Thomas Barwick

Investment thesis

Airbnb (NASDAQ:ABNB) looks to be one of the most attractive investment opportunities in the travel space in the future, given its strong brand, large network of hosts in many cities and countries. Furthermore, it is focused on the design of its platform and continues to bring new product innovation despite initial successes. That said, the current valuation of the company has fully priced in these strong competitive advantage and leadership position of the company. Furthermore, there are risks of a slowdown in the industry that will cause a derating in its multiples in the near-term as investors become more wary of a downturn. As such, I initiate with a neutral rating for the company, recommending that investors wait for a better entry point for the company despite the attractiveness of the business.

Strong product innovation

I think that it is encouraging that while Airbnb could have rested on its laurels as a disruptor in the travel space, management continues to focus its efforts on product innovation. In fact, these improvements in products are aimed at improving the experience for hosts and guests, which will lead to higher retention and better loyalty. In the quarter, Airbnb Categories was launched to design a more interesting way in which Airbnb offerings can be searched. Since the launch, there has been more than 180 million listings viewed in Airbnb Categories. I think that this subtle improvement in the design of searching for Airbnb offerings does help improve the user experience as it brings to guests the more unique offerings on Airbnb that the average guest would not have thought of. As a result, this innovation, in my view, could lead to some unique Airbnb offerings to become more popular as the new search design brings guests to new destinations previously not known to them.

AirCover was another new launch in the quarter. This will protect guests in the case when either the listing is not as per description or when a host cancels on the guest. This simple but new offering for guests will help improve customers that have had a poor experience on Airbnb and salvage the reputation of Airbnb and rebuild the trust with the guest. As a result, management highlighted that the net promoter scores for guests with issues during their Airbnb stay has improved, and in the scenario when a host cancels, Aircover resulted in 10% more re-bookings.

I think that these subtle user experience improvements as well as continued product innovation with the guest and hosts in mind will go a long way to ensure that both parties remain happy on the Airbnb platform and improves the brand equity of the company. While the product innovations launched thus far has been focused on guests, it was also nice that the updates to be launched in the second half of 2022 will be focus on the hosts and improving the experience for hosts. I think improvements and innovations on both the guest and host front is essential for Airbnb as it remains relevant as a platform of the new age of travel.

Q2 2022 results were solid

In Q2 2022, Gross Booking Value (“GBV”) increased 27% year on year to $17 billion while revenues increased by 58% year on year to $2.1 billion. The strong numbers showed strength in demand for Airbnb’s offerings as travel demand remained strong post pandemic.

Adjusted EBITDA came in at $711 million and net income was the strongest ever at positive $379 million. All in all, Airbnb showed strong cost control in a challenging environment and the improving profitability is a big positive in a rising rate environment with increasing global uncertainties. The strong adjusted EBITDA in particular, was above market expectations and showed the strong execution of management in driving upside in adjusted EBITDA. In fact, the current quarter’s adjusted EBITDA margins of 34% has already exceeded its long-term target of 30% and more adjusted EBITDA margins.

In addition, I think that the company’s share repurchase program of $2 billion showed its confidence in maintaining profitability as well as its long-term growth prospects. In fact, the only other online travel company with an active repurchase program is Booking.com (BKNG).

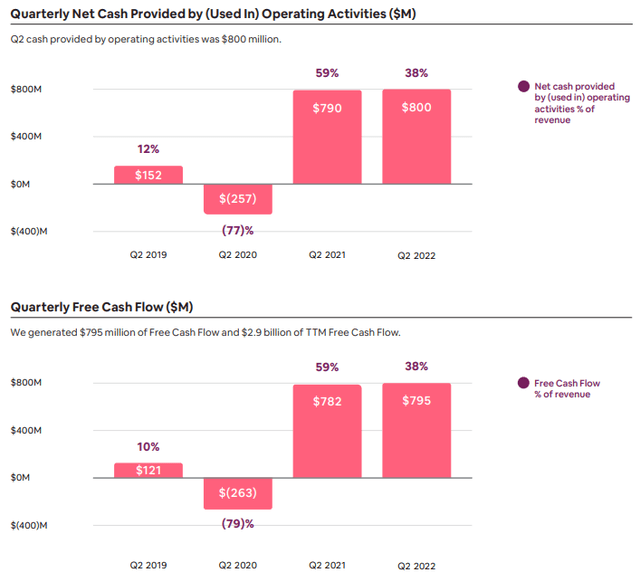

I think that we are starting to see the rather strong cash flow profile as free cash flow margin is now at 38%, compared to the 10% free cash flow margin in 2019. In a similar vein, we see that net cash generated from operating activities as a percentage of revenue has grown to 38% compared to 12% in the quarter for 2019.

Airbnb CFO and FCF (Airbnb IR website)

All in all, Airbnb posted a solid quarter with strong growth in revenues and improving profitability. I think the only concern that investors may have with the print is the relative weakness of Nights and Experiences Booked compared to expectations, which might imply softer growth to be expected given the rather elevated expectations.

Solid guidance

Airbnb’s guidance for revenues for Q3 2022 implies growth of 24% to 29% year on year, which already takes into account the challenging foreign exchange fluctuations for the year compared to 2021. Nights and Experiences Booked is expected to be stable sequentially, and for ADRs, it is expected to come in relatively higher than the prior year. Put together, this will lead to some growth in GBV. This revenue growth shows some deceleration from the revenue growth of 58% in Q2 2022.

The company continues to be focused on delivering profitability as they expect 3Q22 to be their strongest quarter in terms of adjusted EBITDA. This comes as they continue to manage marketing efficiency, optimize fixed expenses and improve on variable unit costs. As a result, adjusted EBITDA margins are expected to be at 49% and Airbnb looks to deliver adjusted EBITDA margin expansion for 2022 compared to 2021.

Airbnb management does highlight that they do not see any headwinds driven by macro factors, but I think that there are starting to be some concerns in the market about a potential slowdown in 2H22. This is because of the fact that the guidance for Nights and Experiences Booked does not show an improvement relative to Q2 2022 despite the comment about a strong July.

Exiting China

Airbnb decided to close its domestic China business in the quarter. As a result, the shift in focus will be on the outbound travelers from China. Management highlighted that this was due to the high operating costs in China as well as the prolonged COVID lockdowns in China. As a result, all China listings were taken down in July. I think that despite this move, Airbnb will still continue to benefit from Chinese travelers’ outbound travels to all over the region, including Asia, resulting in continued strong growth opportunity for the company.

While China only represents only 1% of Airbnb’s revenues, I think that it is important to watch for the demand from China outbound travel when it starts because of the important growth opportunity it represents.

Strong platform and brand as competitive advantage to maintain leadership

I am of the view that Airbnb remains a leader in the alternative accommodations marketplace. Its key advantage is the strong network of hosts it has built over time as well as a strong brand that brings guests to its platform. I expect that Airbnb continue to maintain its leadership position in the industry and even more so as it turns profitable as the company comes out of the pandemic. It will be a key beneficiary of secular trends in travel as it is currently only taking up about 2% of the total $3.4 trillion total addressable market. In addition, Euromonitor expects that lodging spend globally can reach $1.1 trillion by 2026 while overall travel is expected to reach $3.4 trillion.

In addition, Airbnb remains a recognized brand, being well known around the world and associated with vacation rentals, further demonstrating the strength of its brand. In addition, the extensiveness of Airbnb adds to its strength as it has a network of hosts in more than 100,000 cities in 220 countries globally. It is further complemented by its design-driven approach. As evident from the recent product innovations, a key focus for Airbnb is their focus on easy-to-use interface and aesthetically pleasing designs. As a result of the strength of the platform, Airbnb has attracted a unique host community that cannot be replicated by other players, as well as an engaged community of guests that continue to use its platform.

Valuation

My 1-year target price is established based on my 2024 adjusted EBITDA forecasts. I assume a 16x multiple on the adjusted EBITDA forecasts, which is a premium over peers, which is justified below. This implies 6x 2023F EV/S based on my current target price, which is more than ample a premium over current peers. My 1-year target price for Airbnb is $115, it implies an upside potential of 3% from current levels.

In terms of relative valuations, Airbnb is currently trading at 6.8x 2023F EV/S and 20.7X 2023F EV/EBITDA, while peers like Expedia (EXPE) is trading at 1.4x 2023F EV/S and 6.0x 2023F EV/EBITDA and Booking.com is trading at 3.3x 2023F EV/S and 10.1x 2023F EV/EBITDA. While a premium is warranted given Airbnb’s leadership position, strong competitive advantages and higher growth profile, I think that the current premium multiples do already reflect all these advantages over peers.

Risks

Macroeconomic environment

One of the biggest risks for Airbnb remains to be one of the factors it cannot control. With the COVID 19 pandemic, Airbnb was adversely affected as a result of restrictions on cross border travels. Today, I think that the biggest risk factor for Airbnb remains to be a weakness in the macroeconomic environment and souring of consumer sentiment. This comes as the risks of a recession appears to be in the horizon. This recession scenario will definitely affect Airbnb as it reduces demand for travel and thus Airbnb’s offerings.

Competition pressures

While Airbnb has a first mover advantage as well as the strength of its network effect, there is still risk for competition to catch up or innovate to be able to compete with Airbnb. There are other competitors like Booking.com and Expedia that have a strong online presence that could rival Airbnb, along with traditional hotel operators like Marriott (MAR) and Hilton (HLT) that may increase competitive pressures in the industry.

Reputation risk

As a result of Airbnb’s business model being built on the trust that hosts and guests have with Airbnb, I think that in the event of a scenario where Airbnb does not manage negative behaviors of hosts of guests, this could lead to the public perception and reputation of Airbnb deteriorating.

Regulatory risk

While Airbnb has not yet experienced any drawbacks from regulations, it operates in many countries around the world that have rather ambiguous laws and regulations about short term rentals which could be enforced one day and thus affect Airbnb’s operations.

Conclusion

All in all, while I think that Airbnb has strong competitive advantages in the industry that will help it maintain its leadership position given the strength of its platform, hosts and continued product innovation. However, I think that most of the upside has currently been priced in and the risk reward perspective of the company is neutral right now. Given this, my 1-year target price for Airbnb is $115, implying an upside potential of 3% from current levels, and I am initiating investors wait for a better entry on Airbnb as most of the positives are already priced in.

Be the first to comment