EvanaFalconFotografia/iStock via Getty Images

Investment Thesis

Republic Services, Inc. (NYSE:RSG) is one of the 2 largest players in the waste management industry, effectively forming a duopoly that owns and manages most of the largest landfills in the United States.

Being one of the duopolies means it has a ‘respectable’ advantage over other smaller players outside the duopoly. However, within the duopoly, it is the smaller player and hence, is expected to face significant competition from Waste Management, Inc. (WM), which is the larger player within the duopoly.

Waste Connections, Inc (WCN), which is a smaller player outside the duopoly, has a business strategy that allows it to avoid competing directly with the much larger duopoly. This is an advantage that RSG does not have as it still has to deal with the competition from WM.

As such I think it is more worthwhile to invest in WM and/or WCN rather than RSG. In later sections, I elaborate in more detail on how I arrived at this conclusion.

Company Overview

From the company’s latest quarterly report, this is what we can understand about the company’s business:

- RSG is “one of the largest providers of environmental services in the United States, as measured by revenue”. If we measure by market capitalization, RSG is second only to WM in the “Waste Management” industry classified by Finviz.

- The company operates facilities for providing general waste management services like collections, transfer stations, landfills, recycling processing centers, treatment, recovery, disposal, and storage facilities. These are not very different from what other waste management companies are providing.

- On May 2, 2022, RSG completed the acquisition of US Ecology, a “leading provider of environmental solutions offering treatment, recycling and disposal of hazardous, non-hazardous and specialty waste”.

The latest Q1 2022 financial figures saw the company reporting mostly positive results on the top and bottom lines, based on a year-on-year comparison between 2021 and 2022:

- Revenues increased from 2,595.9M to 2,968.8M.

- Net Income increased from 296.4M to 351.9M.

- Cash provided by operating activities increased from 661.0 M to 705.6M.

- Adjusted free cash flow increased from 464.2M to 530.9M.

One of the (smaller) Duopolies of the Garbage Industry

According to CNBC, “Two private companies, Waste Management and Republic Services lead the solid waste management sector. Together they own about 480 landfills out of the 2,627 landfills across the United States”. Quantitatively, this implies WM and Republic Services collectively owns just 18% of the landfills in the US. But if we focus on the ownership of only the largest landfills, we can observe how the 2 companies lead the industry.

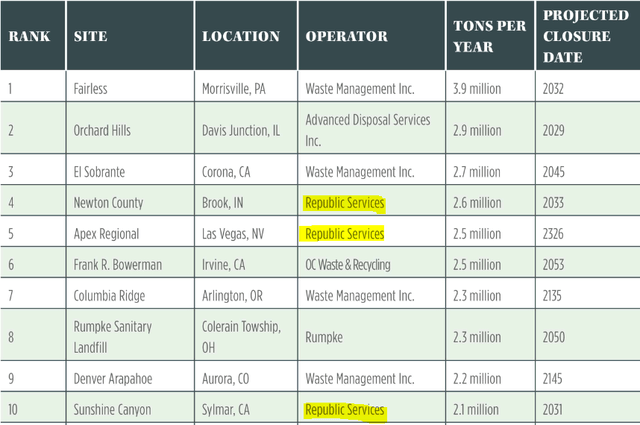

According to this article, which “ranks the largest 30 landfills in the U.S”:

- WM operated 5 landfills and managed 11.9 tons of waste per year.

- Republic Services owns 3 of the top 10 landfills and manages 7.2 tons of waste per year.

- ‘OC Waste & Recycling’ and ‘Rumpke’ own 1 landfill each and managed just 2.5 tons and 2.3 tons of waste per year, respectively.

Largest Landfills List (Waste Today Magazine)

The 10 largest landfill manages 23.9 tons of waste per year in total. That means:

- WM manages 49.8% (11.9/23.9) of waste per year.

- RSG manages 30.1% (7.2/23.9) of waste per year.

From this perspective, RSG is observed to manage significantly less proportion of waste per year compared to WM, although both of them collectively dominated 8 out of the top 10 ownership of landfills.

As one of the duopolies of the Waste Management industry, while RSG enjoys a significant competitive advantage over other smaller players, it is also significantly challenged by being the smaller player within the duopoly.

Strategic Comparison with WM and WCN

WM is the clear leader in terms of market capitalization and landfill ownership as discussed in earlier sections. As one of the duopolies, it is also the larger player. This presents a very clear competitive advantage in terms of the dominance of market share as I discussed in detail in one of my articles covering WM.

WCN, on the other hand, has a ‘unique’ advantage of its own. In another of my article covering WCN, I describe how WCN ‘adopted a unique strategy of serving rural clients with exclusive waste management arrangements to fend off competition’. Using this strategy, WCN adds more value to customers by taking ownership of the entire waste stream end-to-end. While I noted that WCN’s strategy may not be superior to that of WM’s market dominance, it is still a ‘unique’ and ‘identifiable’ advantage in its own rights to shield itself from WM and RSG.

If I perceive RSG as one of the duopolies in the industry, despite its advantage of size at the larger industry level similar to WM, being the smaller of the 2 players ‘within‘ the duopoly, it does not have a clear advantage over WM.

If I compare RSG with WCN, although RSG is significantly larger in terms of its size, I cannot confidently conclude RSG is in a better competitive position than WCN. After all, with its unique strategy as described earlier, WCN is able to shield itself from WM and RSG’s competition by not competing with them directly in landfill ownership. RSG still has to deal with significant competition from WM.

Overall, in my opinion, due to the above reasons, I am more comfortable investing in either WM and/or WCN due to their relatively ‘identifiable’ competitive advantage. However, if I am already holding a position of RSG shares, I will not sell them at a loss below my entry price. After all, as the 2nd largest player, it still has a ‘respectable’ advantage in the overall industry.

Financial Comparison with Competitors

We will compare the financials with some of RSG’s peers:

- Waste Connections, Inc.

- GFL Environmental Inc. (GFL)

- Waste Management, Inc.

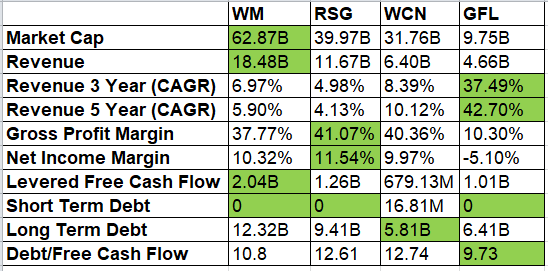

Key Financial Ratios (Seeking Alpha)

- We can observe that WM and RSG are the largest players in the comparison list in terms of market capitalization. This is not surprising as they hold the current duopoly in landfill ownership as described earlier.

- Earlier, we discussed that RSG faced significant competition from the larger player of WM. This is reflected in the slightly lower long-term growth rate of RSG in terms of 3 and 5-year CAGR.

- As we drill down to the bottom line margin figures of Gross and Net income, RSG is roughly tied with WM and WCN. This suggests that WCN’s unique strategy to fend off the competition from WM and RSG appears to be working since it can still maintain roughly the same margin levels despite having a much smaller revenue base.

- In terms of cash and debt profiles, all the players on the comparison list are cash positive but they also incur roughly 10 to 13 times more debt. All the players are observed to be financially highly leveraged.

In my opinion, WM, RSG, and WCN have very similar financial profiles. For GFL, its financials present itself as a much smaller but fast-growing player in the comparison list. It has a much smaller gross profit and is currently not profitable by net income. Despite growing much faster, it has a lot of catching up to do to rise above the competition from the other much larger players.

Valuation

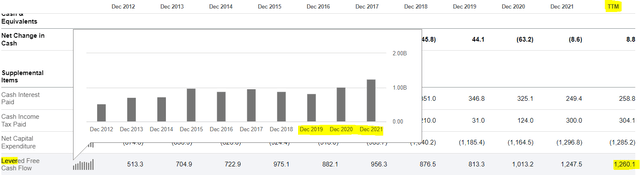

From Seeking Alpha’s cash flow data, RSG has a free cash flow (“FCF”) that is generally increasing consistently since 2019, suggesting that the growth is likely to be sustainable in the long run. We will use the FCF from the TTM period (1,260.1M) in our calculation of intrinsic value.

Levered Free Cash Flow (Seeking Alpha)

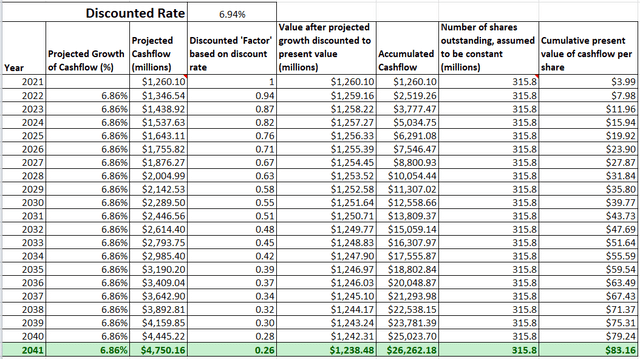

We will make the following additional assumptions when evaluating the intrinsic value of the company:

- From Seeking Alpha’s observation of ‘Compound Annual Growth Rates (“TTM”)‘, the growth rate for Levered Free Cash Flow for the last 5 years is 6.86%. This is very close to the ‘mean value’ of the US GDP growth rate of 6.37%. As a defensive company, I think it is reasonable to assume RSG will grow its free cash flow at this rate of 6.86% for the next 20 years.

- The discount rate is estimated to be 6.94%, taken from the WACC value.

- I assume RSG may not exist beyond 20 years. As such, Terminal Value will not be included in the calculation of intrinsic value.

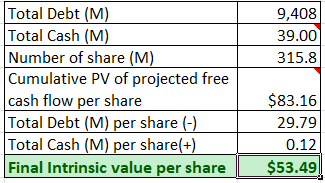

Intrinsic Value (Author’s Calculation)

Based on the above inputs, the present value (“PV”) of projected free cash flow per share for RSG is $83.16

Intrinsic Value (Author’s Calculation)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is $53.49

The current price of around $120.73 implied the stock is currently overvalued.

Investment Risk

Generally, most waste management companies in our comparison list discussed earlier incur a significant level of debt. In the current environment where interest rates are increasing, companies with high levels of debt will hurt more due to the need to incur higher interest expenses. Right now, RSG is having 319.7M in interest expense and 2,831.3M in operating cash flow. That means the interest expense is 11.3% of its operating cash flow, which, in my opinion, is considered low. Investors should monitor and ensure that this percentage does not go up to more than 30%.

Conclusions and Key Takeaway for Investors

As discussed above, the waste management industry is dominated by WM and RSG in terms of ownership of landfills. Despite being one of the largest players in the industry, RSG still faces significant competition from WM.

RSG is bigger than WCN but it does not have an ‘identifiable’ advantage like WCN as discussed earlier.

Overall, in my opinion, investors should be considering investing in WM and/or WCN when they become undervalued due to their relatively ‘identifiable’ competitive advantage as discussed earlier. Even if investors already have a current position in RSG, they do not need to sell it at a loss since RSG is still one of the largest players in the industry with a ‘respectable’ lead in terms of overall market share.

Be the first to comment