David Tran

By The Valuentum Team

Adobe Inc. (NASDAQ:NASDAQ:ADBE) is worth keeping on your radar as shares of ADBE have sold off aggressively year-to-date, though its underlying business model remains rock-solid and it’s supported by a pristine balance sheet. Through our enterprise cash flow analysis process, which we will cover in great detail in this article, we assign Adobe a fair value estimate of $580 per share, well above where the company is trading at as of this writing. Keeping that in mind, shares of Adobe have come under fire as concerns over its near term financial performance are clouding over its promising longer term growth runway.

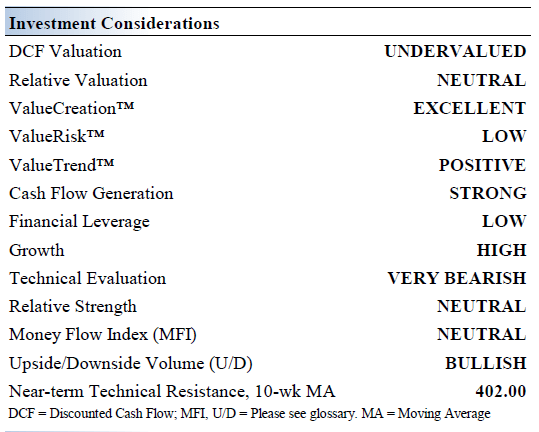

Adobe’s Key Investment Considerations

Image Source: Valuentum

Adobe is one of the largest software companies in the world. The firm’s flagship offering in its digital media business is Adobe Creative Cloud, which allows customers to download the latest version of Adobe Creative Suite products. The firm also continues to focus on digital marketing solutions. It was founded in 1982 and is based in San Jose, California.

Roughly 90% of Adobe’s revenue comes from recurring sources. Please note that Adobe’s fiscal year ends in late November or early December. We like its potential margin expansion, and its sales growth outlook as recurring revenue continues to ramp up. Recurring revenue streams provide ample visibility as it concerns Adobe’s future financial performance and result in stronger cash flow profiles. Adobe continues to gain traction with respect to Creative Cloud subscriptions, and we love this recurring, subscription-based model. Adobe Marketing Cloud is becoming a favorite of Chief Marketing Officers, as digital marketing bookings continue to expand at a nice clip. The firm expects years of growth ahead of it.

Adobe is investing in its AI capabilities to assist its customers by providing enhanced automation features across its offerings. The company is well-positioned to capitalize on the proliferation of e-commerce worldwide, particularly via its ‘Adobe Experience Cloud’ suite of products and services.

Financial Update and Guidance Commentary

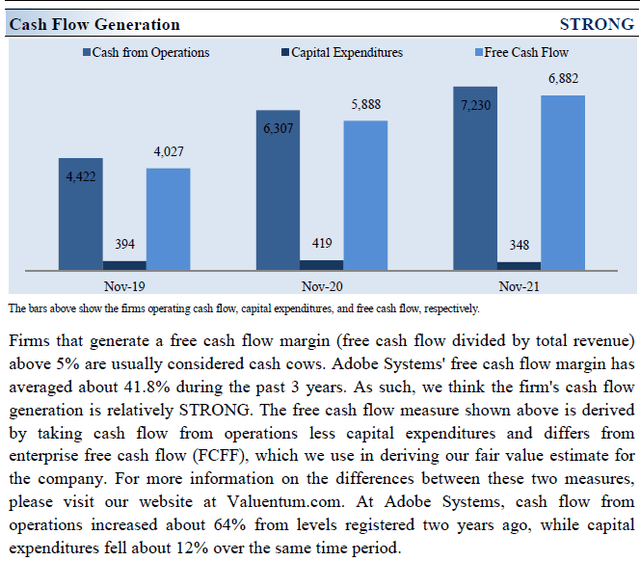

Adobe’s cash-rich business model throws off gobs of excess capital. Traditional free cash flow (defined as net operating cash flow less capital expenditures) has averaged ~$5.6 billion during the past three fiscal years (2019- 2021), helping it repurchase ~$9.8 billion in treasury stock over that time. Its asset-light operations enable significant free cash flow generation due to its relatively modest capital expenditure requirements to maintain a given level of revenues. Adobe does not pay out a common dividend at this time as management prefers to invest in the business and repurchase stock.

On June 16, Adobe reported earnings for the second quarter of fiscal 2022 (period ended June 3, 2022) that beat both consensus top- and bottom-line estimates. Its GAAP revenues rose by 14% year-over-year to reach $4.4 billion, aided by its subscription revenues growing by 16% year-over-year in the fiscal second quarter. Adobe’s GAAP operating income rose by 9% year-over-year to hit $1.5 billion in the fiscal second quarter, as its operating expense growth ate into its revenue growth. The firm’s GAAP diluted EPS hit $2.50 in the fiscal second quarter, up 7% year-over-year, as a larger provision for corporate income taxes was offset to a degree by a reduction in its outstanding diluted share count.

Adobe exited June 3 with $5.3 billion in cash, cash equivalents, and short-term investments on hand versus $0.5 billion in short-term debt and $3.6 billion in long-term debt, goods for a net cash position of ~$1.2 billion. The company generated $1.9 billion in free cash flow during the first half of fiscal 2022 while spending a negligible amount on acquisitions along with $1.2 billion buying back its stock. We appreciate Adobe’s ability to generate substantial free cash flows in almost any operating environment.

However, Adobe did lower its full year guidance for fiscal 2022 during its fiscal second quarter earnings update. The firm now forecasts that its total revenues will grow to ~$17.65 billion versus the ~$17.9 billion guidance put out during its fourth quarter of fiscal 2021 earnings update. Additionally, Adobe now expects to generate ~$9.95 in GAAP EPS (down from ~$10.25) and ~$13.50 in adjusted non-GAAP EPS (down from ~$13.70) in fiscal 2022.

Please note that its latest total revenue and non-GAAP EPS guidance still calls for 11% and 8% annual growth, respectively, while its latest GAAP EPS guidance calls for a modest year-over-year decline. Foreign currency headwinds are a significant reason why Adobe lowered its guidance for fiscal 2022, with an eye towards the strong US dollar seen of late. Additionally, its earnings guidance was negatively impacted by an expected increase in its effective corporate income tax rates. Furthermore, Adobe’s business is contending with near term headwinds due to its decision to cease all new sales in Belarus and Russia. We view these primarily as special items that are not reflective of Adobe’s underlying performance.

In our view, Adobe’s business model remains rock-solid and its underlying growth trajectory remains intact (its revenues are still expected to grow at a robust pace this fiscal year and its adjusted earnings, which removes some of the impact of the aforementioned special items, are also expected to grow at a robust pace in fiscal 2022). The company’s free cash flow generating abilities are impressive and its pristine balance sheet provides Adobe with ample firepower to buy back its stock while continuing to invest in the business. We view its share repurchases favorably given that shares of ADBE have been trading well below their fair value estimate for some time and continue to do so as of this writing.

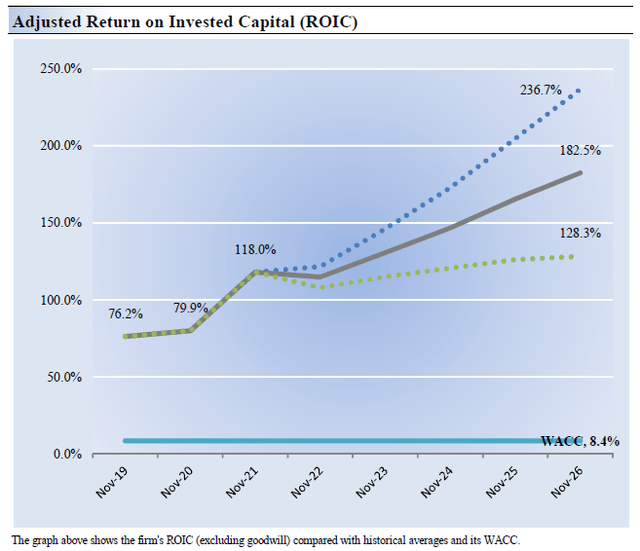

Adobe’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Adobe’s 3-year historical return on invested capital (without goodwill) is 91.4%, which is above the estimate of its cost of capital of 8.4%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Adobe has historically been a solid generator of shareholder value and we forecast that will remain the case over the coming fiscal years.

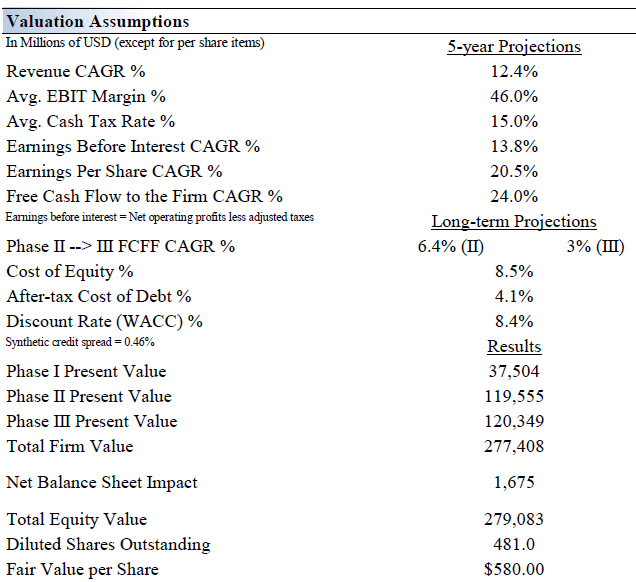

Adobe’s Cash Flow Valuation Analysis

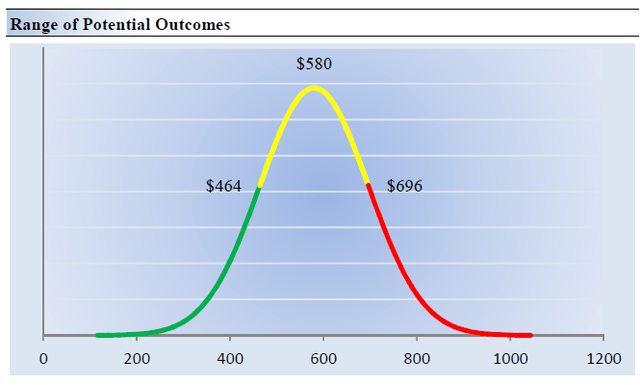

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of its balance sheet considerations. We think Adobe is worth $580 per share with a fair value range of $464.00 – $696.00. Shares of ADBE are trading below the low end of our fair value estimate range as of this writing, indicating that the company’s stock is currently undervalued.

The near-term operating forecasts used in our enterprise cash flow models, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 12.4% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 20.5%. Our model reflects a 5-year projected average operating margin of 46%, which is above Adobe’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 6.4% for the next 15 years and 3% in perpetuity. For Adobe, we use a 8.4% weighted average cost of capital to discount future free cash flows.

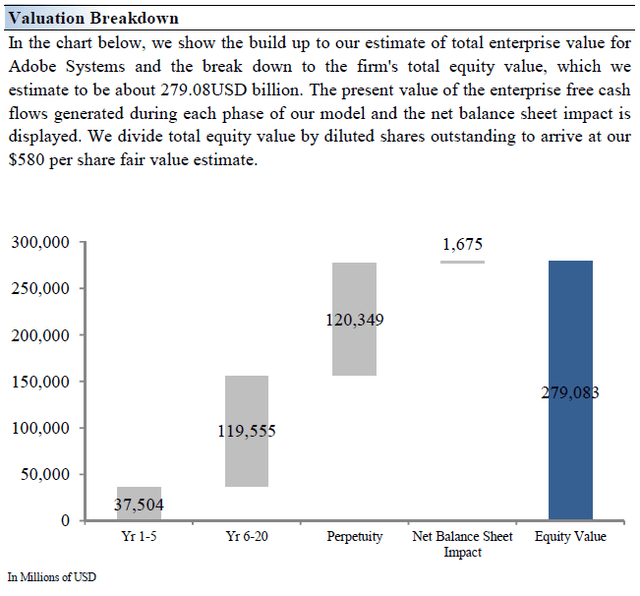

Image Source: Valuentum Image Source: Valuentum

Adobe’s Margin of Safety Analysis

Although we estimate Adobe’s fair value at about $580 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Adobe. We think the firm is attractive below $464 per share (the green line), but quite expensive above $696 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Shares of Adobe are down ~30% year-to-date as of this writing, and we think the sell-off is overdone. While Adobe has various near-term hurdles to contend with, from inflationary pressures to headwinds arising from rising geopolitical tensions, the company’s longer term growth runway remains firmly intact. The firm is a stellar free cash flow generator with a healthy balance sheet, and Adobe will likely continue to take advantage of the decline in its stock price seen year-to-date to repurchase “gobs” of its stock going forward. Adobe is worth keeping on your radar as a prime capital appreciation opportunity.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment