The Good Brigade

Thesis

I have been very concerned about the house bubble that has formed during the pandemic and closely monitoring its bursting. And the recent Q2 earnings report (“ER”) from AGNC Investment (NASDAQ:AGNC) and Annaly Capital (NYSE:NLY) just provided more data to assess the degree of the bursting. And unfortunately, my view is that it can still get worse from here.

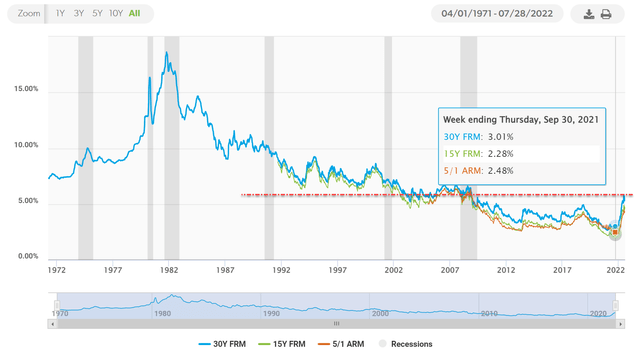

Let’s start from a 30,000 feet point of view, as shown in the chart below, taken from Freddie Mac. Mortgage rates currently stand at a level roughly on par with those seen from 2003 to 2007 before the 2008 great recession. Take 30-Yr FRM rates as an example, it rose sharply from 3.01% about 1 year ago to the current 5.3%.

Higher interest rates and higher borrowing rates hurt mREITs at least twice. First, they cause higher borrowing for the mREIT businesses and squeeze their profits. Second, demand for new mortgages also weakens because higher rates make houses less affordable for potential buyers. Both AGNC and NLY are reporting these impacts in their ER, with no surprise, as to be detailed in the next section. And I see both trends continuing in the near future.

Moreover, this time, I also see they are getting pressured from two other directions. Record inflation will also cause difficulties for EXISTING HOMEOWNERS to service their mortgages, creating the potential for delinquencies or even foreclosure. Consequently, mREIT leaders such as AGNC and NLY will suffer book value losses. And the housing bubble unexpectedly created by the COVID pandemic will exacerbate the problem.

Now, let’s move on to examine these impacts for NLY and AGNC specifically.

Affordability declined

The impacts of rising rates and mortgage rates have already been felt ahead of their Q2 ER. For example, the Mortgage Bankers Association (“MBA”) observed in early June that (the emphasis was added by me):

Weakness in both purchase and refinance applications pushed the market index down to its lowest level in 22 years. The 30-year fixed rate increased to 5.4% after three consecutive declines. While rates were still lower than they were four weeks ago, they remained high enough to still suppress refinance activity.

And the results and comments from both NLY and AGNC during their Q2 ER only added more data points to confirm the above observation. As NLY CEO David Finkelstein commented (abridged and emphases added by me):

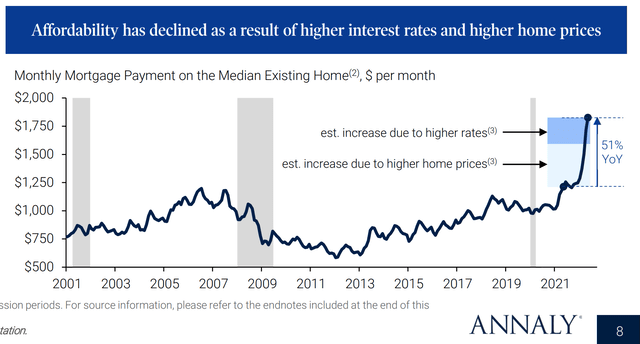

Home prices have continued to risk sharply, appreciating over 10% the first five months of the year, according to the Case-Shiller Index. Housing activity, however, has slowed recently as the highest mortgage rates since 2008 and 40% cumulative home price appreciation since the start of the pandemic has weighed on both consumer and builder sentiment. Affordability for prospective home owners has been significantly reduced with mortgage payments 50% higher year-over-year on a national average. This is curbing consumers’ ability to purchase homes and in turn is reducing demand for mortgages.

To wit, the monthly mortgage payment on the median existing was near the $1000 per month level before the pandemic as you can see from the following chart. It sharply rose to the current level of almost $1800 per month. In the past year alone, it rose about 51%.

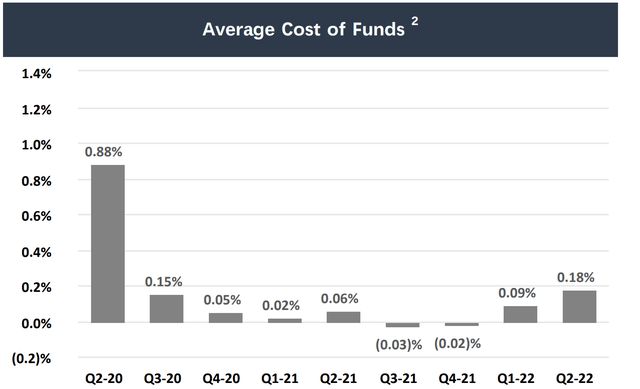

Rising cost of funds and negative economic return

Besides weakening the demand for new mortgages and refinances, the rising rates are also hurting their profit spreads. Take AGNC as an example, the following chart shows it average cost of funds in the past few quarters. As you can see, its cost fund has been 0.88% pre-pandemic. Then it dropped to essentially 0 when the pandemic broke out and the Fed had to implement a hard landing. It even enjoyed two quarters of negative costs (i.e., it was paid to borrow money) during the third and fourth quarters of 2021.

Then the music stopped, and the rates began to rise as the Fed had to combat inflation. In its Q2 ER, AGNC just reportedly its Q2 average cost of funds is 0.18%.

Now note that the Fed just increased the rates by another 75 basis points after its ER. And the 0.18% cost was before this raise. Therefore, investors should expect an even higher average cost of funds for the incoming quarter. And I see a good chance for its cost of funds to gradually revert back to the 0.88% level.

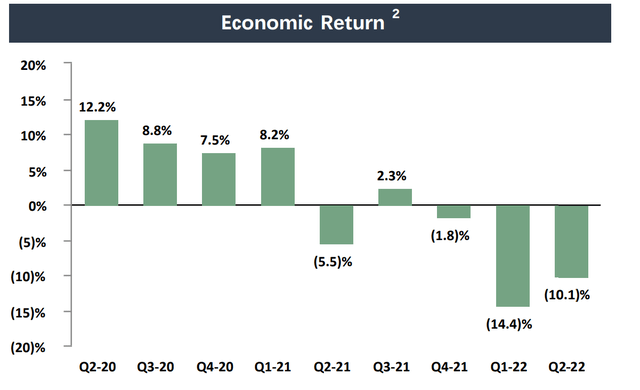

And even at its current level, it is already reporting negative economic returns as you can see from the following chart. Here, the economic return is defined as the change in tangible net book value per common share plus dividends per common share declared. Its economic return has been -14.4% during Q1 this year and -10.1% in the past quarter.

NLY and AGNC: book value losses

As aforementioned, besides weakening mortgage and rising borrowing costs, this time, I also see NLY and AGNC getting hurt from two other directions. First, record inflation will also cause difficulties for EXISTING HOMEOWNERS to service their mortgages. As NAR (National Association of Realtors) Chief Economist Lawrence Yun commented below (emphasis added by me):

The Russia-Ukraine war and escalating fuel prices have contributed to further housing unaffordability for buyers. Mortgages now compared to just a few months ago are costing more money for home buyers. For a median-priced home, the price difference is $300 to $400 more per month, which is a hefty toll for a working family.

Secondly, the pandemic unexpectedly created a housing bubble. Demand has increased as a result of the need for remote employment. And Fed’s landing resulted in historically low mortgage rates, further encouraging the demand and driving up prices. Now as the trends, both in borrowing cost and in housing demand, start reverting, it is very likely that the housing market begins to see increases in delinquencies or even foreclosure, which will lead to book value losses.

And both AGNC and NLY have reported sizable book value losses in Q2 already. For ANGC, its tangible net book value per common share fell to $11.43 from $13.12 last quarter, a 12.8% loss. And for NLY, its book value fell by a similar amount, by 13% this quarter.

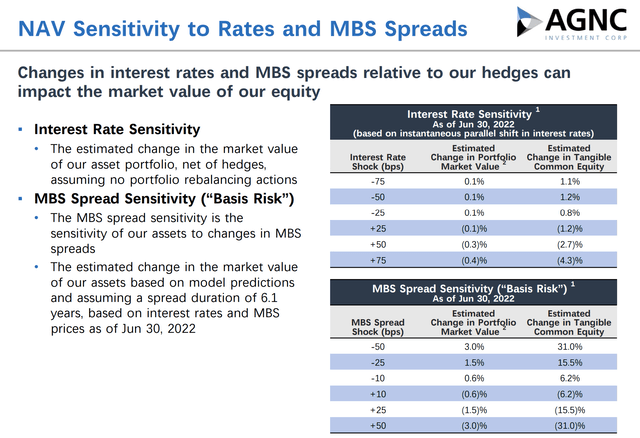

Looking forward, I see a large possibility for the loss of book value to continue or even worsen for the combination of the factors mentioned above (rising rates and rising difficulty of affordability for both new and existing home buys). Rising rates alone would cause sizable loss as shown in the chart below. For a 75 bps rise in interest rates (which the Fed just did after its ER), ANGC’s tangible common equity would suffer a loss of 4.3%. And even for a 10 bps shock in MBS shock, its tangible common equity would suffer a loss of 6.2%.

NLY and AGNC: total shareholder yield

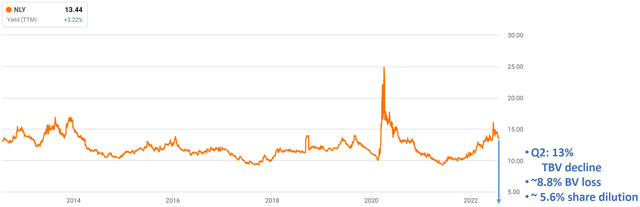

Many mREIT investors are drawn to the high dividend yields. Indeed, both are currently providing high dividend yields. As you can see from the charts below, AGNC is yielding 11.6% and NLY is yielding 13.4%.

Here, I want to urge investors to look at total shareholder yield too, not only in cash dividend yield. To put it in other words, shareholders should holistically consider the combined effects of cash dividends, gain/loss of book value, and share dilution.

As just mentioned, AGNC lost 12.8% of its tangible book value in the past quarter alone, which is more than enough to cancel out its 11.6% of cash dividends in an entire year. Historically, it has also been losing book value too (at about 6% a year since 2013). And it has also been diluting its shares at the same rate. Once you consider these factors, the current 11.6% yield is not that attractive.

The picture is very similar for NLY. Again, its 13% book loss book value loss in the past quarter almost wipes out its cash dividend for the entire year. And historically, it has been losing book value at about 8.8% per year since 20 and diluting its shares by about 5.6% a year.

Final thoughts and other risks

When the above factors are considered, I see the total shareholder yield for both AGNC and NLY as unattractive or even negative going forward. Furthermore, given the headwinds mentioned (higher rates, weakening demand, and affordability risks), I see too many uncertainties for these stocks to maintain their current dividends. A dividend cut is a realistic possibility.

Further share dilution is another possibility. And share dilution at discounted values (right now both are already priced below book value) is very damaging to shareholders’ total returns (at least for existing shareholders).

Be the first to comment