It’s all there. Solve the equation to make money in mortgage REITs! francescoch/iStock via Getty Images

When we last covered AGNC Investment Corp. (NASDAQ:AGNC) we went over the key risks of an investment in this mortgage REIT.

True economic return for the first quarter will be dreadful as drop in tangible book value dwarfs income generated. While a bounce can certainly happen, it is unlikely that AGNC will repurchase recently liquidated assets. Some losses will be actual permanent losses. We strongly urge investors to assess if this is the outcome you are happy with.

Source: Book Value Drop In 2022 Equivalent Of 2.5 Years Of Dividends

The stock drop, while substantial, actually outperformed the S&P 500 (SPY) since that article was written. With the Q1-2022 results out and further changes in treasury yields and mortgage-backed securities, we look to see where AGNC stands relative to its intrinsic value.

Q1-2022

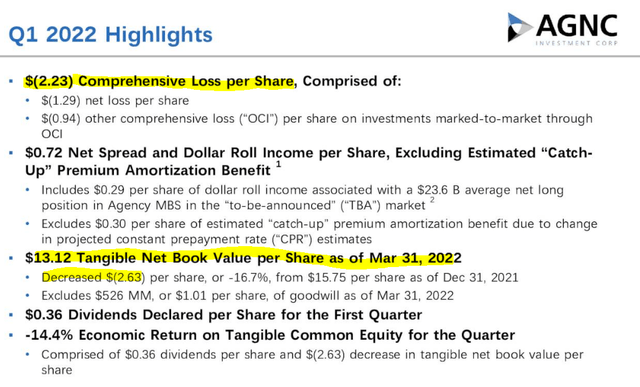

Q1-2022 was a quarter of max pain and AGNC lost $2.63 of tangible book value.

For those keeping score at home, that is about 20 months’ worth of dividends. As bad as the results were, they actually were better than market expectations and AGNC shares rallied on the announcement. As of April 30, 2022, tangible book value had dropped another 6% to about $12.33.

Yes. Bernie mentioned that in her prepared remarks, and I mentioned that spreads were about 10 basis points wider. And Bernie mentioned that as of last Friday, we estimated our book value down around 6%, which would be consistent with the spread widening event of about 10 basis points.

Source: AGNC Q1-2022 Transcript

Deleveraging During Declines

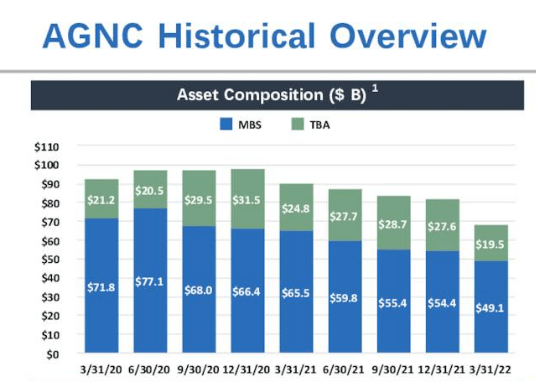

The importance of tangible book value was visible as AGNC reduced its portfolio size by over $13.4 billion during the quarter from $82.0 billion to $68.6 billion.

AGNC Q1-2022 Presentation

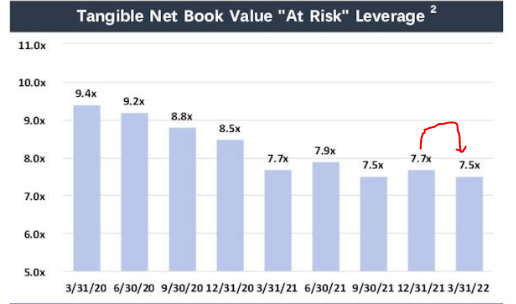

That is the largest single quarter drop and it is the prime reason that AGNC was able to maintain and actually lower its leverage ratios during the quarter.

AGNC Q1-2022 Presentation

With over $13 billion of assets dumped, you can rest assured that AGNC will make less interest than it was previously. Tangible book value recovery will also be less, should spreads normalize. Even if AGNC leverages up again on the way up, this would be a “buy high” and “sell low” situation that its leverage ratios force upon it.

Outlook

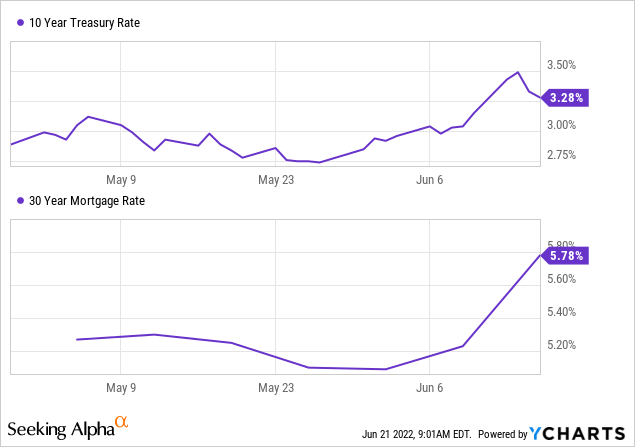

Mortgage-rate to treasury-rate spreads have widened further since the update in early May.

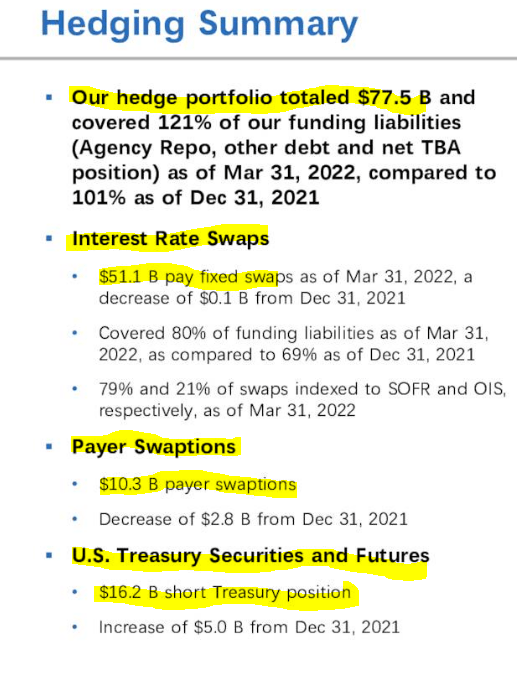

At first glance, AGNC appears “over-hedged”, with hedges covering more than 115% of assets.

AGNC Q1-2022 Presentation

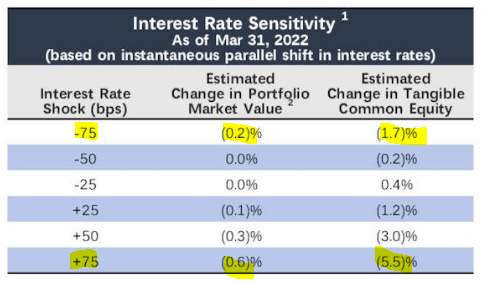

The overall hedge coverage unfortunately does not tell the whole story. AGNC’s hedges are primarily protecting its funding costs. The $51.1 billion fixes swaps are hedges designed to insulate it from increases in the Fed Fund rates. Only the $16.2 billion short positions on Treasuries are protecting the duration downside. In case of a big jump in interest rates, AGNC would lose another 5.5% in tangible book value.

AGNC Q1-2022 Presentation

Fascinatingly, the way it is positioned, it will actually lose tangible book value if rates have an across the board reversal. This is the opposite of what investors might expect, but that is how it is positioned. The key vulnerability remains on spreads of mortgage-backed securities to Treasuries.

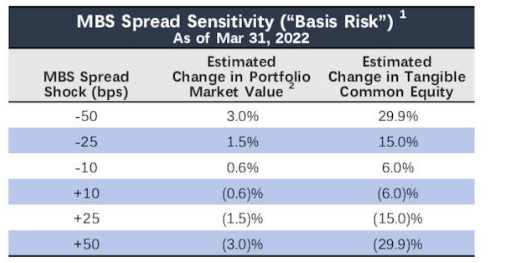

AGNC Q1-2022 Presentation

Here, AGNC has upside as well as downside to this asset class. But if buyers fail to show up for mortgage-backed securities as the Fed’s QT progresses, watch out below.

Verdict

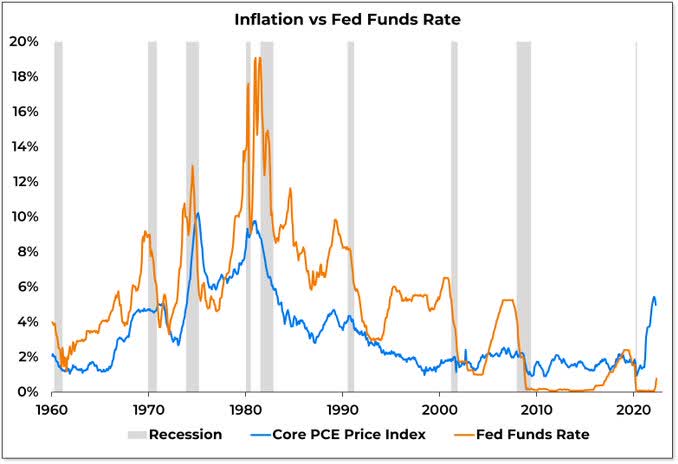

Historically, there have been zero instances of the Fed stopping till the Fed fund rates are over Core Inflation measures.

FRED

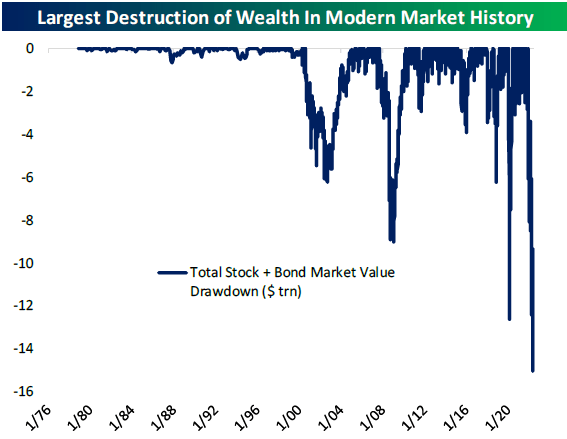

There have also been zero instances of the 10-Year Treasury rate peaking so early in a Fed Funds cycle. Perhaps this time is different, but we would not bet on it. Working in favor of bond bulls, is the collateral damage caused by this selloff.

Bespoke-Twitter

Asset bubble destruction will impact consumption within 1-2 quarters. Working against AGNC and mortgage REITs in general, is their enormous leverage. This is hard to manage during the best of times. Can they navigate this environment with 6-8X leverage? Our bet is that even the best will struggle and the worst will get wiped out. We view AGNC as one of the better ones. So we think it will make it, but we are still reluctant to trade the common shares from the long side. Investors best risk-adjusted returns in AGNC may come via the preferred share

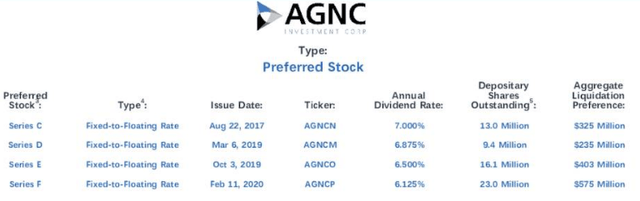

AGNC 7.00% Series C Fix/Float Cumulative Redeemable Preferred (AGNCN) has declined since we last wrote on AGNC and now has a stripped yield of over 8%. However, the more relevant number here is the reset rate as it starts floating in October 2022 at Libor +5.111%. Based on where the Fed Funds rate is headed, AGNCN may well yield over 9.25% by year end. We actually are putting a buy rating on this one.

AGNC 6.125% Dep Shares Series F Fix/Float Cumulative Redeemable Preferred (NASDAQ:AGNCP) has a float/call date for April 2025. Its stripped yield is about 7.3% and will float at LIBOR +4.697%. Both are good choices, though we are biased towards AGNCN. We are still not touching the common, despite the declines.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment