Maksim Safaniuk/iStock Editorial via Getty Images

Investment Thesis

AGCO Corporation’s (NYSE:AGCO) production and sales were impacted due to the supply chain constraints and lower production days in Q2 FY22 due to the cyberattack. This, coupled with strong orders, led to an increased order backlog. As the supply chain constraints ease in 2H FY22, the company should be able to convert its order backlog into revenue at an increased pace. AGCO also plans to increase its production hours in the second half of FY22 to compensate for the lost time in Q2 FY22, supporting the sales growth. The company has been implementing pricing actions across its business portfolio, which should support the company’s sales and margin growth in the second half. While soft commodity prices have been declining since June, they are already near their pre-Russia-Ukraine war levels and we don’t see much downside from these levels. Further, the global food shortage crisis should help limit any further decline. The company is expanding its Fendt business in other regions and making acquisitions to grow the Precision Ag business to improve its sales and margins under its Farmers-First strategy, introduced in March 2022. Valuations appear cheap and the risk-reward favorable. Hence, I have a buy rating on the stock.

AGCO’s Q2 FY22 Earnings

AGCO recently reported mixed Q2 FY22 financial results, with lower-than-expected sales and better-than-expected earnings. The net sales in the quarter was up 2.3% Y/Y at $2.9 bn (vs. the consensus estimate of $3.02 bn). The EPS in the quarter declined 17.4% Y/Y to $2.38 (vs. the consensus estimate of $2.11). The sales growth was primarily the result of pricing (~9%), offsetting the impact of the cyberattack that resulted in lower production sales, particularly in North America and Europe. The adjusted operating margin declined 120 bps Y/Y and remained constant sequentially, largely driven by the effect of lower production and cost inefficiencies due to the cyberattack, supply chain challenges, and higher operating expenses as a percent of revenue.

Near-term Growth Prospects

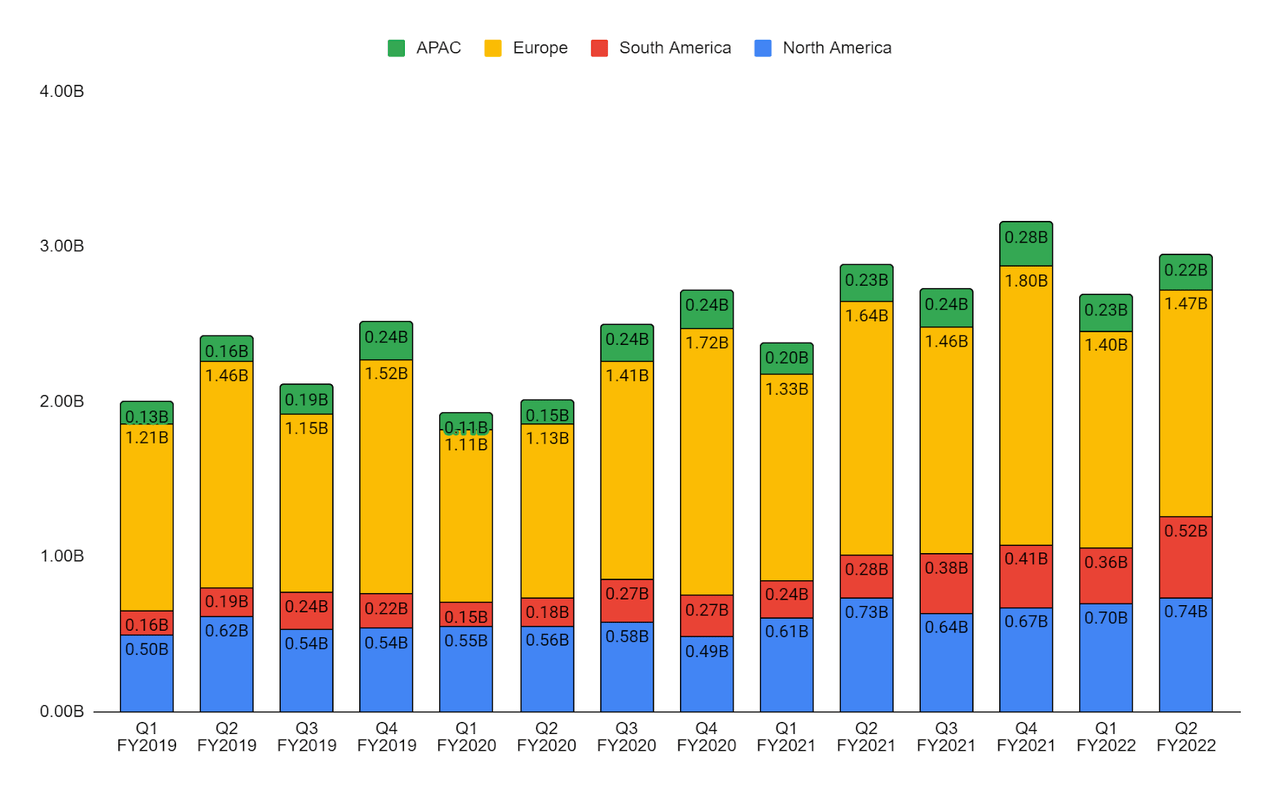

The net sales of the company improved by 2.3% Y/Y or 10% Y/Y excluding the impact of negative currency translation. Net sales in the North America segment increased 0.7% Y/Y or 1.4% Y/Y excluding the impact of negative currency translation. The increase was primarily due to the pricing actions taken by the company to mitigate inflationary cost pressures, partially offset by lower sales of combines and sprayers. The net sales in the South America segment grew 77% Y/Y or 86.6% Y/Y excluding the impact of negative currency translation. The sales were driven by the pricing actions as well as volume and mix effects, with increased sales of high horsepower and midsized tractors as well as sprayers. The net sales in the Asia Pacific/Africa segment declined 5.5% Y/Y and were up 1.6% Y/Y, excluding the impact of negative currency translation. Higher sales in Japan and Australia were partially offset by lower sales in China due to the COVID-related lockdowns. The Europe/Middle East segment’s net sales declined 10.2% Y/Y and were up 3% Y/Y excluding the impact of negative currency translation. The sales growth excluding currency impact was primarily due to pricing, partially offset by lower volumes due to the effect of lower production and supply chain challenges.

At the end of Q2 FY22, the order board (backlog) of AGCO was at an elevated level with a higher mix of the retail portion. The order board in the quarter was up 30% Y/Y in Europe and the company is getting a strong order rate despite the uncertainty in the market. Orders for tractors and combines were significantly higher in North America and Europe and were down modestly in the South America region Y/Y in the last quarter. The company is shortening its order board in Brazil to 3 months to have more pricing flexibility in the region as the level of inflation in the South American region is higher than in other parts of the world.

In the first half of FY22, the industry’s retail sales were negatively impacted due to supply chain constraints. The sales in North America and the Western European region were negative. However, the sales in South America were positive, with increased sales in Brazil and Argentina. Strong crop production levels and commodity prices are supporting the economic conditions in the region, with farmers continuing to replace their ageing fleet.

In May 2022, the company’s operations were impacted due to a cyberattack, due to which AGCO lost approximately 1 to 2 weeks of its production. However, the company has successfully restored its systems. The impact caused the second quarter production hours to be down about 8% compared to the previous year’s same quarter, resulting in lower sales in Q2 FY22. The company plans to recover the lost production hours by increasing production in both the third and fourth quarters by approximately 5% to 7% Y/Y. The production rates in July were solid and, looking forward, the company should continue delivering higher production hours.

AGCO’s revenue distribution (Company data, GS Analytics Research)

The farmer sentiment index has been dropping since 2021 and recently hit the lowest level since October 2016. The weaker farmer sentiment is mainly due to the rising costs and uncertainty related to the economy. Further, the war in Ukraine and the new regulations in the European region impacted the farmers’ sentiments negatively. The new regulation focuses on achieving a green and sustainable system in the agricultural industry. While these regulations are negatively impacting the farmer sentiments they should actually be positive for AGCO as the new emission regulations should give AGCO an opportunity to sell its sustainable and efficient products to farmers in Europe. Despite the declining farmer sentiment index, the company has been witnessing strong demand for its products as farm income remains strong.

Looking forward, the soft commodity prices have been declining since June 2022, which should start affecting the farm income and this correction is already getting reflected in the current low valuations. However, the good news is I don’t see much downside from the current levels as the global food shortage caused by the Russia-Ukraine war, the COVID pandemic, and the climatic changes across various continents. Climate change has resulted in droughts, heatwaves, and wildfire situations in the European Union, North America, and several other continents. Due to the extremely hot and dry conditions in several regions of Europe, the crop yield for EU summer crops in FY22 has been reduced by 8% to 9%. This should impact the supply of grains in the market for some time and should limit the further decline in soft commodity prices.

As the supply chain constraint in the second half of 2022 improves, the company should be able to convert most of its order board into revenue, which should improve the sales growth in FY22. The company is also increasing its production hours in 2H FY22, which should be incremental to its sales growth. Additionally, the company is expecting 10% of sales from pricing actions and is expecting the negative currency translation to negatively impact sales by 7%. The company is expecting sales growth in the range of $12.4 bn to $12.6 bn (12% Y/Y upside at the midpoint) for the full year FY22.

Long-Term Growth Prospects

AGCO is making significant capital investments in the development of new solutions to support its Farmer-first strategy, which it announced on March analyst day. The key element of this strategy is to focus on optimizing existing businesses and accelerating precision agriculture and digital capabilities to provide profitable growth. This should be achieved by capitalizing on the growth businesses, delivering operational improvements, and capturing growing trends in the industry by identifying a small number of new competencies within the company. The company’s growing business includes Fendt full-line, Precision Planting, North America Large Ag, and Global parts & services. Growing the Fendt business has two pieces to it. First is that, over the last few years, AGCO has filled its Fendt product line with different products through acquisitions and by developing its products. The company plans to expand other product lines by leveraging the strong presence of Fendt’s tractor business. The second piece is that the company wants to take this portfolio of Fendt products and extend it into other regions of the world. Note that Fendt is a very strong business in Europe. The company has already started selling some of its products in the North America and South America regions. The Fendt brand sales in 1H FY22 increased over 20% Y/Y and are expected to further improve in 2H FY22 given the current production plan. The Fendt and Challenger sales in North and South America are expected to double in FY22 compared to that in FY20 and the company is targeting to double this growth further over the next five to seven years.

In 2017, AGCO bought Precision Planting Company, a leading manufacturer of high-tech planting equipment. Over the years, AGCO has almost doubled the size of Precision Planting company by offering various planter products such as Fendt’s Momentum planter. The growth trajectory in this business comes from multiple ways, such as offering products through the retrofit channel or the OEM channel. The retrofit channel helps farmers convert their existing machines into advanced machines by installing retrofit kits offered by AGCO. This reduces the capital investment required to buy an entirely new OEM machine. The Precision Planting and Fuse Connected Services technology groups contribute almost 50-50 to the total revenue generated from the Precision Ag business. The Precision Planting business fuels the growth of the retrofit business, whereas the Fuse serves AGCO’s equipment brands from an OEM standpoint. Fuse provides OEM solutions for AGCO equipment such as telemetry, guidance, field mapping, and other precision agriculture capabilities, making AGCO machines smarter and more productive for the farmer.

To grow the Precision Ag business, the company has made almost 5 acquisitions in the last 18 months, with JCA Industries being the most recent one. JCA Industries specializes in electronic systems and software developments to automate and control agricultural equipment. If we look at AGCO’s acquisitions, the company has not been acquiring commercialized businesses; instead, it has been acquiring companies that will accelerate its product launch into the market, such as companies specializing in vision technology, autonomy capabilities, or sensor technology. The company recently announced new products for its retrofit sprayers, which are expected to be commercialized by 2024. The company plans to achieve similar success to that of the Planters retrofit business.

In the last quarter, the company’s Precision Planting business was impacted by the supply chain, particularly around semiconductor chips. AGCO has been working with its engineers to change some design parameters or reengineer its equipment to utilize another chip that might be available. The company is trying every way possible to get its product out of the factory. The order board across the business is strong, which should support the sales growth as the supply chain constraints ease in the second half of FY22. The revenue generated from the Precision Ag business was ~$540 mn in FY21 and the company is expecting it to increase by 20% to 25% Y/Y in FY22. Given the CAGR of over 20% in the Precision Ag business, the company has raised its target from $800 mn to $900 million in revenue generation from this business by 2025.

Margins

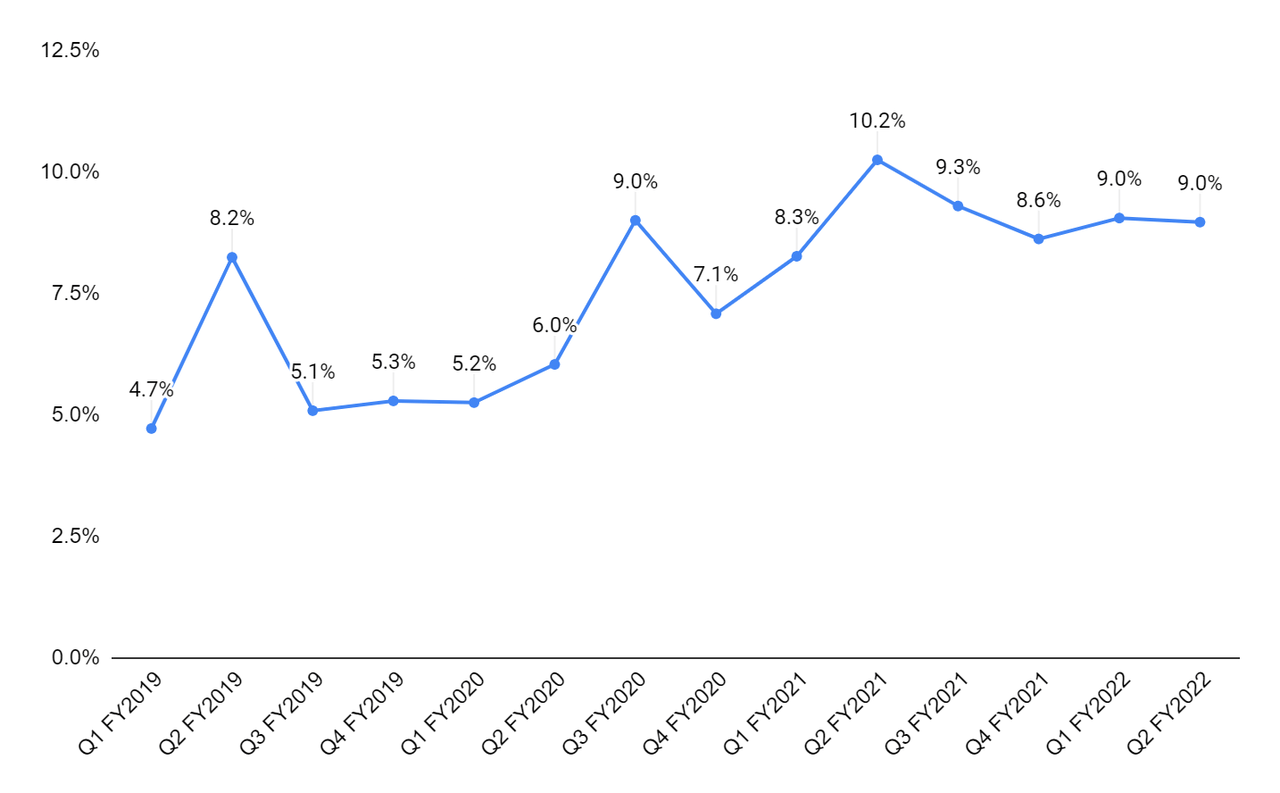

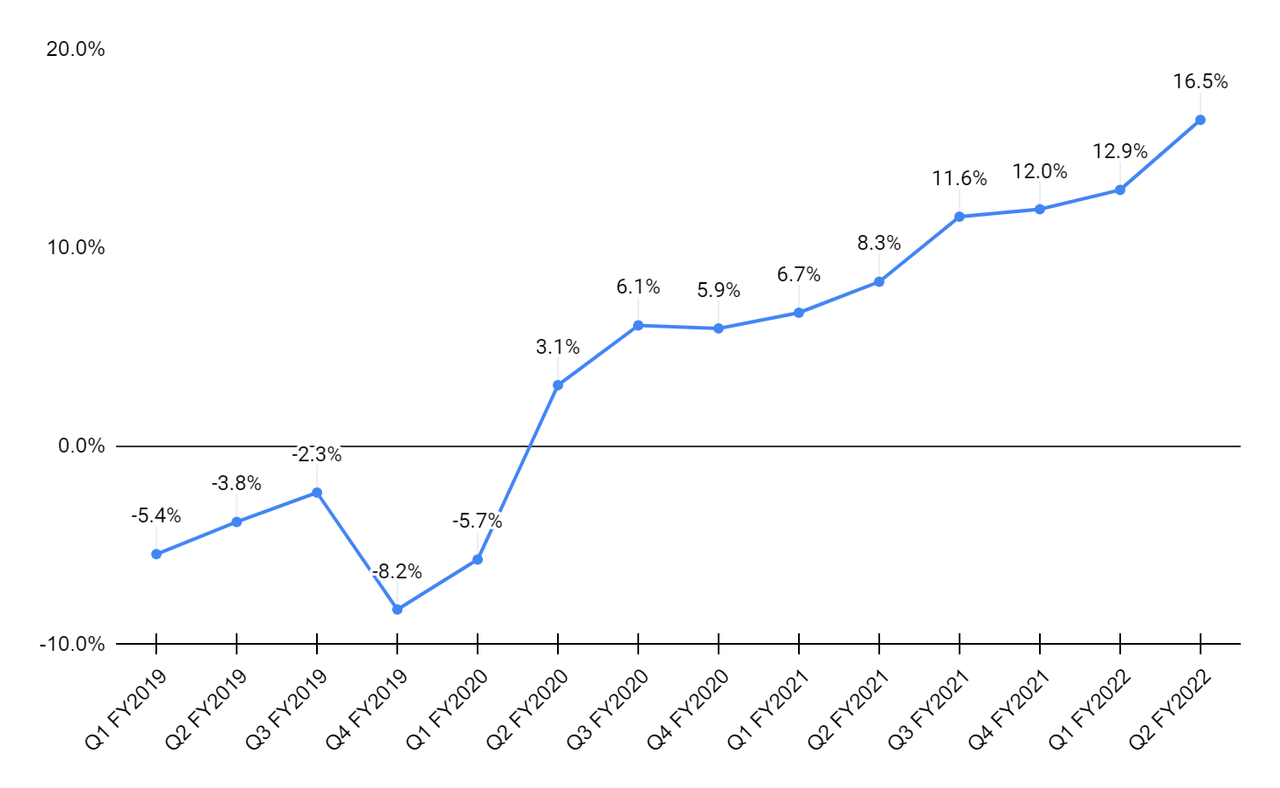

AGCO’s margin has improved from Q1 FY18 to Q1 FY22 by 620 bps. Over the last few years, the company has focused on cost reduction and improving product positioning in terms of product mix, which helped drive margins up. In Q2 FY22, the adjusted operating margin was affected by the inflationary cost pressures as the pricing actions were not able to offset the impact on a margin basis. The North America segment margin dropped 720 bps Y/Y to 6.9% due to lower sales volume and production inefficiencies, coupled with the weaker mix and higher operating expenses. However, the South America segment margin improved 820 bps Y/Y to 16.5% due to significant increases in end market demand along with strong pricing and a healthy sales mix. The Europe segment margin declined 130 bps Y/Y to 11% due to lower production and cost inefficiencies. The Asia Pacific/Africa segment margin improved 260 bps Y/Y to 14.1% due to an improved sales mix.

AGCO’s adjusted operating margin (Company data, GS Analytics Research) South America segment margin (Company data, GS Analytics Research)

Due to a product line transition and a lack of available products in the South American market, the company experienced losses in FY18 and FY19, which resulted in a decline in the company’s overall margin. However, with time, the company managed to improve its margin in the region, which is now at ~12%. The company was stronger in the small equipment business in the region but is now seeing some good momentum in the high horsepower equipment that serves big farms. The high horsepower equipment is typically a higher margin product and improves the mix of product offerings. The company also made changes to its distribution network and brought Fendt products and the Momentum planter to the region. The company was ahead of the inflationary pressures in Brazil by increasing prices, which helped to improve the margins. The company expects this to continue for the rest of the year.

Beyond this unusual inflationary period, the company is focused on improving its margins by growing in high-margin areas, reducing costs, and improving efficiencies. The company’s plan to take Fendt-branded products globally will be accretive to its margin as Fendt offers high-margin products, and with the expansion in North America and South America, the company has good growth opportunities. Precision Planting provides a lot of innovative precision agriculture technology through a retrofit channel, and that is driving good margin improvement. The company has also improved its fill rates, which is how well stocked the company is with its parts and the consistency of parts availability. This should help improve the company’s margin as it is one of the highest. margin businesses. This should drive the company’s adjusted operating margin well beyond 10%.

Operating margins are expected to be higher in the third quarter of FY22 with continued strong market conditions and pricing offsetting the effects of material cost inflation. The company is also witnessing growth in its high horsepower equipment, which has high margin profiles, supporting the margin growth prospects in 2H FY22. The operating margins in FY22 are expected to improve Y/Y as a result of higher sales, favorable pricing net of material costs, and improved factory productivity, partially offset by investments and inflationary cost pressures.

Valuation & Conclusion

AGCO is currently trading at 8.97x FY22 consensus EPS estimate of $11.84 and 8.36x FY23 consensus EPS estimate of $12.70, which is at a discount to its five-year average forward P/E 16.25x. The company has a strong order board, and with the pricing actions taking place along with increased production hours, AGCO should be able to improve its revenue in FY22. AGCO’s strategy to focus on optimizing existing businesses and accelerating precision agriculture and digital capabilities to provide profitable growth should be beneficial in the long term. The company is expanding its Fendt business in other regions and making acquisitions to grow the Precision Ag business to improve sales. Both businesses are accretive to margins. As the supply chain constraints ease, I believe the company should be able to increase its sales, and with pricing actions taking place, it should be able to improve its margins. Hence, I have a buy rating on the stock.

Be the first to comment