Michael Vi/iStock Editorial via Getty Images

Ridesharing has proven to be an important new industry, approaching $100 billion in gross bookings, not including delivery, based on financial reports from the three largest companies. In its 2022 Investor Day presentation, Uber estimates a run rate for mobility gross bookings of $45 billion. Lyft (LYFT) had net revenue of almost $900 million in the first quarter of 2022, which extends to $3.6 annually, equating to approximately $15 billion of gross bookings. DiDi (OTCPK:DIDIY) claims to be the world’s largest mobility platform, with its dominant business in China. It had $25 billion in revenue in 2021 and approximately $40 billion in gross transaction value. All three of these expect to grow rapidly in 2022 as they are still recovering from the COVID setbacks.

However, it is an unprofitable labor-intensive business model, with more than 75% of the cost going to drivers. Uber’s (NYSE:UBER), and other ridesharing companies, path to profitability is to replace the cost of drivers with autonomous driving. This will be the new autonomous ride services model.

Uber is valued at $46 billion but has yet to earn a profit and most likely won’t until it replaces its drivers with autonomous driving. Autonomous ride services will also expand the ridesharing market with significantly lower prices. So the strategic question for Uber is will it be able to make this transition, or will new better-positioned competitors seize the opportunity?

A few months ago, I wrote a popular SA article, ‘Notable Progress At Cruise Increases GM’s Value’. I described the unique opportunity to invest in GM (NYSE:GM) and get the enormous potential of Cruise as a bonus. This is still the opportunity, but I won’t repeat the article here. Instead, I’ll compare GM’s Cruise to Uber in the upcoming battle for the new autonomous ridesharing business. There are also other companies involved in the competition. Lyft is in a similar situation as Uber and has a similar strategy. New Autonomous Ride Services companies include Waymo (GOOG), which is a co-leader in the new market with Cruise, as well as Ford/Argo (F), Aurora, Zoox, Motional, and possibly Apple (AAPL). I expect Waymo to be very successful, but the investment opportunity is lower because of Alphabet’s higher valuation of $1.4 Trillion is much more than GM’s $50 billion.

We’ll start by looking at how Uber perceives the opportunity and threat of autonomous driving and then at its strategy. I’ll define the platform required for delivering autonomous ride services and show the advantages Cruise has over Uber. Finally, I’ll summarize the unique opportunity to invest in GM with Cruise as a bonus.

Uber

Uber is a large global business that is worth $46 billion but has yet to make a profit. In its first quarter of this year, Uber had $26.5 billion of gross bookings but only $6.8 billion in revenue. The other $20 billion went to its drivers, including the cost of driver vehicles. It charges approximately $16 – $35 (depending on the level of service and the city) for a typical 7-mile trip ($2.25 – $5.00 per mile). The driver gets $12 on the $16 plus a tip, with some of this payment covering the cost of the driver’s vehicle. The cost of a driver’s vehicle for that trip is estimated at $5, using IRS mileage reimbursement rates and additional miles for the pick-up.

This leaves Uber with only $4 per trip. This equates to $6.8 billion in revenue this quarter, but its expenses were higher, so it lost money. Uber is also under a lot of pressure to increase driver compensation, especially by classifying them as employees with additional benefits and taxes.

Uber, and other ridesharing companies, also have safety issues with a small portion of their drivers. According to the Washington Post (12/5/19), Uber disclosed that 3,000 sexual assaults were reported on its US rides in 2018. According to NPR (10/22/21), Lyft received an increasing number of reports of sexual assault, including more than 1,800 in 2019, according to a company safety report. These cases may have reduced in recent years, but the safety issue may remain a concern for some riders. Autonomous vehicles won’t have these risks.

Are AVs an Uber opportunity?

Autonomous vehicles allow Uber to make money by eliminating the cost of drivers. It could take back most of that other 75% when are no drivers to pay.

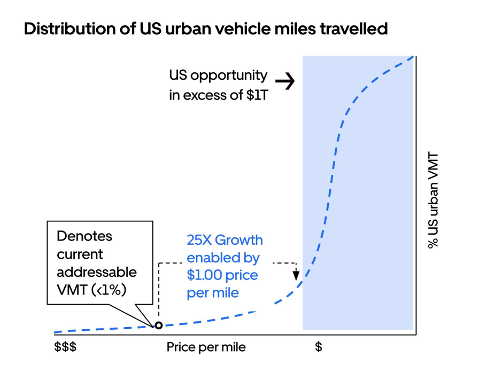

It can also expand its market by lowering prices. Uber predicts that a cost per mile reduction to $1, which is feasible with autonomous vehicles, could increase its market opportunity by 25X to more than $1 trillion in the US alone.

Projection of Market (Uber Investor Day Presentation 2022)

This all depends on Uber making a successful transition to autonomous driving before or better than others. If it doesn’t, autonomous ride services could displace ridesharing and threaten its future.

Or a Threat!

Uber acknowledged this threat in its 2021 10-K.

If we fail to offer autonomous vehicle technologies on our platform or fail to offer such technologies on our platform before our competitors, or if such technologies fail to perform as expected, are inferior to those offered by our competitors, or are perceived as less safe than those offered by competitors or non-autonomous vehicles, our financial performance and prospects would be adversely impacted.

We believe that autonomous vehicle technologies may have the ability to meaningfully impact the industries in which we compete and that autonomous vehicles present substantial opportunities. Several companies other than Aurora, including Waymo, Cruise Automation, Tesla, Apple, Zoox (which Amazon has acquired), Aptiv, and Nuro, are developing autonomous vehicle technologies, either alone or through collaborations with car manufacturers, and we expect that they will use such technology to further compete with us in the mobility, delivery, or logistics industries. Waymo has already introduced a commercialized ridehailing fleet of autonomous vehicles, and it is possible that our competitors could introduce autonomous vehicle offerings earlier than we will be able to offer autonomous vehicles on our platform through our commercial agreement with Aurora or other partners. In the event that our competitors bring autonomous vehicles to market before we are able to offer autonomous vehicles on our platform, or their technology is or is perceived to be superior to the technology of parties with which we partner to offer autonomous vehicles on our platform, they may be able to leverage such technology to compete more effectively with us, which would adversely impact our financial performance and our prospects. For example, use of autonomous vehicles could substantially reduce the cost of providing ridesharing, delivery, or logistics services, which could allow competitors to offer such services at a substantially lower price as compared to the price available to consumers on our platform. If a significant number of consumers choose to use our competitors’ offerings over ours, our financial performance and prospects would be adversely impacted.

Uber’s strategy for autonomous driving relies on working with various partners. In January 2021, it disposed of its autonomous technologies business to Aurora and included a $400 million investment in Aurora, along with a commercial agreement to collaborate on the launch and commercialization of autonomous vehicles on its ridesharing network.

Even if Uber isn’t very successful in autonomous ride services, it will still continue to use a driver-based model. Autonomous ride services will initially focus on southern and western cities, so driver-based services will still be used in rural communities and some Northern cities for many years. It will just be less profitable.

Let’s now look more closely at the autonomous ride services platform and what will be required to succeed. This shows how Uber will fall short of others, specifically GM Cruise.

The Autonomous Ride Services Platform

Products and services in any industry, but especially technology industries, are generally based on a platform of multiple layers. I’ve written about this previously in several books.

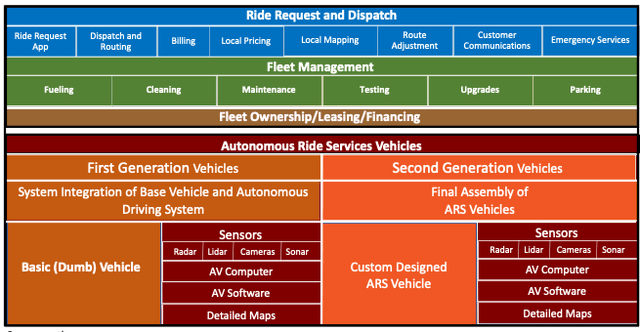

The diagram below illustrates the layers and components of the autonomous ride services platform. Let’s compare how Uber and Cruise are prepared to offer autonomous ride services by looking at the layers of this platform.

Autonomous Ride Services Platform ( Autonomous Vehicles: Opportunities, Strategies, and Disruptions)

Ride Request and Dispatch. This is the customer-facing layer. It includes the ride request app, which is Uber’s strength. The dispatch and routing of autonomous vehicles are very different from requesting drivers to respond to a trip request. It requires a sophisticated computer system to keep track of all autonomous vehicles and optimize utilization.

Cruise has developed and released its own app — Cruise Anywhere, which appears to work fine. Cruise has developed and is testing its dispatch systems. The other components are more local services that either Uber or Cruise could supply.

Fleet Management. Uber has no plans to manage an autonomous fleet. It will partner with others to provide the vehicles. Cruise is building its first fleet maintenance and charging facility at 640 Cesar Chavez St. in San Francisco.

Fleet Financing. Since Uber doesn’t plan to own a fleet, someone else will need to finance the AVs. Cruise has $5 billion to fund the first 100,000 or so vehicles in its fleet.

Autonomous Vehicles. An autonomous vehicle consists of the basic vehicle, the sensor suite of cameras, lidars, radars, and most importantly, the autonomous vehicle software. Uber intends to partner on all of these. One Uber partner is Aurora, which plans to charge a service fee for its autonomous driving software of $0.30 to $0.50 per mile. While this is less than the approximately $1 per mile a driver gets (net of the cost of his vehicle), it is still very expensive and takes most of the savings. It also gets to be prohibitively expensive at lower price levels.

Cruise has developed its own autonomous driving technology, sensor suite, and autonomous software. There are two variations of vehicles used for autonomous driving: standard vehicles customized for autonomous driving and vehicles custom-built for autonomous driving without any driver controls. Waymo is using the customized approach so far with its autonomous ride services. Cruise has designed the Origin for autonomous ride services without any driver controls. GM plans to manufacture tens of thousands of these next year.

The key strategic question when you look at the platform as a value chain is who will take what portion of the value. Uber will need to extract a large portion of the fees for simply providing the user interface for it to be successful.

Cruise Strategy

Cruise, on the other hand, has invested tens of billions in developing the entire autonomous ride services platform. It intends to control the entire value chain and garner all the revenue.

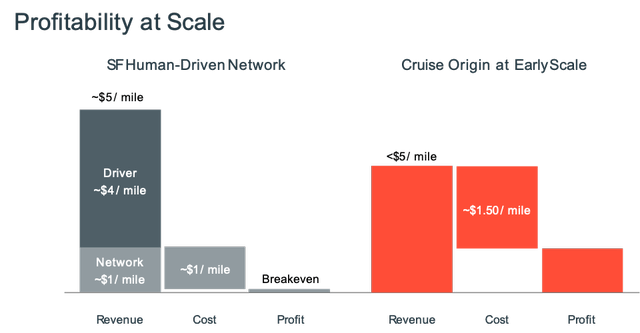

Compared to Uber’s current service, Cruise believes it will have significant cost advantages. It provided the following chart in its investor presentation to make that case. It uses the price of $5 per mile, which is the approximate price for Uber Select in SF. For comparison, it shows that it can be very profitable at a lower price.

Profitability at Scale (GM/Cruise Investor Presentation 9/21)

Cruise has developed its autonomous driving technology and has completed significant testing. Over the last five years, Cruise drove more than 2 million miles in San Francisco, its first market. It just was the first to obtain the permits for a customer-paid driverless autonomous ride service in San Francisco. Initially, some restrictions limited it to 30 autonomous vehicles, restricted speeds and hours, and certain limited locations. As it proves to be safe and successful, it will be able to expand these limits.

It’s important to note that there have been a couple of insignificant incidents that receive a lot of press. In one case, a few Cruise AVs clustered together, temporarily disrupting traffic, and there was an accident where another car sped through an intersection and hit a Cruise AV that was turning legally.

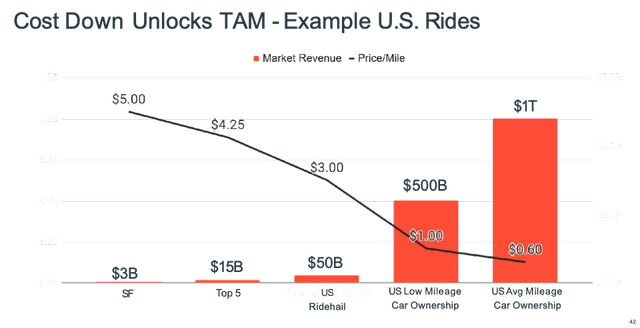

Beyond its first market in San Francisco, Cruise has an aggressive rollout plan. One of its executives stated, “This race is about getting us into tens of cities with hundreds of thousands of vehicles.” The following chart illustrates its strategy. Its first market, San Francisco, it expects a price/mile of $5 and an available market of $3 billion per year. If it initially achieves 20% of the SF market, it would generate $600 million in revenue by employing 800-1,000 Origin vehicles.

It expects to reduce the cost per mile in the next top 5 markets, which are about a $15 billion market opportunity. The US ridesharing market is estimated at $50 billion, and cruise expects to reduce its price per mile to $3. Like Uber’s projections, it estimates a $1 trillion market in the US when prices get reduced to $1 per mile. Even at $1 per mile, autonomous ridesharing can be profitable given sufficient utilization and reduction in vehicle costs.

Expanding Market at Lower Prices (GM/Cruise Investor Presentation 9/21)

GM: A Unique Investment Opportunity

In October 2021, at its investor presentation, Cruise made some bold claims projecting that it could grow to $50 billion in revenue in six years and have margins in the ballpark of 40%. GM reaffirmed this projection a few days ago on its Q2/22 earnings call: “The permit received by Cruise is a major event in the overall objective to pursue $50B potential annualized revenue by the end of the decade and continues to validate GM’s bullish approach on the AV strategy.”

Any estimate for operating costs and P/E ratio on this $50 billion estimate suggests a market value for Cruise of multiple hundreds of billions. Most likely, this is overly optimistic but does indicate significant upside potential.

GM owns approximately 80% of Cruise after buying back Softbank’s ownership share. In 2021, Cruise had outside investors, including Honda and Microsoft, that valued it at $30 billion. If you deduct GM’s 80% share of this $30 billion from GM’s market cap, then the remainder of the company would be valued at a paltry $26 billion. This is about $16 per share with a P/E of 3X. So, investors aren’t assigning any value to Cruise.

The point of this is that GM is a truly unique buying opportunity. At $34 per share, there is not only tremendous upside, but you also get what could be one of the hottest companies in cruise essentially as a free bonus. BofA has a price target of $90 for GM and sees its potential.

Be the first to comment