DutchScenery/iStock Editorial via Getty Images

Investment Thesis

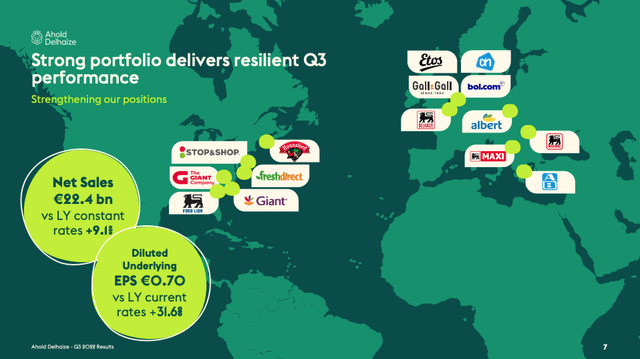

Ahold Delhaize (OTCQX:ADRNY) is one of my largest personal holdings and not without a reason. Ahold is a multinational conglomerate owning supermarkets, convenience stores, and online drug stores in Europe and the US. Ahold consists of 21 brands that employ 375,000 people in total. The company manages 6500 stores divided over 11 countries. The company has a great moat across its regions and industries. Ahold Delhaize is my number one choice within the consumer staples sector as it has great exposure to different regions, strong management, and nice growth prospects.

A little over a month ago I wrote my first article about Ahold Delhaize. I rated the company a buy and ever since it has grown its share price by little less than 10%. Today, October 9th, Ahold reported its third-quarter earnings and they sure did not disappoint.

Within this article, I want to take you through their third-quarter earnings and see whether this changes my rating from a month ago. Within the current economic environment and the market volatility, opinions and theses can change rather fast. Though, I am investing for the long term and will therefore be looking at long-term opportunities.

3Q22 earnings report

Ahold saw revenue grow during their third quarter and delivered strong results which beat both top and bottom-line estimates from analysts. Net sales increased 20.8% YoY to €22.4 billion. Where we have seen many companies in the US being hit by FX headwinds, for European Ahold these FX changes are a strong tailwind. On FX neutral basis, revenue increased by 9.1% last quarter. This is still very strong growth, but significantly less as Ahold is impacted by FX tailwinds. Ahold saw a market share increase in most of its markets, which reflects strong customer loyalty.

Net consumer sales increased by 16.9% or 11.5% on constant currency. The operating margin came in at 4.4%, which was in line with the prior year’s results and was stronger than the 4.1% margin reported the previous quarter. Underlying EPS came in at €0,70, which is an increase of 31.6% YoY.

The US segment increased revenue by 27.4% to €14.7 billion. 20.8% online sales growth was also strong and was building on the 53% from the year-ago quarter. The underlying margin in the US was 5% and an increase from 4.8% a year ago.

Revenue in Europe was $7.7 billion and increased by 10%. If we look at FX-neutral growth, Europe actually grew at a faster 10% pace than the US at only 8.8%. Growth in the US was supported by FX tailwinds from a stronger dollar. Europe saw a lower operating margin of just 3.4%, down by 0.9 percentage points YoY. Margins in Europe were mainly affected by rising energy prices and utility costs.

Ahold Delhaize

Based on last quarter’s results Ahold increased the FY22 outlook and now expects low double-digit EPS growth vs mid-single-digit guidance previously. The free cash flow outlook remains the same at €2 billion with a Capex of €2.5 billion.

Ahold also launched a new €1 billion share buyback program which will start at the beginning of 2023.

Numbers look good, growth is strong, and FX tailwinds are a driving force for extra growth. The recent numbers are very impressive and confirm my thesis of Ahold being fairly recession-resistant. The company can push prices on to consumers to cover inflationary pressure. A very strong quarter for a very solid company.

Ahold Delhaize

This strong growth and resilience despite price increases is supported by strong penetration of own-brand products and consumer loyalty. According to Ahold Delhaize, it is seeing 50% penetration of own-brand products in Europe and 30% penetration in the US. Penetration of own brands is a very strong moat because it will support consumer loyalty and higher margins on products sold. The company has also expanded its click & collect service in the US and operates a total of 1471 pick-up points.

If we look at separate brands’ growth, we can see very strong performance across the board:

- Food Lion just marked 10 years of positive sales growth. The company has 601 Food Lion To Go stores and will expand to nearly 1000 stores by the end of 2022.

- Dutch Supermarket Albert Heijn has a very strong “100 items below €1” campaign which does very well in times of high inflation.

- Delhaize Belgium continues to see its growth rates improve. This supermarket is boasting its own-brand products by launching a campaign including 500 different new products.

- Bol.com, the eCommerce store of Ahold Delhaize in the Benelux is seeing third-party sales grow double-digits again. Net consumer sales came in at €1.2 billion for the quarter, up 5.6% YoY. Third-party sales represented 59% of total sales and the platform now has 51,000 platform partners.

Ahold also remains committed to returning cash to shareholders. As mentioned before, the company launched a new share buyback program of €1 billion, which will start at the beginning of 2023. Ahold also wants to keep its dividend payout ratio between 40% -50% and grow the dividend according to revenue and sales growth. This is a strong capital return outlook and increases the attractiveness for shareholders.

Balance sheet and valuation

Ahold maintains a healthy balance sheet. It currently holds a total cash position of €3.9 billion, which is higher than the €3 billion in cash at the start of the year. Debt did also increase from €17.8 at the beginning of the year to €19 billion at the end of the latest quarter. I always prefer a company with a positive net debt position, but this is not a requirement for a company such as Ahold. Ahold has very strong cash flows and is able to manage the debt on the balance sheet, so I am not worried at all.

Ahold is currently valued at a forward P/E of 11.48, which means that despite the increase in share price, the P/E is still the same as a month ago. Ahold remains to be relatively cheap and receives a B+ for valuation from Seeking Alpha Quant. On a P/E basis, Ahold is undervalued by 32% compared to the sector average. From a valuation standpoint, Ahold is a clear buy.

Ahold currently pays a 3.18% forward dividend yield. Yield is more than 30% higher than the sector average while maintaining a 42% payout ratio. The payout ratio is within the goal of 40%- 50% and leaves enough room for dividend increases. The company seems to be well-positioned for dividend increases in the future, supported by a low payout ratio and strong company growth. Ahold has been paying a dividend for 7 straight years but did lower it during the covid-19 pandemic.

Risks

In my previous article on Ahold Delhaize I said the following regarding possible threats:

Company-specific, there are not many threats. Company management is dealing well with current macroeconomic headwinds as can be seen from H1 numbers. But there is a big chance of a recession by year’s end or the start of 2023, and then even Ahold Delhaize may start struggling. This will be mainly because of less consumer spending. Ahold Delhaize is in a relatively strong industry for economic downturns, but there is a threat of people looking for cheaper alternatives. For example, in The Netherlands Albert Heijn has a great market share, as mentioned before. But it is not the cheapest of supermarkets in The Netherlands. So, if consumers start saving money, they might go to cheaper options. All in all, I think the company will keep posting strong numbers even in the case of a recession, although growth may not be as high as now expected.

Another threat is the extremely high inflation all over the world, but most extreme in Europe. Ahold Delhaize does have some pricing power, which they used very well during H1. But for a company with very thin margins like Ahold Delhaize, higher energy bills and higher wages in combination with higher production and transport pricing, might put some pressure on its margins. I do not expect Ahold Delhaize to start posting negative margins any time soon, but it needs to be something management is looking out for.

I do still think these risks are relevant. I will note that inflationary problems have not yet had an impact on Ahold’s financials, and this is impressive. I was also scared that consumers might start looking for cheaper alternatives, but according to Ahold they even increased market share for most businesses. Of course, these risks remain and problems regarding these might still occur at a later stage. Inflation does not seem to be easing, maybe slowing down, and a recession seems more and more likely. I still expect Ahold to feel the impact of a recession, but maybe not as much as I previously expected.

Conclusion

Ahold remains one of my favorite companies and one of the best recessionary and inflationary picks as proven by their financial results. Ahold continues to grow its top and bottom line and increased the FY22 outlook once again. Ahold is very well positioned to make use of a difficult economy to win extra market share and strengthen its position. Ahold remains a buy for the long-term, but as their market share is increasing and strong growth remains (supported by a stronger dollar), I upgrade Ahold to a strong buy as I think the company is an excellent pick to put your money in a relatively safe place while investing in a strong long-term opportunity. The strong dividend yield is another benefit of owning Ahold Delhaize. Buy on current weakness and reap the benefits when the market recovers.

I rate Ahold Delhaize a strong buy after reporting their 3Q22 results.

Be the first to comment