koto_feja

Four hostile newspapers are more to be feared than a thousand bayonets. ― Napoleon Bonaparte

Today, we put Agios Pharmaceuticals (NASDAQ:AGIO) in the spotlight. The company has been in the news recently and this is a name I get an occasional question on from Seeking Alpha followers. An analysis follows below.

Company Overview

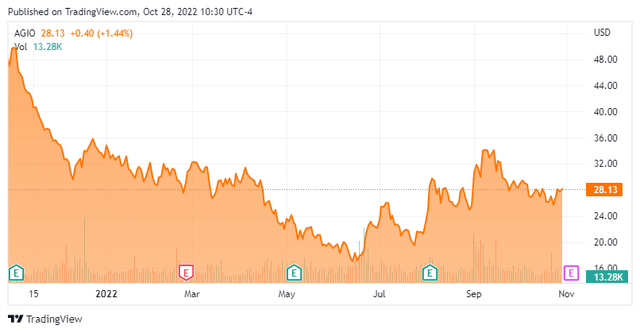

Agios Pharmaceuticals is located in Cambridge, MA right outside of Boston. The company is focused on the discovery and development of medicines in the field of cellular metabolism and adjacent areas of biology. The stock currently trades around $28.00 a share and sports an approximate market capitalization of $1.55 billion.

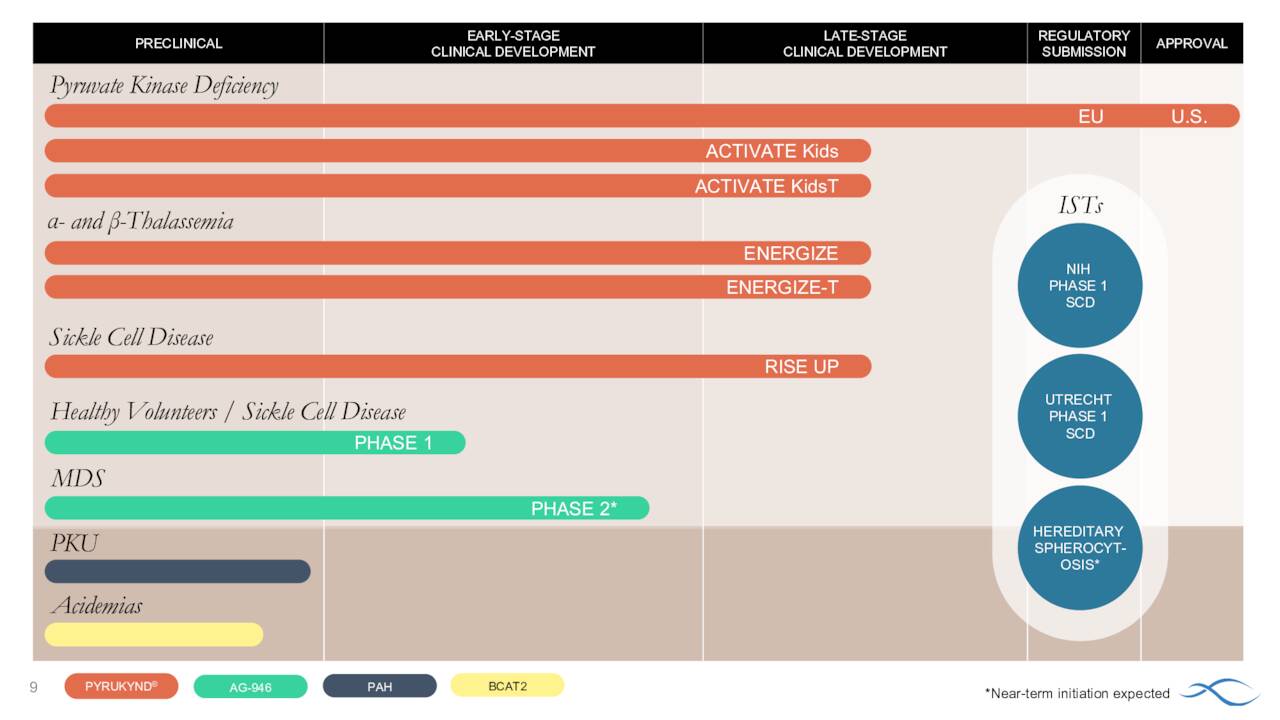

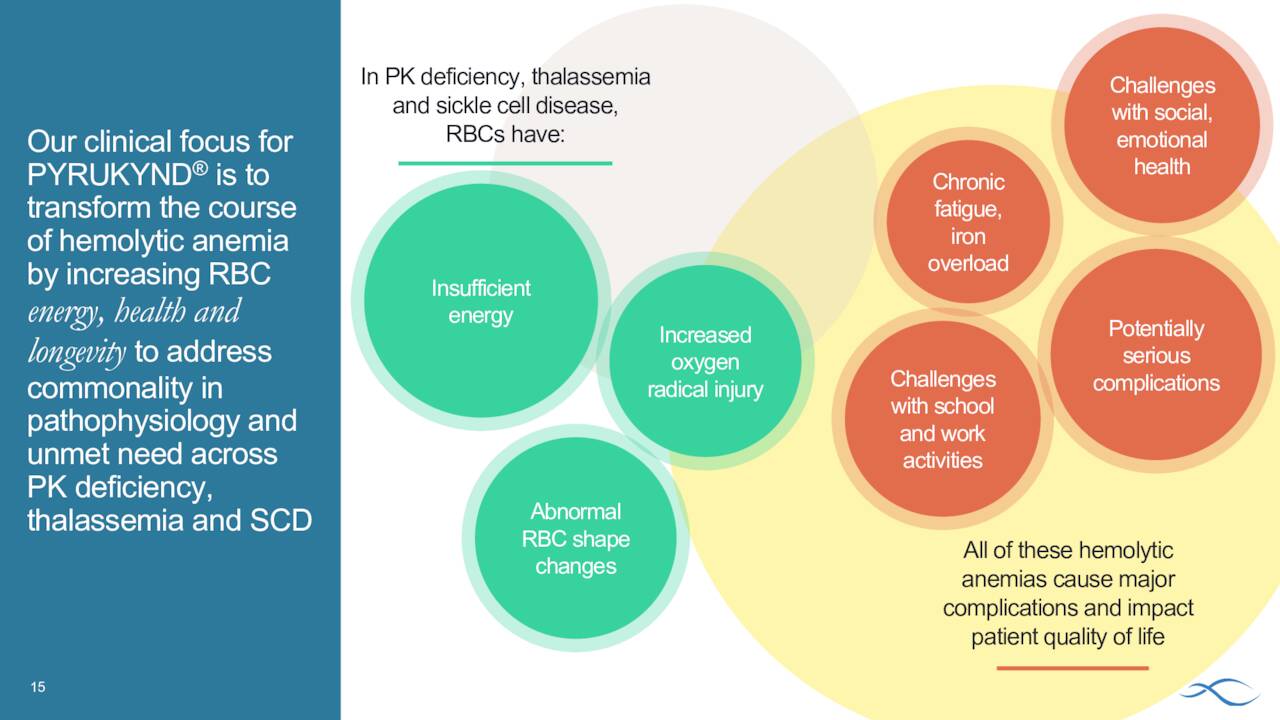

The company has one product on the market. That is Pyrukynd, also known as mitapivat. This compound was greenlighted by the FDA early this year to treat hemolytic anemia in adults with pyruvate kinase deficiency.

February Company Presentation

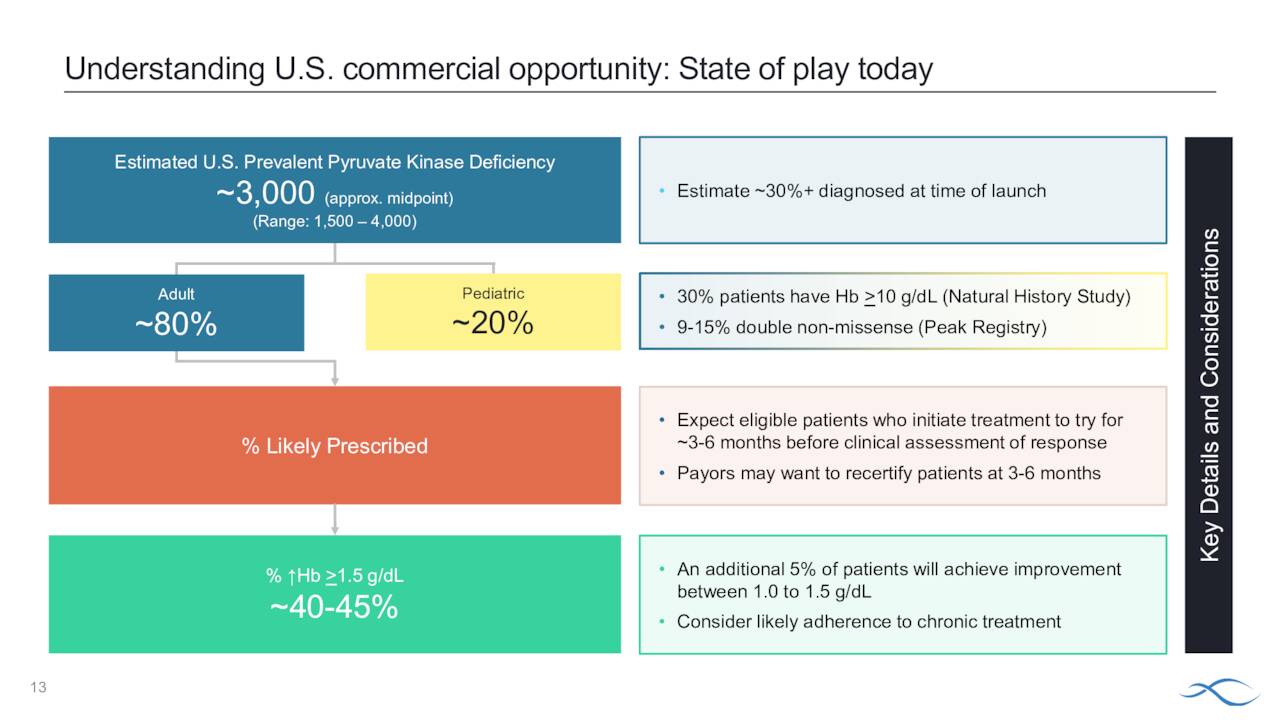

Pyruvate kinase deficiency is defined as ‘a rare inherited disorder that affects red blood cells, which carry oxygen to the body’s tissues. People with this disorder have a condition known as chronic hemolytic anemia, in which red blood cells are broken down (undergo hemolysis) prematurely, resulting in a shortage of red blood cells (anemia).’

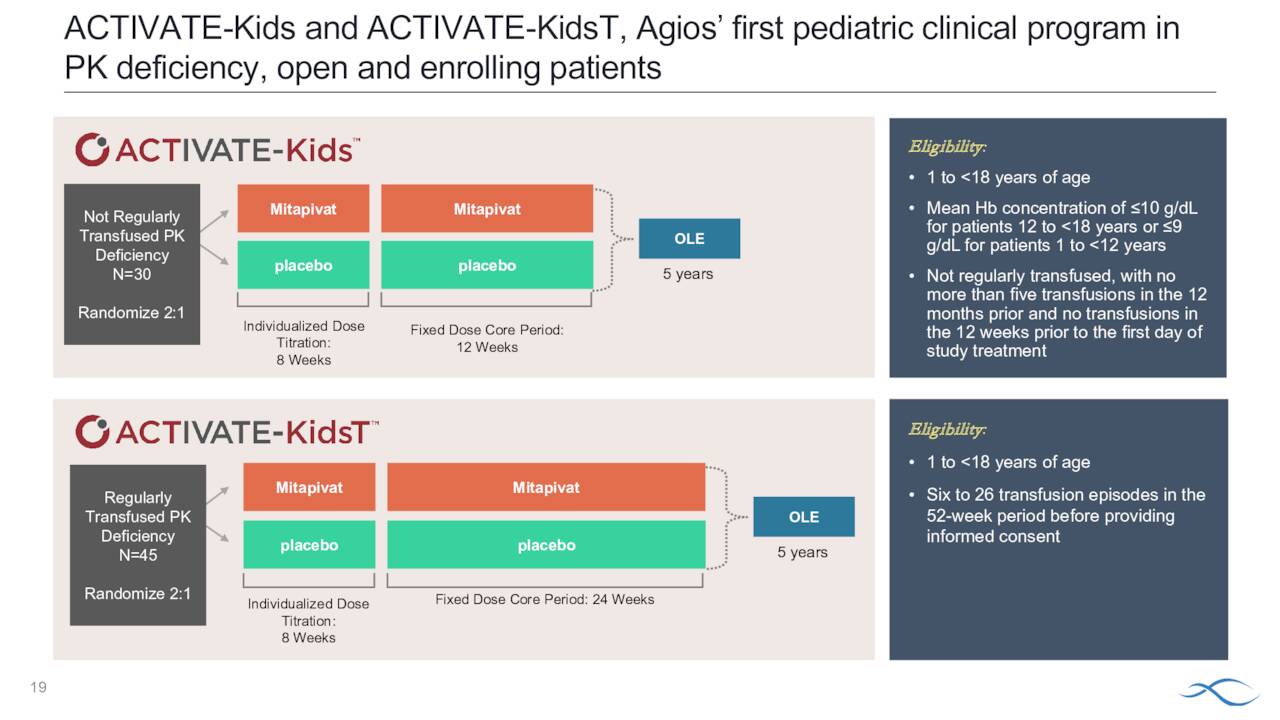

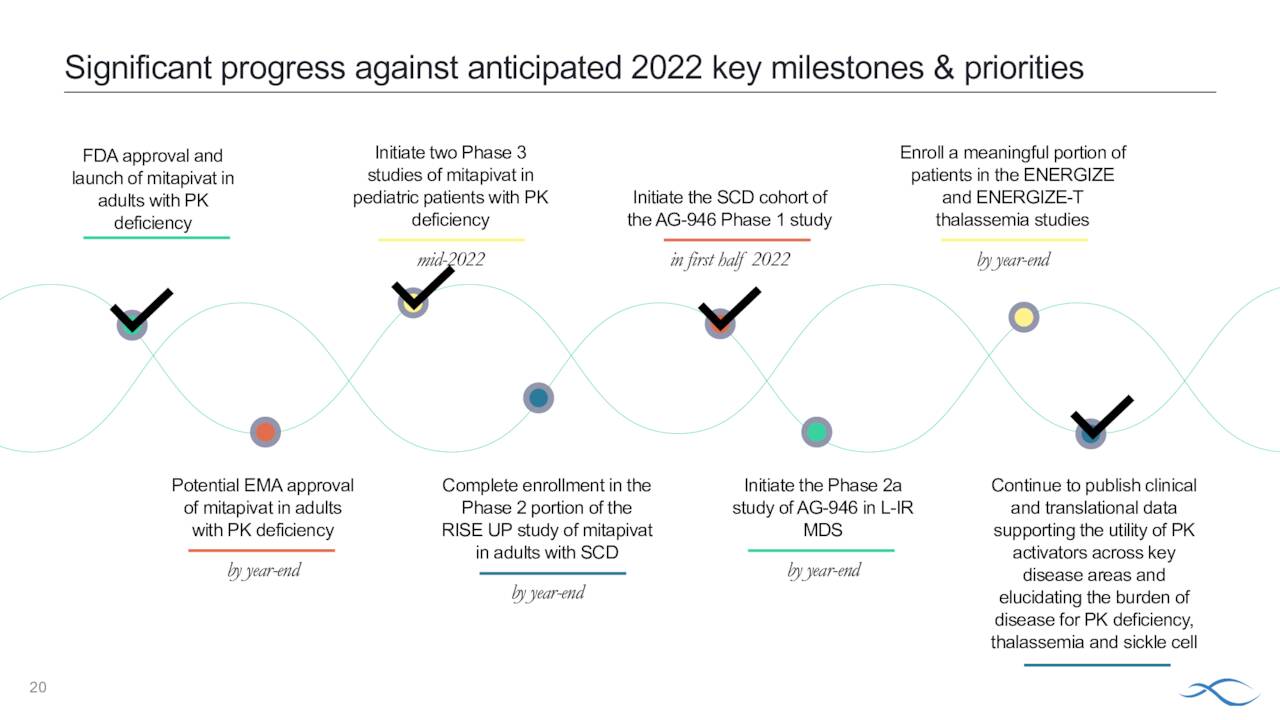

Symptoms vary by individual and mutation. There are approximately 1,500 to 4,000 individuals affected by this rare affliction in the United States. Prior to Pyrukynd, treatments included blood transfusions and bone marrow transplants. The company is working to get eventual approval for the pediatric portion of this population and recently initiated its Phase 3 ACTIVATE-kids and ACTIVATE-kidsT studies.

August Company Presentation

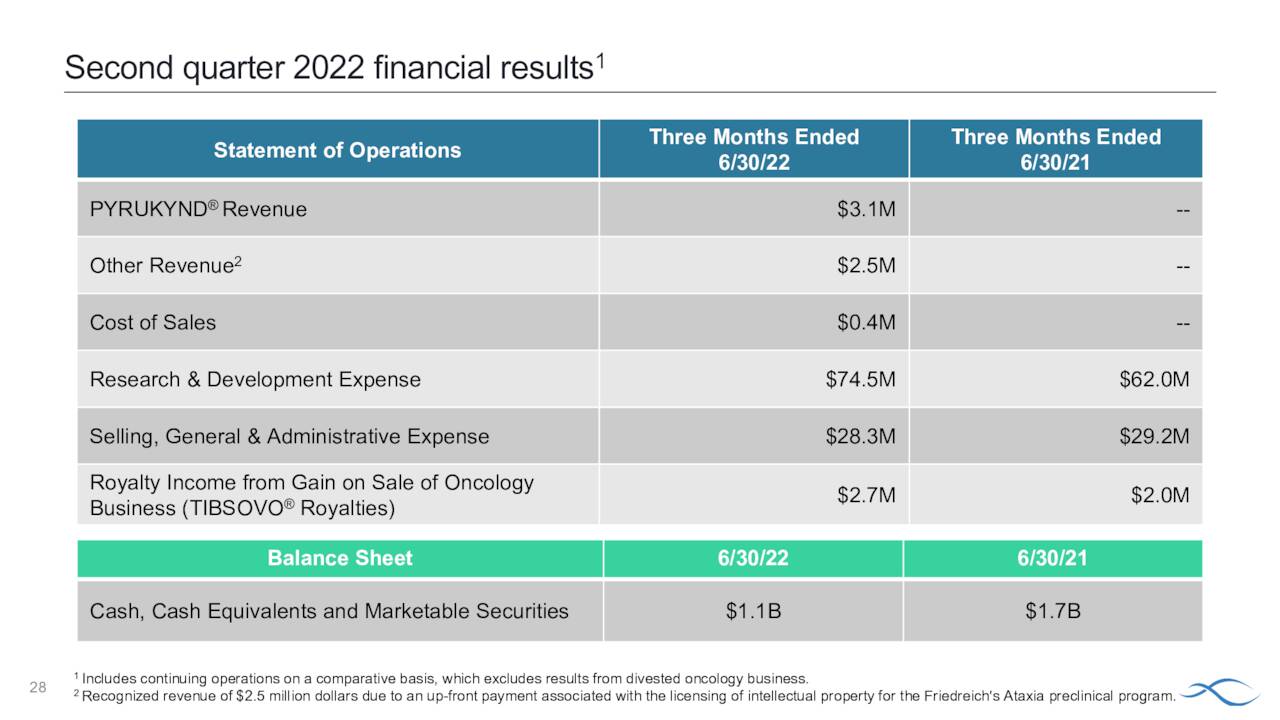

In mid-September the European Medicines Agency recommended Pyrukynd for approval for this indication and it likely will be greenlighted shortly and will be the first approved disease-modifying therapy for European patients with PK deficiency. Pyrukynd had $3.1 million of net product sales in second quarter of this year, which was the first full quarter of its launch.

August Company Presentation

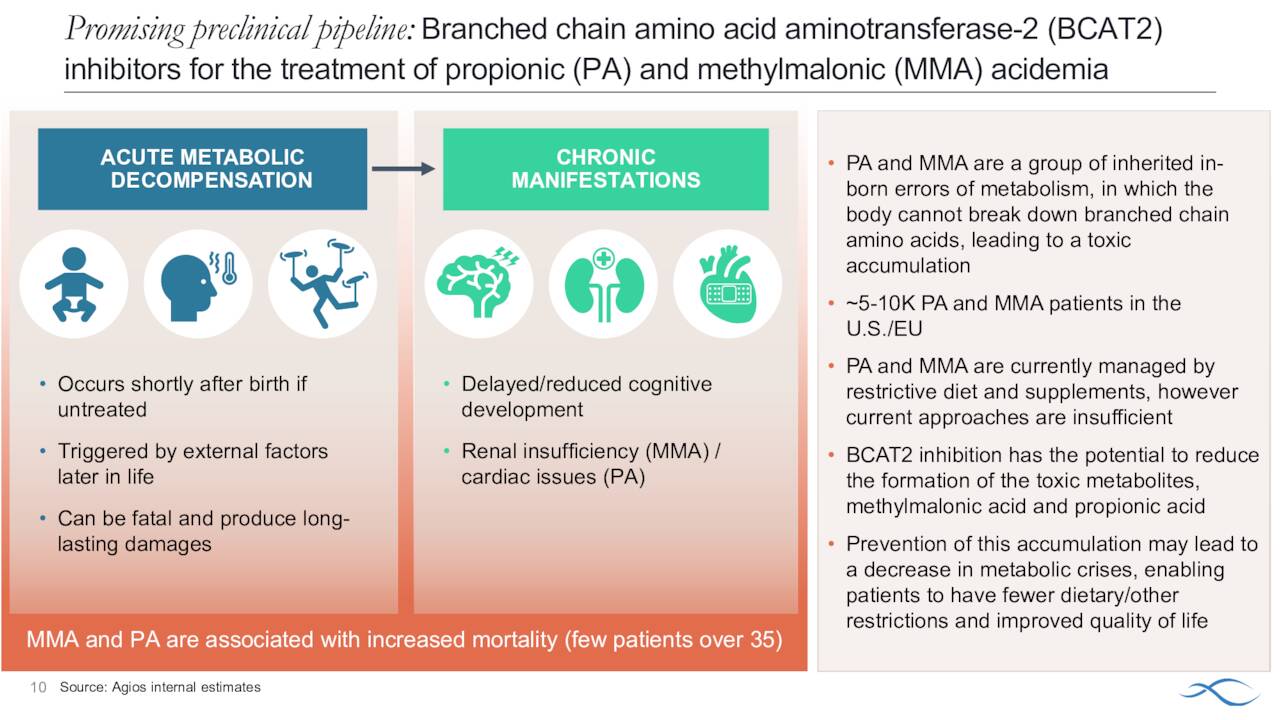

In all, Agios Pharmaceuticals currently has five pivotal trials underway. It also has multiple early stage clinical studies planned or underway as well as a promising preclinical pipeline. The company is focused on expanding Pyrukynd to potentially much more lucrative indications in sickle cell disease and thalassemia. These efforts will be the primary focus of this analysis.

August Company Presentation

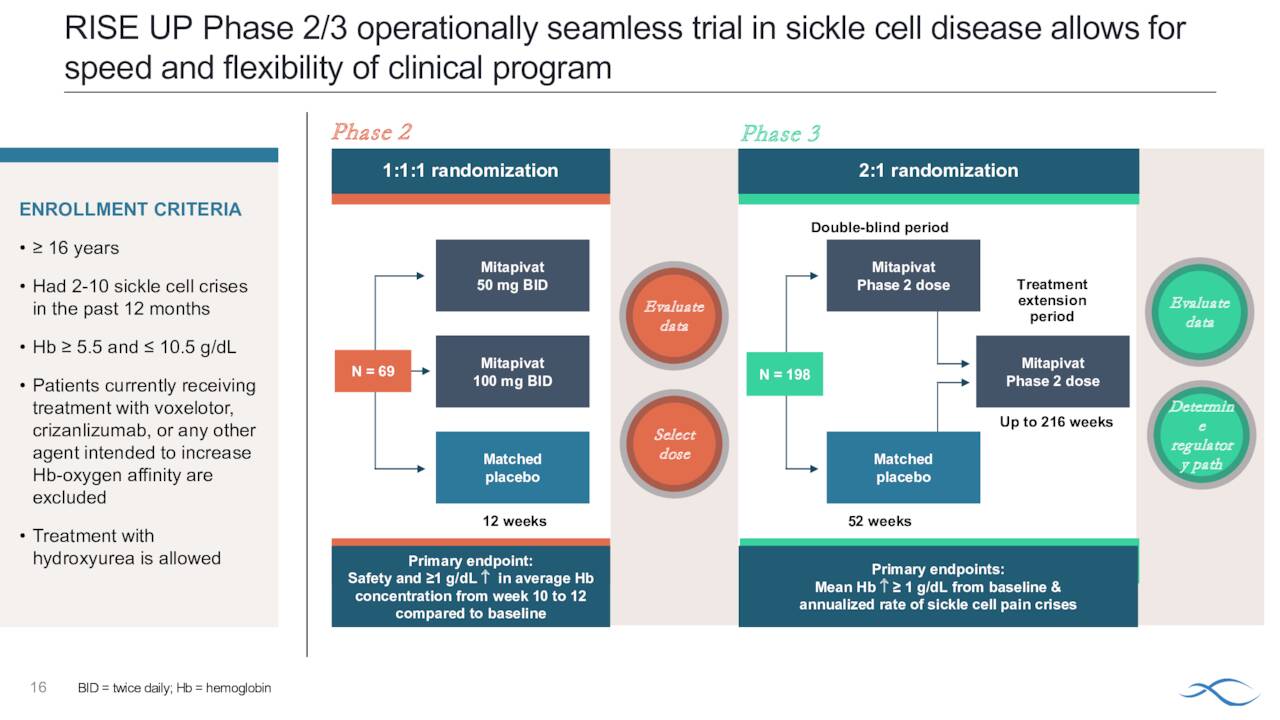

Th company recently initiated a Phase 2/3 study ‘RISE UP’ in adults with sickle cell disease or SCD. The goal of this effort is to position Pkrukynd as the first oral agent to improve anemia, reduce VOCs and improve quality of life by increasing methemoglobin resulting in reduced pain and fatigue in this population. Agios hopes to have the approximate 70 person Phase 2 portion of this trial completely enrolled by yearend.

August Company Presentation

The primary endpoints for this study will be hemoglobin response defined as equal or more than one-gram per deciliter increase in average hemoglobin concentration from week 10 through week 12 compared to baseline and safety. After this portion of the study is completed, Agios will evaluate the data from it and make a determination on the dosing paradigm for the Phase 3 portion in the protocol.

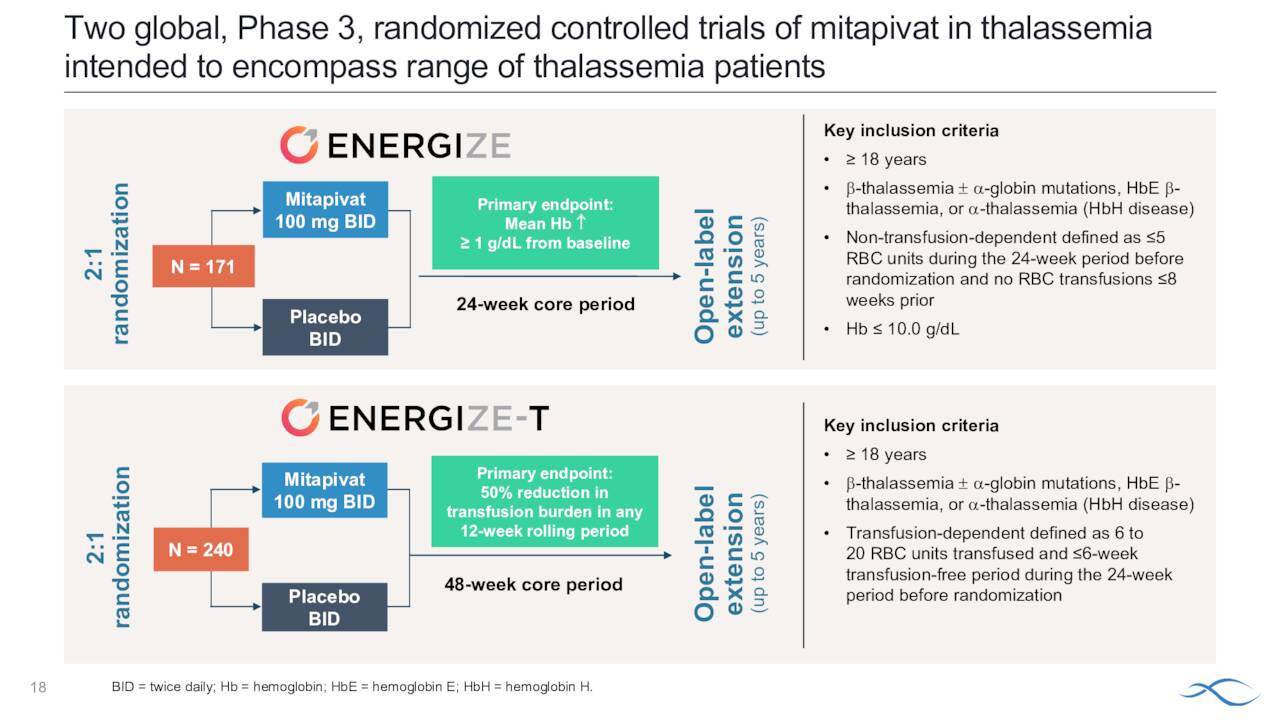

In addition, management is moving to position Pkrukynd as the first oral therapy to improve hemolytic anemia and alpha thalassemia as well as transfusion-dependent and transfusion-independent thalassemia. This condition is an inherited blood disorder characterized by the formation of abnormal form of hemoglobin. It causes tiredness, yellowish skin, dark urine, abdominal swelling and facial bone deformities. This affliction affects just under 200,000 individuals in the United States annually. This condition can be dangerous or life threatening if untreated. Current treatments can help manage thalassemia but there is no current cure.

The company initiated two late stage studies late last year ‘ENERGIZE and ENERGIZE-T. We go to the company’s second quarter press release for a description of both trials.

ENERGIZE will evaluate 171 patients randomized 2:1 to 100 milligrams of mitapivat twice daily or placebo in both alpha and beta thalassemia patients who are not regularly transfused. The primary endpoint of hemoglobin response defined as an equal or more 1-gram per deciliter increase in average hemoglobin concentration from week 12 to week 24 compared with baseline. ENERGIZE-T will evaluate 240 patients randomized 2:1 to 100 milligrams of mitapivat twice daily or placebo in both alpha and beta thalassemia patients who are regularly transfused, defined a six to 20 red blood cell unit transfused during the 24 weeks prior to randomization. The primary endpoint is transfusion reduction response defined as a 60% or greater reduction in transfused red blood cell units with a reduction of equal or more than two units of transfused red blood cells in any consecutive 12-week period through week 48 compared with baseline.

August Company Presentation

Agios intends to have a meaningful portion of patients in both of these Phase 3 trials by yearend.

Analyst Commentary & Balance Sheet

The analyst community is quite mixed on the company’s prospects right now. So far in 2022, five analyst firms including RBC Capital and Canaccord Genuity have reissued Buy/Outperform ratings on AGIO. Price targets proffered range from $44 to $96 a share. Meanwhile, Raymond James, Goldman Sachs ($16 price target) and J.P. Morgan ($48 price target) have initiated or maintained Hold/Sell ratings on the stock.

August Company Presentation

Almost 12% of the outstanding float in AGIO is currently held short. One insider sold nearly $25,000 worth of shares in February. That is the only insider activity in AGIO so far in 2022. As of the end of the second quarter, the company held approximately $1.1 billion of cash and marketable securities on its balance sheet. The company has no long term debt. That cash balance is about to be bolstered. Earlier this week, Agios announced that it had sold its rights to 5% royalties on U.S. net sales of French pharma firm Servier’s Tibsovo drug for $131.8 million. The company had $2.7 million in revenues from this royalty stream in the second quarter. It should be noted Agios sold its entire cancer division to Servier for $2 billion in 2021, which is why the company is so cash rich. The company had a net loss from continuing operations of $91.8 million in the second quarter.

Verdict

The current analyst firm consensus has Agios Pharmaceuticals losing nearly seven bucks a share in FY2022 on revenues of approximately $19 million. Next year a roughly six dollar a share loss is projected as sales rise to $66 million, although analysts have a wide range of sales estimates (roughly $40 million to $90 million).

August Company Presentation

Agios has numerous key milestones on the horizon and is aiming at some potentially large markets. SCD is a multibillion dollar space that is currently dominated by Global Blood Therapeutics’ Oxbryta and Novartis’ (NVS) Adakveo. Approximately, 100,000 individuals are impacted by SCD in the U.S. There are also some potential gene editing therapy candidates in development.

Agios Pharmaceuticals has plenty of cash on hand to support development even as it burns through nearly $100 million a quarter. The company also has a new CFO and CEO in place. I would like to see more sales traction from Pkrukynd and late stage trial data for SCD and thalassemia before I would be comfortable taking a significant stake in Agios Pharmaceuticals.

August Company Presentation

That said, if you equate for cash on the balance sheet, you are getting a company with one recently approved product on the market in the U.S. for one indication, that looks like it will soon be approved in Europe for under $400 million. The pediatric population for that indication looks like it will eventually garner approval as well. Mid/late stage trials are underway to potentially target the SCD and thalassemia. The company has some potential valuable earlier stage assets that were not germane to this analysis and were not covered as part of this piece. Add it all up and AGIO would seem to merit a small ‘watch item‘ position within a well diversified biotech portfolio at this time.

Free speech is the right to shout ‘theater’ in a crowded fire. ― Abbie Hoffman

Be the first to comment