Olemedia/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 19th, 2022.

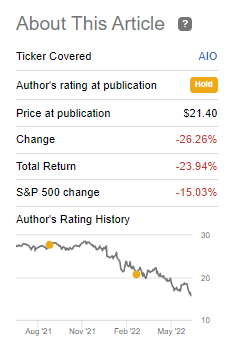

Earlier this year, I provided an update on Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund (NYSE:AIO). Tech was going through a sell-off then, and this has only got even uglier.

AIO Performance From Previous Update (Seeking Alpha)

Not only have the losses mounted, but the fund will be changing its name effective June 22nd, 2022. This is in connection with AllianzGI no longer being able to manage assets in the U.S. due to fraud in an unrelated fund. Still, not a good image to have in the highly competitive world of finance. The funds are simply dropping the “AllianzGI” portion of their name.

Besides the name change, the investment objectives and policies remain the same. There are no changes to that. The subadvisor will also be dropped during a transition period.

…have been informed by Allianz Global Investors U.S. LLC (“AllianzGI”), the subadviser to each Fund, that AllianzGI will no longer act as a subadviser to the Funds after a transition period of up to four months. Consequently, in the coming weeks, the Board of each Fund will consider possible options and alternatives, including a potential proposal to Fund shareholders to approve a new subadviser.

In the first press release announcing the future change in subadviser, it would appear that Voya will also become involved in some capacity.

Concurrently, AllianzGI announced its intention to enter into an agreement with Voya Investment Management (“Voya”) to transfer the investment teams who currently manage the Funds to Voya.

From reading this, it doesn’t say that the funds are going to Voya but the “investment teams.” As expected, a transfer to Voya being the advisor would require shareholder approval. There were some more details in their proxy for the annual shareholder meeting.

Any such transition for a Fund will require both Board and Shareholder approval for that Fund. Under the terms of its settlement, AllianzGI US will bear all expenses associated with a transition of the Funds necessitated by the settlement.

With all this up in the air, it can be adding to even more uncertainty about the future of these funds. Given the transition, we would often see activists start jumping in as they have more leverage to negotiate tender offers. For AIO, there are no activists or even large institutional ownership at the end of March 31st, 2022. Since this wasn’t announced until later, it will be interesting to see if any of the funds garner activist interest.

Closed-end funds are very much a function of their own objectives and investment policies. So, while this can lead to some uncertainty, it shouldn’t impact the fund too dramatically. That would happen if there were a change in the objectives or investment policies.

The managers have some choice in how they invest. I’m not saying they don’t have any impact on the outcome. However, AIO is a more focused thematic play – so the flexibility here is somewhat limited. The sector performance, more broadly, in my opinion, plays a greater role than the management team.

The fund takes a rather unique approach to invest through a hybrid allocation. So, a new manager could have some impact on that. From the sounds of it, though, they will try to bring the same management team and funds and just transfer them to Voya. That would mean the same managers could ultimately end up running the same funds.

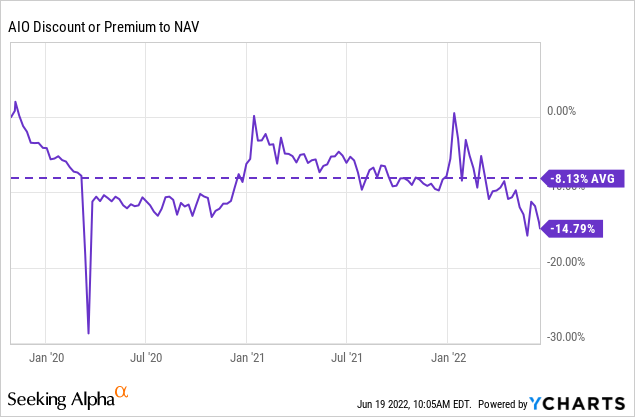

All this being said, the strong sell-off in tech and the fund’s almost 15% discount has set up for an interesting opportunity in this fund. It would be more appropriate for a long-term investor, though, as it could take some time to recover and see growth to once again become a market leader.

The Basics

- 1-Year Z-score: -2.48

- Discount: 14.79%

- Distribution Yield: 11.41%

- Expense Ratio: 1.43%

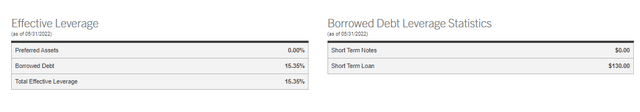

- Leverage: 15.35%

- Managed Assets: $846.68 million

- Structure: Term (12th year, expected October 29th, 2031)

AIO focused on generating “a stable income stream and growth of capital by focusing on one of the most significant long-term secular growth opportunities in markets today.” They will do this by investing “in a growing universe of opportunities across a broad spectrum of technologies and sectors embracing the disruptive power of artificial intelligence and other new technologies.”

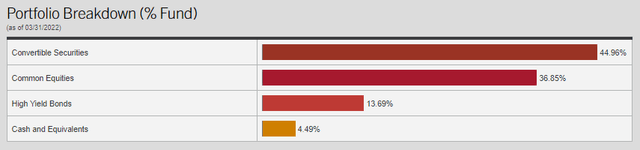

With a “…dynamically allocating to attractive segments of a company’s debt and equity in order to offer an attractive risk/reward profile.” That leaves AIO flexible to invest across assets into this market segment. That is one of the main reasons that sets this fund apart from its CEF tech-focused peers.

The fund is only lightly leveraged up with short-term borrowings. Though it has been an increase since the last update. They now have $130 million in borrowings, up meaningfully from the $30 million. It seems they are putting more capital to work as the market is also beaten down.

AIO Leverage Stats (AllianzGI)

The weighted average interest rate of the fund’s leverage was 0.83%. As interesting rates are rising, this will increase going forward. So, while they are taking advantage of the lower prices to scoop up investments, it will also increase their expenses going forward. They currently have a rate based on 3-month LIBOR plus 0.55%.

Performance – Attractive Discount

Like many funds in the tech space, they enjoyed incredibly strong gains through most of 2020 and 2021. They launched near the end of 2019, meaning they also went through the lows in 2020 before the rapid moves higher. This year, we are seeing a similar pattern of sharp losses that began in November.

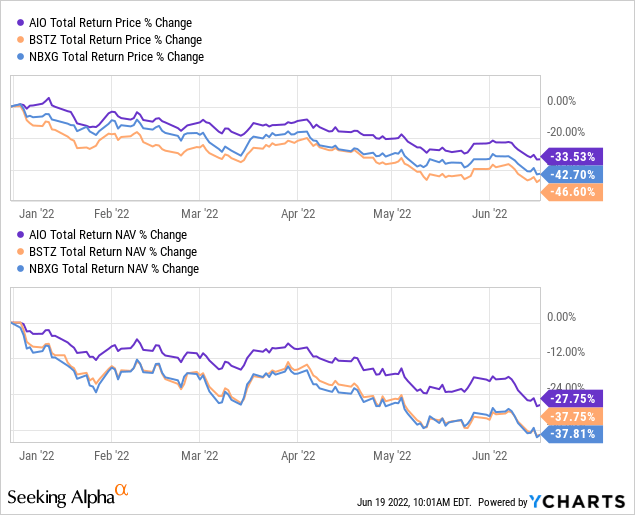

YCharts

We can see the YTD performance has AIO holding up better than what could be considered similar “peers.” Not exact peers as the fund takes the hybrid approach, where the bonds and convertible exposure can limit downside moves. That’s exactly what we see playing out relative to BlackRock Science and Technology Trust II (BSTZ) and Neuberger Berman Next Generation Connectivity Fund (NBXG).

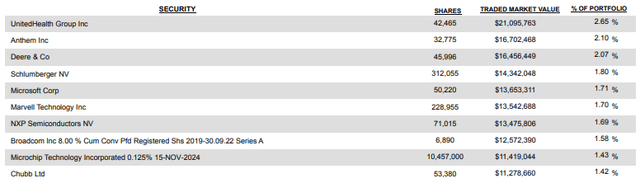

We will also see that AIO holds some unusual “tech” names. Part of why I continue to be interested in this fund and its sister fund Virtus AllianzGl Diversified Income & Convertible Fund (ACV). AIO’s exposure is more focused on large-cap names that have a tech angle but aren’t necessarily in the tech sector. Those names include UnitedHealth Group (UNH) and Deere (DE).

AIO is at a deeper discount than almost any period since it launched, except for the 2020 sharp spike lower.

YCharts

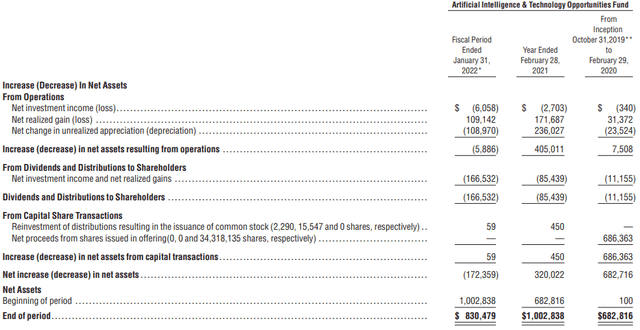

Distribution – At Risk

On a more somber note, the fund will be at risk of a distribution cut. They rely significantly on capital gains to fund their distributions. In each of 2020 and 2021, we also saw massive specials paid out. Thanks again for the incredibly strong years of performance. They also boosted their regular distribution heading into 2022, taking it from $0.13 per month to $0.15.

You know a fund is paying out some serious specials when it distorts the graphs, making the regular payouts indistinguishable when they are raised!

AIO Distribution History (Seeking Alpha)

With the latest declines, the fund has been pushed to a distribution rate of 11.41%. On a NAV basis, it appears a bit better at around 9.72%. This would be thanks to the large discount. Investors can collect an even higher distribution yield than the fund has to earn. However, we know the fund hasn’t been earning this payout for the year due to the losses generated in the fund.

The fund generates no net investment income from its portfolio. The entire distribution will rely on capital gains. That’s why it would make sense if we see the fund cut its distribution at this time.

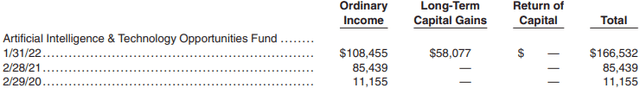

For tax purposes, though, the fund has mostly generated “ordinary income” classifications.

That might be a bit surprising at first, but short-term capital gains are lumped in as ordinary income too. So that’s why we see ordinary income at such a large amount. Now that the fund has been around for a bit, we are starting to see long-term capital gains make their way into the classifications as well. Ultimately, in the longer run, it would be best for shareholders to see mostly long-term capital gains. That’s better on the tax bill and means the fund is earning its payout.

AIO’s Portfolio

As we saw above in the comparison to some other tech-focused CEF funds, the hybrid allocation has helped reduce AIO’s collapse. It has still been an awful period for shareholders in the fund, but relatively speaking, it has been performing better.

AIO Asset Breakdown (AllianzGI)

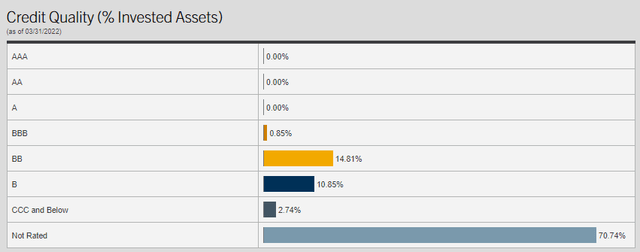

The credit quality of the portfolio is firmly in the high-yield or below-investment-grade space. However, the “not rated” category makes up the largest portion of their credit quality breakdown. The reasoning for this is that convertible securities are often issued under Rule 144A. This saves them the time and costs of issuing convertible securities.

The introduction of Rule 144a in 1990 created the institutional private placement market. 144a private placements can be brought to market quickly without the voluminous disclosure that a public offering requires. These companies are typically already well known to the institutional buyers, so underwriting costs can be significantly reduced through the use of 144a private placements.

AIO Credit Quality (AllianzGI)

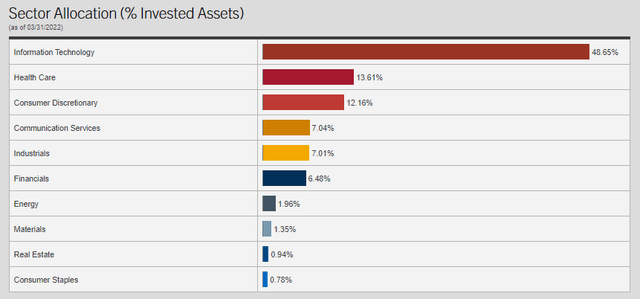

As I mentioned above, the fund’s unique approach to tech investing. While they focus most of their portfolio on companies identified as tech stocks, they aren’t entirely a pure-play tech fund. They carry significant allocations outside traditional tech stocks.

AIO Sector Allocations (AllianzGI)

This is done in positions such as UNH and DE, where they are working on AI processes to increase efficiency and services to society.

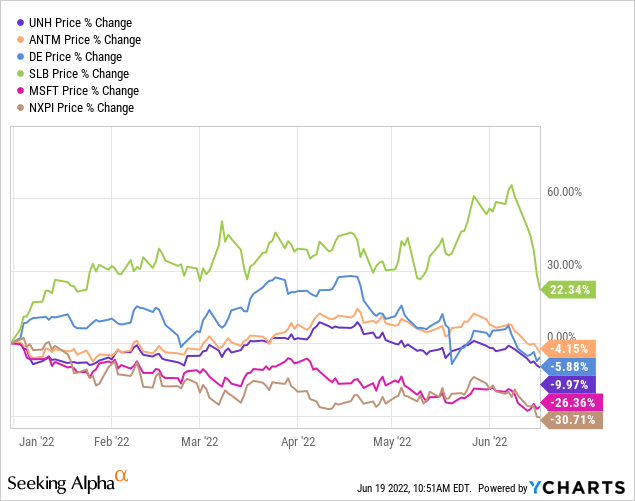

UNH and Anthem (ANTM) have actually now moved up on the list of top holdings to comprise the largest allocations. DE also moved up the list to the third-largest allocation at the end of May 31st, 2022. It has taken the spots away from Microsoft (MSFT) and NXP Semiconductors (NXPI). We also see that Schlumberger (SLB) is joining the top holdings list.

These were all positions previously. Market performance has been a factor but so have changes in the number of shares being held. For ANTM, they had increased their share count to 32,775 from 26,225 seen in their Annual Report. For SLB, we see the opposite. Instead, they have reduced their share count to 312,055 from 346,750.

MSFT saw a decline to 50,220 shares for the latest update from 67,505. NXPI had also decreased the total shares held to 71,015 from 91,365.

YCharts

SLB had been performing as one of their top positions. The bear market has now even grabbed hold of the energy space. However, they are still showing quite strong gains on a YTD basis.

Conclusion

The tech space has been continuing to get slaughtered. That has impacted AIO with its significant overweight tech allocations. That being said, it has been holding up relatively well as it takes a hybrid approach. AIO invests in convertible bonds and that can help with some downside protection. The fund also isn’t invested solely in the tech space. As names such as SLB are up for the year, that has helped offset the declines for the fund for just one example. The declines in the space and being exacerbated by the discount expansion in the fund set up a fairly attractive opportunity for long-term investors.

Be the first to comment