IRA_EVVA/iStock via Getty Images

Water is incredibly important for our day-to-day lives. This is true pretty much irrespective of its end-use application. So naturally, given the large variety of ways in which water can be utilized, it stands to reason that there would be a number of companies dedicated to operating in this space. One player, which produces innovative water management solutions in the stormwater and on-site septic wastewater industries, that is worth considering is Advanced Drainage Systems (NYSE:WMS). Despite posting strong growth on both its top and bottom lines, the company has followed the broader market lower. More likely than not, the decline it experienced has more to do with how shares were priced than any fundamental concern over the enterprise. But between the stock getting cheaper and management guiding to even stronger results this year than last, I cannot help but retain my ‘buy’ rating on the firm.

Recent performance is encouraging

The last time I wrote an article about Advanced Drainage Systems was in February of this year. In that article, I acknowledged that shares of the company were not exactly cheap. In fact, I even went so far as to call them pricey. On the other hand, I was drawn in by the strong growth the company had experienced and, given how performance had been up to that point, I said that if that strong growth persists, that shares might offer investors nice upside potential. I ultimately rated the business a ‘buy’, reflecting my belief at the time that it should outperform the market moving forward. Although the company has not performed exactly as I would have hoped, it did achieve this outperformance. While the S&P 500 is down by 13%, shares of Advanced Drainage Systems have generated a more modest loss of 8.6%.

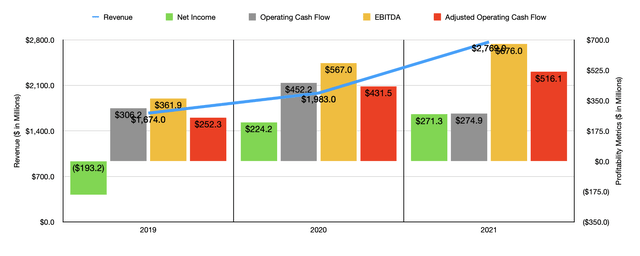

Author – SEC EDGAR Data

This relative outperformance by the business came solely as a result of strong performance from a fundamental perspective. When I last wrote about the company, I only had data covering through the first half of the firm’s 2022 fiscal year. Fast forward to today, and we now have data available through the rest of that year. For 2022 as a whole, revenue came in strong at $2.77 billion. That represents an increase of 39.6% over the $1.98 billion generated during the company’s 2021 fiscal year. Revenue for the company came in strong across the board. The strongest performance came from its Pipe segment, which saw an increase of 46.2% due to a mixture of improved pricing and product mix. Infiltrator revenue rose by 39.9%, while the Allied Products & Other segment saw revenue jump by 27.5%. Even the International segment fared well, with sales climbing by 29.7% thanks to strong performance across Canada and Mexico.

On the bottom line, performance for the company was mixed but generally positive. Take, as an example, net income. This rose from $224.2 million in 2021 to $271.3 million last year. That translates to a year-over-year growth rate of 21%. Operating cash flow actually fell, plummeting from $452.2 million to $274.9 million. But if we adjust for changes in working capital, it would have risen by 19.6% from $431.5 million to $516.1 million. Meanwhile, EBITDA for the company also improved, climbing from $567 million to $676 million. Although most of these profitability metrics were higher year over year, it is important to note that margins clearly decreased. The primary culprit seems to have been in the company’s cost of goods sold would, which rose from 65.2% of sales in 2021 to 70.4% of sales in 2022. This increase was driven by management’s inability to transfer all of the higher costs pertaining to recent inflation onto its customer base. Separate from this but also included in the company’s gross profit figures was an item related to employee stock option program acceleration and special dividend compensation to the amount of $19.2 million. But that should be considered more of a one-time item.

When it comes to the 2023 fiscal year, management still has pretty high hopes for the company. They currently anticipate revenue of between $3.1 billion and $3.2 billion. At the midpoint, that would translate to a 13.8% increase over 2022 results. And when it comes to EBITDA, the expectation is for a reading of between $800 million and $820 million. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that EBITDA should, then we should anticipate net income of $355.4 million and adjusted operating cash flow of $618.4 million.

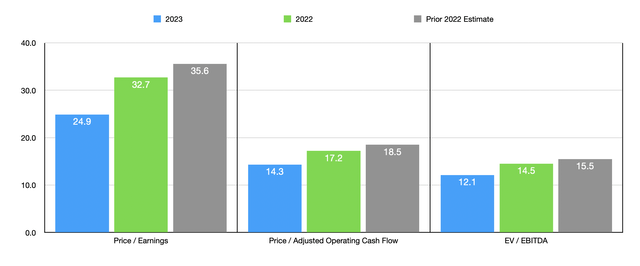

Author – SEC EDGAR Data

Given these figures, pricing the company becomes fairly straightforward. On a forward basis, the company is trading at a price-to-earnings multiple of 24.9. The price to adjusted operating cash flow multiple is 14.3. And the EV to EBITDA multiple should be 12.1. If, instead, we use the 2022 results for the firm instead of the 2023 expectations, then these multiples should be 32.7, 17.2, and 14.5, respectively. To put this in perspective, when I last wrote about the firm, my forward 2022 estimates were 35.6, 18.5, and 15.5, respectively. So between the difference in my own guidance and what actually occurred, and the decrease in price the company experienced since I last wrote about it, shares have gotten cheaper from a valuation perspective. To put the pricing of the firm into perspective even further, I decided to compare it to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 4.1 to a high of 29. And using the EV to EBITDA approach, the range was from 3.6 to 13.6. In both cases, Advanced Drainage Systems was the most expensive of the group. Meanwhile, using the price to operating cash flow approach, the range was from 6 to 21.3. And in this case, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Advanced Drainage Systems | |||

| Builders FirstSource (BLDR) | 5.8 | 6.0 | 4.1 |

| Cornerstone Building Brands (CNR) | 4.1 | 8.1 | 3.7 |

| Tecnoglass (TGLS) | 12.2 | 8.5 | 7.4 |

| Insteel Industries (IIIN) | 5.8 | 10.1 | 3.6 |

| Johnson Controls International (JCI) | 29.0 | 21.3 | 13.6 |

Takeaway

All the data provided right now seems to suggest that while Advanced Drainage Systems is experiencing some margin compression, the overall outlook for the enterprise in the near term is positive. Sales and profits should continue to rise for the foreseeable future and shares are getting cheaper as a result. On both an absolute basis and relative to similar firms, I would not call shares of the company cheap. And in all likelihood, there are better prospects on the market to be had. But for investors who want a decent firm at a good price, particularly a firm that is growing at a nice clip, Advanced Drainage Systems is definitely worth consideration.

Be the first to comment