bymuratdeniz

Adecoagro S.A. (NYSE:AGRO) has a diversified business model with stable free cash flow margins. Management is building a low-cost production model, which appears to be a powerful competitive advantage against peers. Considering conservative revenue growth rates and stable EBITDA margins, I obtained a fair valuation that is considerably more significant than the current stock price. Yes, there are risks from lack of supply of raw materials, increases in the price of fertilizers, or economic downturns. However, despite the risks, the current price appears too cheap.

Adecoagro Produces Many Different Products, Debt Matures Late, And Free Cash Flow Appears Stable

Adecoagro is an agro-industrial company in South America running dairy operations, and producing sugar, ethanol, and energy. The largest production is located in Brazil, but the company also produces in Argentina and Uruguay.

Investor Presentation

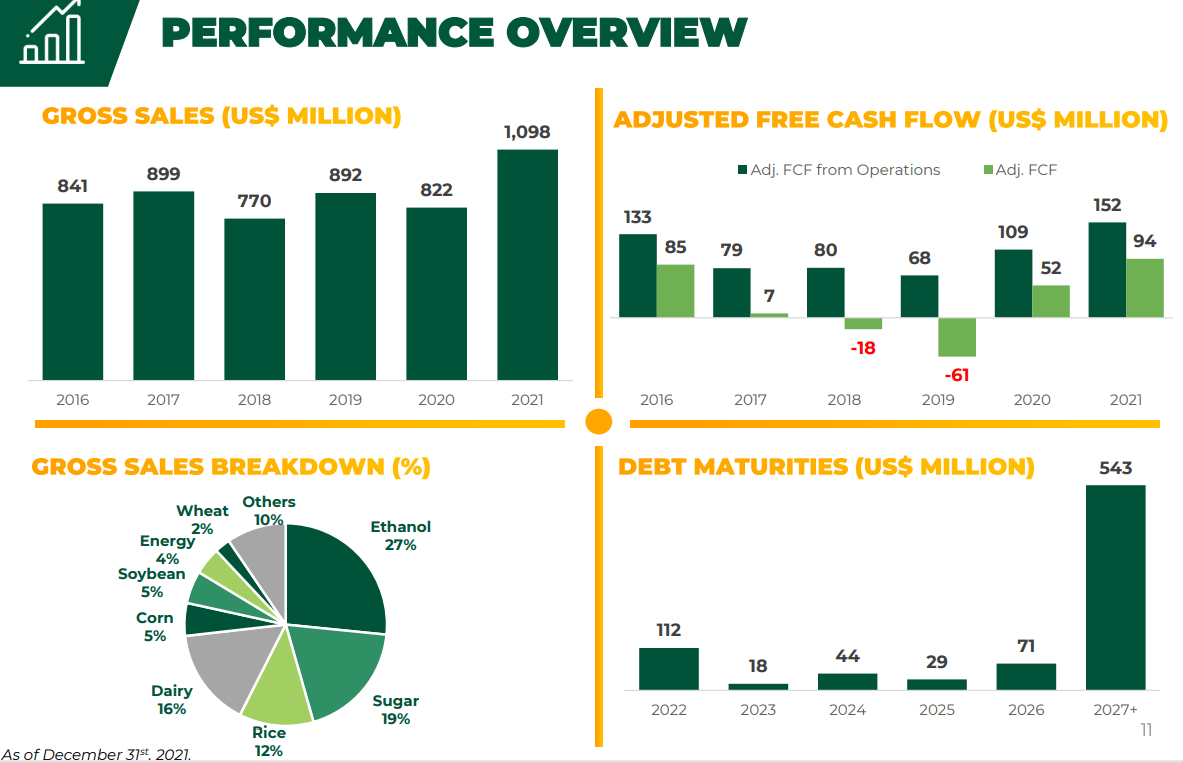

Adecoagro produces many different products, thus lowering the risks from changes in commodity prices or lack of supply of certain raw materials. I became interested in Adecoagro’s business profile after receiving the company’s recent sales growth and stable adjusted free cash flow. Besides, it is also worth noting that most debt matures around 2027, so management has plenty of time to negotiate with debt holders.

Investor Presentation

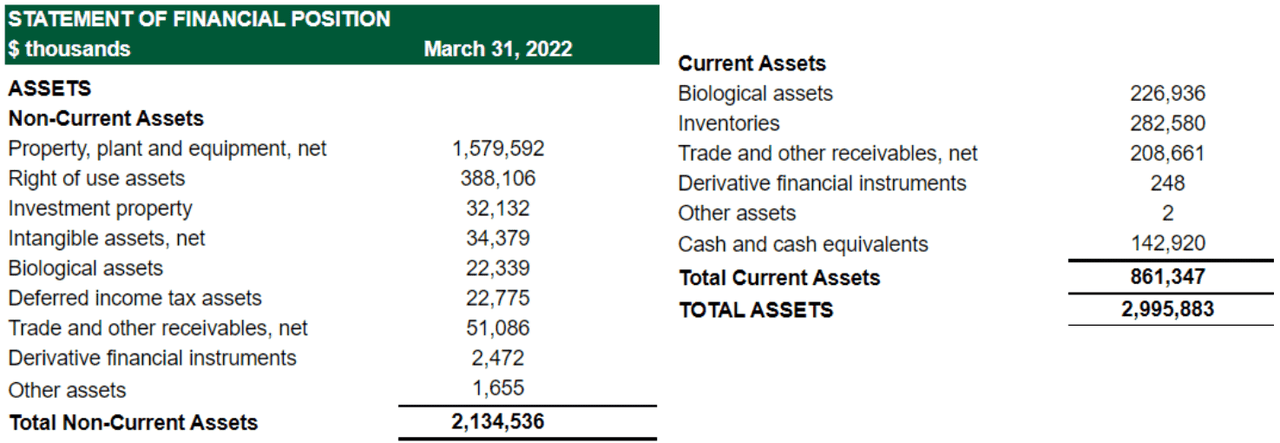

Balance Sheet

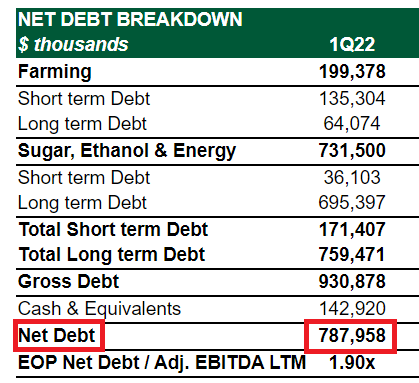

As of March 31, 2022, Adecoagro reported cash worth $142 million, $2.9 billion in total assets, and $1.8 million in total liabilities. I believe that the company’s financial situation is quite stable. The company’s most relevant asset is property and equipment, and Adecoagro does not seem to need a lot of cash to function.

10-Q

Considering that the business model is easily predictable, in my opinion, the total amount of debt is not that high. The net debt / adjusted LTM EBITDA is equal to 1.9x. I don’t think most investment advisors will be afraid of Adecoagro’s debt level.

10-Q 10-Q

Beneficial Expectations From Analysts

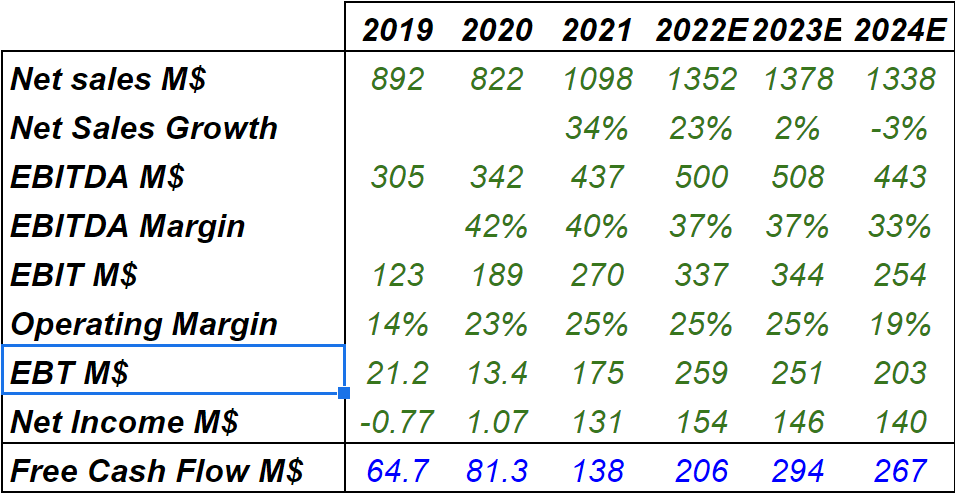

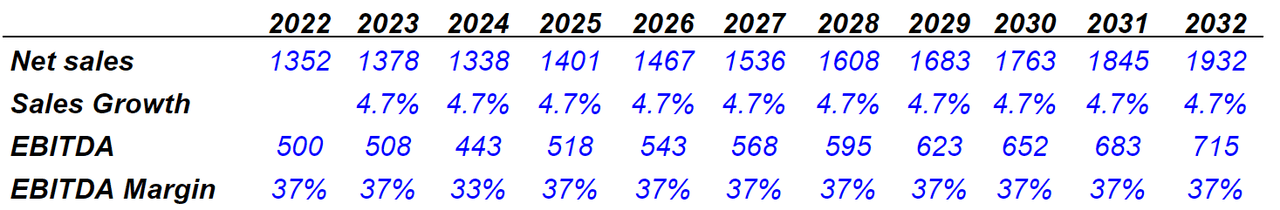

Investment analysts expect 2023 sales growth of 23%. The EBITDA margin will likely stand at close to 37%-33%, and Adecoagro is also expected to report positive net income and positive free cash flow. Even with a small deterioration in the operating margin and EBITDA margin in 2024, in my opinion, the growth in free cash flow from 2020 to 2024 is quite beneficial.

marketscreener.com

Conservative Conditions

Under a beneficial case scenario, I believe that the company’s low-cost production model will likely represent a competitive advantage over peers. It is also worth noting that geographic diversification and vertical integration are some of Adecoagro’s great assets. In my view, the special characteristic of Adecoagro will likely help offer low volatility of returns and free cash flow volatility.

Besides, Adecoagro will likely improve its profitability ratios over time thanks to strategic divestitures of unprofitable assets and technological innovation. More profit may increase the demand for the stock and may lead to higher stock price marks. Adecoagro reported some of these initiatives in the annual report.

Acquiring and transforming land to improve its productivity and realizing land appreciation through strategic dispositions, implementing sustainable production practices and technologies focused on long-term profitability. Source: 20-F

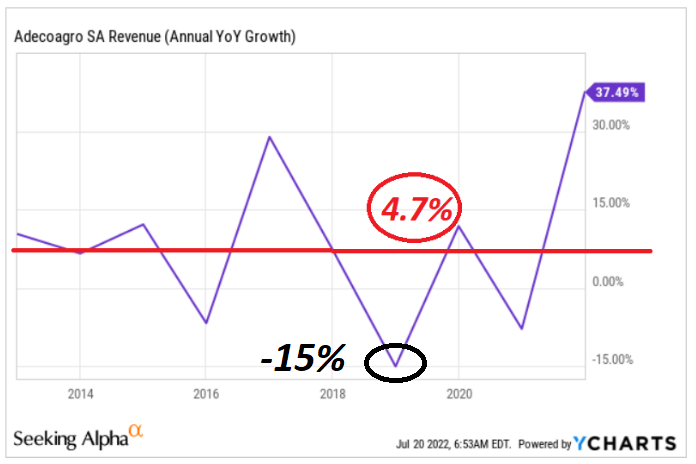

Very recently, Adecoagro reported as much as 37% sales growth, but revenue growth of -15% was also reported in 2018-2020. I believe that long-term sales growth of 4.7% appears achievable. Let’s note that it is lower than the sales growth reported by other investment analysts.

YCharts

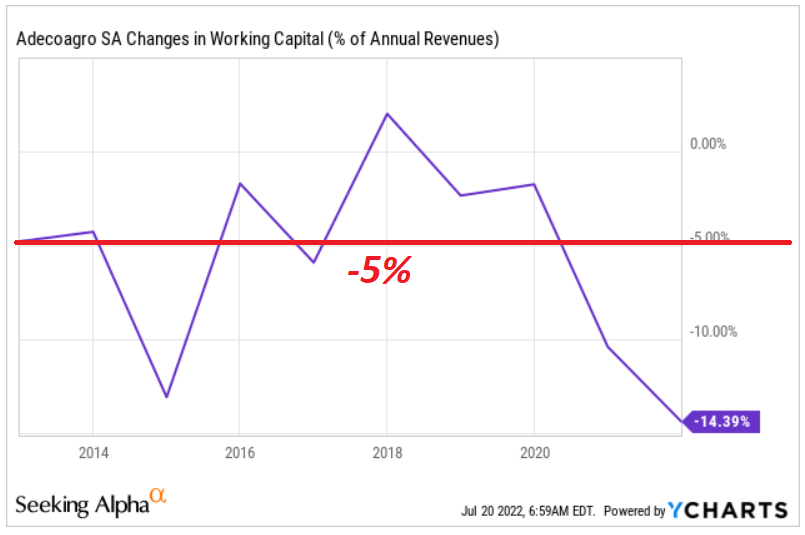

I also included changes in working capital/sales of 4% and a capex/sales ratio of 14%-16%. My figures are quite conservative, and they are all in accordance with previous figures reported by Adecoagro’s management.

YCharts

My figures included sales growth of 4.7%, 2032 revenue of $1.9 billion, and EBITDA margin close to 37%, so that 2032 EBITDA stands at $715 million.

My DCF Model

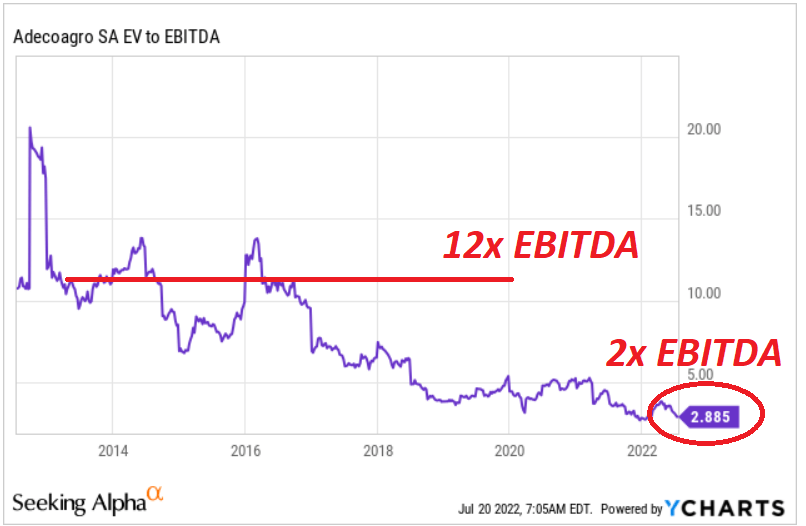

Adecoagro is currently trading at 2.8x EBITDA, but it traded, in the past, at 12x and even 15x EBITDA. With these figures and considering the current EBITDA margin, I believe that an exit multiple around 7x and 4x EBITDA makes a lot of sense.

YCharts

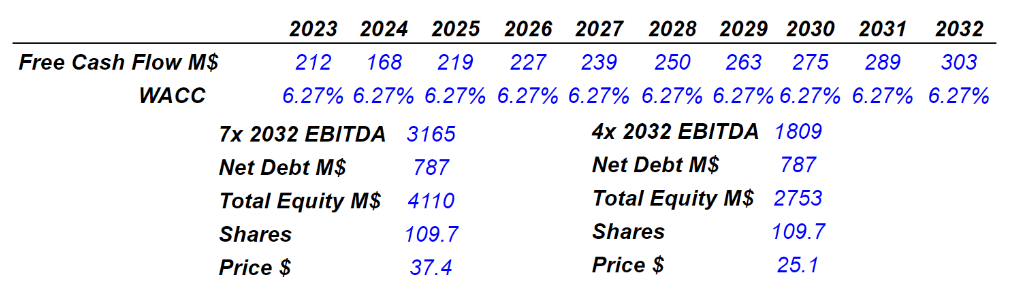

If we assume a CAPM model with a discount of 6.27%, net debt of $787 million, and an exit multiple of 7x EBITDA, we obtain an implied price of $37.4 per share. With an exit multiple of 4x EBITDA, we would obtain an implied price of $25.1 per share.

My DCF Model

Detrimental Environmental Conditions, Diseases, And Lack Of Fertilizers Could Bring The Fair Price Down To $6.9 Per Share

For starters, Adecoagro’s free cash flow growth could be seriously damaged because of several weather conditions. Considering the current climate change, higher temperatures could affect the company’s business conditions. The worst part about this risk is that we simply cannot make any forecast. In this case scenario, I assumed some problem areas:

Severe weather or environmental conditions, in particular, droughts, hail, floods, frost or pestilence, are unpredictable and may have a significant adverse impact on agricultural production and the supply and price of agricultural commodities that we sell and use in our business. Moreover, adverse weather conditions may be exacerbated by the effects of climate change which impacts the entirety of our business and policies. Source: 20-F

Management may also suffer significantly from diseases, fungi, and bacteria, which could damage the production of agricultural products. Less production would lead to less revenue and less free cash flow.

The company may also suffer from reputational damage, which could also affect the stock price. If many researchers discuss the diseases or the decline in production, the demand for the stock may decline significantly.

Similarly, the occurrence and effects of disease and pestilence can be unpredictable and devastating to agricultural products, potentially rendering all or a substantial portion of the affected harvest unsuitable for sale. Our agricultural products are also susceptible to fungi and bacteria that are associated with excessively moist conditions. Source: 20-F

The company is quite sensible to changes in the supply or costs of fertilizers. These products represent more than 17% of the company’s cost of production. In the future, if management cannot acquire fertilizers at a competitive cost, the free cash flow will likely decline. In this regard, the war between Russia and Ukraine could be quite detrimental for Adecoagro.

In our Farming business, fertilizers and agrochemicals represented approximately 17.1% of our total cost of production for the 2021/2022 harvest year. In our Sugar, Ethanol and Energy business, fertilizers and agrochemicals represented 17.1% of our cost of production for the 2020/2021 harvest and 20.9% for the 2021/2022 harvest.

Shortages in its supply remain, which has been aggravated by the ongoing war between Russia and Ukraine. Source: 20-F

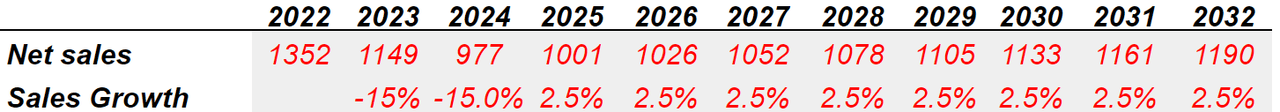

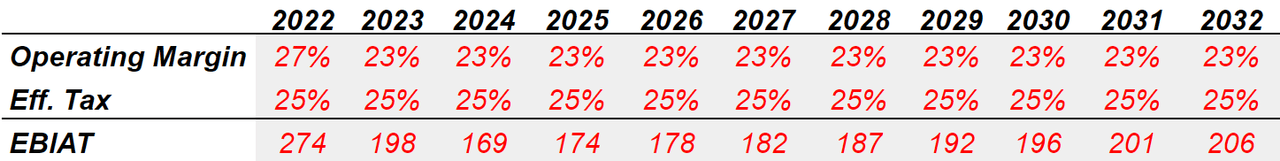

Under this scenario, I assumed sales growth of -15% in 2023 and 2024, and 2.5% sales growth from 2025 to 2032. The results include 2032 net sales of $1.19 billion, and 2023 net sales of $1.1 billion.

My DCF Model

With conservative EBITDA margin around 33%, operating margin of 23%, and effective tax of 25%, I obtained 2032 EBIAT of $206 million.

My DCF Model

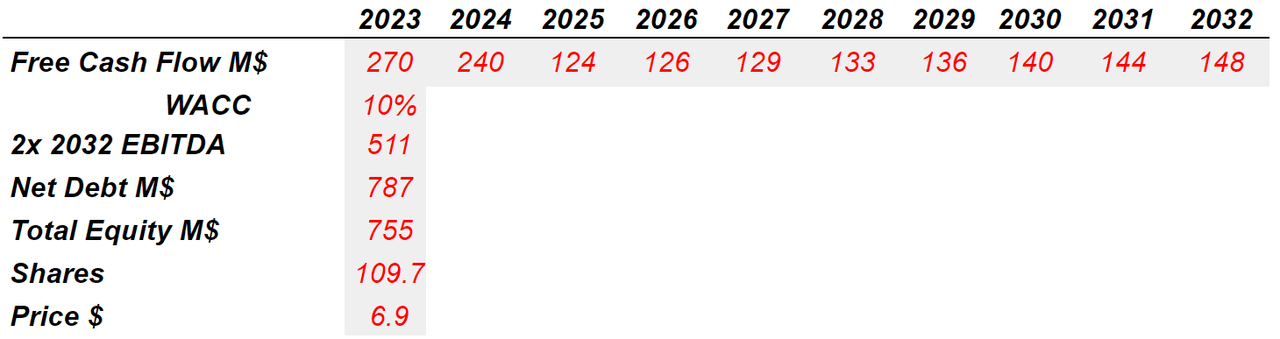

Now, under this case, the free cash flow would decline from $270 million in 2023 to $148 million in 2032. I also used a weighted average cost of capital of 10%, exit multiple of 2x EBITDA, and a share price of $6.9 per share.

My DCF Model

Risk From An Economic Downturn

It is quite relevant noting that a deterioration in the economic climate, further increase in the oil price, or larger taxes may have an impact on Adecoagro. We cannot really predict the influence of such events on the stock price, but they will likely deteriorate the free cash flow line.

Adverse changes in the perceived or actual economic climate, such as higher fuel prices, higher interest rates, stock and real estate market declines and/or volatility, more restrictive credit markets, higher taxes, and changes in governmental policies could reduce the level of demand or prices of the products we produce. We cannot predict the duration or magnitude of a downturn or the timing or strength of economic recovery. Source: 20-F

Volatility In The Prices For Agricultural Products Could Drive The Price Mark Down

AGRO would most likely suffer a decrease in the price of sugar, ethanol, grains, and other commodities. Besides, the supply and demand of these products could drive the company’s production down, which may affect AGRO’s future financial products. Management offered an explanation about these risks in the annual report.

Prices for agricultural products and by-products, including, among other things, sugar, ethanol, and grains, like those of other commodities, have historically been cyclical and sensitive to domestic and international changes in supply and demand and can be expected to fluctuate significantly. In addition, the agricultural products and by-products we produce are traded on commodities and futures exchanges and thus are subject to speculative trading, which may adversely affect us. Source: 20-F

Conclusion

Adecoagro has a diversified business model with stable free cash flow predictions. Most financial analysts are optimistic about the years 2023 and 2024, and free cash flow margins are expected to be stable. In my view, if management continues to build its low-cost production model, and technological innovation improves, the company’s valuation will likely increase. Even taking into account risks from lack of fertilizers or production stoppage, in my opinion, the current price does not represent future free cash flow. I believe that Adecoagro is undervalued.

Be the first to comment