Melpomenem/iStock via Getty Images

The technology sector is among the worst performer in the past year. While many companies may have been excessively hyped and their stock price led to valuations that were pragmatically not reflected in their fundamentals, consequently, many stocks have been particularly intensely sold off. Others are experiencing pressure from a higher cost of capital, increasing inflationary pressure, bottlenecks among the supply chains, as well as headwinds caused by pandemic-related restrictions, geo-political tensions, and the ongoing war in Ukraine. Companies in the application software industry have particularly suffered from a yearly perspective, but more recently the selloff seems to slow down, while other companies, such as manufacturers in the semiconductor industry, continue performing poorly.

While there are many very interesting companies in the application software industry, the two selected companies are two leaders in their specific field, and only partially competitors, mostly in customer analytics and marketing campaign planning. I consider both of them among the most promising companies in their industry.

Adobe Inc. (NASDAQ:ADBE) has significantly impacted the global digital experience, enhanced the productivity and creativity capacity of companies and individuals, and continues building on 40 years of innovation while leveraging on its leadership position in strong secular growth drivers. Salesforce, Inc. (NYSE:CRM) is the global leader in providing cloud-based customer relationship management solutions, counting over 150,000 companies among its customers, offering industry-specific software platforms and tools, while the company continues to aggressively grow with organic innovation and creating new opportunities through the acquisition of third-party technologies and capacities.

The global Software as a Service ((SaaS)) market is forecasted to grow at 18.82% Compound Annual Growth Rate (CAGR) through 2030, driven by the increased usage of mobile devices and smartphones with app-based services, the increasing usage of public and hybrid cloud, the integration of technologies such as Artificial Intelligence (AI) and Machine Learning (ML), as well as the trend of business outsourcing in the global digital economy. While reduced overall IT infrastructure costs are the main reason for the increased adoption of SaaS by companies, the technology significantly increases a company’s potential agility, scalability, reliability, and flexibility by also granting secure and globally accessible storage of data online. Both companies have great opportunities ahead, quantified by an estimated $205B total addressable market (TAM) for Adobe, and an even larger TAM for Salesforce, forecasted at $290B by 2026.

An in-depth company comparison

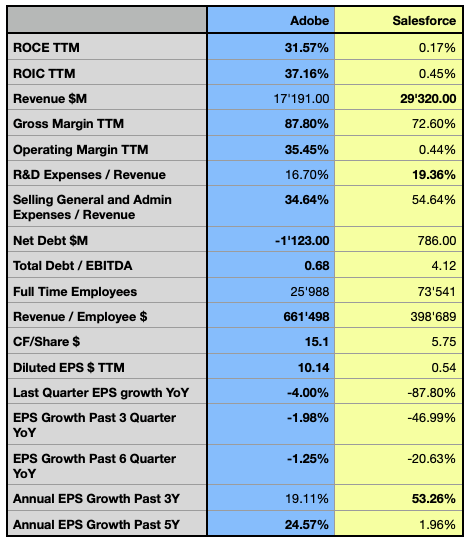

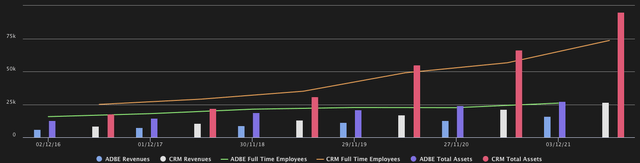

Author, using data from S&P Capital IQ

The financial comparison highlights the massively different performance of the two companies in terms of their Return on Invested Capital (ROIC), a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment. While both companies are profitable, Adobe is by far more efficient than its competitor in terms of capital allocation.

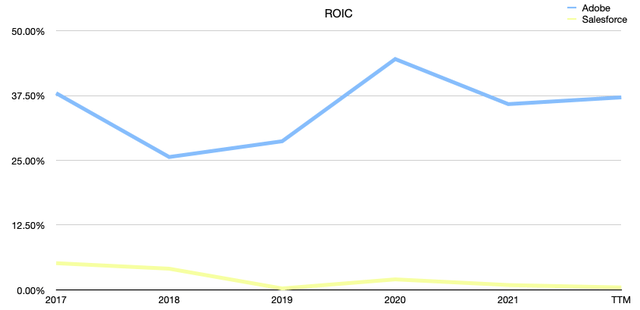

Salesforce continuously struggles to consistently create value for its investors, reporting huge operating expenses, while both companies are significantly investing in research and development. Adobe, instead, while having a highly efficient core business, demonstrates also having quite efficient cash management, shown in its relatively narrow spread between its ROIC and the Return on Capital Employed (ROCE) with the company reportedly owning a massive cash position of over $5.76B. Adobe’s ROIC is tendentially increasing after a drop in 2018, while, as we will see later, Salesforce’s metric is even lower than its Weighted Average Cost of Capital (WACC). This is a rather alarming sign, as the company is seemingly destroying value for its investors instead of building it.

Author, using data from S&P Capital IQ

Although reporting a deceleration of this metric from 19.12% CAGR in the past 5 years to 16.68% CAGR in the past 3 years, Adobe stands out for its significantly higher gross margin. CRM’s gross margin growth decelerated from 22.34% CAGR in the past 5 years to 18.29% CAGR in the past 3 years, as the company’s aggressive expansion strategy is challenged by other established companies. As I explained in my article, “SAP Has Potential, But There May Be Better Options Right Now In The Market,” the increasingly high competition in the industry impacts the pricing power. On the operational side, the companies have a diametric opposite profile, as Adobe is substantially increasing its operational profitability by 23.09% CAGR in the past 3 years, while Salesforce’s operating margin is even decelerating by 34.69% CAGR over the same period.

Author, using data from S&P Capital IQ

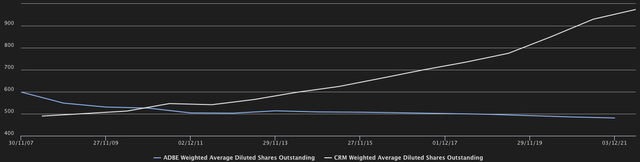

Adobe reportedly has a much more cash-rich business than the analyzed peer, by also significantly returning capital to its investors through a consistently increasing share repurchase program. While Salesforce announced its first-ever stock buyback program for up to $10B on August 24, 2022, the company has repeatedly used share issuance as a tool for maximizing its expansion, by offering generous share compensation to its employees and using the returns from new issuances for takeovers.

The stocks’ performance

Considering both stocks’ performance in the past 5 years, ADBE returned 84.03% performance, while CRM performed worse, returning 61.31%. Both stocks significantly outperformed the S&P 500 (SP500) and the broader market reference tracked by the iShares Russell 2000 ETF (IWM), while recently underperforming the broader technology index, tracked by the Invesco QQQ ETF (QQQ). The more specific iShares Expanded Tech-Software Sector ETF (IGV), could instead establish itself quite well, with only ADBE outperforming this reference over almost the entire analyzed period.

Author, using SeekingAlpha.com

Both stocks could report consistent relative strength in the past few years, with Adobe being the most resilient, while even this stock has recently been sold off, pushing its price back to levels not seen since the pandemic lows. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer even better opportunities, while also assessing the possible risks in different scenarios.

Valuation

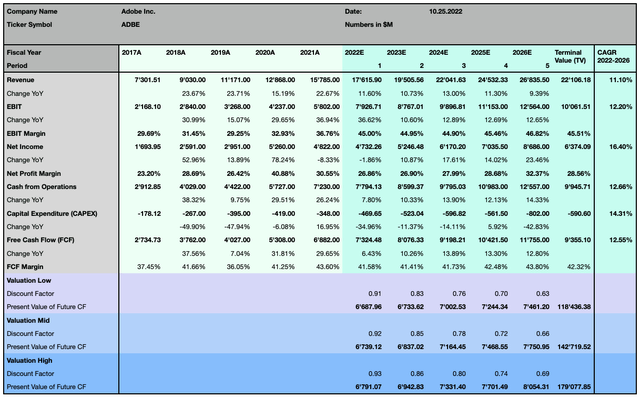

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the WACC and the terminal value. As forecasted by the street consensus, Adobe is anticipated to generate a solid 12.55% Free Cash Flow (FCF) CAGR over the coming 5 years, with similarly increasing operating profitability at 12.20% CAGR, while its net profit is projected to expand even faster at 16.40% CAGR.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

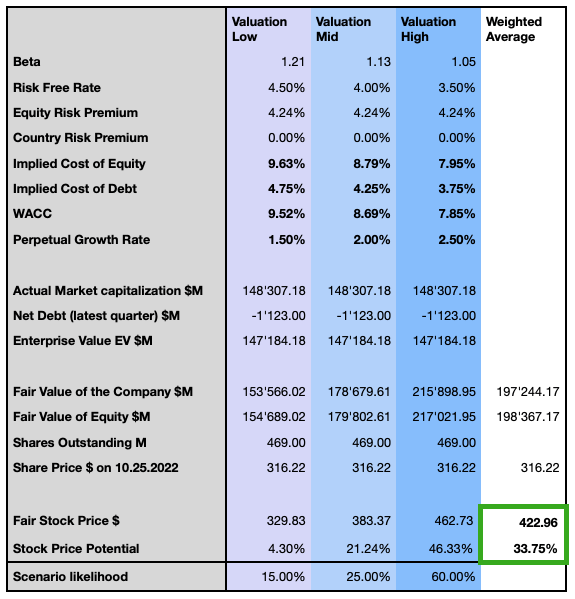

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider Adobe stock to be massively undervalued, with a weighted average price target, with about 34% upside potential, at $423.

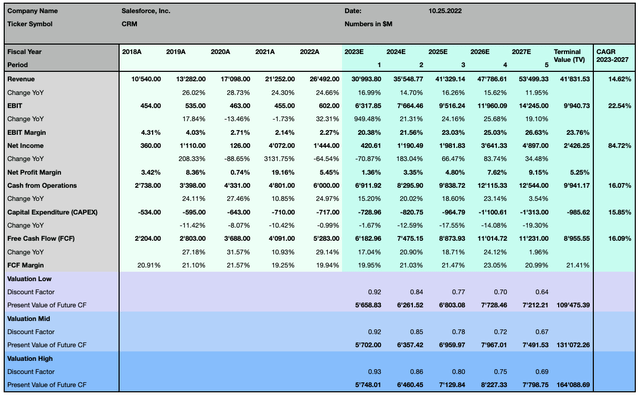

Salesforce is forecasted to expand even faster, with its sales growing at 14.62% CAGR over the next 5 years, and its FCF is seen expanding at 13.53% CAGR, while in terms of net income the forecast looks still quite volatile, and its margins, even if expanding at a relatively faster pace, are expected to be significantly lower than those of the analyzed peer.

Author, using data from S&P Capital IQ

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

Author

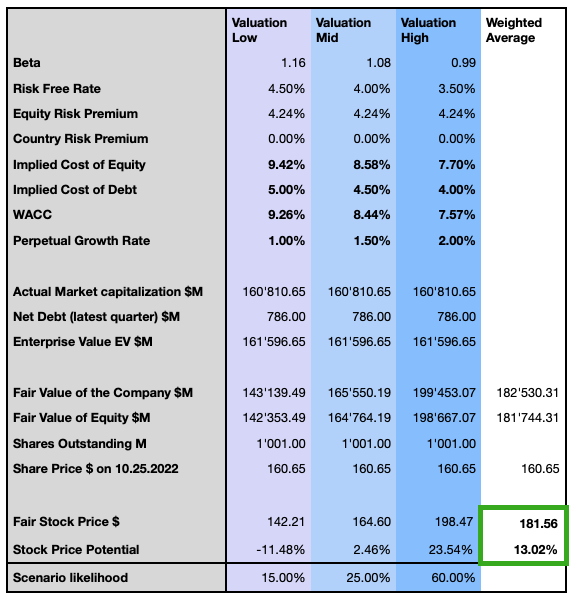

This leads us to conclude that CRM may be priced more fairly at the current price level, as the stock seems to offer a lower return, with an upside potential of about 13% at $181.50, when considering the weighted average price target, and a significantly lower return in the less optimistic scenarios, when compared to ADBE.

Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and Risk discussion

The stronger dollar tends to harm the companies’ margins if the company does not mitigate that risk. Both companies declared entering into derivative or hedging transactions, but those operations just partially compensate for the foreign currency fluctuation and could harm the companies’ financials also in the future. Adobe is more exposed to foreign currency volatility with 43% of its sales in 2021 generated outside the Americas, while Salesforce’s metric stood at 32%. Conversely, a broader geographical diversification can lead to less volatile revenue streams, especially in more difficult times, when the company’s most important region is at higher risk of an economic downturn.

While Salesforce is exclusively focusing on enterprises, Adobe has also a large private customer base which can be more price-sensitive, as the company’s products are considered to be rather expensive, opening up opportunities for comparably cheaper products offered by competitors or even free solutions. On the other hand, Adobe’s brand awareness has no equal in its field, with a brand value estimated at $24.8B, and ranked in position 21 within Interbrand’s best global brands, while Salesforce stood in position 38 with a brand value estimated at $14.7B.

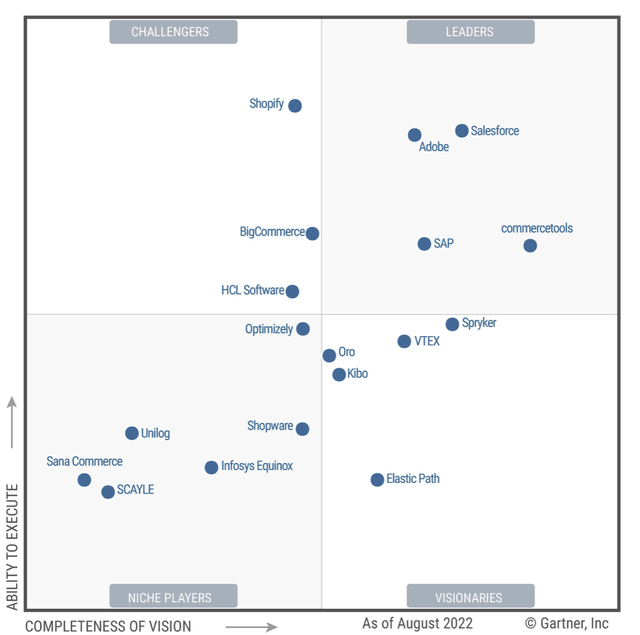

While Adobe isn’t facing a strong direct competitor but more smaller and fragmented solution providers, Salesforce is, despite leading the Customer Relationship Management software market, facing rising competitive pressure from well-established companies such as Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL), and SAP (NYSE:SAP). Both companies have been repeatedly nominated as leaders by Gartner (NYSE:IT) for their excellent execution abilities and completeness of vision.

Gartner, Magic Quadrant for Digital Commerce

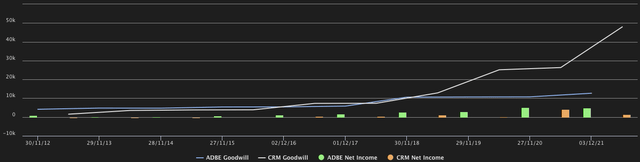

Adobe’s strategic partnership with Microsoft is supporting investments of companies in their digital transformation while boosting ADBE’s customer base and revenue streams, and building on the companies’ common vision of the future workplace and transforming digital experiences. Adobe’s recent acquisition of Figma is a great complement to its Creative Cloud Strategy, despite the fact the transaction may bear a higher execution risk, given the expected longer integration timeline and the rather high acquisition price of approximately $20B, which will certainly also impact ADBE’s balance sheet in terms of goodwill. In those terms, Salesforce is seemingly bearing a much higher risk, given its extremely aggressive expansion in the past few years.

Salesforce’s, and in more recent years almost completely also Adobe’s, success is relying on cloud-based SaaS-delivered solutions, a slowdown in this trend or major security breaches could significantly impact the company’s business, although I consider this eventuality as highly unlikely when observing many other significant players in the technology industries. They are massively investing in cloud-based technologies or applications, and many future-oriented trends, as well as entire industry groups, and are now highly dependent on the successful development and implementation of cloud-based solutions.

The Verdict: Which stock is the better buy?

Both analyzed companies are two leaders in the application software industry, with their respective strengths and weaknesses, but also offering inherent opportunities with their correlated risks. From an investor’s point of view, it’s important to consider the company’s ability to create value for its shareholders. While CRM’s share price has been boosted by the company’s forecasted likely financial achievements, its actual valuation seems to be priced more pragmatically, as the company’s expected valuation gives an upside potential of only 13%. Adobe’s shareholders can count on a stronger balance sheet, a less leveraged business, consistently efficient capital management, and strong ROIC, while the company is facing great opportunities in a market that isn’t occupied by another major competitor.

The actual pullback could offer an interesting entry point for ADBE, as my valuation model hints at a weighted average upside potential of 34% for the stock while underscoring the limited downside risk in terms of valuation. Both companies could be considered as investment opportunities, but looking at the companies’ setup, and the forecasted outlook, while also considering the individual chances and risks, I consider Adobe to be my favorite stock pick among the two analyzed companies.

Be the first to comment