Kwarkot/iStock via Getty Images

Mortgage REIT valuations are under increasing pressure now that interest rates are expected to reset to the upside. The central bank is under pressure to rein down inflationary pressures, which reached a four-decade high in January. As the Fed focuses more on containing inflation, mortgage REITs such as AGNC Investment Corporation (AGNC) will see reduced net interest spreads and trade at lower book value multiples.

Prepare For More Downside As The Interest Rate Environment Evolves

Inflation is becoming a major issue, not only for consumers who have less purchasing power, but also for mortgage REITs, which rely on low-cost financing to finance the purchase of high-yielding mortgage assets. Inflation has recently been reported to have increased to 7.5% in January, putting the central bank in an awkward position.

Inflation is at its highest level in four decades, yet interest rates remain at zero, creating an intolerable position for both investors and consumers. To offset out-of-control inflation rates, the central bank will have to embark on an aggressive interest rate hike cycle this year, which would be damaging to the business model of mortgage REITs like AGNC.

AGNC uses low-cost loans to purchase higher-yielding mortgage securities. A net interest spread (NIS) is the difference between the trust’s funding costs and investment yield. AGNC’s net interest spread increased dramatically in 2020 as the central bank gave monetary assistance amid the COVID-19 outbreak.

The Federal Reserve’s pandemic relief program comprised monthly purchases of $120 billion in government and mortgage-backed securities. Monetary stimulus on one hand, and large government infrastructure spending plans on the other, have created a situation in which inflation rates are skyrocketing, compelling the central bank to act now that the playing field has shifted.

Because net interest spreads remain inflated due to ultra-low borrowing costs, higher interest rates pose significant margin risks to trusts such as AGNC. AGNC’s net interest spread climbed significantly in the second and third quarters of this year, and it stayed above 2.0% in the fourth quarter. Borrowing costs for AGNC’s asset purchases were near to zero in 2021 (including 4Q-21), making the trust a beneficiary of the Fed’s low-interest-rate policy. However, this will change in 2022, as the central bank is now forced to reverse previous policies and emphasize inflation control. Higher interest rates will undoubtedly result in decreased net interest spreads and profit margins for AGNC.

Net Interest Spread (AGNC Investment Corp)

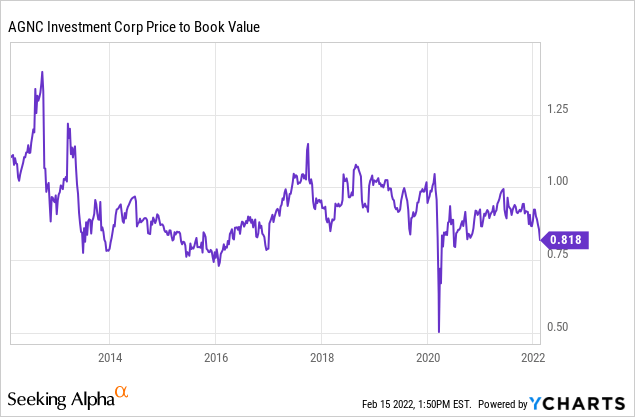

As a result of the Fed’s policy move, AGNC’s stock may trade at an even greater discount to book value, which is already the case in the market. Mortgage REITs are trading well below book value once more, reflecting increased inflation and rates. AGNC is trading at 0.82x book value, representing a 18% discount to book value. Higher inflation and interest rates may frighten mortgage REIT investors and cause capital outflows from the industry, potentially resulting in an even greater book value discount for AGNC in 2022.

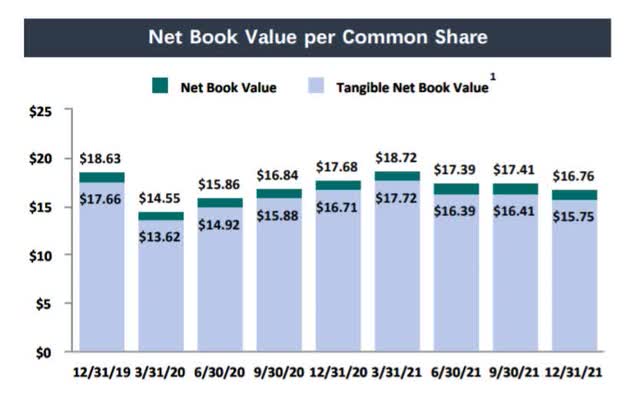

In 2021, the trust’s book value had two down-quarters. AGNC’s book value was $16.76 in 4Q-21, down 3.7% QoQ, the greatest loss since 2Q’21, when book value fell 7.1% QoQ.

Net Book Value Per Common Share (AGNC Investment Corp)

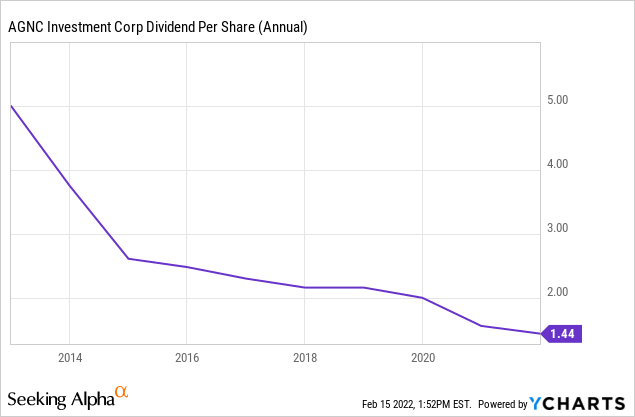

The Dividend Might Get Cut (Again)

AGNC is a high-yielding stock, although the trust’s payout is frequently reduced. As a result, the dividend payment should not be relied on. The company presently pays $0.12 per share monthly, for a 10.5% dividend.

Since the trust has frequently reduced its dividend payout in the past, I have little faith that AGNC would suddenly become a trustworthy dividend provider, especially with interest headwinds on the horizon. Higher interest rates offer margin concerns for the trust in 2022, so another pay-out drop should not be surprising.

My Conclusion

The situation is not favorable for AGNC and mortgage REITs in general, and I expect trusts to face reductions in book value, reduced net interest spreads, and bigger discounts to book value in 2022. Investors may applaud the central bank for this because its policies contributed to the crisis it now has to tackle.

In the past, the mortgage REIT industry benefited from the central bank’s policies, but there is no such thing as a free lunch in the stock market. With interest rates likely to climb significantly this year, investors should expect decreased profitability as well as lower stock prices for trusts such as AGNC.

Be the first to comment