Marc Dufresne

It’s been about four months since I put out a bullish piece on Patrick Industries Inc. (NASDAQ:PATK), and in that time, the shares have returned just shy of 11% against a loss of 2.6% for the S&P 500. Let’s all just take a moment to mull that over for a moment. 13.5% outperformance in four months. It’s very pleasant reviewing this performance, but I didn’t get much time to enjoy it because I had to spend time shushing that tedious voice going on about “people don’t like braggarts” and “pride goeth before something or other”. That voice always ruins everything. Anyway, the company has reported financial results since and they deserve commentary. The fact is that a stock trading at $63.59 is, by definition, more risky than that same stock when it’s trading at $57.64, so I have to spend some time deciding whether or not to buy more, hold, or sell my stake. Also, some puts that I wrote on this name are going to expire this week, and I’m absolutely champing at the bit to write about those also.

If you’re a regular reader you know what this paragraph is. If you’re one of the new people, you’re about to find out. This is the “thesis statement paragraph”, where I offer up a pithy summation of my article in a single paragraph. This saves you both time and the nausea induced by reading an inveterate braggart who seems to have an aversion to proofreading. You’re welcome. Previously, I concluded that the combination of sustainable dividend and cheap share price was too compelling to pass up, and I find myself in a very similar circumstance today. The dividend remains well covered, and the shares are even cheaper today, so I’m adding to my Patrick Industries position this morning. Although the stock price has obviously risen, earnings have risen faster, so the shares are even more attractively priced today. While it’s volatile, I think it’s reasonable to suggest that the volatile RV market will grow reasonably well over the next five years at least, and so I’m comfortable owning this business for the long term. I should also point out that the options market isn’t offering much at the moment, so I’m going to manifest the long position by simply buying the stock. The valuation is so compelling that I think this is the way to go.

Financial Snapshot

It may come as a shock to readers, but I actually try to refrain from being redundant, and for that reason I’m not going to cover the same ground as I did in my previous missive on this name. If you want to read all about the sustainability of the dividend, and the long financial history here, I’d recommend my previous work on this name. Today I want to write about the most recent financial performance. That said, in case you’re not in the mood to expose yourselves to more of my writing, I’ll point out that I think the dividend is very well covered. You can read my earlier work for details.

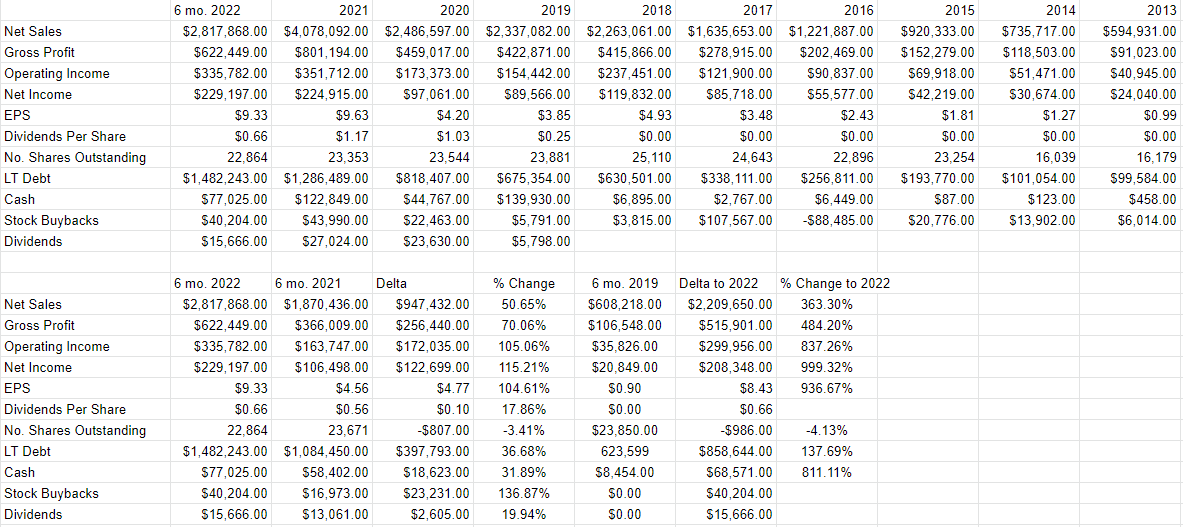

When thinking about the most recent financial performance, the word “spectacular” comes to mind. In particular, revenue is up by about 50.6% relative to the same period in 2021, and net income is up by an eye watering 115%. This improved profitability happened in spite of massive upticks in warehouse and delivery expenses (up by 32%), SG&A expenses (up by 49%), interest expenses (up by 15%) and provisions for income taxes (up a whopping 144%). In other words, this was driven almost entirely by improvements in the business. In my view, these improvements were driven by the massive acquisition activity the company has undergone over the past 19 months. The company made 13 acquisitions in 2021, and completed three so far in 2022. They acquired Diamondback Towers in May, and I don’t expect it to have a significant impact on the financial results until Q3 at the earliest.

It’s not all sunshine and lollipops at Patrick, though, as acquisitions cost money, and the capital structure has deteriorated as a result. Specifically, long term debt is up by about 37% (or $397 million) relative to the same period in 2021, and is up by over 137% (or $$858 million) relative to the same period in 2019. On the bright side, there’s still a fairly massive cash hoard of about $77 million, which is sufficient to fund both operations and the dividend in my view.

In some ways, it makes little sense to compare the most recent performance to the showing in 2019, as this is in many ways a completely different enterprise, with a host of acquisitions bolted on. Something making “little sense” has never stopped me before, though, so I’ll make the comparison. Revenue and net income are higher by about 363% and 999% (!) compared to the same period in 2019. As stated above, the level of indebtedness has also increased but at a much lower percentage increase.

As I pointed out above, in my previous missive I determined that the dividend is very well covered, and nothing’s happened in the meantime to change my mind on that score. Thus, I’d be happy to buy a few more shares at the right price.

Patrick Industries Financials (Patrick Industries investor relations)

The Stock

Remember earlier in the article when I wrote that I try to avoid redundancy. I need to clarify that position somewhat. Just because I try to avoid it doesn’t mean I always succeed. I’m about to tread over very old ground that you know well if you subject yourself to my stuff regularly. I think the stock is distinct from the business in many ways. A business buys a number of inputs, adds value to them, and then sells the results for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company, and it’s buffeted by a number of forces that may have little to do with the underlying business. For instance, a fashionable analyst may offer an opinion on a given sector, and that drives the stock up and down, even if the company is only peripherally related to the “sector.” The crowd may form a view about the relative attractiveness of stocks in general, and that drives your shares up or down. The stock of a given company may be affected by narratives about currencies, and the shares of a given company get taken along for the ride. Strangest of all, stock investors can be mesmerized by the pronouncements of Fed officials, who drive prices up or down massively because of a 25 basis point difference in the overnight rate. Anyway, every company is impacted by things like the relative changes of one currency or another, but you’d be forgiven for thinking the shares often “overreact.”

Although it’s tedious to see your favorite investment get buffeted because the asset class of “stock” goes in and out of favor, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

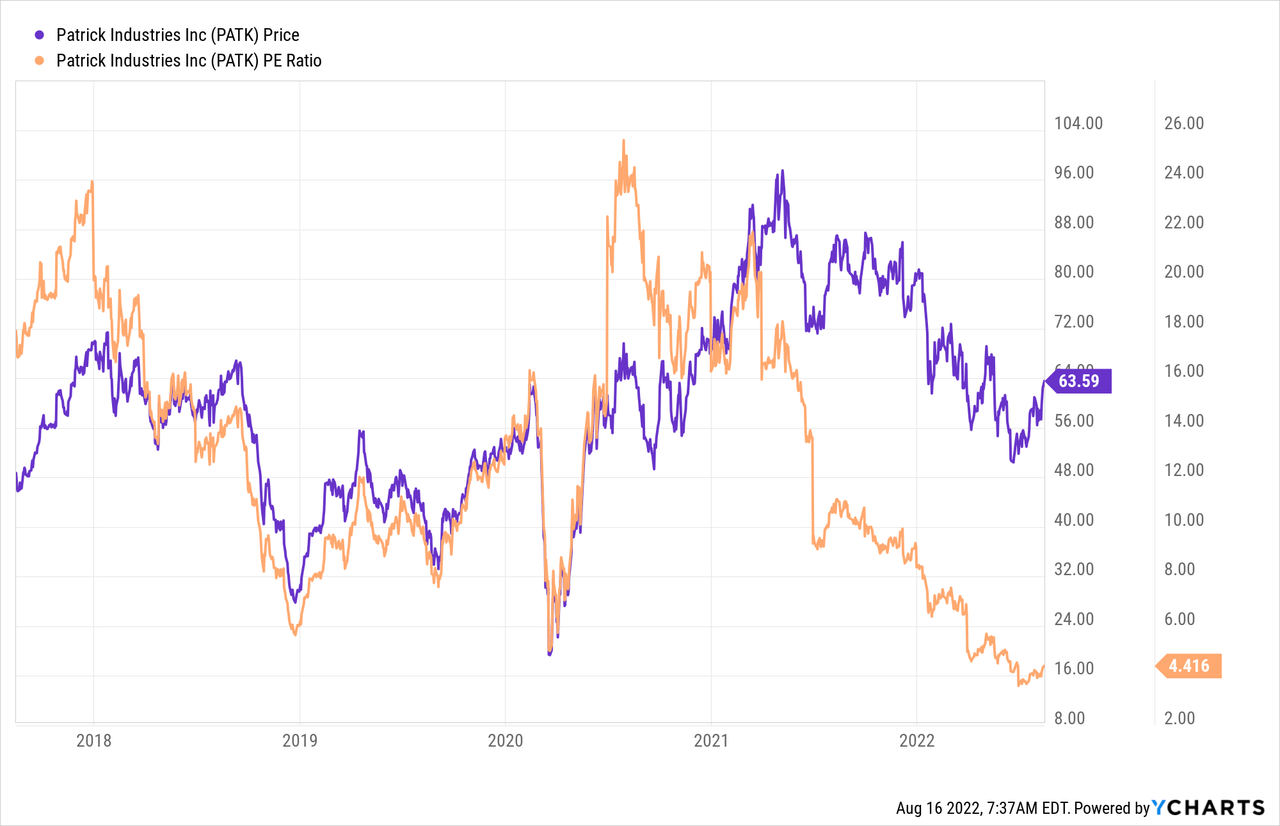

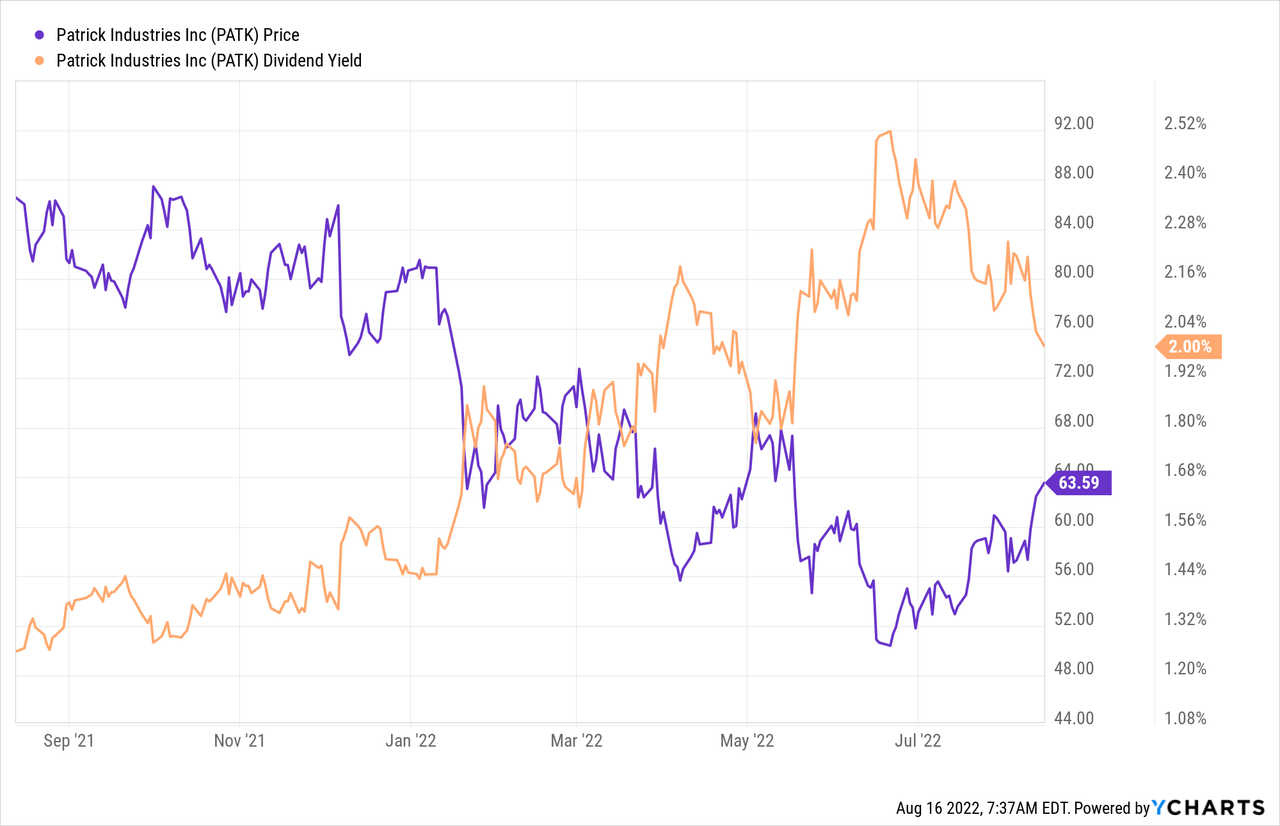

As my regulars know, when judging the cheapness (or not) of a stock, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you’ve forgotten, I became excited when Patrick was trading at a P/E of 5.88, and a (well supported) dividend yield of 2.16% a few months back. Fast forward to the present, and the valuation is arguably more compelling in spite of the run up in prices, per the following:

At the same time, though, the yield is about 7% lower per the following. This isn’t egregious, but people who buy in today will be getting slightly less income over time, obviously.

In addition to looking at simple ratios, I want to try to unpack the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to accomplish this. This approach uses stock price itself as a source of information. It involves “reverse engineering” the assumptions that make the current price. In my previous article on Patrick I determined that the market was assuming that the firm would be bankrupt in ~8 years, which I considered very nicely pessimistic. Fast forward to the present, and the market is currently forecasting a similarly pessimistic forecast, and seems to assume that the firm will be bankrupt in about 9 years. I consider that forecast to be very nicely pessimistic. Given all of the above, I’ll be adding to my Patrick Industries position.

Options Update

In addition to buying shares, I sold 10 Patrick August puts with a strike of $45. I sold these for $1.75 each, and they’re going to expire in three days. I think this trade worked out rather well. I’d like to take this opportunity to remind investors once again how they can affect a “win-win” trade using put options. Had the share price dropped after I sold these, I would have been obliged to buy this stock at an adjusted price of approximately $43.25. That would have meant that I’d be buying this stock at a price to free cash of 5.3 times, sporting a dividend yield of about 3%. That would have been a “win.” As it stands, I’m pocketing $1,750 in options premia, which I also consider to be a “win.”

When I wrote earlier that I try to refrain from being redundant, I want to emphasize that I “try”, though I don’t always succeed. I’m about to go over the same old ground by reminding investors that deep out of the money short puts offer a great risk adjusted return. Either they expire worthless, at which point you collect the premia and drive on, or you get to buy a business you like at a very attractive price.

Although I like to repeat success when I can, the premia on offer for short puts isn’t that great at the moment, so I can’t recommend a similar trade today. If the shares get taken down in price I expect this to change, and will sell some more puts. For now, though, the mood of the options market is pretty buoyant, so the premia on offer for puts is pretty thin.

Conclusion

Although the shares of Patrick Industries are volatile, as is the RV market in general, I think they currently represent great value. The shares are cheap, reflecting what I consider to be an excessive level of pessimism here. Additionally, the dividend is reasonably well covered in my view, which is a bonus. It gives investors the time necessary to wait for the market to realize that these shares are underpriced. The RV market is certainly impacted by the business cycle, and if that is troublesome for you, then stocks may not be your investment of choice. In some sense, this stock has the characteristics of my “win-win” short put trades. If the shares fall in price, we’ll be in a position to buy even more of this sustainable dividend. If the shares rise in price, we’ll obviously benefit from the capital gain. Thus, I’ll be adding to my stake here, and will add more if the current bear market rally peters out. I would recommend other investors with similar timelines to mine (15 years+) do the same.

Be the first to comment