risks, the macro environment could easily turn worse for the sector. The numbers below show the different sectors in the ADP employment report published today – November 2.

It is easy to see that Leisure and Hospitality remain very strong in terms of job creation, while many other areas are significantly lagging or even cutting jobs. A good part of this exceptional strength in leisure and hospitality is the impact of the post-pandemic reopening, and sooner or later this effect will fade away.

I would not assume that Airbnb can sustain this kind of performance if the economy enters a sharp and prolonged recession.

This macro risk is external and temporary by nature, but it is arguably the biggest headwind for Airbnb going forward.

From a long-term point of view, we also need to worry about competition, not only from hotels and online travel agencies entering the space but also from smaller local players trying to make inroads. Success attracts competition in the business world, and it is not hard to imagine that big tech players such as Google (GOOG) (GOOGL) or Amazon (AMZN) could decide to enter the space in the future.

Airbnb is doing brilliantly from a competitive point of view right now. The company gets 90% of its traffic organically, and it has the leading brand in the sector by a wide margin. However, the competitive risk is always an important factor to keep in mind in highly dynamic sectors, especially because Airbnb has very high take rates and abundant profit margins.

Those risks being acknowledged, Airbnb is an excellent business with enormous profitability and plenty of room for sustained growth ahead. Due to market conditions, the stock is now trading at compelling valuation levels based on cash flow generation. All things considered, the risk-to-reward ratio in Airbnb stock looks quite attractive over the long term.

Be the first to comment