Claude Laprise

It’s been a much slower year for M&A after a hectic 18 months, from Q1 2020 to Q4 2021. However, the sharp pullback in the sector that has suppressed valuations for some companies has led to the extinguishment of the Gold Fields (GFI)/Yamana (AUY) proposed merger, with a superior offer made by Agnico Eagle (NYSE:AEM) and Pan American Silver (PAAS) to pick apart Yamana Gold and acquire the pieces they want in a deal valued at ~$5.0 billion, which is more reflective of Yamana’s true value. Regarding Agnico Eagle’s side of the proposed offer, the price is fair, and the deal makes a lot of sense. In fact, this is the fourth consecutive deal that follows the company’s stated strategy to be a regional miner.

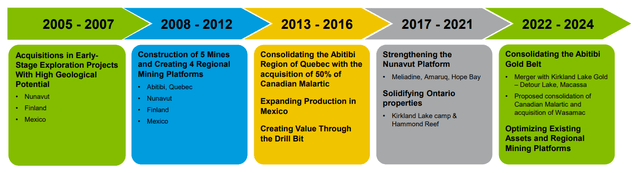

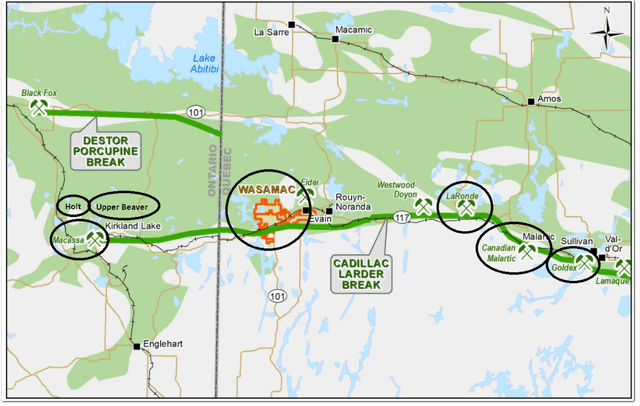

For those unfamiliar, this M&A spree started by adding an 80-kilometer greenstone belt, high-grade reserves, plus infrastructure in Nunavut for a dirt-cheap price (TMAC Resources). This was followed by the merger of equals with KL Gold to allow for corporate synergies, plus operational synergies in Ontario/Quebec and consolidate the Kirkland Lake Mining Camp. That deal was followed by partnering with Teck Resources (TECK) to potentially bolster its Mexican footprint (advanced-stage San Nicolás Project in a premier mining state, Zacatecas). Finally, the most recent proposed acquisition adds production to its largest regional mining center. It adds a high-grade and high-margin operation in the one area of the Cadillac-Larger Break where it doesn’t have an operation, potentially allowing for future synergies.

The continued delivery against its stated goal without deviating is one reason Agnico Eagle remains one of the safest bets in the sector vs. some other producers that have overpaid for risky acquisitions in past and current cycles, especially when considering the risk inherent in those deals. However, I think Agnico should be praised for its two most recent acquisitions especially given that they have been very creative with fair prices paid for these offers and partnerships to ensure that Agnico is not taking on unnecessary risk and in the case of the Yamana offer, only taking what it wants out of the deal which is the other 50% of Canadian Malartic, Wasamac, with non-core exploration properties in Canada thrown in as well (Monument Bay, Domain and Madsen in Manitoba and Red Lake, respectively). Let’s take a closer look below:

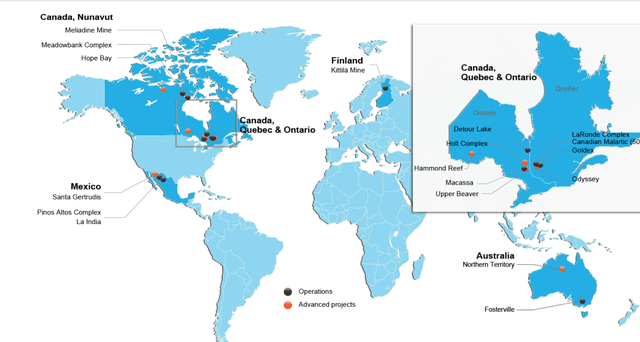

Agnico Eagle – Regional Mining Strategy & Operations/Projects (Company Presentation)

Recent Deal & History

Under the current Executive Chair and previous CEO, Sean Boyd, Agnico Eagle has done an incredible job building this company into a mining giant, and it’s done so methodically with a clear plan to add value to assets through exploration and focus on safe jurisdictions where it can operate for decades without disruption. This is a clear differentiator vs. some names like Kinross (KGC) that have gone into riskier jurisdictions and paid the price for deals where the price paid has been enormous and made it difficult to add value given that the upside was already paid for in the acquisition price. Three clear examples are the acquisition of Aurelian (Ecuador), the acquisition of Red Back (Mauritania, Ghana), and the acquisition of N-Mining (Russia).

Agnico Eagle History & Future (Company Presentation)

Since then, Ammar Al-Joundi has taken over as CEO of Agnico Eagle, who has an engineering background (Professional Engineer – Mechanical Engineering) and was the previous CFO and EVP for Barrick (GOLD). He has done a phenomenal job in a hectic first year as CEO in a nearly unprecedented difficult backdrop. Most importantly, we have not seen any deviation from what has earned Agnico its premium multiple. This is sticking to the safest jurisdictions, being laser-focused on the highest-quality assets that can weather the down cycles in the gold price, and putting per share growth over everything, which leads to considerable due diligence and extreme discipline when it comes to the prices paid to bring any new assets into their portfolio/pipeline. As stated eloquently by Agnico’s new CEO below:

“Our objective is to build a high-quality, low-risk business that generates superior returns for our shareholders and does so in a way that is environmentally and socially responsible, that contributes to the communities in which we work, and is a great place to work. One thing that separates Agnico is that a lot of our growth has been from existing assets, leveraging off existing infrastructure, and you will never get a better return on capital than leveraging off existing infrastructure. And you never get a better risk-adjusted return on capital.”

– Agnico Eagle Mines CEO, Gold Forum Americas

The last point in this quote is critical because while there are multiple undeveloped world-class deposits globally, there are always considerable risks along the path to putting an asset into production and praying that the production profile looks as planned. The early risks include permitting, local opposition, and cost overruns. The latter risks include grade underperformance (excessive dilution, poor grade reconciliation), geotechnical issues, metallurgical issues, geological potential (the ability to replace reserves to improve returns above the existing mine plan), commodity price risk, environmental risk, and geopolitical risk.

In the case of Canadian Malartic, Agnico Eagle knows this mine inside and out, given that it has operated it with Yamana Gold for nearly eight years, making this about as low-risk of a transaction as possible. In fact, Agnico’s previous CEO and current Executive Chair Sean Boyd stated when discussing the initial acquisition of 50% of Canadian Malartic in 2014 that the transaction comes without permitting, construction capital, or start-up risk, explaining why it was so interested in the deal despite a focus on pre-production assets historically. So, if you are going to spend upwards of $2.0 billion on a deal, it makes sense to know exactly what you’re getting, and this is undoubtedly the case here.

Canadian Malartic Mine (Company Presentation)

Moving over to Wasamac, this deal may carry some obvious risks that Canadian Malartic does not, given that it’s not yet in production or fully permitted. Still, Wasamac fits Agnico Eagle’s strategy of growth within regions it’s already operating in, with it lying right along the Cadillac-Larder Break in between a potential future mining complex to the west (Macassa/Upper Canada/Upper Beaver/Holt) and multiple mines to the east (Canadian Malartic, LaRonde, Goldex, Akasaba West). The result (assuming Wasamac is built to handle a throughput of 7,500 tonnes per day) would be that Agnico would have over 87,000 tonnes per day (31+ million tonnes per annum of processing capacity) along this belt.

This figure excludes the much smaller Camflo Mill, which has an available processing capacity of 1,600 tonnes per day.

Wasamac Technical Report, Location of Agnico’s Mines/Projects (Company Presentation)

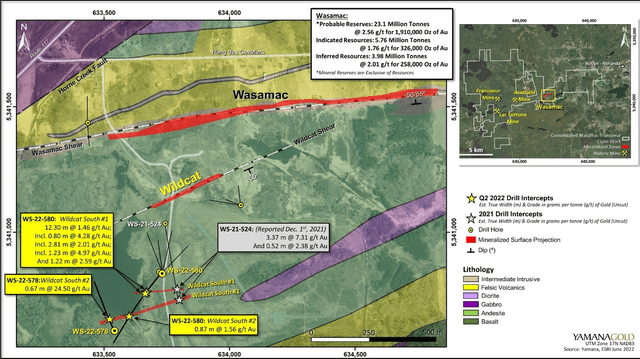

Assuming Wasamac is green-lighted, this could allow for more favorable contracts due to increased buying power for supplies and significantly decrease any risk from a labor standpoint, with Wasamac located roughly an hour from the Kirkland Lake Camp and less than an hour to LaRonde, two of Agnico’s major operations. In addition, Agnico knows the geology in these two provinces very well, given that it’s operated for years (decades in some cases) in Quebec and has strong relationships with local communities. Finally, Wasamac looks to have considerable upside from an exploration standpoint with two new parallel structures in Wildcat & Wildcat South plus regional potential. Hence, this asset meets its criteria of beginning production in a region and staying for decades ideally.

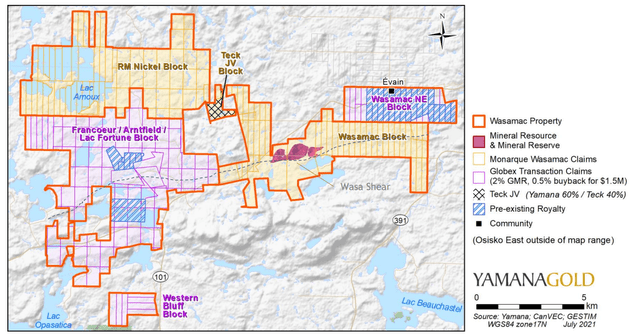

Wasamac – Regional Potential (Yamana Presentation) Wasamac – Exploration Upside (Yamana Presentation)

The Wasamac Project is expected to be a future bulk underground mining operation with a relatively small footprint and minimal GHG emissions, given that ore will be transported from production levels to a central hub, crushed and loaded onto an underground conveyor, and then transported under Route 117 to surface. Initially, it was believed that the production profile would average ~170,000 ounces per year at industry-leading all-in sustaining costs (AISC) of sub $900/oz based on average throughput of 7,000 tonnes per day and a plant/infrastructure designed to handle 7,500 tonnes per day.

However, Yamana now believes that Wasamac could produce an average of 200,000 ounces per annum (9,000 tonnes per day) and up to 250,000 in early years, making this large enough to be a solid fit for Agnico, which would likely require at least 180,000 ounces per annum to make a project worthwhile to pursue given its growing size. This is supported by significant reserve and resource growth in the most recent update, with an updated reserve of ~2.17 million ounces (2.51 grams per tonne of gold) and an updated resource of ~800,000 ounces of gold at slightly lower grades in the inferred and indicated categories combined.

Wasamac Recent Drilling (Yamana Presentation)

Having said all that, the driving force behind this acquisition was consolidating Canadian Malartic. So, regardless of how things pan out with Wasamac, Agnico Eagle has added a second Tier-1 operation in a top mining jurisdiction. However, it’s worth noting that its two Tier-1 operations (Detour and Canadian Malartic) have excess capacity and could ultimately become 1.0 million-ounce per annum operations in a best-case scenario for a combined production rate of 2.0 million ounces per annum from two assets. This would rival what Barrick’s future looks like in Nevada on an attributable basis, which is two operations (Cortez and Carlin) with annual production to Barrick of 700,000 to 950,000 ounces per annum.

The Canadian Malartic Opportunity

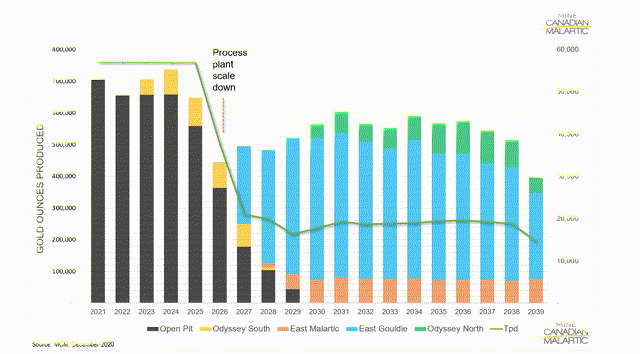

Outside of the obvious synergies of moving a mine from two operators to one, such as what Northern Star (OTCPK:NESRF) did at KCGM in Western Australia, the opportunity at Canadian Malartic is significant. The opportunity is that this asset is transitioning from an open-pit mine with a 55,000+ tonne per day processing rate (capacity: ~60,000 tonnes per day) to an underground mine with a planned processing rate of 19,000 tonnes per day. The result is an excess of 40,000 tonnes per day of capacity will be available at the mill as the plant scales down to the future processing rate of ~20,000 tonnes per day to accommodate the lower underground mining rates relative to the open pit.

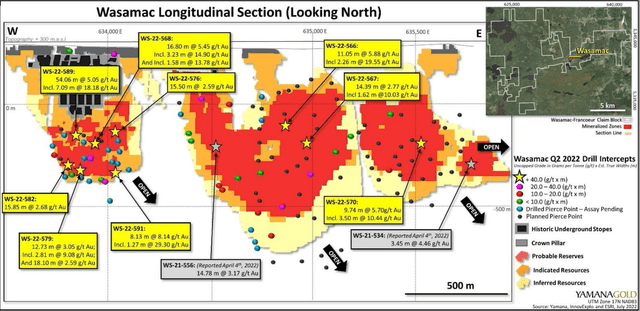

Canadian Malartic – 2020 Mine Plan (Company Technical Report)

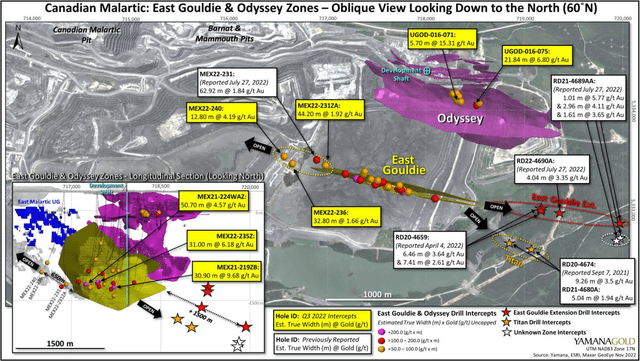

If this asset were not enjoying exploration success, this wouldn’t be much of an opportunity, given that there wouldn’t be the tonnes to support topping up the massive mill. However, the Canadian Malartic Partnership (Yamana & Agnico) has enjoyed considerable exploration success, extending East Gouldie to the east by more than one kilometer, seeing strong results from internal zones at Odyssey, and seeing extensions to the west of East Gouldie with solid grades over thick intercepts. The company is also seeing exploration success on surrounding properties that could provide future nearby spokes, including East Amphi and Camflo. In fact, an initial evaluation of the Camflo property has identified porphyry and diorite-hosted gold mineralization that could be mined from an open pit.

Canadian Malartic – Exploration Success (Yamana Presentation) Canadian Malartic & Camflo Location (Google Earth)

Given the continued resource growth, there appears to be the potential to top up the mill, meaning that the assumed production profile (100% basis) at Canadian Malartic of ~550,000 ounces per year from 2029-2039 is likely to be much higher. Hence, the “downgrade” in the production profile (550,000 ounces vs. ~750,000 ounces) may not be a downgrade since this production profile utilizes just one-third of the capacity. While conceptual and very early days, 10,000 tonnes per day of material at 0.80 grams per tonne added to the mill from open pits could result in incremental production of 80,000+ ounces per annum. Meanwhile, a second shaft hoisting 12,500 tonnes per day at a conservative 2.40 grams per tonne of gold could add an incremental 325,000 ounces per annum.

If we add these two opportunities together, a second shaft and the mining of open pits could push the production profile from ~550,000 ounces to more than 950,000 ounces post-2030. There is no better-suited company to exploit this “top-up” opportunity than a company with multiple operations and projects in Ontario/Quebec, considerable technical experience, and the world’s most aggressive driller in the gold sector on an exploration budget vs. production profile basis. So, while Agnico is paying a premium price for this asset, I think this premium is justified given that I am cautiously optimistic this could be a 900,000-ounce per annum operation post-2030.

The New Agnico Eagle

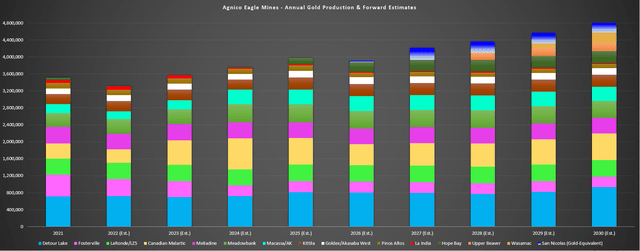

Based on the base case estimated production profile of ~580,000 ounces at Canadian Malartic from 2023-2030, Agnico Eagle would add approximately 290,000 ounces of gold production per annum by adding the other 50% of Canadian Malartic, pushing annual production to more than 3.5 million ounces per annum in 2023, and upwards of 3.65 million ounces in 2024. This increase in production in 2024 would be related to the benefit of a full year of production from Canadian Malartic on a 100% basis, the additional contribution from the Kirkland Lake Camp (#4 Shaft & Amalgamated Kirkland), the progressive ramp-up of production at Detour Lake, and increased throughput at Meliadine, offset by lower grades at Fosterville.

Agnico Eagle – Current Production & Conceptual Forward Estimates (Company Filings, Author’s Chart)

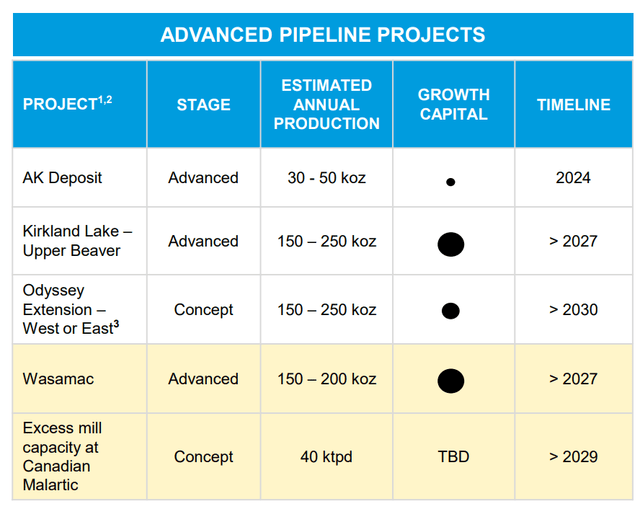

Looking ahead to FY2026, when Hope Bay is likely to be restarted and ramping up and Detour Lake is likely to operate at ~800,000 ounces per annum, we could see production increase further to ~3.90+ million ounces per annum before increasing further to ~4.2+ million gold-equivalent ounces per annum assuming a 2027 start for its shared San Nicolas Project in Mexico. Finally, looking out to 2028, there are multiple assets in the pipeline, and it’s unclear which will take priority yet. Still, assuming one of its two projects is put into production (Upper Beaver or Wasamac), we would see production increase further to 4.3+ million ounces per annum, with Agnico making progress to close some of the gaps between itself and the #2 and #1 producers from a scale standpoint.

Agnico Eagle – Advanced Pipeline Projects (Company Presentation)

The incredible part about this pipeline, though, is that even at a 4.2 million-ounce production rate, Agnico would still have a massive pipeline with either Wasamac or Upper Beaver in the wings (depending on which is built first), the potential for a larger production rate at Hope Bay vs. the 275,000 ounces I have assumed, the potential to head underground and top up the Detour Mill, sinking a second shaft at Canadian Malartic, filling the mill with incremental material at Canadian Malartic, and lastly Santa Gertrudis. Given this incredible pipeline of high-margin projects in solid jurisdictions where it’s already present, I don’t see any need for future acquisitions, given that this portfolio could produce close to 5.0 million ounces per annum with these additional opportunities.

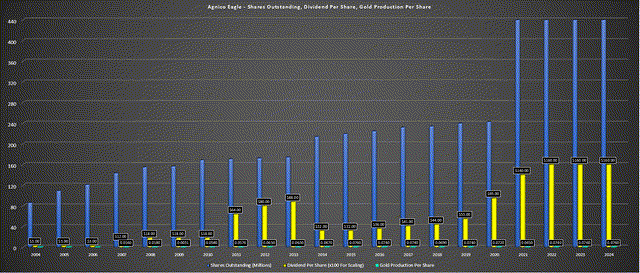

It’s also worth noting that Agnico Eagle’s CEO Ammar Al-Joundi stated in a recent presentation that they are regional miners looking at building multiple mines in a region over multiple decades and that they don’t care how big they are; they only care about what they accomplish on a per share basis. Based on this statement, one would conclude that growth will not be pursued simply for the sake of growth. The good news is that Agnico’s future growth is coming at more attractive margins, with low-cost incremental production from Macassa, lower-cost production from Detour Lake as it further benefits from economies of scale, lower-cost production if San Nicolas is green-lighted, and potentially lower-cost production at Wasamac and or Upper Beaver, with the latter benefiting from copper by-product credits.

Hence, I expect the pipeline to play a key role in Agnico’s future growth, given that these pipeline projects complement its current portfolio and provide per-share growth and the potential for further margin expansion. The last point to note is that none of these projects are mega projects, but most assume relatively modest growth capital. Therefore, Agnico can continue to opportunistically buy back shares, maintain a strong balance sheet, and grow its dividend per share while it pursues this growth, unlike some other miners that have tried to do too much at once and seen their share price descend into free-fall, like Equinox Gold (EQX).

To summarize, not only is Agnico Eagle set to significantly grow its gold production per share which already differentiates itself from its peers, but it’s also set to enjoy margin expansion if high-margin projects in its pipeline are green-lighted. Therefore, for investors looking for a superior way to play the gold price, given that Agnico has a long-term track record of growing per share metrics (which includes a 50x increase in its dividend over the past two decades), I see Agnico Eagle as the premier choice for investors with high liquidity, jurisdictional safety, discipline, and industry-leading margins (sub $950/oz all-in-sustaining costs post-2023).

Agnico Eagle – Shares Outstanding, Dividend Per Share, Gold Production Per Share (excluding Yamana Deal) (Company Filings, Author’s Chart)

Valuation

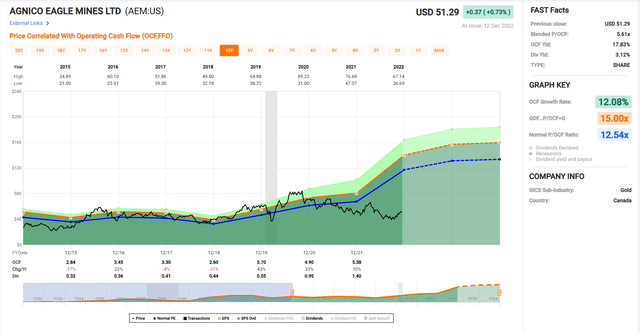

Based on an updated share count of ~490 million shares and a share price of US$52.00, Agnico Eagle trades at a market cap of $25.5 billion, making it one of the largest gold miners globally. The chart below shows that the stock has historically traded at ~12.5x cash flow (10-year average), with this multiple closer to 14.0 for its 15-year average. I believe that a cash flow multiple of 13.0x is a fair multiple, given the significant upgrades we’ve seen to Agnico’s portfolio and pipeline. Comparing this figure to FY2023 cash flow per share estimates of $5.25 translates to a fair value for the stock of $68.25. However, it’s important to note that these estimates assume the gold price averages less than $1,800/oz in FY2023. Plus, this valuation method places zero value on its organic growth and development pipeline, which isn’t captured in its FY2023 cash flow estimates.

The share count of 490 million shares assumes the Yamana deal goes through with Pan American and Agnico Eagle.

Agnico Eagle – Historical Cash Flow Multiple (FASTGraphs.com)

Even if we assign a very conservative $4.5 billion in value for the development pipeline (Santa Gertrudis, Upper Beaver, 50% San Nicolas, Wasamac, Hammond Reef, Hope Bay, exploration upside), this would add another $9.20 in fair value when divided by an updated share count of ~490 million shares. After adding this to its price target based on FY2023 cash flow estimates, I see a fair value for Agnico closer to $77.00 per share. If we measure from a current share price of $52.00, this points to a 48% upside from current levels or closer to 51% upside on a total return basis (dividend yield + potential share buybacks). Hence, even after Agnico’s outperformance vs. other senior producers, I still see the stock as undervalued and a Buy on dips.

Summary

Agnico Eagle continues to execute near flawlessly from an operational and an M&A standpoint, and it’s difficult to find any flaws here, which is so rare in a sector where unnecessary missteps or risky moves seem like a monthly occurrence. Given its world-class portfolio, Tier-1 jurisdictional profile, massive development pipeline, industry-leading margins, and a laser focus on per-share growth, I continue to see AEM as the premier name among gold producers. Therefore, I would view any sharp pullbacks in the stock as a buying opportunity.

Be the first to comment