Justin Sullivan/Getty Images News

You make most of your money in a bear market; you just don’t realize it at the time. Shelby Davis

You rarely get to buy exceptional companies at reasonable valuations, with the exception of bear markets, where even these great investments can become attractive. We believe that is currently the case with Agilent Technologies (NYSE:A), a solid company that has a lot of attractive financial attributes, and which rarely trades at what we would consider an attractive valuation. While we still don’t believe shares to be a bargain, we do believe they are now in ‘Buy’ territory.

Q2 2022 Results

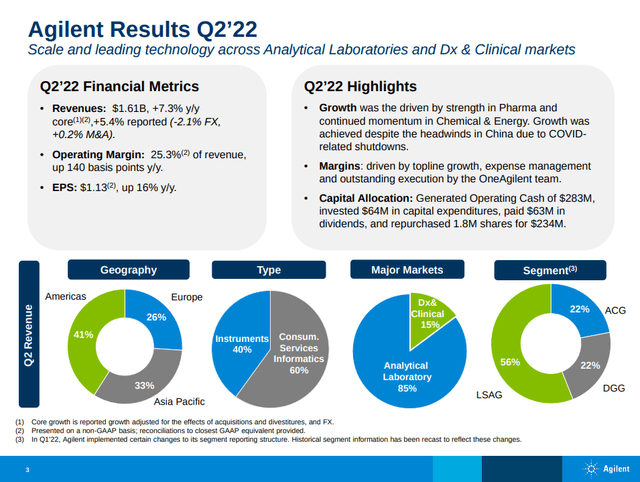

Agilent released solid second quarter results, and management slightly increased its fiscal 2022 bottom line outlook. Sales grew 7% y/y on a core basis (adjusted for currency and acquisitions/divestitures).

The Chinese lockdowns created a 350 basis points headwind in the quarter, as Agilent’s Chinese operations were down from late March through the entire month of April. Given the strong underlying demand in China, management believes those sales were not lost and should be realized in calendar 2022.

Agilent Technologies Investor Presentation

Competitive Advantages

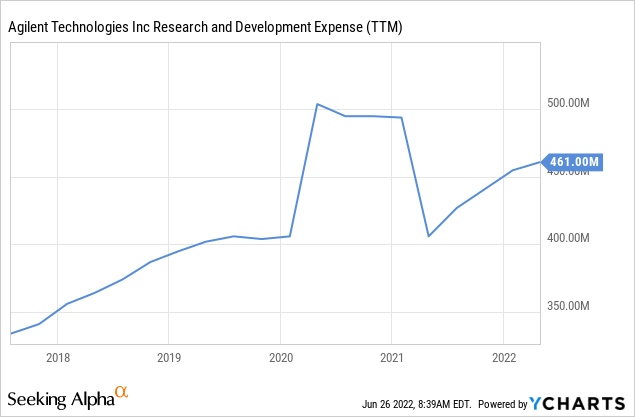

Agilent has a wide competitive moat derived from a combination of strong intellectual property (patents, trade secrets, etc.), and high switching costs for customers. Once customers are trained to use a given piece of equipment it is a hassle to have to learn to operate another one just because it is slightly cheaper. There are also calibration and maintenance issues that would motivate customers to keep buying from the same supplier. We are encouraged to see that Agilent continues to invest heavily in R&D and that it is not resting in its laurels living off past R&D investments.

Financials

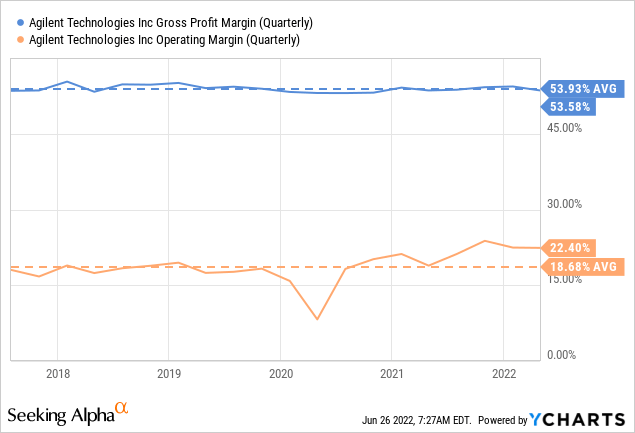

As sales have been increasing, Agilent has been displaying operating leverage, which has increased the operating margin from an average of ~18% the last five years to ~22% currently. We believe there is room for operating margins to improve further as sales continue to increase.

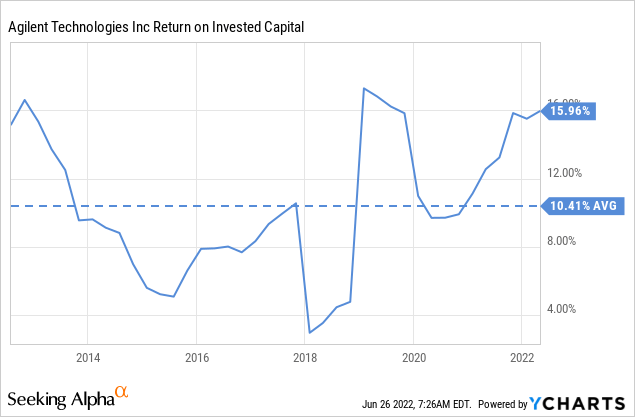

Improved margins and better working capital management have resulted in much higher returns on invested capital, which are now exceeding 15%.

Growth

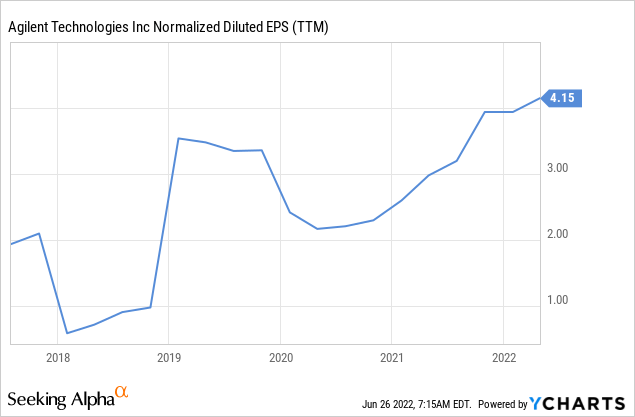

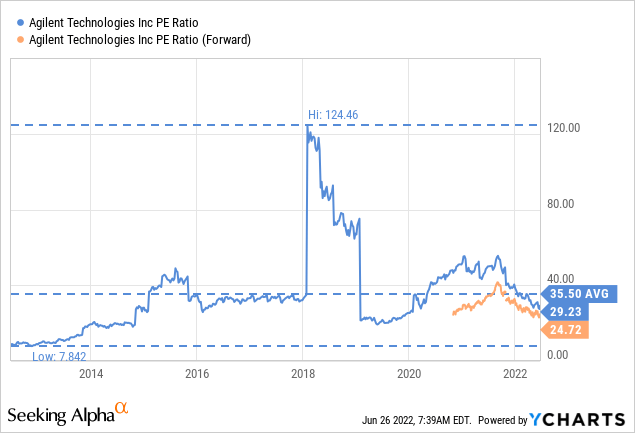

In the quarter, Agilent’s adjusted EPS grew 16% year over year and has reached $4.15 for the last twelve months. This is almost 2x the lows reached during the worst of the pandemic and puts the price/earnings ratio at ~30x.

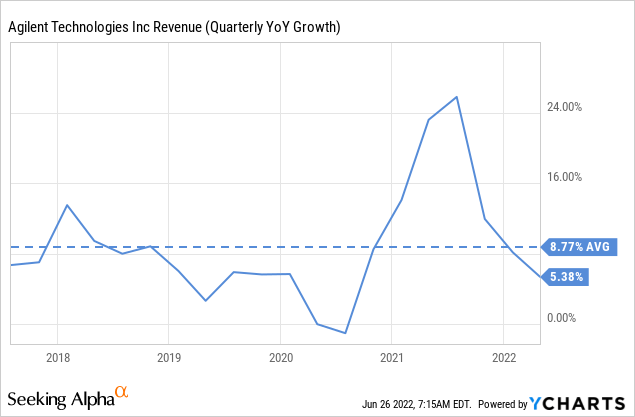

Revenue growth has not been very constant, but on average has grown ~8.7% over the last five years.

Competition

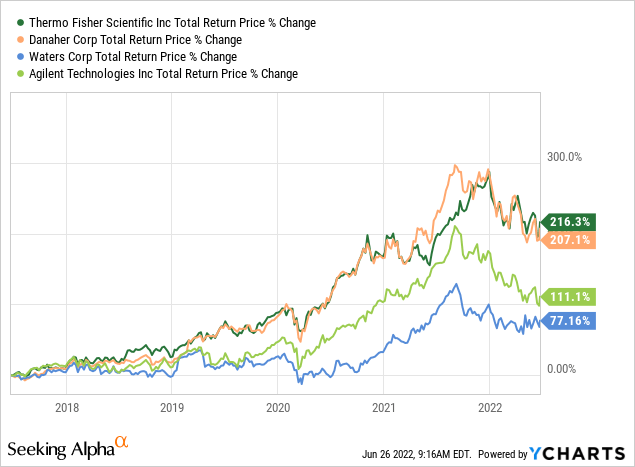

In the last five years, Agilent has under-performed competitors Thermo Fisher Scientific (TMO) and Danaher (DHR) with respect total returns delivered to shareholders, but outperformed Waters Corporation (WAT). Part of the reason is that Thermo Fisher and Danaher have been growing revenues at a faster rate, something Agilent will hopefully get better at moving forward.

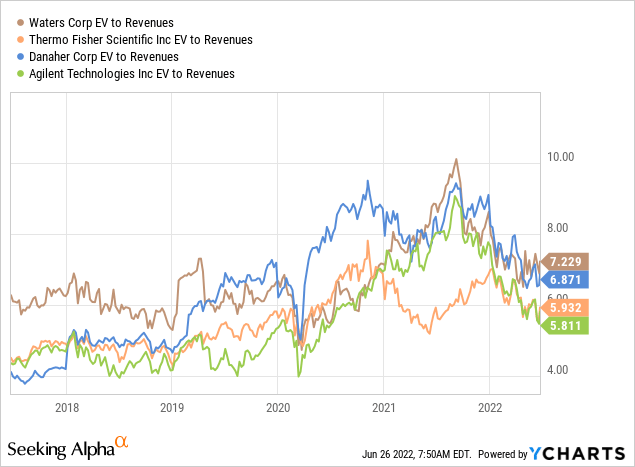

At least Agilent is trading at a cheaper multiple of revenues compared to these competitors, with an EV/Revenues ratio of ~5.8x.

Valuation

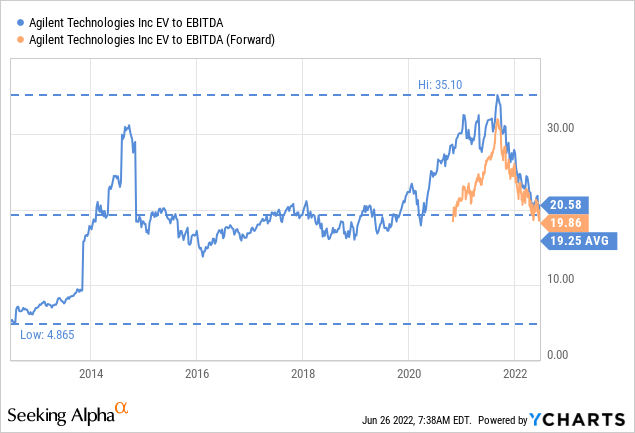

Looking at some valuation multiples, we can see that EV/EBITDA is getting close to the ten-year average after a couple of years of trading at much higher valuations.

Similarly, the price earnings ratio is finally below 30x, which has not happened since early 2020. The forward p/e is 24x, which we believe is a reasonable multiple for a quality company like Agilent with still some decent amount of growth.

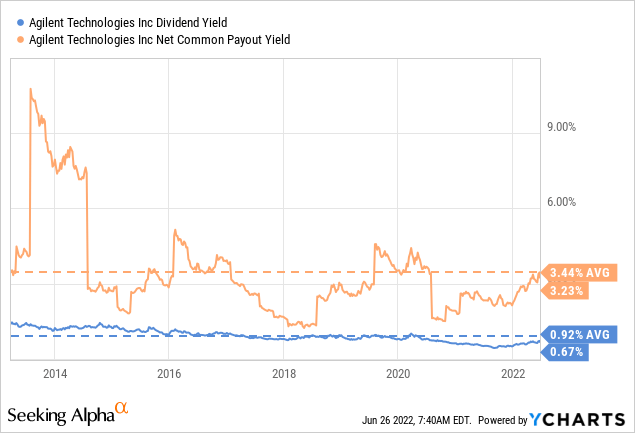

Some investors might be disappointed by the low dividend yield, but we would suggest looking at the net common payout yield instead, which combines the dividend yield with the net share repurchases yield.

We estimate the net present value of the shares at $108, which is slightly below where shares are currently trading. We were conservative in this calculation, using average earnings estimates for the next three years as compiled by Seeking Alpha, and the assuming 9% growth (in line with growth for the last five years, and not assuming any additional operating leverage). We discounted everything by 10%, but if we use 8% instead, we get $128 per share. We therefore believe that shares are currently priced to deliver ~8-9% returns going forward.

| EPS | Discounted @ 10% | |

| FY 22E | 4.91 | 4.46 |

| FY 23E | 5.38 | 4.45 |

| FY 24E | 6.09 | 4.58 |

| FY 25E | 6.64 | 4.53 |

| FY 26E | 7.24 | 4.49 |

| FY 27E | 7.89 | 4.45 |

| FY 28E | 8.60 | 4.41 |

| FY 29E | 9.37 | 4.37 |

| FY 30E | 10.21 | 4.33 |

| FY 31E | 11.13 | 4.29 |

| FY 32 E | 12.13 | 4.25 |

| Terminal Value @ 3.5% terminal growth | 186.69 | 59.48 |

| NPV | $108.11 |

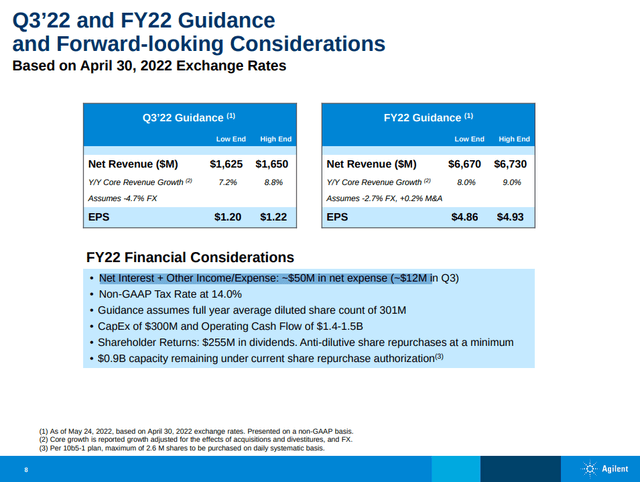

FY22 Guidance

For fiscal year 2022 the company is guiding for core revenue growth between 8-9% and EPS between $4.86 and $4.93.

Agilent Technologies Investor Presentation

Risks

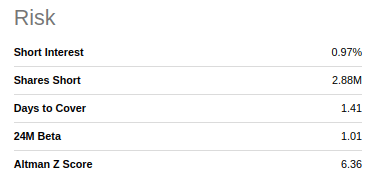

The main risk we see with Agilent is that of valuation risk. While shares are now trading closer to fair value, there isn’t much in the form of margin of safety, and shares could go from having been overvalued to undervalued. In any case the balance sheet is strong, and the company sports a very safe Altman Z-score of 6.36. Short-sellers don’t seem to have found anything worrisome with the company as less than 1% of the shares are sold short currently.

Seeking Alpha

Conclusion

For investors who have been waiting to buy shares in Agilent, this is probably a good time to buy at least a starter position. It had been at least a couple of years during which Agilent had been trading above what fundamentals justified, and now finally shares are priced to deliver a very decent 8-9% returns going forward. This is a quality company, with decent growth, and an attractive financial profile.

Be the first to comment