AsiaVision

In this analysis of Adyen N.V. (OTCPK:ADYEY), we analyzed the company’s transaction volumes from POS as the company recently announced its new payment terminals and partnership with Apple (AAPL) Pay Tap to Pay. In 2021, the company’s POS payment volumes surged by 100.6% accounting for 12.5% of total volumes based on its annual report.

High Growth of POS Volumes of 62.3%

|

Adyen Transaction Volumes (EUR bln) |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

POS Transaction Volume |

16.6 |

29.2 |

32.2 |

64.6 |

104.8 |

164.9 |

251.0 |

369.7 |

525.9 |

|

Growth % |

75.9% |

10.3% |

100.6% |

62.3% |

57.3% |

52.3% |

47.3% |

42.3% |

|

|

% of Total Processed Volume |

10.4% |

12.2% |

10.6% |

12.5% |

13.6% |

14.9% |

16.3% |

17.9% |

19.7% |

|

Total Processed Volume |

159.0 |

239.6 |

303.6 |

516.0 |

769.5 |

1,109 |

1,543 |

2,069 |

2,672 |

|

Growth % |

50.7% |

26.7% |

70.0% |

49.1% |

44.1% |

39.1% |

34.1% |

29.1% |

Source: Adyen, Khaveen Investments

Based on the table above, Adyen’s POS transaction volumes had grown at a 3-year average of 62.3% which is higher compared to its total transaction volume growth average of 49.1%. Its POS as a % of total volume had increased in 2019 but fell in 2020 with the pandemic but increased again in 2021 to a high of 12.5%.

Recently, Adyen announced the launch of its new payment terminal hardware devices which allows merchants to accept cash and manage inventory and was expected to launch this year with Europe and North America as the initial markets. Thus, we believe Adyen’s new payment terminals highlight its continued focus to expand in the POS payments and grow its revenues.

We projected the company’s POS volume growth based on its 3-year average of 62.3% in 2022 which is higher compared to its 3-year average of 49.1% for its total processed volume growth but tapered down by 5% per year as a conservative estimate. Thus, we expect its POS volumes as a % of total volumes to increase to 19.7% by 2026 from 12.5% in 2021.

Maintaining Competitiveness with Apple Pay Partnership

Furthermore, Adyen also announced that it launched Apple Pay Tap to Pay in July. According to Adyen, this new feature allows merchants:

to use iPhones to accept contactless payments without the need to purchase or manage additional hardware.

Adyen also highlighted some partnerships including with NewStore to enable retailers to use Tap to Pay.

Currently, the Tap to Pay feature by Apple is only limited to the US. There are an estimated 116.3 mln iPhone users in the US based on eMarketer and 75% have activated Apple Pay according to Yahoo Finance. Based on a 2021 study by Pulse, Apple Pay was the most popular mobile wallet in the US accounting for “92% of all mobile wallet transactions” which highlights its dominance. However, according to a survey by Yahoo Finance, only 22% of respondents use Apple’s Tap to Pay feature compared to 75% for Apple Pay.

|

Companies |

Accepts Apple Pay |

Integration with Tap to Pay |

|

Adyen |

Yes |

Yes |

|

Global Payments (GPN) |

Yes |

N/A |

|

First Data, Clover (Fiserv) (FISV) |

Yes |

N/A |

|

FIS Global (FIS) |

Yes |

N/A |

|

PayPal (PYPL) |

Yes |

Yes |

|

Square (Block) (SQ) |

Yes |

Yes |

|

Stripe |

Yes |

Yes |

Source: Company Data, Khaveen Investments

We compared Adyen against its competitors in terms of acceptance of the Apple Pay payment method and integration with Tap to Pay in the table above. As seen in the table, all companies accept Apple Pay which is unsurprising with the popularity of the mobile wallet. Moreover, Adyen, PayPal, Square and Stripe have integrations with Apple’s new Tap to Pay feature. That said, we believe that while Adyen is one of the 4 companies on the table with Tap to Pay integration, we expect other competitors to integrate with Tap to Pay as they already accept Apple Pay. Therefore, we believe that Adyen’s partnership with Apple for Tap to Pay would not provide it a competitive advantage as its top competitors also integrate their platform with Tap to Pay.

Most Competitive Fee Structure Against Top Competitors

Finally, we compared the company’s POS fees with its competitors to determine its competitiveness against competitors in the following table below. Adyen charges a fee of EUR0.10 plus a variable fee depending on the payment method used. We estimated the company’s average variable fee % by first calculating its fixed fee revenue based on its fixed fee and an estimated number of transactions of 17.6 bln in 2021 which we derived from its 2017 transactions at 3.7 bln growing at its historical yearly total processed volume growth. We subtracted the fixed fee revenue of EUR 1.8 bln from its 2021 revenue which leaves us with EUR4.43 bln and then we divided it by its total volumes of EUR516 bln to obtain its average variable fee of 0.9%.

|

Companies |

Total Revenue ($ mln) |

Average Transaction Fee (Fixed) |

Average Transaction Fee (Variable) |

Average Monthly Fee |

|

Adyen |

7,092 |

EUR0.1 ($0.10) |

0.9% |

N/A |

|

Global Payments |

8,524 |

$ 0.19 |

0.8% |

$ 10 |

|

First Data, Clover (Fiserv) |

16,226 |

$ 0.33 |

2.0% |

$ 20 |

|

PayPal |

25,400 |

$ 0.09 |

2.3% |

N/A |

|

Square (Block Inc) |

17,661 |

$ 0.10 |

2.6% |

N/A |

|

Stripe |

12,000 |

$ 0.50 |

3.4% |

N/A |

Source: Company Data, Khaveen Investments

As seen above, Adyen is the smallest company by revenue at $7.1 bln followed by Global Payments while PayPal and Square have the highest revenues. In terms of fees, all companies charge a fixed fee and a variable fee. Adyen is tied with Square with the second lowest fixed fee of $0.10 while PayPal has the lowest fixed fee of $0.09. Whereas in terms of variable fees, Adyen has the second lowest variable fee an average of 0.9% compared to Global Payments which has the lowest average fee of only 0.8%. Lastly, in terms of monthly fees, Adyen as well as PayPal, Square and Stripe do not charge monthly fees unlike Global Payments and First Data. To determine which company has the most competitive fees overall, we ranked these companies based on the transaction fees (fixed & variable) and monthly fees with the highest rank for the most competitive company.

|

Companies Ranking |

Transaction Fee (Fixed) |

Transaction Fee (Variable) |

Monthly Fee |

Average Ranking |

|

Adyen |

2 |

2 |

1 |

1.7 |

|

Global Payments |

4 |

1 |

5 |

3.3 |

|

First Data, Clover (Fiserv) |

5 |

3 |

6 |

4.7 |

|

PayPal |

1 |

4 |

1 |

2.0 |

|

Square (Block Inc) |

2 |

5 |

1 |

2.7 |

|

Stripe |

6 |

6 |

1 |

4.3 |

Source: Khaveen Investments

Based on our ranking, we ranked Adyen as the overall leader with the most competitive fees with an average ranking of 1.7, the best among its competitors with a ranking of 2 for both fixed and variable fees and tied at first with no monthly fees. PayPal follows this with the second-best average ranking of 2.0 despite its high variable transaction fee. On the other hand, we ranked First Data as the worst in terms of fees with its high fixed and variable transaction fees on top of its monthly fees which is the highest among competitors.

|

Adyen Transaction Volume (EUR bln) |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

POS Transaction Volume |

29.2 |

32.2 |

64.6 |

104.8 |

164.9 |

251.0 |

369.7 |

525.9 |

|

Growth % |

75.9% |

10.3% |

100.6% |

62.3% |

57.3% |

52.3% |

47.3% |

42.3% |

|

% of Total Processed Volume |

12.2% |

10.6% |

12.5% |

13.6% |

14.9% |

16.3% |

17.9% |

19.7% |

|

Total Processed Volume |

239.6 |

303.6 |

516.0 |

769.5 |

1,109 |

1,543 |

2,069 |

2,672 |

|

Growth % |

50.7% |

26.7% |

70.0% |

49.1% |

44.1% |

39.1% |

34.1% |

29.1% |

|

Take Rate |

1.10% |

1.20% |

1.20% |

1.17% |

1.17% |

1.17% |

1.17% |

1.17% |

|

POS Revenue |

0.32 |

0.39 |

0.78 |

1.22 |

1.92 |

2.93 |

4.31 |

6.14 |

|

Growth % |

93.5% |

20.3% |

100.6% |

57.8% |

57.3% |

52.3% |

47.3% |

42.3% |

|

Total Revenue |

2.64 |

3.64 |

6.19 |

8.98 |

12.94 |

18.00 |

24.14 |

31.17 |

|

Growth % |

65.8% |

38.2% |

70.0% |

45.0% |

44.1% |

39.1% |

34.1% |

29.1% |

Source: Adyen, Khaveen Investments

All in all, we believe that Adyen has the most competitive fees based on our ranking of its fixed and variable transaction fees which are the second lowest among competitors and tied at first place with no monthly fees. On the other hand, we believe PayPal is the second most competitive with the lowest fixed fees despite its high variable fees while First Data ranked as the lowest with high transaction and monthly fees. We projected the company’s revenue growth based on our forecast of its transaction volume growth by POS and its total processed volume with the 3-year average take rate of 1.17%. We projected its revenue to grow at an average of 38.3% and its POS revenue to grow by 61.4% by 2026.

Risk: Larger Competitors

Based on the comparison with its competitors, Adyen is the smallest company by revenue among its top rivals. The company faces competition from larger competitors who also have similar competitive integrations such as Apple Pay and Tap to Pay which Stripe was the first to integrate with Apple. Thus, we believe the company’s competitiveness is dependent on its attractive fees with a low take rate of 1.2%.

Verdict

All in all, we expect its POS volumes to continue growing at 62.3% on average until 2026 as the company focuses on growing its POS transactions with the launch of its new payment terminals and integration with Apple Tap to Pay but we do not expect it to provide a competitive advantage to the company as its top competitors also have the integration with Apple. Compared to its competitors, we determined that Adyen is the most competitive in terms of fees based on our rankings of its fixed and variable fees which are the second lowest among competitors and tied at first place with no monthly fees. In terms of revenues, we projected its POS revenue growth to average 51.4% with a 3-year average take rate of 1.17%.

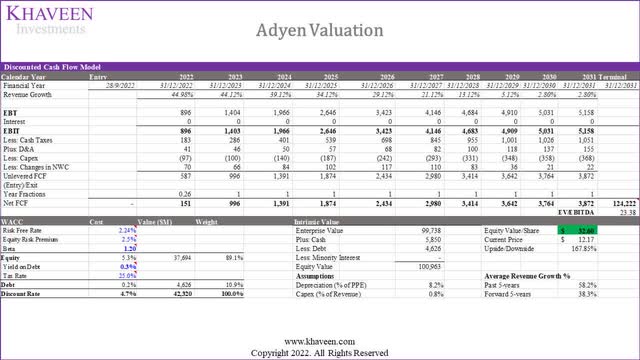

Overall, we updated our DCF valuation of the company and obtained a higher upside of 168% with a target price of $32.60 as the company’s stock price had declined by 60% over the past 1 year, thus we maintain our Strong Buy rating.

Be the first to comment