JL Images/iStock Editorial via Getty Images

Air Liquide (OTCPK:AIQUF, OTCPK:AIQUY) is a French industrial gas giant active around the world. After its German peer Linde (LIN), they are the second-largest supplier of industrial gases of the world, measured by revenue. Examples of their products are industrial gases which are supplied to companies active in the petrochemical industry, hydrogen, and healthcare gases such as oxygen and nitrous oxide which are used for treating patients. The nature of its operations makes the industrial gas segment a very capital-intensive business, and economies of scale can be very powerful in these types of industries. This gives Air Liquide an impressive moat.

In this article, I will focus on the possession of Air Liquide for long-term investors, which can be quite untransparent and difficult to assess when only looking at graphs. One has to take into account their many free share attributions. Also, I will talk about what makes the company such a solid pick for buy-and-hold investors. Full disclosure: I have owned Air Liquide shares since 5 years, and I am planning on holding them.

“Air Solide”

I am situated in the Netherlands myself. One of the arguments of US or other non-EU investors against owning shares of European companies is that governments can sometimes have a large stake in companies. For Air Liquide, this is not the case, their largest investors are pension funds and money management firms. In fact, Air Liquide has the largest share of capital owned by individual shareholders of all firms in the CAC 40 (CAC:IND): about 33% of its market capitalization.

The company also has an active policy of rewarding their long-term shareholders: They give a loyalty bonus of 10% on dividends and free share attributions (the latter of which is in fact a stock dividend). You do have to become a registered shareholder to be eligible for this bonus. As another illustration of their dedication to a long-term view: Air Liquide has only had 6 different CEOs since 1902. This focus on the long term combined with a solid performance in the past has led to some investors dubbing the company “Air Solide”.

Performance and Dividends

Let us take a look at the past performance of the company’s shares now to see if this stable-looking enterprise is also performing accordingly.

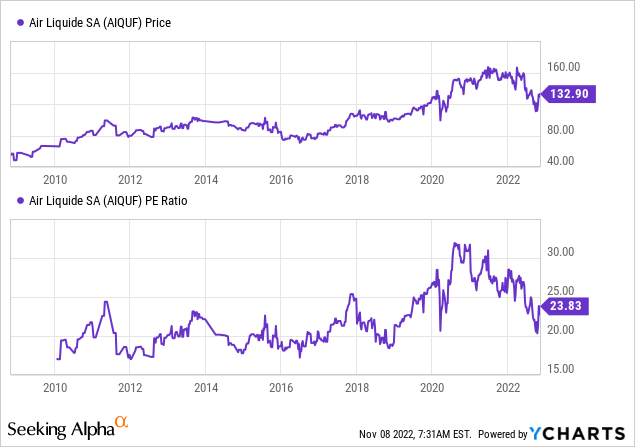

Graph 1: Air Liquide share price and profit/earnings ratio over the years

In the first graph, you can see the price development of Air Liquide shares over the last ~13 years. I took the AIQUF shares here, since they translate 1:1 to the European shares traded on Euronext (note: AIQUY corresponds to 1/5 of the regular shares).

When looking at the price graph of Air Liquide shares, it can be noted that the company performed in a relatively stable way but that there was likely no extraordinary outperformance compared with major indices, if any. Also, recently, the company’s shares have experienced a correction more or less in line with worldwide markets.

Of course, dividends are not accounted for in the price graph. But there is another important factor which has not been included: the loyalty bonus which Air Liquide awards to shareholders which have held their shares for more than 2 full calendar years. Every time Air Liquide pays out its dividend, long-term shareholders receive 10% extra. Of course, investors need to pay dividend tax, so the benefit in the end will be a bit less.

Air Liquide’s aims to pay out 55% of its net profit in dividend, which makes their past payouts look like this:

| Air Liquide annual dividend | Amount |

| 2022 | €2.90 |

| 2021 | €2.75 |

| 2020 | €2.70 |

| 2019 | €2.65 |

| 2018 | €2.65 |

| 2017 | €2.60 |

| 2016 | €2.60 |

| 2015 | €2.55 |

| 2014 | €2.55 |

| 2013 | €2.50 |

| 2012 | €2.13 |

| 2011 | €1.91 |

| 2010 | €1.91 |

| 2009 | €1.73 |

Table 1: Last annual dividends paid out by Air Liquide (source: Air Liquide)

Free Shares

For loyal shareholders, not only the dividend will be increased by 10%, also the free share attributions are increased by the same percentage. In addition to its annual dividend, Air Liquide somewhat irregularly awards free shares to its shareholders. To partially counter the dilution effect of these free share giveaways, the company put into work multiple share buyback programs. These free shares should be viewed as nothing less than a stock dividend, which does not directly change the value of an individual shareholder’s investment. This is because the total number of shares of Air Liquide gets diluted by the same percentage as the free share allocation. But shareholders who receive the 10% extra bonus do gain something, since not all shareholders receive this extra 10%, and thus are fractionally better off after such a free share attribution.

Air Liquide gave away free shares in the following years (1:10 means that 1 free share was given for every 10 shares owned, fractional shares when shareholders owned a number which was not dividable by 10 were paid out in cash):

| Air Liquide free shares | 2022 | 2019 | 2017 | 2014 | 2012 | 2010 |

| Attribution | 1:10 | 1:10 | 1:10 | 1:10 | 1:10 | 1:15 |

Table 2: Free shares provided by Air Liquide (source: website Air Liquide)

Air Liquide awarded 9 free share attributions in the last 20 years. As I mentioned before, these free share attributions do not directly increase performance of investors’ holdings. But these free share allocations do have a very large influence on the amount of dividends paid over the longer term. Let us make a calculation using the dividend of 2009 as a baseline and include dividend payments and free share allocations.

| Annual dividend | Free shares | Corrected dividend with 10% bonus for dividend + free shares | |

| 2009 | €1.73 | €1.90 | |

| 2010 | €1.91 | 1:15 | €2.10 |

| 2011 | €1.91 | €2.26 | |

| 2012 | €2.13 | 1:10 | €2.51 |

| 2013 | €2.50 | €3.28 | |

| 2014 | €2.55 | 1:10 | €3.34 |

| 2015 | €2.55 | €3.71 | |

| 2016 | €2.60 | €3.78 | |

| 2017 | €2.60 | 1:10 | €3.78 |

| 2018 | €2.65 | €4.28 | |

| 2019 | €2.65 | 1:10 | €4.28 |

| 2020 | €2.70 | €4.84 | |

| 2021 | €2.75 | €4.93 | |

| 2022 | €2.90 | 1:10 | €5.20 |

Table 3: Annual dividends corrected for bonus and free shares (source: calculations by author)

Note that, in this table, I am assuming that all the free share attributions happened after the payment of the annual dividend in the given years, of which I am not sure whether this was always the case.

We can conclude from this table that when you include the free share allocations and the 10% bonus in the dividend of Air Liquide, the dividend development looks a whole lot rosier than when leaving this out. At first glance, the ‘normal’ dividend numbers of Air Liquide look like a company which increases its dividend bit by bit, but nothing impressive. The corrected numbers reveal that Air Liquide has been an impressive dividend growth investment for long-term investors.

On paper, Air Liquide increased its dividend by 68% from 2009 to 2022, which is an average annual increase of 4.1%. Not bad, but nothing impressive. When we include our calculated corrected dividends, we end up at a total dividend increase of 174% between 2009 and 2022, or an annual rate of 8.1%. These percentages are so different because of the large influence of the free share attributions.

Valuation

A quality stock like Air Liquide is rarely cheap, and if we look at the metrics, it does not appear to be cheap today either:

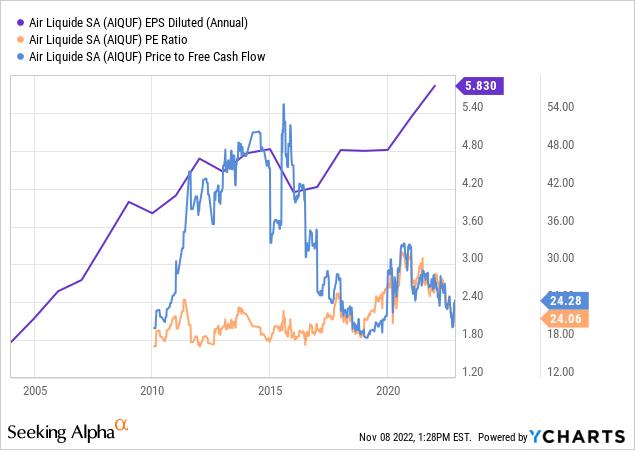

Graph 2: Air Liquide PE ratio, earnings per share and price to free cash flow ratios over the years

On a price to free cash flow basis, the shares do appear to be fairly valued, but when looking at the PE ratio, shares seem historically a bit overvalued at a ratio of 24.06. Around 2010 or 2019 was probably the best time to buy Air Liquide shares, but even then, their PE ratio was around 18, which is relatively high.

Conclusion

Air Liquide looks like a very solid holding for buy-and-hold investors. In this article, we took a look at the share price development of the stock in combination with its annual dividend and free share attribution policy. At first glance, Air Liquide looks like a bit of a lackluster performer dividend-wise. But when accounted for their free share attributions in combination with their growing dividend, the company looks like a very solid dividend growth machine for long-term investors. This is more or less hidden in plain sight.

I have owned Air Liquide shares since 5 years and will continue to do so for as long as I’m able. Their current valuation is rich, so I would consider the stock a ‘hold’ at current prices. But quality stocks like these are rarely cheap, so long-term investors should not be deterred by the slightly higher-than-historic valuation.

Thank you for reading! Please let me know in the comment section what you think about Air Liquide and its potential for buy-and-hold investors!

Be the first to comment