cemagraphics

Those who thought I had the “magic touch” when it came to trading the shares of United Guardian Inc. (NASDAQ:UG) are about to be disabused of that notion. Up until August of this year, it would have been reasonable enough to call me “successful” in my trades in United Guardian, because I bought the shares way back in 2018 at $18.55, then sold them this past April at $24.45. This past August I bought back in and things have gone less well. My investment is down about 29% against a loss of 6.95% for the S&P 500.

In today’s article, I want to work out what to do with this investment today. After all, if the company is in good shape, and was a good buy at $15.70, it’ll be an absolute steal at $11.40. I may hold, not willing to throw “good” money after “bad.” Or I may take my lumps and walk away from this investment entirely. I’ll decide the above by looking at the most recent financial performance and by looking at the current valuation.

My regular readers know better than most that my writing can be “a bit much.” For that reason, I present a “thesis statement” at the beginning of each of my articles that walks you through my thinking. By insulating you in this way, you then have the option to leave the article, or risk the involuntary eye rolls that some of my stuff has been known to engender. You’re welcome. This is just one of the many ways I try to keep my readers happy. Anyway, although the financial results this year haven’t been great, with slightly lower revenues and much higher operating costs, that deterioration is more than reflected in the price. I think the market’s gotten a bit ahead of itself, and so I’ll be adding to my United Guardian position today. There you have it. If you read on from here, that’s on you.

Company Background

If you’re unfamiliar with the company, I’d recommend you review the “Company Background & Risks” portion of my previous article on this name. In case you’re not in the mood to click a link, I’ll offer up the highlights of that section in bullet point form here:

-

The company operates in four distinct product categories and those are “cosmetic ingredients”, “pharmaceuticals”, “medical products”, and “specialty industrial products.”

-

“Cosmetic Ingredients” is the company’s largest category, and represents just under ½ of all sales.

-

The company has been granted 30 patents since its founding in 1942, and its chief efforts have been directed toward formulating “natural” products. These are used as compounds of various cosmetic products that are then included in the formulations produced by marketing partners.

-

The company sells its products through 5 marketing partners, the largest of which is Ashland Specialty Ingredients.

-

In my view, the global pandemic has exposed the greatest single risk here, namely the logistical and supply chain challenges that are imposed on many other companies.

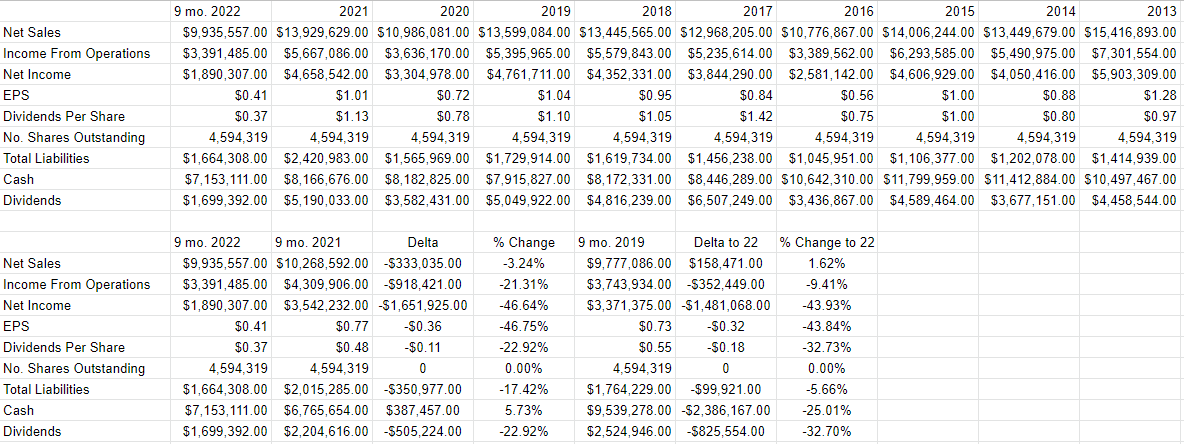

Financial Snapshot

The latest financial results have been rather poor in my view. Revenue was down about 3.25% from this time last year, though is still higher (by 1.6%) compared to the same period pre-pandemic. Income from operations and net income in 2022 have absolutely cratered, though. The former is down about 21% compared to the same period last year, and the latter down about 47%. The company took pains in its second quarter letter (its latest) to point out that a significant portion of the reduction in net income can be blamed on the decline of its stock portfolio, but, we can’t ignore the 7.15% uptick in cost of sales, the 19% uptick in operating expenses, and the 4.5% uptick in R&D expenses. The company remains profitable, but the level of profit has collapsed relative to 2021 or 2019.

It’s not all bad news over at United-Guardian, though. Sales of non-pharmaceutical medical products remains strong, and as of the second quarter at least, was up 55% in 2022 compared to the same period a year ago.

That said, I remain of the view that the capital structure is reasonably secure here, given the strength of the balance sheet. Although it no longer pays one, the company spent $1.699 million on dividends for the first nine months of this year, has $1.664 million total liabilities, and a cash hoard of ~$7.153 million. Thus, the risk of this company going bankrupt anytime soon is very, very low in my view, and I think it’s reasonable to hope for a return to some kind of dividend.

I remain of the view that this is a “demographic play”, and that the long term demand for various “Lubrajels” will remain reasonably robust because a generally ageing population is a population that tends to care about skin hydrating solutions. Given all of this, I’d be happy to add to my position at the right price.

United Guardian Financials (United Guardian investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits, and the stock is a speculative instrument that gets traded around based on long term expectations about the business. Given that the financial statement valuation of the business is “backward looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two. The tension is highlighted by the fact that the business is about doing R&D in an effort to find chemical formulations that make skin and hair feel smooth and silky, and the stock is buffeted by a host of factors having nothing to do with that. One of the things that affects the performance of a given stock, for example, is the crowd’s ever changing views about the desirability of “stocks” as an asset class. There’s no way to prove this definitively, as it’s an obvious counterfactual, but a reasonable argument could be made to suggest that some portion of the 29% loss I’ve suffered on these shares can be blamed on the 7% loss in the S&P 500 over the same period. I don’t know if you follow the financial news, but the mood about “stocks” as an asset class has been mixed lately. This attitudinal shift may have caused some of United-Guardian’s fall.

So this is why I consider the stock as a thing distinct from the business. It’s often a poor proxy for what’s going on at the company, and I think it’s possible to profitably exploit this disconnect. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. What I want to see in this regard is a stock that the crowd is somewhat pessimistic about that goes on to exceed expectations. When the crowd is pessimistic, the shares are cheap, which is why I try to buy only cheap stocks.

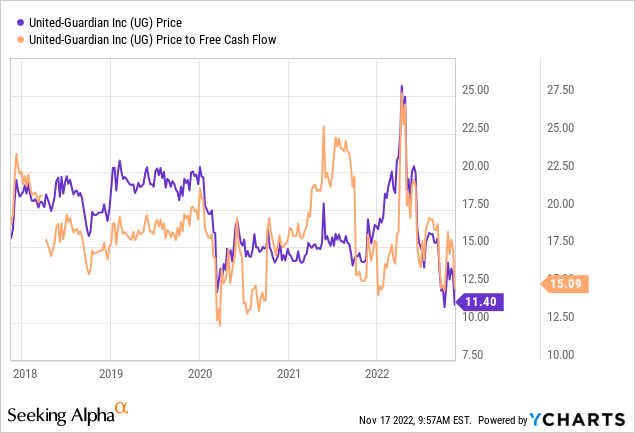

In my previous piece, in case you’ve forgotten, I got excited about United Guardian when the shares started trading at a price to free cash flow of about 16.5 times and a dividend yield of about 6.5%. Fast forward to the present and we see that the shares are about 9% cheaper on a price to free cash flow basis per the following:

Source: YCharts

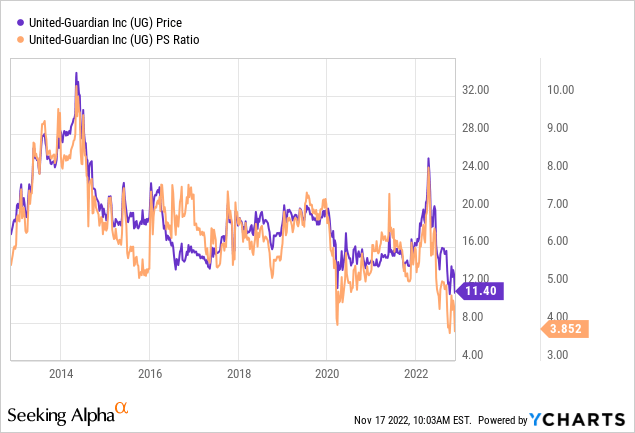

At the same time, the market is paying less for $1 of sales than it has at any time over the past decade.

Source: YCharts

The shares seem to be objectively cheap in my view.

In order to validate (or refute) this view, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to United Guardian at the moment suggests the market is assuming that this company will grow at a rate of about 2%, which I consider to be nicely pessimistic. Given the above, I’ll be adding to my United Guardian stake today.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment