Oat_Phawat

Part I – Introduction

Agnico Eagle (NYSE:AEM) is one of the preferred long-term gold miners I have covered quarterly on Seeking Alpha since 2014. The company reported its third-quarter 2022 results on October 26, 2022.

Note: This article is an update of my article published on September 3, 2022.

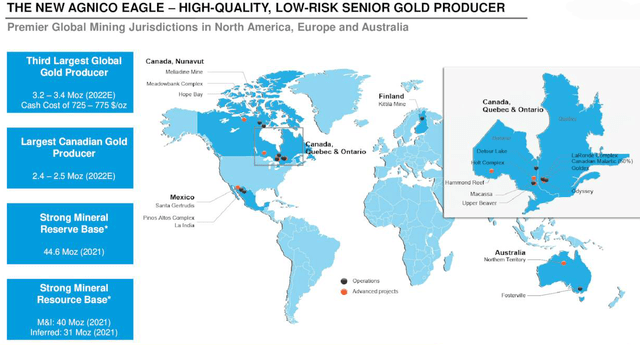

AEM Map Presentation (AEM Presentation)

1 – 3Q22 results snapshot

Note: Agnico Eagle became a new company after February 8, 2022, when the AEM and Kirkland Lake Gold announced the completion of the merger of equals transaction.

The third quarter of 2022 is the second full production quarter post-merger, giving a more meaningful look at the fundamentals. The new AEM is now a more significant entity with larger gold production after adding the three producing mines from Kirkland Lake Gold (Fosterville, Macassa, and Detour).

However, the outstanding shares diluted increased in 3Q22 from 244.94 million in 3Q21 to 456.27 million. Agnico Eagle reported a net income of $79.64 million or $0.17 per diluted share in the third quarter of 2022, compared with $114.48 million or $0.47 per diluted share reported last year (before restatement). The adjusted net income per share was $0.52 in the third quarter of 2022.

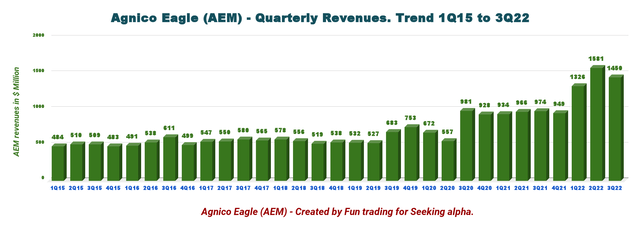

The company generated revenues of $1,449.70 million this quarter, below the $1,581.06 million generated in 2Q22.

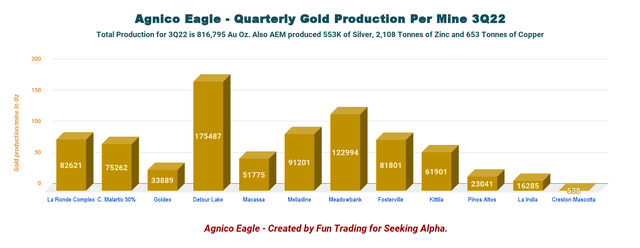

Production in the third quarter of 2022 was down sequentially to 816,795 Au ounces, 553K Ag ounces, 2,108 T of Zinc, and 653 T of Copper. AEM sold 830,246 Au Oz, 553k Ag Oz, 2,099 T of Zinc, and 653 T of Copper in 3Q22.

2 – Stock performance

Agnico Eagle, Newmont (NEM), and Barrick Gold (GOLD) continue to be my preferred long gold miners.

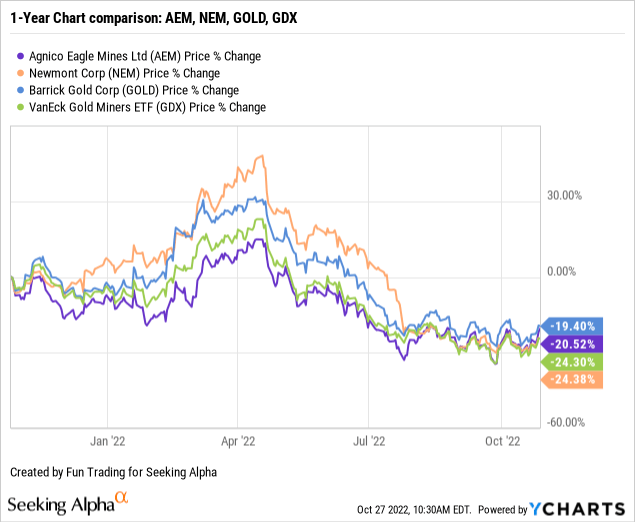

As shown below, AEM is down 21% on a one-year basis and has slightly underperformed VanEck Gold miners ETF (GDX). The effect of the recent merger with Kirkland Lake Gold on February 8, 2022, has been neutral, as I had expected. I recommend reading my article about the merger by clicking here.

Note: I have read so many articles praising the merger and the tremendous synergies that I still wonder where the beef is. I miss my KL shares.

The chart below shows a significant selloff since May due to the Fed’s action against rampant inflation, which may continue if the FED decides to hike the interest rate by another 75-point next week.

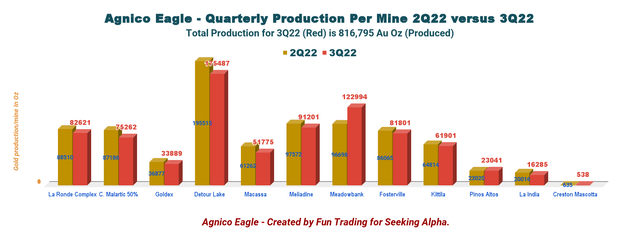

A quick look at Agnico Eagle’s production in 3Q22 shows a general decline sequentially with an increase in AISC.

Agnico Eagle presently produces gold from 12 mines with details below:

AEM Production per mine 2Q22 versus 3Q22 (Fun Trading)

Detour Lake, Macassa, and Fosterville mines are included in the chart above and represent the second total quarter production, rendering the chart above much more meaningful.

The project pipeline is vital, especially with Detour Lake, Odyssey, and Hope Bay.

In the third quarter of 2022, underground development and the critical infrastructure projects for the production start-up at Odyssey South in March 2023 remained on schedule.

At Hope Bay, exploration drilling totaled 76,200 meters during the first nine months of 2022, and the company anticipates completing approximately 100,000 meters of drilling in 2022.

At Macassa, exploration in the third quarter of 2022 targeted multiple underground zones, including Main Break, South Mine Complex, Near Surface Amalgamated, and the adjacent AK deposit.

3 – Investment thesis

Agnico Eagle presents a solid financial profile for a savvy investor’s balanced portfolio. Nothing has changed at this level, even if the company has grown in size after the Kirkland Lake Gold acquisition.

The new company is generating a free cash flow estimated at $139.78 million in 3Q22 and pays a secure and attractive dividend with a yield of 3.57%.

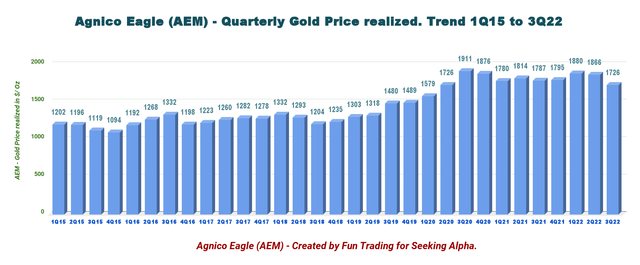

However, the crucial issue is the world economy and rampant inflation. The market seems too complacent at the moment, but I believe the FED will have to hike by 75-point again on November 2 and potentially another 75-point on December 14. The gold price will struggle until the end of 2022 and potentially the first quarter of 2023. Furthermore, the US dollar strength is here to stay for quite a while, adding more pressure on gold.

Thus, as I have said in my preceding articles, I recommend accumulating AEM on any weakness for the long term. I am not expecting a solid uptrend unless gold turns extremely bullish and can cross $1,800 per ounce again, and it is not likely for the next few months, but still possible, of course.

Thus, trading short-term LIFO at a minimum of 40% of your AEM position is crucial.

Agnico Eagle – Financials and Production in 2Q22 – The Raw Numbers

| Agnico Eagle | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Total Revenues in $ Million | 974.1 | 949.1 | 1,325.7 | 1,581.1 | 1,449.7 |

| Net Income in $ Million | 114.8 | 101.1 | 109.8 | 275.9 | 79.6 |

| EBITDA $ Million | 415.6 | 388.4 | 458.0 | 747.7 | 518.8* |

| EPS diluted in $/share | 0.47 | 0.41 | 0.28 | 0.60 | 0.17 |

| Cash from operations in $ Million | 291.0 | 261.7 | 507.4 | 633.3 | 575.4 |

| Capital Expenditure in $ Million | 244.6 | 236.9 | 293.2 | 408.6 | 435.7 |

| Free Cash Flow in $ Million | 46.4 | 24.8 | 214.3 | 224.7 | 139.8* |

| Total cash $ Billion (including equity securities) | 0.24 | 0.19 | 1.06 | 1.02 | 0.82** |

| Total debt in $ Billion | 1.57 | 1.57 | 1.57 | 1.44 | 1.34 |

| Dividends per quarter in $/ share | 0.35 | 0.40 | 0.40 | 0.40 | 0.40 |

| Shares outstanding diluted in millions | 244.9 | 245.5 | 385.6 | 456.8 | 456.3 |

Source: Company filing and Fun trading.

* Estimated by Fun Trading

** Cash and Cash equivalent are indicated in the Press release on page 78.

Part II – Gold Production Details

1 – Gold production

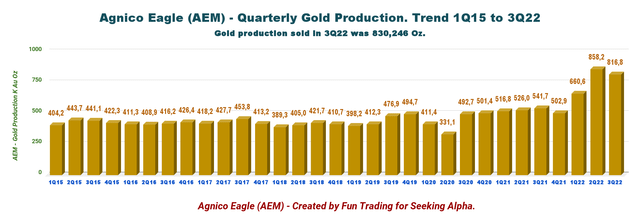

Agnico Eagle had gold production this quarter. Production was 816,795 Au Oz from 660,604 Au ounces the preceding quarter.

The Company produced 816.8K Ag ounces, 588K Ag Oz, 2,568 Zinc, and 778 Tonnes of Copper.

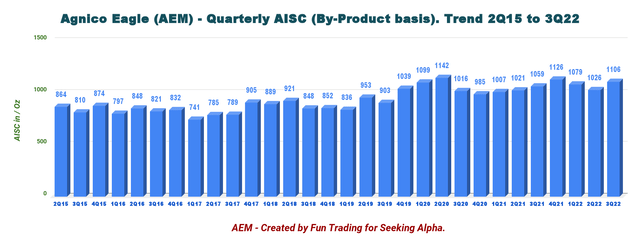

AEM Quarterly Gold production history (Fun Trading) The new AEM included three new producing mines (Detour, Fosterville, and Macassa). The 3Q22 is the second full quarter of production, combining Agnico Eagle and Kirkland Lake Gold. AEM Quarterly gold production per mine 3Q22 (Fun Trading) All-in sustainable costs, or AISC, were an average of $1,106 per ounce in 3Q22 compared to $1,059 in the prior-year period. Inflationary pressures did not help. The company said in the press release: In the third quarter of 2022, inflation on production costs was largely driven by higher input prices in key consumables (such as energy, cyanide and steel), which have experienced increases above the 5% to 7% general inflation rate forecast at the beginning of the year. Workforce availability and supply chain issues for equipment parts also remained challenging during the quarter. AEM Quarterly AISC History (Fun Trading)

2 – Guidance for 2022 unchanged

The company remains unchanged from the previous quarter, with payable gold production for 2022 in the 3.2-3.4 Moz range.

It also projects total cash costs per ounce of $725-$775 and AISC of $1,000-$1,050 per ounce for 2022.

The forecast for 2022 CapEx is set at roughly $1.4 billion. The 2022 depreciation and amortization expense guidance remain unchanged (between $1.37 to $1.47 billion for the full year 2022).

Part III – Balance Sheet Analysis

1 – Revenues of $1,449.7 million in 3Q22

Revenues were $1,449.7 million, up 48.8% compared to the same quarter a year ago (before revised) and down 8.3% quarter over quarter.

The company posted a $79.64 million net income, or $0.17 per diluted share, in the third quarter of 2022. Adjusted net income of $235.4 million or $0.52 per share for the third quarter of 2022.

AEM Quarterly Revenues history (Fun Trading) AEM Quarterly Gold Price history (Fun Trading)

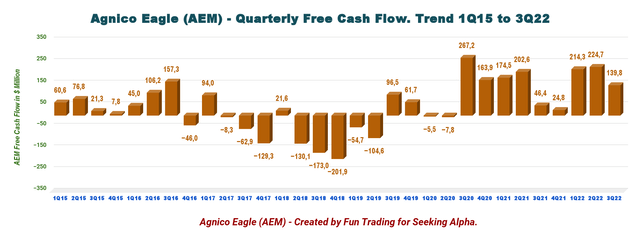

2 – Free cash flow was estimated at $139.78 million in 3Q22

The trailing 12-month free cash flow is estimated at $603.56 million (“TTM”), and the free cash flow for 3Q22 was estimated at $139.78 million.

AEM Quarterly Free Cash flow history (Fun Trading)

Free cash flow generation is expected to weaken in the next few quarters due to a weakening gold price. However, the company declared a quarterly dividend of $0.40 per share, or about a 3.6% yield.

The company said about the share buyback:

In the third quarter of 2022, the company repurchased 999,320 common shares for $42.6 million through its normal course issuer bid (“NCIB”). Under the NCIB, the company is authorized to purchase up to $500 million of its common shares (up to a maximum of 5% of its issued and outstanding common shares) and year to date approximately $65 million has been purchased.

It will help reduce the diluted outstanding shares, which went up from 244.94 million in 3Q21 to 456.27 million in 3Q22, an increase of 86.06% (please see table above).

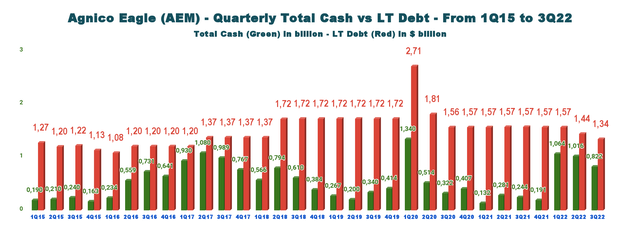

3 – Net debt was $0.52 billion in 2Q22

Agnico Eagle has solid financials with a low net debt of $520 million, up sequentially from $425 million.

Agnico Eagle’s debt profile is what we want to see for a long-term investment.

AEM Quarterly Cash versus Debt history (Fun Trading)

Agnico Eagle had total cash of $821.76 million in 3Q22 compared with $191.07 million as of December 31, 2021. Long-term debt was around $1,341.6 million, compared with $1,441.2 million in 2Q22.

On July 24, 2022, the company repaid $100 million on the 2012 Series A 4.87% senior notes with available cash, reducing the company’s indebtedness and re-affirming its commitment to maintaining a strong investment grade balance sheet.

In the third quarter of 2022, 999,320 common shares were repurchased for $42.6 million.

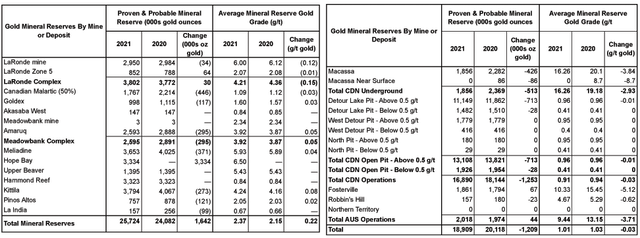

4 – 2021 Reserves (Proven and Probable) – Total AEM and KL are 44.7 Moz.

AEM Reserves 12/31/21 (AEM Presentation)

Part IV – Technical Analysis and Commentary

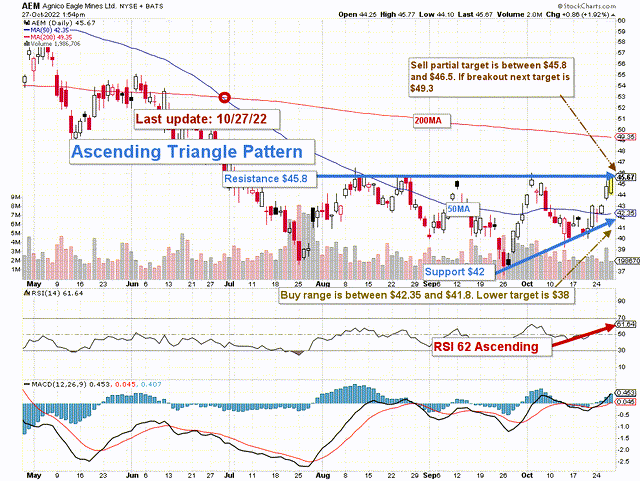

AEM TA Chart short-term (Fun Trading StockCharts)

Note: The chart has been adjusted for dividends.

AEM forms an ascending channel pattern with resistance at $45.8 and support at $42.

An ascending triangle is generally considered a continuation pattern, meaning that it is a bearish formation in this case because the general trend is negative and will probably resume later by breaking down. The RSI is now above 62 and is approaching an overbought situation.

However, the FED’s decision on November 2 may turn the pattern bullish; in this case, we call it a reversal pattern.

The trading strategy I recommend is to sell about 40% between $45.8 and $46.5 with a potential upper resistance at $49.5. On the other side, I recommend buying between $41.8 and $42.35, with possible lower support at $38.

AEM has dropped precipitously starting in April and is now trading in a narrow channel. However, the Fed has turned more hawkish since April with a couple of 75-point hikes and a definite hike in November again.

I continue to expect the miners to experience frequent wild swings for the next several months. Thus, it is crucial to allocate a sizeable portion of your investment in AEM to trade short-term LIFO and take advantage of the volatility. About 40% is reasonable.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote of support. Thanks.

Be the first to comment