SeanShot/iStock Unreleased via Getty Images

Adobe (NASDAQ:ADBE) has one of the strongest software offerings and one of the highest quality business models in the cloud space. Although such a statement might be a reason to invest in a company operating in a less popular sector, such as consumer staples for example, in the case of cloud & software it requires a different approach.

Adobe Website

Too much attention from retail and institutional investors for the high growth and high margin players in the cloud sector has resulted in valuations that do not allow for much margin of error as far as revenue growth is concerned. That is why even small deviations from the double digit expected growth are often catastrophic for shareholder returns.

In the meantime, there are early signs that Adobe’s growth rate could already be reaching peak levels which creates moral hazard in the sense of management being incentivized to take on more risk through M&A deals in order to meet growth expectations. Last but not least, Adobe’s share price has become increasingly dependent on momentum trades which seems to have hijacked the valuation.

Adobe Has It All

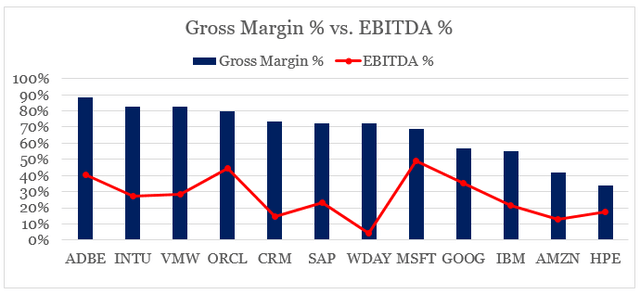

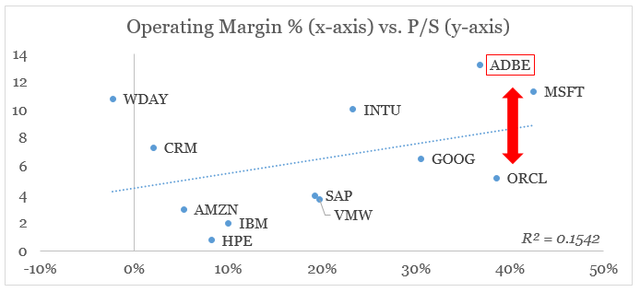

First of all, as of last reported period Adobe is one of the most profitable enterprises in the cloud space. On a gross margin basis, the company is unrivalled at the moment, while its EBITDA margin is comparable to those of Microsoft (MSFT) and Oracle (ORCL).

prepared by the author, using data from Seeking Alpha

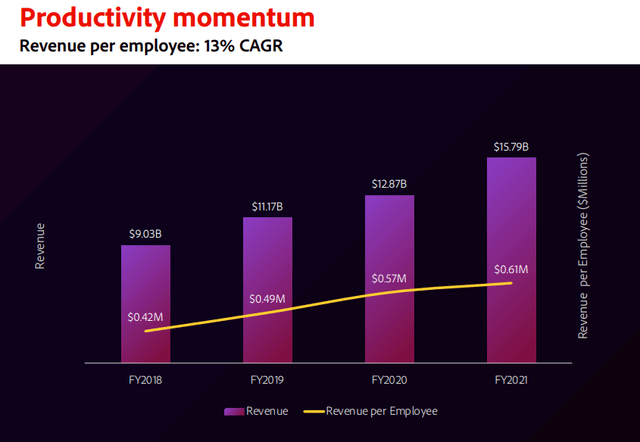

Adobe operating margins benefited massively from economies of scale as the business expanded rapidly in recent years. This has resulted in nearly 50% increase in revenue per employee since fiscal year 2018.

Adobe Q4 2021 Earnings Presentation

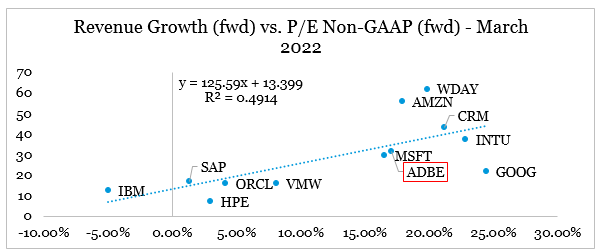

However, as I showed in my recent deep dive into the sector called ‘The Cloud Space In Numbers: What Matters The Most‘, profitability in the space has taken the back seat while expected revenue growth has become the only game in town. This is shown in the graph below, where we plot forecasted topline growth on the x-axis versus forward Price-to-Earnings on a Non-GAAP basis on the y-axis.

prepared by the author, using data from Seeking Alpha

In that regard, Adobe is among the high flyers within the sector with its expected revenue growth of nearly 20%. Nevertheless, there are early signs that this growth might be slowing down, especially following the last week’s results announcement.

Further accelerating this growth rate in the coming years, could potentially result in a multiple repricing upwards, but at the time such a scenario appears unlikely and we should also not forget the implications of rising interest rates on the slope of the trend line we see above.

As overall growth in the software space slowly cools down, profitability and return on capital would become increasingly more important for shareholder returns, however, any such transition could prove to be painful for the high flyers within the sector. So far, the relationship on a cross-sectional basis between operating profitability and Price-to-Sales ratios is weak.

prepared by the author, using data from Seeking Alpha

Even if this does not happen anytime soon, Adobe has both highly profitable business model and exceptionally high topline growth rate. That is why, in terms of valuation there is such a large difference to Oracle, for example, which has similar margins but in recent years has been growing at a modest rate.

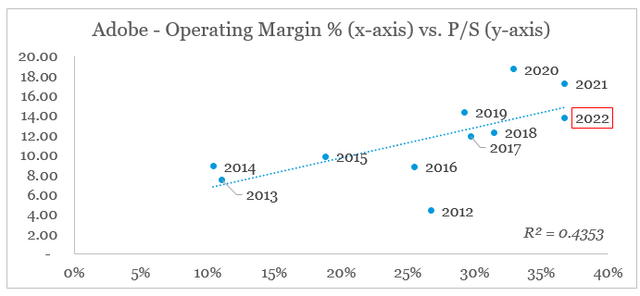

Changes in profitability do have an impact on the Adobe’s valuation on a time series basis since it has been growing at double digit rates for almost a decade now, but should this growth rate decline, the slope of the curve below would likely change drastically.

prepared by the author, using data from Annual Reports & Yahoo!Finance

When looked in isolation, Adobe’s highly profitable business model makes the company an excellent long-term opportunity. Such high quality businesses almost never trade at a significant discount and as such deserve their premium multiples.

However, things are not always so straightforward and in the case of Adobe there are two major areas of concern.

Is Nearly 20% Growth Sustainable?

One of the major risks for Adobe is its exceptionally high growth. This could sound counterintuitive since high topline growth is what almost every investor is looking for in a business.

However, as we saw above, Adobe’s high forward P/E ratio is supported almost entirely by the nearly 20% expected revenue growth rate. So far the company has delivered on these optimistic growth projections, but only a small deviation from analyst expectations could lead to disastrous performance.

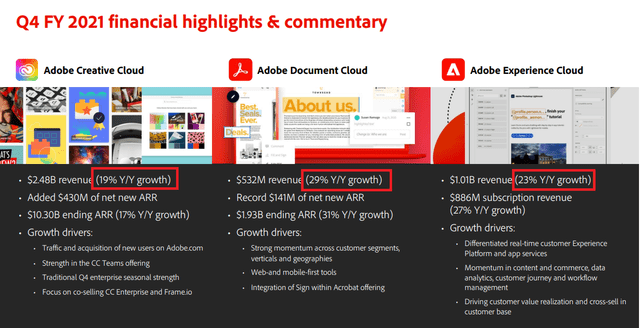

To illustrate that, in 2021 all three major cloud offerings – the Creative, Document and Experience clouds grew in the range of 19% to 29%.

Adobe Q4 2021 Earnings Presentation

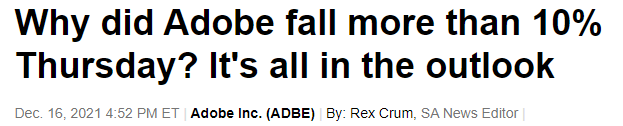

But even these numbers were not enough to appease shareholders, who were already pricing in even better outlook.

Seeking Alpha

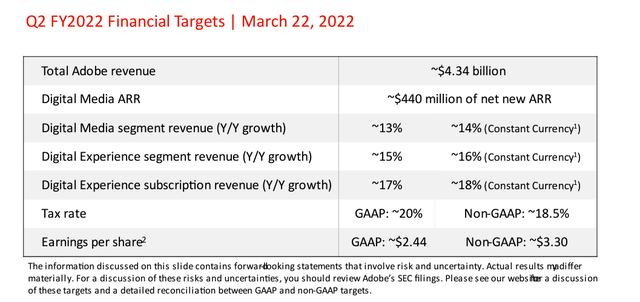

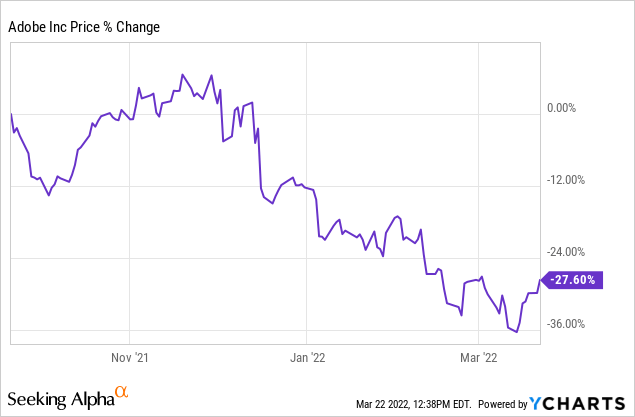

The story continued last week, when the share price fell significantly, following a supposedly disappointing guidance that looked as follows.

Adobe Earnings Presentation

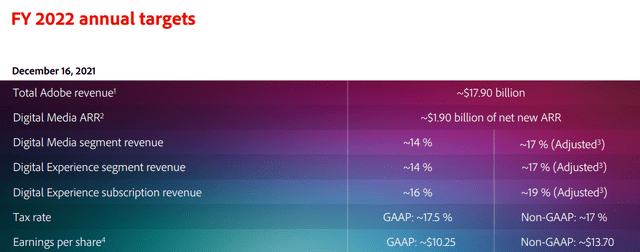

Even though, these are not vastly different numbers from the annual guidance for 2022 provided a few months ago, initial market reaction shows just how sensitive valuations are at these levels.

Adobe Q4 2021 Earnings Presentation

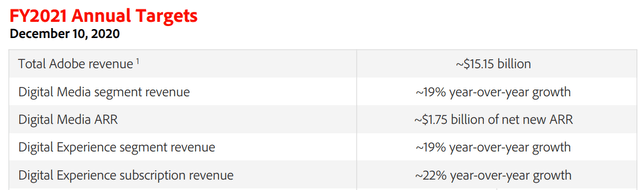

Back in 2020, the outlook for topline growth was much higher which partially explains why Adobe’s share price corrected so sharply during 2021.

Adobe Q4 2020 Earnings Presentation

The slowing growth could also explain why Adobe suddenly engaged in two major acquisitions since November of 2020 – those of Wrokfront and Frame.io.

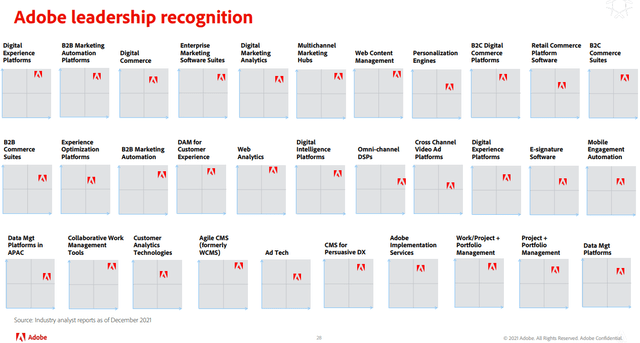

The urgency and exceptionally high price of these deals, seems to be at odds with Adobe’s current leadership in almost every single service line it operates in.

Adobe Q4 2022 Earnings Presentation

In addition to the need to grow at double digit rates, Adobe also faces a crowded and competitive landscape in these segments. For example, in digital experience platforms in addition to the large SaaS players, such as Salesforce (CRM) and Oracle, the company faces stiff competition from a number of smaller players, such as Acquia and Optimizely.

Adobe Website

According to Optimizely, the company was actually named a leader in these ranking in 2022:

Optimizely named a Leader in the 2022 Gartner Magic Quadrant for Digital Experience Platforms

Source: optimizely.com

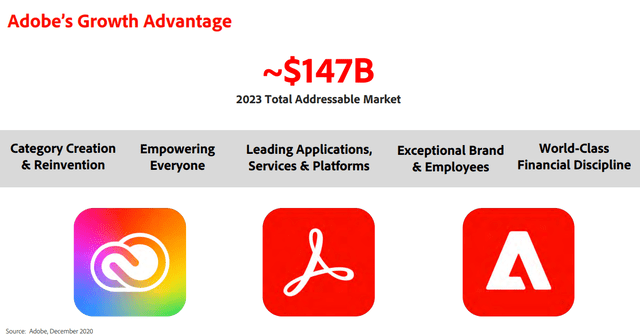

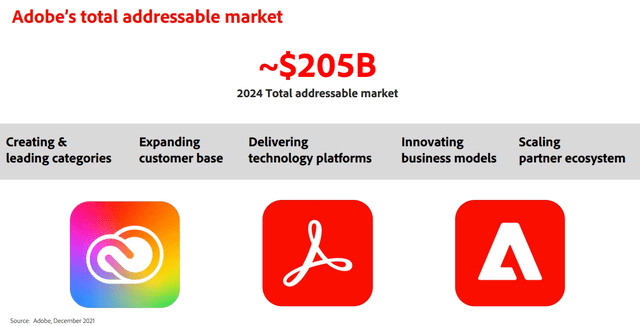

All that competition will likely intensify into the future, given the attractive margins that could be achieved at scale. At the same time, Adobe’s strategy seems to be focused on expanding its Total Addressable Market, which was expected to be roughly $147bn in 2023.

Adobe Q4 2020 Earnings Presentation

In just one year, expectations of Adobe’s TAM have ballooned to around $205bn in 2024.

Adobe Q4 2021 Earnings Presentation

Although this is partly a result of recent acquisitions and new verticals, it goes to show just how discretionary these calculations are and that they are predominantly used as a sales pitch once expected growth starts cooling off. What usually follows is that a company in such situation embarks upon an aggressive M&A strategy in order to deliver on these optimistic growth projections. This has been the case of Salesforce and as of late appears to be the case for Intuit. Although this is not necessarily a bad thing, it brings in significant additional risk for shareholders of an already richly priced enterprise.

Market wide Risk Factors

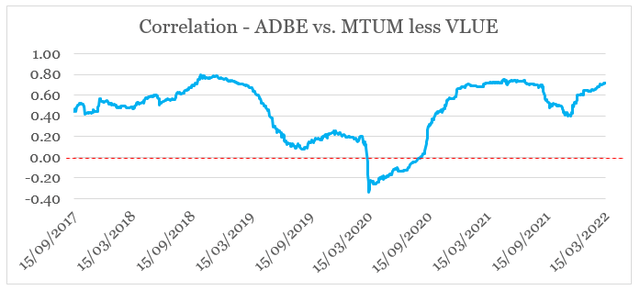

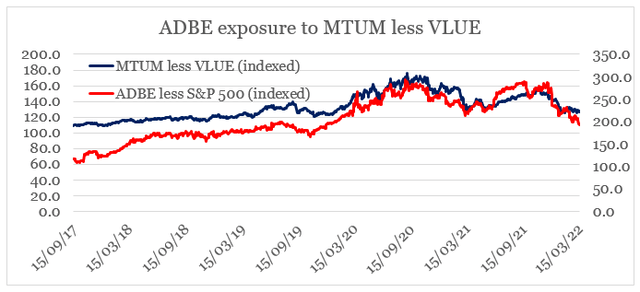

In addition to Adobe’s valuation being heavily dependent on a continued topline growth, the company has also become highly exposed to momentum trade. Down below is plotted Adobe’s correlation of daily returns on a six-month rolling basis with an index that takes a long position in the iShares Edge MSCI USA Momentum Factor ETF (MTUM) and a short position in iShares Edge MSCI USA Value Factor ETF (VLUE).

prepared by the author, using data from Yahoo!Finance

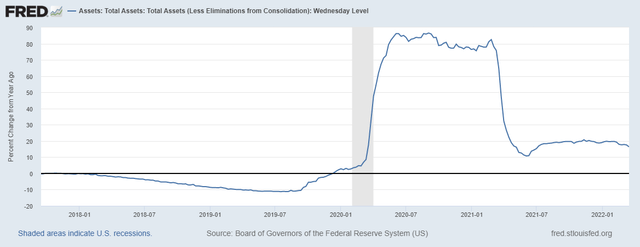

The rolling 6-month rolling correlation between ADBE and MTUM less VLUE index seems to be influenced by the amount of liquidity pumped into the financial system which incentivizes risk-on behavior. Down below is plotted the year-on-year change of the Federal Reserve’s Total Assets.

FRED

As the Federal Reserve is about to reverse course on its balance sheet expansion, Adobe’s returns are also at risk unless the correlation with MTUM-VLUE index disappears.

We could also see that for the past two years, Adobe’s outperformance of the S&P 500 (red line below), has moved with unison with the Momentum’s outperformance of Value (blue line below), which highlights the importance of momentum trade for the company’s share price returns.

prepared by the author, using data from Yahoo!Finance

In addition to the slightly lower outlook provided in 2021, this also helps to explain Adobe’s poor performance over the past few months.

Conclusion

Adobe has created a very strong ecosystem of cloud offerings oriented towards content creation, customer experience and various commerce solutions. Leading in these areas has resulted in both high margins and years of double digit revenue growth.

However, the current valuation does not seem to reflect any meaningful reduction in growth rates and any small deviation from expectations results in sharp corrections of Adobe’s share price. That is why, as growth rates are showing early signs of cooling off, the management is incentivized to take on more risk in order to support valuations. Additionally, Adobe’s share price is also heavily exposed to momentum trade, which adds another layer of risk for shareholders. This whole setup results in a limited upside for Adobe in the short to medium term, while at the same time the risk of multiple contraction looms ahead.

Be the first to comment