Jarretera/iStock Editorial via Getty Images

Dear readers,

It shouldn’t come as a big surprise to most that I’m a heavy investor in groceries. Over 15% of my portfolio is exposed to various domestic and international players in the fields of supermarkets, hypermarkets, food or food-related sectors.

Ahold Delhaize (OTCQX:ADRNY) is a large exposure here, with several percentages.

I’ve written about the company before, and in this article I will update the company’s thesis for the recent market movements – my first update on ADRNY in over 3 months.

Let’s get going.

Updating on Ahold Delhaize

I have been bumping my targets on Ahold Delhaize a few times this year. The reason for this becomes obvious when you look at what the company does, despite how the investment has been performing overall. Since my last article, the decline has been close to that of the S&P 500, which is a poor performance overall.

ADRNY Article (Seeking Alpha)

Am I worried about such a development? No, not in the least. My grocery and food investments include giants like Nestlé (OTCPK:NSRGY), Axfood (OTCPK:AXFOF), Unilever (UL), Diageo (DEO), Kesko (OTCPK:KKOYF), Europris (OTC:ERPSY), Kroger (KR) and Carrefour (OTCPK:CRRFY). I’ve staked out significant positions in virtually every major publicly listed business in Europe, and even some smaller ones like Europris ASA which most of you probably have never heard of.

Consumer staples have a very specific purpose in my portfolio, and perhaps in yours. Their purpose is never to make you rich or to provide those 100-200% RoRs in 3-4 years. Their purpose is safety and for the long term, keeping pace with overall inflation.

They can do this, and allow you to sleep well at night because Grocery companies such as Ahold Delhaize do not really ever (or very rarely) go bankrupt. And while Ahold won’t give you 200%, it may well get up to 80-90% RoR given how low things have dropped.

My targets for this company have always been pretty clear – and the business usually performs without any sort of major surprises. This business is one of the best in the entire world in terms of preparation for managing cost impacts and inflation. Savings have already been realized, and the company’s CEO already earmarked over €800M for 2022 alone.

While 2022 guidance early on was seen as negative or disappointing, this is now shown in a different light as we’re 9 months into this year, and it’s starting to look very realistic.

The recent set of results from Ahold confirms what the company saw for the year. The latest set of results is the 2Q22/1H22 results, and these change the thesis in the following way.

Savings are confirmed. The announced saving program is already absorbing cost increases and introducing more budget product options while expanding the company’s own higher-quality store brand options combined with loyalty programs. This has helped keep costs low while keeping options wide.

It also contributed to a 6.1% YoY sales increase, coming in at €21.4B for the group at constant FX. Driven by actual FX, net sales grew by 15%.

Those are impressive numbers.

On that revenue, the company has an operating margin of around 4.1%, which is mostly in line with where grocers expect to be. The business has the trend that its margins are relatively low, with some US companies as low as 2% in terms of margins.

Ahold has also adjusted its targets for 2022E, now expecting single-digit EPS growth versus a decline previously expected. Ahold now expects upwards of €2B in FCF for the full year.

You may also recall that the company owns Bol.com and sought to IPO this holding. Naturally and expertly, the company has postponed this action given current market conditions. It’s my view that no company, unless forced, should be IPO’ing or seeking to raise equity in these times. These are times to hunker down and survive – so that is what we are trying to do here.

The company’s dividend is remaining stable as a rock – as with everything with this company, except the current share price development. When investing in Ahold Delhaize though, I’m never worried about my capital. Sure, the share price might drop and I might be in the negative for some time – but my long term is protected by one of the best grocers on the planet. Not exactly high-growth, nor high-yield – but high-safety.

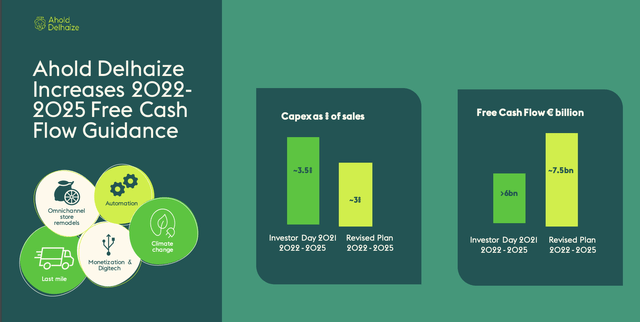

The company now expects to be able to significantly lower CapEx while at the same time increase free cash flow. If this ends up even close to true, my money would be on a massive appreciation once those expected results flow through.

As a reminder from me also, management has a track record of under-promising and over-achieving in terms of financial performance.

This is a company that you should not be betting against, and my PT bump very much reflects this upside. With the drop we’ve been seeing, it shouldn’t be a surprise to you that I’ve been adding more for the past few days.

The final thing I want to say in this update is the continued positive expectations for this sort of grocer. It can drop, it can even be volatile for some reason. But its earnings aren’t really going anywhere. The company is “too big”, and we’re talking about non-optional purchases.

Let me show you the current valuation the company works with.

Ahold Delhaize Valuation

Ahold’s valuation is naturally better than it was when I wrote about the company last. Why?

Because expectations are up, while share price is down.

Not exactly a complex equation.

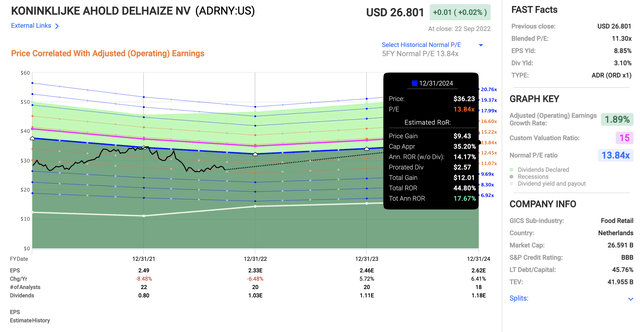

What we see in ADRNY is that 2022 is expected to bring in only single-digit earnings decline – now close to 6% – which is then followed by single-digit growth. To my mind, at this multiple, every downside to the company is already accounted for.

Ahold is a worldwide grocer with a BBB trading at a P/E multiple of close to 11x. That’s insane, given that domestic peers trade closer to 20x, even with the market in its current state. Even calculating Ahold at only a 5-year P/E average of around 14x, the upside for 2024E is now close to 45%, assuming a 13.84x P/E and a share price just above $36.

Ahold Delhaize Upside (F.A.S.T Graphs)

And this upside is one I consider to be quite likely. Analysts rarely miss here – less than 20% on a 2-year basis with a 20% of error, and analysts following the company are equally positive on this business’s upside. 20 analysts following the company give the business an average upside of 15% here, with 12 analysts at either a “BUY” or “outperform”. Some are at a “HOLD”, wishing to see how the company’s cost savings initiatives truly measure up in one of the most difficult cost environments in decades.

Me, I’m willing to be slightly more positive on this company, owing to Ahold’s excellent track record and safety. The company is one of several core grocery investments in my main portfolio.

I previously held a €35/share price for the native share for AD. I’m not shifting this PT an inch. The BOL IPO postponement is a positive for me, but I won’t raise my share price because of it. If the company had gone ahead and IPO’ed in this environment, I would have impaired my NAV estimates, but for now I’m keeping them.

I see very few, if any, company-specific risks or downsides that are worth truly discounting the company for. If anything, the company is already addressing most of these risks. For peers, the company moves with comps such as Casino (OTCPK:CGUIF), Tesco (OTCQX:TSCDF) (OTCQX:TSCDY), Jeronimo Martins (OTCPK:JRONF) (OTCPK:JRONY), Sainsbury (OTCQX:JSNSF) (OTCQX:JSAIY), and others. I continue to consider AD significantly superior to all of these – and that is why I invest so much in this company, while staying relatively nimble and light in all of the others, with no stocks at all in Sainsbury and Tesco.

I’m at a “BUY” here, and my PT remains in this updated thesis.

Thesis

My thesis for Ahold Delhaize is the following:

- The company is one of the more appealing EU/US grocery retailers that is trading at what I consider to be a significant discount to conservative multiples. This discount has increased since my last article.

- I’m keeping my PT and sticking to my “BUY”. Despite inflation and SCM issues, I believe the company is one of the best in the entire market to stick to during these troubles, and I believe 2Q22 to be the proof of just how well the company is managing.

- My PT is €35, and I’m at a “BUY” here. I recently bought more AD.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment